Nutrigenomics-Based Personalized Supplements Market Size

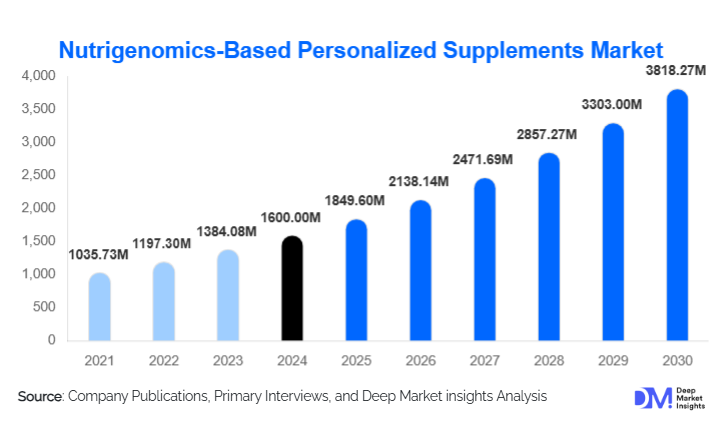

According to Deep Market Insights, the global nutrigenomics-based personalized supplements market size was valued at USD 1,600 million in 2024 and is projected to grow from USD 1,849.60 million in 2025 to reach USD 3,818.27 million by 2030, expanding at a CAGR of 15.6% during the forecast period (2025–2030). Market growth is driven by the rising demand for personalized wellness solutions, declining genomic testing costs, and growing consumer preference for preventive, gene-guided nutrition.

Key Market Insights

- Falling genetic testing costs and advancements in AI-driven bioinformatics are accelerating the adoption of personalized supplements.

- Obesity & metabolic health management remain the dominant application areas, driven by high global lifestyle disease prevalence.

- Direct-to-consumer (D2C) channels lead the market as consumers increasingly seek convenient at-home genetic testing and subscription-based supplement plans.

- North America dominates the global market due to high digital-health adoption and mature genomics infrastructure.

- Asia-Pacific is the fastest-growing region, propelled by rising middle-class incomes, chronic disease burden, and growing interest in personalized wellness.

- AI-powered personalization engines leveraging multi-omic data (genomic, lifestyle, biomarker) are transforming supplement customization.

What are the latest trends in the nutrigenomics-based personalized supplements market?

AI-Driven Personalized Nutrition Platforms

Artificial intelligence is revolutionizing the nutrigenomics landscape by enabling more accurate interpretation of genetic data and nutrient interactions. Companies are developing advanced algorithms that combine genomic markers, lifestyle inputs, and biomarker readings to create dynamic, individualized supplement regimens. Real-time updates through connected health apps are helping consumers track outcomes and adjust supplementation automatically. This trend is strengthening consumer confidence and supporting evidence-based nutrition plans.

Expansion of At-Home Genetic Testing & Subscription Models

Convenience-focused consumers increasingly prefer saliva-based at-home genetic kits that integrate seamlessly with mobile apps. Personalized supplement brands are pairing these kits with subscription-based monthly nutrient packs tailored to users’ genetic profiles. This recurring revenue model is reshaping the competitive landscape, with major players building vertically integrated ecosystems that include testing laboratories, AI engines, and supplement fulfillment centers.

What are the key drivers in the nutrigenomics market?

Growing Prevalence of Chronic & Lifestyle Diseases

The global rise in obesity, diabetes, cardiovascular conditions, and metabolic disorders is leading consumers to seek proactive wellness solutions. By identifying genetic predispositions related to metabolism, nutrient absorption, and inflammation, nutrigenomics-based supplements offer a personalized path to improved health outcomes. This preventive focus is especially appealing to younger, digitally engaged consumers who value data-backed health optimization.

Advances in Genetic Analysis & Bioinformatics

Declining costs for SNP genotyping, improved saliva-collection technologies, and sophisticated machine-learning tools have significantly reduced barriers to adoption. Modern bioinformatics platforms can analyze thousands of gene–nutrient interactions, enabling supplement recommendations that are more precise and actionable. These technological advancements enhance market scalability and improve clinical credibility among healthcare professionals.

