Natural Colors & Flavors Market Size

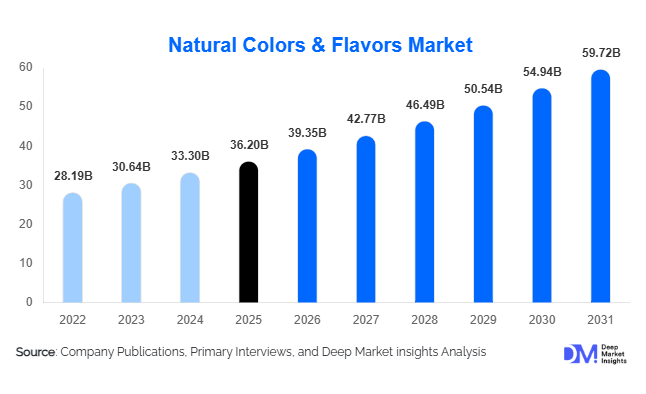

The global natural colors & flavors market size was valued at USD 36.2 billion in 2025 and is projected to grow from USD 39.35 billion in 2026 to reach USD 59.72 billion by 2031, expanding at a CAGR of 8.7% during the forecast period (2026–2031). The natural colors & flavors market growth is primarily driven by increasing consumer preference for clean-label products, rising regulatory pressure on synthetic additives, and the growing adoption of plant-based and organic food & beverage formulations across global markets.

Key Market Insights

- Natural flavors account for the majority of market revenue, driven by high usage in beverages, bakery, savory foods, and nutraceutical applications.

- Plant-based sources dominate the supply landscape due to regulatory acceptance, scalability, and consumer trust.

- Europe holds the largest market share, supported by stringent food safety regulations and widespread clean-label adoption.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, expanding processed food industries, and export-oriented manufacturing.

- Food & beverages remain the largest application segment, accounting for more than two-thirds of total demand.

- Technological innovation in fermentation and extraction is improving cost efficiency, stability, and supply reliability.

What are the latest trends in the natural colors & flavors market?

Acceleration of Clean-Label Reformulations

Food and beverage manufacturers are rapidly reformulating products to eliminate artificial additives and comply with evolving regulatory and consumer expectations. Natural colors and flavors are increasingly being positioned as premium, health-forward ingredients, particularly in bakery, dairy, beverages, and confectionery. This trend is reinforced by transparent labeling regulations in Europe and North America, pushing global brands to standardize formulations across regions using natural ingredients.

Growth of Fermentation-Derived Natural Ingredients

Fermentation-based production of flavors and colorants is gaining traction as it offers higher yield consistency, reduced dependence on agricultural cycles, and improved sustainability. These ingredients are increasingly accepted as “natural” under regulatory definitions, making them attractive for large-scale manufacturers seeking stable supply and predictable pricing.

What are the key drivers in the natural colors & flavors market?

Rising Health Awareness and Ingredient Transparency

Consumers are increasingly scrutinizing ingredient lists, favoring products free from artificial colors and flavors. This behavioral shift is significantly boosting demand for natural alternatives across packaged foods, beverages, and dietary supplements. Brands leveraging natural ingredients are experiencing higher consumer trust and premium pricing potential.

Stringent Regulatory Restrictions on Synthetic Additives

Governments across Europe, North America, and parts of Asia are tightening regulations on synthetic food additives, including artificial dyes and flavoring agents. These regulatory changes are compelling manufacturers to transition toward natural ingredients, accelerating long-term market growth.

What are the restraints for the global market?

High Cost of Natural Ingredients

Natural colors and flavors are significantly more expensive than synthetic alternatives due to complex extraction processes, raw material variability, and lower yields. This cost differential can limit adoption among price-sensitive manufacturers, particularly in emerging markets.

Supply Chain Volatility and Raw Material Dependency

Dependence on agricultural raw materials exposes the market to climate risks, seasonal fluctuations, and geopolitical disruptions. Variability in crop quality and availability can impact pricing stability and supply continuity.

What are the key opportunities in the natural colors & flavors industry?

Expansion in Asia-Pacific and Emerging Markets

Rapid growth in processed food consumption, rising disposable incomes, and increasing export-oriented food manufacturing in countries such as China, India, Indonesia, and Vietnam present significant opportunities. Localized production facilities and regional partnerships are expected to unlock long-term growth.

Advancements in Biotechnology and Encapsulation

Innovations in encapsulation, enzyme-assisted extraction, and bio-fermentation are improving stability, shelf life, and application performance of natural ingredients. These advancements are enabling broader adoption across beverages, pharmaceuticals, and cosmetics while enhancing profit margins.

