Night Vision Surveillance Cameras Market Size

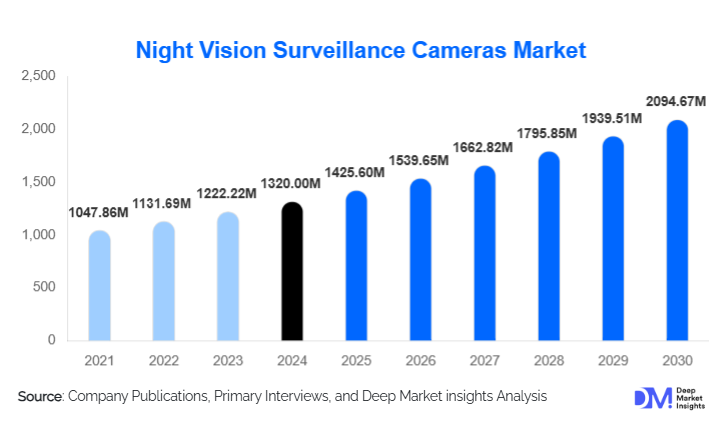

According to Deep Market Insights, the global night vision surveillance cameras market size was valued at USD 1,320.00 million in 2024 and is projected to grow from USD 1,425.60 million in 2025 to reach USD 2,094.67 million by 2030, expanding at a CAGR of 8% during the forecast period (2025–2030). Market growth is primarily driven by rising global security concerns, expanding smart city infrastructure, increased defense and homeland security spending, and rapid advancements in thermal imaging, infrared, and AI-enabled video analytics technologies.

Key Market Insights

- Thermal and infrared-based night vision cameras dominate demand due to their ability to operate in complete darkness and adverse weather conditions.

- Defense and homeland security remain the largest end-use segment, accounting for the highest share of global revenue.

- Asia-Pacific is the fastest-growing regional market, driven by large-scale urban surveillance and border security investments.

- AI-powered analytics and edge computing are transforming night surveillance from passive monitoring to predictive threat detection.

- Smart cities and critical infrastructure projects are accelerating adoption across transportation, utilities, and public safety networks.

- Wired surveillance systems continue to dominate due to higher reliability and cybersecurity advantages.

What are the latest trends in the night vision surveillance cameras market?

AI-Integrated and Intelligent Night Surveillance

The integration of artificial intelligence into night vision surveillance cameras is one of the most transformative trends shaping the market. Modern systems now support facial recognition, behavior analysis, anomaly detection, and automated alerts even in low-light or no-light environments. AI-powered edge processing reduces latency and bandwidth dependency while enabling real-time threat assessment. These capabilities are increasingly adopted in smart cities, airports, border checkpoints, and industrial facilities, where proactive security and automation are critical.

Rising Adoption of Thermal Imaging Technology

Thermal imaging cameras are gaining significant traction due to their ability to detect heat signatures regardless of lighting conditions. Unlike traditional infrared cameras, thermal systems perform reliably in fog, smoke, rain, and total darkness, making them essential for defense, perimeter security, and critical infrastructure protection. Continuous improvements in sensor resolution and declining component costs are expanding thermal camera adoption into commercial and industrial applications.

What are the key drivers in the night vision surveillance cameras market?

Rising Global Security and Defense Spending

Escalating geopolitical tensions, cross-border threats, and urban crime rates have increased government and military investments in advanced surveillance systems. Night vision cameras play a critical role in border monitoring, military installations, and maritime security. Governments across North America, Asia-Pacific, and the Middle East continue to allocate substantial budgets to modernize surveillance infrastructure, directly supporting market expansion.

Expansion of Smart Cities and Infrastructure Projects

The global push toward smart city development is driving widespread deployment of intelligent surveillance systems. Night vision cameras are essential for traffic monitoring, public safety, emergency response, and infrastructure protection during nighttime operations. Integration with IoT platforms and centralized command centers further enhances their value, making them indispensable components of modern urban infrastructure.

What are the restraints for the global market?

High Cost of Advanced Night Vision Systems

Thermal imaging and long-range night vision cameras involve high manufacturing and integration costs, limiting adoption in price-sensitive markets. Budget constraints in developing regions often favor conventional visible-light cameras, slowing penetration of premium night vision solutions.

Data Privacy and Regulatory Challenges

Strict data protection regulations and public concerns over surveillance privacy pose challenges, particularly in Europe and North America. Compliance with cybersecurity standards, data storage regulations, and surveillance laws increases operational complexity and costs for manufacturers and system integrators.

What are the key opportunities in the night vision surveillance cameras industry?

Smart City and Public Safety Programs

Government-led smart city initiatives present long-term growth opportunities for night vision camera manufacturers. Large-scale deployments for traffic control, crime prevention, and emergency response create sustained demand, particularly in Asia-Pacific, the Middle East, and Latin America.

Industrial and Critical Infrastructure Security

Industries such as oil & gas, power generation, logistics, and data centers increasingly require night vision surveillance for perimeter protection and remote monitoring. The rise of unmanned and automated facilities further strengthens demand for reliable low-light surveillance solutions.

