News Syndicates Market Size

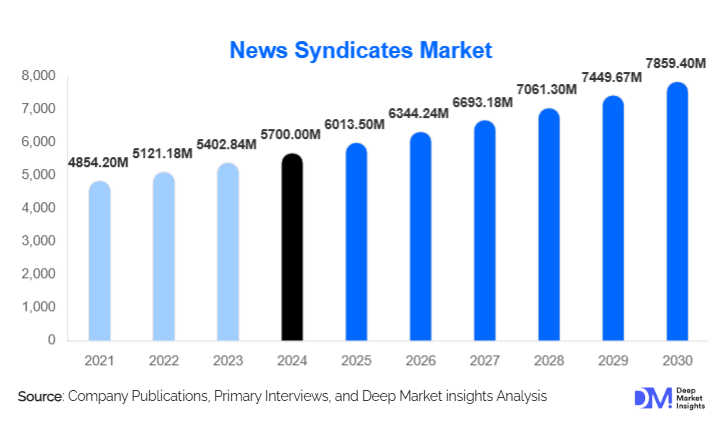

According to Deep Market Insights, the global news syndicates market size was valued at USD 5,700 million in 2024 and is projected to grow from USD 6,013.50 million in 2025 to reach USD 7,859.40 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Growth in the market is driven by rapid digitalization of news consumption, rising demand for high-quality and real-time content, expansion of syndication networks across emerging markets, and the integration of advanced technologies such as AI, automation, and blockchain for content distribution, verification, and scalability.

Key Market Insights

- Digital-native syndicated content dominates global distribution, supported by rising mobile readership, OTT news consumption, and increased publisher reliance on cost-efficient content supply.

- Satellite-based distribution continues to hold a major share due to its reliability and extensive reach, especially for global broadcast networks and public broadcasters.

- North America accounts for the largest global share, led by advanced media infrastructure, strong digital adoption, and long-established wire agencies.

- Asia-Pacific is the fastest-growing region, driven by expanding digital penetration, rising middle-class news consumption, and growing cross-border syndication deals.

- AI-driven content creation, automated translation, and blockchain usage are transforming the speed, accuracy, and traceability of syndicated content.

- Commercial media organizations contribute over 60% of the total market demand, making them the dominant application segment globally.

What are the latest trends in the news syndicates market?

AI-Enabled and Automation-Driven News Syndication

One of the most significant trends reshaping the news syndicates market is the increasing use of artificial intelligence and automated content workflows. AI tools are now widely adopted for drafting short news summaries, translating articles into multiple languages, tagging metadata, and personalizing content feeds for clients. These solutions drastically reduce turnaround time and cut operational costs for syndicates while enabling higher content volumes with consistent quality. Automation also improves real-time distribution to publishers, broadcasters, and OTT platforms, ensuring continuous news updates. As misinformation concerns grow, AI-driven fact-checking and verification add further value, making automated syndication a core capability for modern agencies.

Hyper-Local and Niche Content Syndication

As news audiences shift from general to specialized content, syndicates are increasingly offering hyper-local and vertical-specific news packages. Topics such as finance, healthcare, technology, climate, and entertainment are experiencing fast-rising demand. Hyper-local syndication, covering neighborhood-level events, helps digital news portals and regional broadcasters strengthen their daily coverage without expanding internal reporting teams. This approach also supports advertisers seeking highly targeted impressions. The result is a dual revenue advantage: publishers acquire tailored content efficiently, while syndicates expand reach by tapping into local and community-level media networks.

What are the key drivers in the news syndicates market?

Growing Digital News Consumption and Subscription Models

Global audiences are consuming more news via digital platforms such as mobile apps, news portals, and social channels. Publishers are scaling digital subscription offerings, increasing their need for high-quality syndicated content across text, video, and multimedia formats. This shift strengthens demand for real-time, diverse storytelling that syndicates can supply at scale. As developing nations increase internet penetration, demand from digital-native publishers is accelerating, driving sustained market expansion.

Technological Innovations in Content Delivery

Adoption of AI, NLP-based translation, automated publishing, and blockchain-based rights management significantly enhances content accuracy, speed, and security. Syndicates leverage automated feeds for live news, financial markets data, and breaking alerts, capabilities essential for broadcasters and digital publishers. Multimedia integrations, including data visualizations and interactive elements, strengthen engagement, making syndicated offerings more valuable than ever. These innovations help agencies extend reach and remain competitive in a fast-changing media landscape.

What are the restraints for the global market?

Competition from Free Digital Content

The proliferation of free content on social media platforms, independent blogs, open-source news feeds, and user-generated content limits the growth potential of paid syndication services. Many audiences prefer free news access, reducing the monetization scope for publishers and, in turn, constraining their budgets for syndicated material. This dynamic puts pressure on pricing models for traditional and digital syndicates alike.

Complexity of Copyright and Content Licensing

With global distribution comes a complex web of copyright laws, licensing agreements, and cross-border content regulations. Violations, intentional or accidental, can expose syndicates and publishers to legal liabilities. Ensuring proper content attribution and protecting creators' intellectual property remain ongoing challenges, especially when content is redistributed across digital channels with high virality potential.

What are the key opportunities in the news syndicates industry?

