Niacinamide Beauty Products Market Size

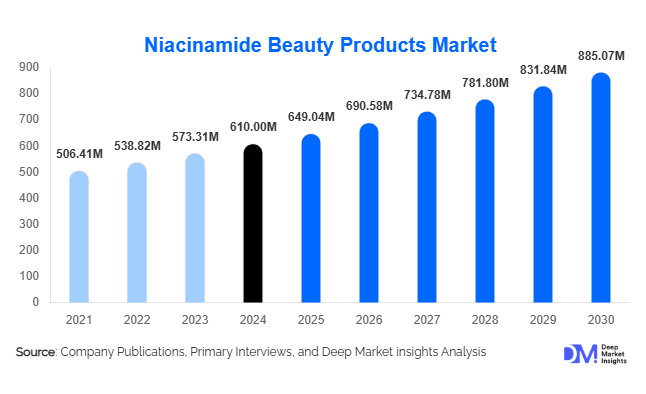

According to Deep Market Insights, the global niacinamide beauty products market size was valued at USD 610.00 million in 2024 and is projected to grow from USD 649.04 million in 2025 to reach USD 885.07 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). The market growth is primarily driven by the increasing adoption of active skincare products, rising awareness about multifunctional ingredients such as niacinamide, the expansion of male grooming and body-care segments, and the growth of e-commerce and digital-first sales channels globally.

Key Market Insights

- Niacinamide continues to be a preferred multifunctional ingredient, supporting barrier repair, oil regulation, and pigmentation correction, which drives consistent demand in face and body-care products.

- Asia Pacific dominates the market, accounting for around 45% of global revenue in 2024, led by South Korea, China, Japan, and India, due to high skincare adoption rates and K-beauty/J-beauty influence.

- North America holds a substantial share, with the U.S. and Canada being the largest national markets, supported by premium pricing acceptance and strong brand presence.

- Male grooming and body-care segments are emerging rapidly, expanding the consumer base beyond traditional women-focused skincare products.

- Online and e-commerce channels are growing fastest, fueled by D2C brands, influencer marketing, and social-commerce platforms.

- Innovation in formulations, including high-concentration serums, hybrid active combinations, and novel textures like emulsions and essences, is reshaping product offerings.

What are the latest trends in the niacinamide beauty products market?

High-Concentration and Multi-Functional Formulations

Brands are increasingly launching niacinamide products with concentrations above 10%, targeting pigmentation, acne, and anti-aging concerns. Hybrid formulations that combine niacinamide with hyaluronic acid, retinoids, or peptides are gaining popularity, meeting consumer demand for multifunctional skincare. The trend of layering skincare routines has also strengthened, with serums becoming the preferred delivery format for higher active doses, driving premiumization and enhancing perceived efficacy.

Expansion into Male Grooming and Body-Care Segments

Male consumers are adopting niacinamide for oil control, barrier repair, and minimalistic grooming routines. Brands are introducing men’s gels, moisturizers, and post-shave care products with niacinamide to capture this growing segment. Simultaneously, body-care applications such as lotions, washes, and sprays enriched with niacinamide are emerging to address pigmentation, dryness, and overall skin health, expanding usage occasions beyond facial care.

Digital-First and E-Commerce-Driven Distribution

The rise of online platforms, social media, and influencer-led marketing is enabling brands to reach consumers directly. E-commerce channels now account for a growing proportion of sales, particularly among younger, tech-savvy demographics in APAC, North America, and Europe. Digital-first marketing and micro-influencer campaigns accelerate awareness and adoption, enabling niche and indie brands to compete alongside global conglomerates.

What are the key drivers in the niacinamide beauty products market?

Increasing Consumer Awareness of Skincare Actives

Consumers are seeking scientifically-backed ingredients that deliver visible benefits. Niacinamide’s versatility, addressing oiliness, pigmentation, barrier repair, and aging, has made it a trusted ingredient endorsed by dermatologists. Skincare education, social media, and expert reviews amplify consumer knowledge and drive product adoption globally.