Product Type Insights

Thermal imaging cameras remain the leading product segment, capturing approximately 34% of the global market in 2024. Their dominance is fueled by superior performance in complete darkness, fog, smoke, and harsh weather conditions, making them indispensable for defense, border security, and critical infrastructure monitoring. Increasing government and military investments in high-security zones and strategic facilities further bolsters their demand. Infrared (IR) and near-infrared (NIR) cameras continue to hold a strong presence in commercial and residential markets due to their cost efficiency, ease of installation, and suitability for mid-range surveillance applications such as retail loss prevention, office security, and small-scale industrial monitoring. Low-light CMOS-based cameras are gaining traction in mid-tier commercial and smart city deployments, offering a balance of image clarity, affordability, and energy efficiency, especially in urban monitoring systems where continuous night-time surveillance is required.

Connectivity Insights

Wired night vision cameras dominate with nearly 55% market share in 2024. Their reliability, stable data transmission, and cybersecurity advantages make them the preferred choice for high-security installations, such as government facilities, airports, and industrial plants. Wired systems also integrate seamlessly with existing surveillance infrastructure, reducing operational risks and maintenance complexity. Meanwhile, wireless and cellular-enabled cameras are witnessing rapid adoption, particularly in remote and temporary surveillance setups, mobile security units, and areas where cabling infrastructure is limited. The growing demand for flexible, scalable, and IoT-integrated surveillance solutions is further driving the adoption of wireless technologies, especially in smart city initiatives and outdoor industrial monitoring.

End-Use Insights

Defense and homeland security remain the largest end-use segment, contributing approximately 38% of total market revenue in 2024. The primary growth driver is escalating security concerns, including cross-border threats, urban crime, and protection of critical infrastructure. Military and government agencies are investing in advanced night vision systems for perimeter security, surveillance of high-risk zones, and maritime monitoring. The commercial and industrial sectors are the fastest-growing, driven by retail loss prevention, warehouse monitoring, logistics centers, and industrial automation. Integration of night vision cameras with AI-based analytics, cloud storage, and smart monitoring systems is enhancing operational efficiency and safety. Residential adoption is steadily increasing as smart home security systems incorporate night vision cameras for 24/7 monitoring, real-time alerts, and remote access via mobile apps, expanding the consumer base for mid-tier and affordable camera solutions.

| By Product Type | By Connectivity | By End-Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 32% in 2024, with the United States leading regional demand. Key growth drivers include substantial defense and homeland security budgets, rapid adoption of smart city technologies, and integration of AI-powered surveillance systems. The presence of advanced infrastructure, early adoption of high-resolution thermal and low-light cameras, and regulatory support for critical infrastructure security further propel market growth. The commercial sector, including retail, transportation hubs, and industrial facilities, is also contributing significantly to regional expansion, driven by increasing requirements for continuous night surveillance and perimeter monitoring.

Asia-Pacific

Asia-Pacific accounts for nearly 29% of global revenue and is the fastest-growing region, with a CAGR exceeding 13%. China, India, Japan, and South Korea are the primary growth engines, driven by large-scale urban surveillance projects, transportation security, and border monitoring initiatives. Rapid urbanization, smart city programs, industrial automation, and public safety initiatives are boosting demand for both thermal and low-light CMOS-based night vision cameras. Government-led investments in defense modernization and infrastructure protection, combined with rising awareness of safety in commercial and residential sectors, are key drivers of regional market expansion.

Europe

Europe represents around 21% of the global market, with Germany, the UK, and France leading adoption. The region’s growth is driven by transportation security requirements, industrial monitoring, and urban surveillance programs in major cities. Regulatory frameworks related to data privacy and security are shaping deployment strategies, encouraging investment in advanced night vision systems that comply with cybersecurity standards. Increasing integration of AI analytics in commercial and public safety applications further supports market expansion, particularly in industrial facilities, airports, and city-wide smart surveillance networks.

Middle East & Africa

This region accounts for approximately 11% of global demand, with Saudi Arabia, the UAE, and Israel as the major contributors. Growth is primarily fueled by government initiatives for defense modernization, border security, and protection of critical infrastructure such as oil & gas facilities. Rising investments in smart city projects and urban security, coupled with the deployment of high-resolution thermal cameras for strategic monitoring, are key drivers. Additionally, geopolitical tensions and the increasing need for advanced surveillance in industrial and transportation sectors are contributing to steady market expansion.

Latin America

Latin America holds about 7% of the global market, led by Brazil and Mexico. Urban security needs, infrastructure expansion, and growing investment in public safety initiatives are driving demand. Commercial adoption, particularly in retail, logistics, and industrial monitoring, is rising due to increasing awareness of nighttime security challenges. Government programs for city-wide surveillance and border monitoring, combined with improvements in digital infrastructure, are supporting the gradual but steady growth of the night vision surveillance market in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|