Product Type Insights

Natural flavors dominate the global market, accounting for approximately 62% of the total market share in 2025. This leadership is primarily driven by their extensive application across beverages, bakery, dairy, and savory food products, where manufacturers are actively replacing synthetic additives with plant-derived and fermentation-based alternatives. The strong growth of clean-label, organic, and minimally processed food products has further accelerated the adoption of natural flavors.

Natural colors constitute the remaining market share and continue to witness robust demand, particularly for carotenoids, anthocyanins, spirulina, and curcumin. These ingredients are increasingly used in confectionery, beverages, dairy desserts, and personal care products due to their dual functionality of visual enhancement and perceived health benefits. The leading growth driver for this segment is the consumer preference for visually appealing products that comply with clean-label and synthetic-free standards.

Source Insights

Plant-based sources lead the market with nearly 74% share, supported by wide regulatory acceptance, strong consumer trust, and abundant availability of raw materials such as fruits, vegetables, herbs, and spices. Their compatibility with vegan, vegetarian, halal, and kosher product formulations makes them the preferred choice across global food and beverage applications.

Microbial-based sources represent the fastest-growing segment, driven by advancements in fermentation and biotechnology that enable consistent quality, higher yields, and improved sustainability. These sources are gaining traction among manufacturers seeking supply-chain stability and lower dependence on agricultural variability. Animal- and mineral-based sources remain niche, constrained by regulatory scrutiny, ethical concerns, and limited acceptance among clean-label-focused consumers.

Application Insights

The food & beverages segment accounts for approximately 68% of total market demand, making it the dominant application area. Growth is led by bakery, dairy, beverages, and confectionery, where natural flavors and colors are critical for product differentiation and compliance with evolving regulatory standards. The leading driver for this segment is large-scale reformulation initiatives by global and regional food brands.

Nutraceuticals and dietary supplements represent the fastest-growing application segment, supported by rising preventive healthcare awareness, increasing disposable incomes, and demand for functional ingredients. Cosmetics and personal care applications are expanding steadily, particularly for botanical extracts, essential oils, and naturally derived pigments, driven by the clean beauty and plant-based skincare movement.

End-Use Industry Insights

Packaged and processed food remains the largest end-use industry, supported by continuous product reformulation, private-label expansion, and growing retail penetration of clean-label food products. Manufacturers are increasingly investing in natural ingredient portfolios to meet retailer and consumer expectations.

Beverages are the fastest-growing end-use segment, driven by strong demand for natural beverage flavors in functional drinks, juices, flavored waters, energy drinks, and ready-to-drink (RTD) beverages. Pharmaceutical usage is expanding at a moderate pace, primarily due to increasing flavor-masking requirements in syrups, chewable tablets, and pediatric formulations.

| By Product Type | By Source | By Form | By Application | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe holds approximately 34% of the global market share in 2025, led by Germany, France, the U.K., Italy, and Spain. The region benefits from stringent food safety regulations, strong enforcement of clean-label standards, and high consumer awareness regarding ingredient transparency.

Key regional growth drivers include early adoption of natural food additives, strong demand for organic and non-GMO products, and the presence of major flavor and ingredient manufacturers with advanced R&D capabilities.

North America

North America accounts for around 28% of the global market, with the United States representing the dominant contributor. Demand is primarily driven by packaged food, beverage, and dietary supplement manufacturers actively transitioning away from artificial ingredients.

Regional growth is supported by strong clean-label movements, high consumption of functional foods and beverages, and continuous product innovation in plant-based and wellness-oriented categories.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR exceeding 10%. China and India serve as key growth engines, supported by large populations, rising urbanization, and increasing consumption of processed and convenience foods.

Major growth drivers include rapid expansion of the food processing industry, growing export-oriented manufacturing, and rising middle-class demand for premium and natural products. Favorable agricultural conditions also support raw material availability across the region.

Latin America

Latin America holds a modest yet steadily growing market share, with Brazil and Mexico leading regional demand. Increasing adoption of natural ingredients in beverages, confectionery, and dairy products is reshaping the regional landscape.

Growth is driven by rising health awareness, regulatory alignment with global food safety standards, and expanding domestic food and beverage manufacturing capacities.

Middle East & Africa

The Middle East & Africa region exhibits steady growth, supported by increasing food imports, urban population growth, and gradual expansion of local food processing industries.

Key regional drivers include growing demand for halal-certified products, rising tourism-driven foodservice demand, and increasing investments in regional food manufacturing infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|