Global Oil Control Lotion Market Size

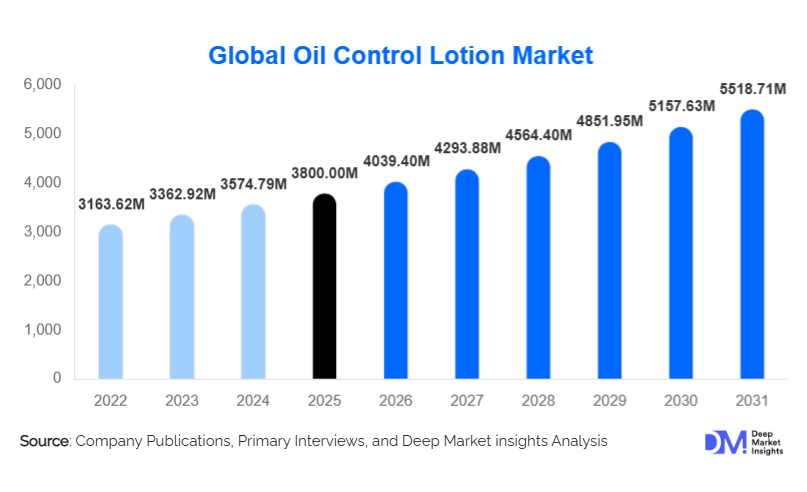

According to Deep Market Insights, the global oil control lotion market size was valued at USD 3800 million in 2025 and is projected to grow from USD 4039.4 million in 2026 to reach USD 5518.71 million by 2031, expanding at a CAGR of 6.3% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer awareness of skin health, increasing preference for targeted skincare solutions, and the expansion of multifunctional formulations that combine oil control with acne prevention, SPF protection, and natural ingredients.

Key Market Insights

- Gel-based formulations dominate due to their lightweight, non-greasy texture, which is highly preferred by consumers with oily skin types, particularly in humid regions.

- Online retail channels are increasingly leading distribution, driven by convenience, social commerce integration, and direct-to-consumer marketing strategies.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, disposable income, and cultural adoption of skincare routines in countries such as China, India, and Japan.

- Natural and botanical ingredient-based products are trending upward, reflecting consumer demand for clean beauty and eco-conscious formulations.

- Men’s grooming segment is expanding, with formulations tailored for thicker and oilier skin types driving incremental growth in previously untapped demographics.

- Technological integration in product innovation, including AI-assisted skincare personalization and online diagnostic tools, is reshaping consumer engagement and adoption.

What are the latest trends in the oil control lotion market?

Multifunctional and Clean Beauty Formulations

Consumers increasingly prefer oil control lotions that offer multifunctional benefits, such as sebum regulation, acne prevention, and UV protection. Natural and botanical ingredients like niacinamide, green tea extract, and salicylic acid are highly sought after for their perceived safety and efficacy. Clean, eco-certified products appeal to environmentally conscious consumers, particularly in North America and Europe. Premium formulations with natural actives command higher pricing, while providing differentiation in a highly competitive market.

Digital and E-commerce Adoption

Online retail continues to drive market growth through direct-to-consumer portals, e-commerce marketplaces, and social commerce. AI-powered diagnostic tools, virtual product trials, and influencer-led marketing campaigns help consumers select formulations suited to their specific skin types. Mobile applications enable personalized recommendations, subscription-based delivery models, and real-time feedback on product performance, further increasing engagement and repeat purchases.

What are the key drivers in the oil control lotion market?

Rising Awareness of Skincare and Personal Grooming

Increasing knowledge about skin types and targeted solutions is driving demand. Social media, dermatologists, and beauty influencers have heightened awareness of excess sebum and acne prevention, particularly among younger consumers. Routine use of oil control lotions is becoming a standard part of daily skincare, contributing to consistent market growth.

Expansion of Men’s Grooming Segment

Historically dominated by female consumers, the market is witnessing increased adoption among men. Targeted formulations for male skin, which is generally oilier and thicker, are being marketed through specialized grooming ranges. This untapped segment is growing rapidly in North America and Asia-Pacific, creating incremental revenue streams for established and emerging brands.

Social Media Influence on Consumer Behavior

Platforms like Instagram, TikTok, and YouTube strongly influence product discovery and adoption. Viral beauty content, tutorials, and reviews encourage consumers to experiment with new formulations. Younger demographics are highly engaged with online skincare communities, creating faster adoption cycles for innovative products.

What are the restraints for the global market?

Volatile Ingredient Costs

Natural and premium actives, such as botanical extracts, salicylic acid, and niacinamide, are susceptible to price fluctuations. Rising raw material costs can impact profitability, particularly for small and mid-sized manufacturers in competitive markets.