Multi-Functional Skincare and Routine Expansion

Modern consumers prefer products that address multiple concerns simultaneously. Niacinamide’s compatibility with other actives supports combination products and layering routines. Its inclusion in serums, creams, and body-care products enhances penetration into various categories, thereby expanding market size and volume consumption.

Rapid Growth of Online and D2C Channels

Digital retail enables global reach, cost-effective marketing, and faster product launches. Online channels facilitate influencer engagement, reviews, and community-building, which are critical for active skincare adoption. Particularly in APAC and emerging markets, this distribution model is accelerating the penetration of premium niacinamide products.

What are the restraints for the global market?

Price Sensitivity and Competitive Pressure

While premium active skincare can command higher prices, mid-market consumers are highly price-conscious. Competition from established mass brands and emerging indie brands exerts pressure on profit margins. Achieving the balance between efficacy, formulation quality, and affordable pricing is a persistent challenge.

Formulation and Consumer Tolerance Issues

High-concentration niacinamide or improper ingredient combinations can trigger irritation in sensitive skin. Additionally, the widespread availability of niacinamide in skincare products risks consumer fatigue, reducing differentiation. Manufacturers must ensure safe, stable, and compliant formulations to maintain consumer trust.

What are the key opportunities in the niacinamide beauty products industry?

Emerging Markets and Untapped Skin Types

Countries such as India, Southeast Asia, and the Middle East are experiencing rising disposable incomes, urbanization, and awareness of active skincare. Expanding into these markets with localized products, pricing strategies, and digital marketing campaigns presents significant growth potential for both established brands and new entrants.

Innovation in Formulations and Delivery Systems

There is strong demand for novel formats such as emulsions, essences, and hybrid serums combining niacinamide with complementary actives. Premium and encapsulated delivery systems allow brands to differentiate and achieve higher price points. Innovations that enhance stability, absorption, and tolerability further drive consumer adoption.

Male Grooming and Inclusive Skincare

Male grooming is a rapidly growing category, with interest in oil control, barrier repair, and minimalistic routines. Niacinamide-based products tailored for men and gender-neutral formulations can capture this segment, opening additional revenue streams and broadening market reach.

Product Type Insights

Serums remain the leading product type globally, accounting for approximately 62% of the 2024 market (USD 347 million). Their dominance is driven by consumers seeking high-concentration actives and targeted “booster” treatments, supported by dermatologist endorsements and a preference for layering routines. Creams and moisturizers are significant, particularly for daily barrier repair and hydration needs, combining niacinamide with moisturizing ingredients to appeal to both mature and anti-aging segments. Cleansers benefit from routine integration and convenience, driving high-volume sales in mass-market channels. Masks and treatments are expanding rapidly, propelled by K-beauty influence and at-home professional skincare trends, while body lotions gain traction due to growing interest in all-over brightening, repair, and body-care premiumisation. Sunscreens and hair-care products are emerging cross-category opportunities, combining SPF or strengthening benefits with niacinamide to appeal to multi-benefit product seekers.

Application Insights

Facial skincare remains the dominant application, especially for pigmentation correction, acne management, and anti-aging benefits. Body-care applications, including lotions, washes, and sprays, are rising as premiumization and awareness of all-over skin health increase. Male grooming is one of the fastest-growing segments, with niacinamide included in minimalistic skincare and oil-control products. Hybrid and multifunctional formulations, combining niacinamide with other actives, further drive adoption across facial, body, and male grooming categories.

Distribution Channel Insights

Online and e-commerce platforms are the fastest-growing distribution channels, offering lower customer acquisition costs, faster product launches, and community-driven marketing. Supermarkets and hypermarkets remain key for volume-driven mass-market sales. Specialty and professional channels, including dermatology clinics and premium beauty stores, act as credibility drivers, promoting higher-concentration clinical products. Omni-channel strategies, blending offline presence with robust digital engagement, are increasingly essential for brand visibility and premium product adoption.