What are the restraints for the global market?

Regulatory, Ethical, and Data Privacy Concerns

Handling genetic data involves stringent data protection requirements and ethical considerations. Variation in regulatory frameworks across countries, challenges with claim substantiation, and concerns over data misuse pose significant adoption barriers. Companies must invest in transparent consent models, secure genomic storage, and compliant bioinformatic processes to build consumer trust and meet regulatory expectations.

High Cost of Personalized Supplement Programs

Despite falling genetic testing prices, many consumers still view personalized supplement programs as premium offerings. The combination of testing, algorithmic interpretation, and tailored supplement formulation increases cost per user, limiting adoption among lower-income populations. Limited insurance coverage for preventive genomic services also constrains mass-market penetration.

What are the key opportunities in the nutrigenomics industry?

Integration with Digital Health & Wearables

As consumers increasingly track biomarkers via smartwatches, continuous glucose monitors, and metabolic sensors, nutrigenomic platforms can integrate real-time data to refine supplement regimens. This hybrid model, combining genetics with continuous lifestyle data, presents significant opportunities for companies to create dynamic, hyper-personalized nutrition ecosystems.

Emerging Market Expansion in Asia-Pacific & Latin America

Rapid population growth, rising chronic diseases, and increasing disposable incomes in emerging markets offer substantial room for expansion. Localizing genetic panels to reflect regional variations, partnering with healthcare providers, and integrating multilingual mobile platforms can help companies gain a first-mover advantage in high-growth regions.

Product Type Insights

Genetic testing kits currently represent the largest product segment, driven by the widespread adoption of saliva-based home test kits, increased affordability, and the rising consumer desire to understand hereditary predispositions related to nutrition, metabolism, and long-term health. Convenience, rapid result turnaround, and strong brand-driven D2C penetration further strengthen this segment’s dominance. AI-powered interpretation platforms are rapidly expanding as companies integrate machine learning, predictive analytics, and multi-omics data modeling to decode complex gene–nutrient interactions. This segment is increasingly becoming central to product differentiation, as consumers demand actionable insights rather than raw genetic data.

Personalized supplement formulations represent the fastest-growing segment. Growth is propelled by subscription-based personalized nutrition packs that combine genetic markers, lifestyle inputs, microbiome data, and continuous health tracking. Automated formulation engines, dynamic nutrient adjustments, and recurring monthly delivery models are establishing this segment as a major revenue driver for market participants.

Application Insights

Obesity and weight management dominate market share, fueled by global obesity prevalence, heightened awareness of metabolic disorders, and consumer demand for science-backed personalization. Nutrigenomic insights on fat metabolism, appetite regulation, and glucose response are powering personalized diet and supplementation strategies. Metabolic and cardiovascular health is a fast-growing segment, supported by the increasing clinical integration of genetic testing to guide preventive interventions for hypertension, diabetes, and lipid disorders. Healthcare providers are adopting nutrigenomics to support precision lifestyle programs and long-term disease management.

Cognitive health, immunity, and performance optimization are emerging growth areas. Demand is rising among athletes, biohackers, and aging populations seeking targeted cognitive support, inflammation management, and energy optimization through gene-directed nutrition plans and specialized supplements.

Distribution Channel Insights

Online and direct-to-consumer (D2C) platforms lead the market, driven by seamless digital ordering, integrated health dashboards, automated supplement subscription renewals, and personalized report delivery. Users benefit from convenience, transparency, and real-time access to genomic insights. Specialist nutrition clinics and integrative healthcare providers are gaining momentum as clinical accuracy, validation, and practitioner oversight become central to consumer decision-making. This shift is particularly evident in markets with stronger medical regulation and wellness infrastructure.

Retail partnerships are emerging but remain limited, as consumer preference continues shifting toward app-driven, highly personalized nutrition models. Meanwhile, influencer-led education, digital content ecosystems, and community-based wellness programs are increasingly shaping consumer purchasing behavior.