AI-Based Personalized News Feeds and Smart Syndication

AI is enabling next-generation syndication models that tailor news content to publisher requirements, audience demographics, and niche industry segments. Smart syndication platforms can match content to specific publisher categories such as politics, finance, science, culture, or local community news. This not only enhances publisher value but also opens new revenue opportunities for syndicates through premium personalization add-ons, subscription tiers, and data-enriched feeds.

Cross-Border Expansion into Emerging Markets

Rapid digitization in Asia-Pacific, Africa, and Latin America provides substantial opportunities for syndicates to expand. Many regional newsrooms lack the resources for high-quality international or specialized reporting, creating dependence on syndicated content. By forming partnerships with local media houses, educational institutes, and broadcasters, syndicates can rapidly scale their presence. Localization services, such as translation, cultural adaptation, and regional reporting, further enhance value, allowing market entrants to differentiate and capture underserved segments.

Product Type Insights

Digital-native content leads the market, driven by the rapid adoption of mobile and online news platforms. This segment benefits from low distribution costs, unlimited scalability, and constant demand for breaking news and specialized stories. Newspaper and magazine content syndication remains significant but is gradually transitioning to hybrid digital formats. Multimedia syndication, including video clips, infographics, and interactive visuals, is expanding rapidly as publishers prioritize richer engagement formats. Demand for data-driven journalism, such as financial market updates and real-time analytics, is also creating a strong niche within the digital syndication ecosystem.

Application Insights

Commercial users, including digital publishers, broadcast networks, OTT platforms, and corporate communication divisions, account for over 60% of global syndication revenue. Their need for high-volume, diverse, and timely content drives subscription and licensing growth. Public sector users, including government broadcasters, academic institutions, and policy centers, represent a stable segment with growing interest in verified and multilingual content. Meanwhile, new applications across fintech, health-tech, and enterprise communications are driving incremental demand for trustworthy syndicated insights and sector-specific reporting.

Distribution Channel Insights

Digital distribution channels, including API-based content delivery, RSS feeds, OTT integration, and cloud-hosted platforms, dominate global syndication. Publishers prefer digital channels due to instant delivery, automated formatting, and compatibility with CMS systems. Satellite broadcast remains influential for large networks requiring high-reliability feeds across vast geographic coverage. Direct licensing models through syndicate-owned portals continue to expand, supported by analytics dashboards that allow clients to track content usage, engagement, and performance trends.

End-User Insights

The commercial media sector, including broadcasters, digital publishers, online portals, and news apps, remains the largest end-user group due to its extensive demand for real-time, multi-category content. Corporate communications teams increasingly license syndicated commentary and industry reports for internal and external messaging. Educational institutions leverage syndicated articles for academic use, research, and knowledge dissemination. New end-user categories such as content marketing agencies, fintech platforms, and e-learning providers are driving incremental growth by integrating syndicated material into value-added services.

| By Content Type | By Distribution Model | By End-Use Industry | By Delivery Platform |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, holding approximately 35–42% of global revenue in 2024. The U.S. leads demand due to its advanced media ecosystem, widespread digital adoption, and long-established news agencies. High-value clients, including financial news publishers, global broadcasters, and digital-first media houses, contribute to strong subscription revenues. Canada also maintains a steady demand through public broadcasters and specialized digital outlets.

Europe

Europe is a mature market supported by strong public broadcasting institutions and established agencies such as AFP and dpa. Demand is driven by high digital literacy, multilingual content consumption, and strong interest in specialized and investigative journalism. Germany, the U.K., and France represent the largest markets, with increasing adoption of digital syndication models across EU nations.

Asia-Pacific

Asia-Pacific is the fastest-growing market, led by China, India, Japan, and South Korea. Rising internet penetration, growing middle-class news consumption, and expanding digital publishing ecosystems are fueling growth. India and China are seeing strong demand for international content syndication as both markets accelerate digital subscriptions and mobile news consumption. Regional broadcasters increasingly rely on syndicated feeds to complement domestic reporting.

Latin America

Latin America is witnessing steady growth as Brazil, Mexico, and Argentina expand digital publishing capabilities. Despite economic constraints in some countries, digital-first news portals and TV broadcasters show rising interest in syndicated international coverage and multimedia content. Localized Spanish and Portuguese content syndication offers a strong opportunity for market expansion.

Middle East & Africa

The Middle East demonstrates rising demand due to expanding digital news networks in the UAE, Saudi Arabia, and Qatar. Africa is gradually increasing its reliance on syndicated content as internet access and mobile news consumption improve. Regional broadcasters and public institutions seek verified, high-quality content for multilingual audiences, making this a promising long-term growth region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the News Syndicates Market

- Associated Press (AP)

- Thomson Reuters

- British Broadcasting Corporation (BBC)

- Canadian Broadcasting Corporation (CBC)

- King Features Syndicate (Hearst)

- Agence France-Presse (AFP)

- Deutsche Presse-Agentur (dpa)

- Bloomberg News

- United Press International (UPI)

- E.W. Scripps Company

- A&E Networks

- ViacomCBS (Paramount)

- News Corp

- Great Big Story Media (revived digital brand)

- Heartland Media

Recent Developments

- In March 2025, Reuters expanded its automated multimedia syndication service, introducing AI-powered translation and global distribution tools for digital publishers.

- In February 2025, Associated Press launched a blockchain-based content authentication platform aimed at reducing misinformation and ensuring source traceability.

- In January 2025, BBC Global News unveiled a new API-driven syndication model allowing real-time content integration for OTT platforms and smart news apps.