End-User Insights

Women account for 61% of market revenue (USD 342 million in 2024), primarily driven by interest in anti-aging, pigmentation, and skincare layering routines. Men are the fastest-growing end-user segment, particularly in grooming and minimalistic skincare routines. Consumers aged 31–50 represent the largest user group, balancing disposable income with skincare knowledge, while younger demographics drive online and social-commerce adoption. Older consumers gravitate toward premium formulations emphasizing barrier repair and pigmentation correction. Niacinamide’s anti-inflammatory and sebum-regulating benefits make it especially attractive for youth and acne-prone skin.

| By Product Type | By Distribution Channel | By Price Tier | By End-User / Demographic | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 23% of global revenue (USD 129 million in 2024), with the U.S. and Canada leading adoption. Market growth is driven by strong clinical and dermatologist endorsement, a robust DTC and prestige retail network, and consumers’ willingness to pay for clinically-backed actives. Serums and premium products dominate due to their perceived efficacy and high concentration of niacinamide. Male grooming, digital marketing, and influencer-led campaigns further fuel growth, while e-commerce enables penetration beyond urban centers. Consumers also prioritize multifunctional formulations that combine anti-aging, pigmentation, and hydration benefits.

Europe

Europe is a mature market (20% of global revenue), with Germany, the UK, and France leading adoption. Growth is driven by clean beauty positioning, “science-meets-natural” narratives, strict labeling, and sustainability-focused regulatory regimes. Premiumization remains central, with consumers seeking multifunctional skincare and clinically validated actives. Serums and creams dominate, benefiting from the combination of high-efficacy ingredients and everyday barrier repair needs. Digital marketing, e-commerce penetration, and sustainability-conscious formulations are shaping the European market, particularly among younger and eco-conscious demographics.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region (45% share, USD 252 million in 2024). Growth is driven by K-beauty and J-beauty innovation, rapid adoption of multi-step routines, high interest in targeted actives, sheet-mask/serum formats, and strong online/social commerce. India is the fastest-growing country (CAGR 8.2% to 2030). Serums and masks/treatments lead due to high concentration, at-home professional skincare trends, and layering routine compatibility. Rising middle-class affluence, influencer-led education, and localized product innovations further accelerate adoption across facial and body-care applications.

Latin America

Latin America is an emerging market (6–8% share), led by Brazil, Argentina, and Mexico. Growth is driven by a growing urban middle class, increasing skincare penetration, and the value-to-premium product mix. Imports of active-led formulations and multifunctional products are increasing. Serums dominate premium segments, while cleansers and moisturizers drive volume sales. Consumers prioritize affordability, multifunctionality, and lifestyle-driven product experiences, supporting the gradual expansion of niacinamide beauty products.

Middle East & Africa

Gulf countries, particularly the UAE and Saudi Arabia, are high-income markets for premium skincare, while African nations primarily serve as production hubs. Market growth is supported by premium import demand in GCC countries, rising local brand activity, and strong consumer interest in sun-protection and brightening claims. Serums and creams lead premium sales, while multifunctional products such as SPF + niacinamide see adoption in mass and specialty channels. Urbanization, social media influence, and growing male grooming adoption further support market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Niacinamide Beauty Products Market

- L’Oréal S.A.

- Unilever PLC

- The Estée Lauder Companies Inc.

- Beiersdorf AG

- Shiseido Company, Limited

- Johnson & Johnson Services, Inc.

- Kao Corporation

- AMOREPACIFIC Group

- Minimalist Health & Beauty

- The INKEY List

- Paula’s Choice

- CosRX

- Dot & Key Wellness Pvt Ltd

- Dr. Sheth’s

- SkinCeuticals

Recent Developments

- In May 2025, Minimalist Health & Beauty expanded its high-concentration niacinamide serum line in India, targeting male and female consumers with multi-functional products.

- In April 2025, The Estée Lauder Companies launched an online-exclusive niacinamide-based skincare range in Asia-Pacific, combining serums and emulsions for sensitive skin.

- In February 2025, L’Oréal S.A. introduced a hybrid niacinamide + peptide body-care range across Europe, leveraging e-commerce and influencer-led marketing to capture younger consumers.