End User Insights

Direct-to-consumer users represent the largest end-user group. Growth is attributed to rising health awareness, proactive disease prevention, and the convenience of at-home genomic sampling paired with digital interpretation platforms. Clinics and healthcare institutions are expanding adoption for metabolic disease management, functional nutrition, and preventive care strategies. Genetic insights are increasingly integrated into clinical workflows to support tailored diet and supplement recommendations.

Corporate wellness programs are emerging as a high-potential segment. Organizations are integrating genetic-based wellness screening, personalized supplement protocols, and long-term health optimization programs to improve workforce wellbeing and reduce chronic disease risk.

Age Group Insights

Consumers aged 25–45 years represent the highest share, as this tech-savvy demographic actively seeks personalized, data-driven wellness solutions and engages heavily with D2C platforms. The 45–60 age group shows strong adoption fueled by goals around longevity, chronic disease prevention, and lifestyle improvement. Consumers aged 18–24 years are increasingly entering the market, driven by social media influence, fitness culture, and interest in optimizing performance and appearance.

| By Product Type | By Application | By End User | By Technology |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, supported by advanced genomic testing infrastructure, high consumer healthcare expenditure, and strong venture capital funding. The U.S. leads in D2C adoption due to widespread use of app-based personalized nutrition programs, while Canada is expanding through clinically supervised nutrition interventions. strong presence of genomics startups, high digital literacy, integration of nutrigenomics in corporate wellness programs, and rapid adoption of AI-driven nutrition platforms.

Europe

Europe shows strong and steady growth, driven by rising interest in preventive healthcare, robust regulatory frameworks such as GDPR that enhance consumer trust, and the increasing popularity of clinically validated, sustainable supplement programs. The U.K., Germany, and France lead adoption, supported by strong wellness ecosystems. government-supported personalized health initiatives, growing demand for sustainability-focused nutrition products, and widespread adoption of medical-grade genetic testing in clinical settings.

Asia-Pacific

Asia-Pacific is the fastest-growing market, led by China, India, Japan, and South Korea. Growth is fueled by rising chronic disease prevalence, rapid urbanization, expanding middle-class wealth, and long-standing cultural emphasis on preventive wellness. Localized genetic panels, AI-enabled personalized diet apps, and integrated health ecosystems are accelerating adoption. booming digital health adoption, expansion of telehealth nutrition platforms, government interest in genomic medicine, and growing sports & performance nutrition culture.

Latin America

Latin America is emerging as a promising region with increasing adoption in Brazil, Mexico, and Argentina. Growing health awareness, improved access to digital health tools, and a rising preference for personalized weight-management and metabolic health solutions are contributing to market expansion. expanding private healthcare sector, increasing smartphone-based wellness engagement, and growing consumer interest in affordable nutrigenomic test kits.

Middle East & Africa

In the Middle East, rapid digitalization, strong disposable incomes, and increasing investment in premium wellness services in the UAE, Saudi Arabia, and Qatar are driving the adoption of high-end nutrigenomic testing and personalized supplement programs. Africa shows early-stage but promising traction, especially in South Africa and Kenya, where wellness ecosystems and digital health platforms are gaining momentum. government-led health modernization programs, rising focus on lifestyle disease management, and expanding tele-nutrition ecosystems supporting personalized health engagement.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nutrigenomics-Based Personalized Supplements Market

- Persona Nutrition (Nestlé Health Science)

- Zoe

- InsideTracker

- Rootine

- DNAfit

- Nutrigenomix

- GenoPalate

Recent Developments

- In May 2025, InsideTracker launched a multi-omic wellness platform integrating genetic, blood biomarker, and lifestyle data for precision supplementation.

- In April 2025, Rootine introduced an AI-driven micronutrient optimization engine offering real-time updates to personalized supplement packs.

- In February 2025, Persona Nutrition expanded its personalization framework to include advanced genetic markers linked to cognitive aging and immunity.