High Competition and Price Sensitivity

The market features numerous global, regional, and local players, leading to intense competition. Consumers in emerging markets often prioritize price over brand, constraining premium segment adoption. Differentiation through innovation, packaging, and branding is crucial to maintain market share.

What are the key opportunities in the oil control lotion market?

Emerging Markets Penetration

Rapid urbanization and increasing disposable incomes in Asia-Pacific, Latin America, and the Middle East are driving demand for oil control solutions. Tailored regional formulations and localized marketing campaigns present opportunities for global players to expand market share. Countries like India, China, and Brazil are key focus areas for growth, fueled by rising awareness of skincare routines and environmental factors like humidity and pollution.

Innovation in Multifunctional Skincare

Formulations combining oil control with acne treatment, SPF protection, and hydrating agents are gaining popularity. Clean and natural formulations appeal to eco-conscious consumers. Investment in R&D to develop multifunctional products provides a competitive edge while justifying premium pricing strategies.

Digital and Direct-to-Consumer Channels

Online retail and social commerce provide cost-effective and targeted consumer reach. Brands leveraging AI diagnostics, personalized skincare recommendations, subscription services, and influencer marketing can capture younger, digitally savvy audiences. Enhanced engagement through digital channels improves brand loyalty and repeat purchases, creating a sustainable growth pathway.

Product Type Insights

Gel-based oil control lotions dominate the market (~38% of 2025), favored for their lightweight, non-greasy feel suitable for oily skin types. Cream-based lotions appeal to combination skin and sensitive skin consumers seeking hydration with oil regulation. Spray/mist formulations are emerging in premium skincare portfolios, providing convenience and ease of application. Acne-targeted and SPF-integrated lotions cater to multifunctional needs, reflecting the trend toward targeted, high-efficacy skincare products.

Application Insights

Daily skincare remains the primary application, with consumers using oil control lotions to regulate sebum, maintain a matte appearance, and prevent acne. Men’s grooming, youth-focused routines, and premium skincare segments are expanding rapidly. Photographic and social media trends drive interest in products that enhance appearance and makeup longevity. E-commerce penetration and influencer marketing are boosting adoption in younger demographics.

Distribution Channel Insights

Online retail dominates (~35% of 2025), benefiting from convenience, personalized marketing, and digital engagement. Supermarkets, specialty stores, and pharmacies maintain strong presence, particularly for mass-market and mid-range products. Department stores and salon-based retail remain relevant for premium skincare lines. Subscription models and D2C platforms are emerging as important growth channels for both global and regional brands.

Consumer Demographic Insights

Young adults (18–34) represent the fastest-growing demographic (~32% of 2025), driven by social media influence, urban lifestyle, and environmental factors impacting oily skin. Teenagers and adults (35–54) remain key consumers for acne-targeted and multifunctional lotions. Male consumers are increasingly adopting skincare routines, fueling growth in the men’s grooming segment. Older adults (55+) represent a smaller but growing market for premium and sensitive skin formulations.

| By Product Type | By Skin Type | By Distribution Channel | By Consumer Demographic | By Ingredient Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for ~30% of the global market, led by the U.S. and Canada. High disposable income, awareness of skincare routines, and widespread e-commerce adoption support growth. Demand is focused on premium, multifunctional, and natural formulations.

Europe

Europe holds ~24% of the market, with Germany, the U.K., and France driving demand. Consumers prioritize natural ingredients, sustainable production, and multifunctional products. Online retail and specialty stores are key distribution channels.

Asia-Pacific

Asia-Pacific (~34%) is the fastest-growing region, fueled by China, India, Japan, and Southeast Asia. Rising disposable income, urbanization, and digital influence accelerate adoption of premium and multifunctional formulations. Social media engagement and e-commerce penetration further drive growth.

Latin America

Latin America (~6%) is emerging, led by Brazil, Mexico, and Argentina. Consumers show rising interest in mid-range and multifunctional products. Outbound demand and premium brand adoption are slowly increasing.

Middle East & Africa

Middle East (~6%) shows growth from UAE, Saudi Arabia, and Qatar, driven by high-income populations. Africa’s growth is limited but supported by urban markets seeking premium skincare and natural formulations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Oil Control Lotion Market

- L’Oréal S.A.

- Procter & Gamble Co.

- Unilever PLC

- Johnson & Johnson Services, Inc.

- Estée Lauder Companies Inc.

- Shiseido Co., Ltd.

- Beiersdorf AG

- Coty Inc.

- Henkel AG & Co. KGaA

- Clinique Laboratories, LLC

- The Body Shop International Limited

- Avalon Natural Products, Inc.

- e.l.f. Cosmetics, Inc.

- Mamaearth

- The Ordinary (DECIEM)