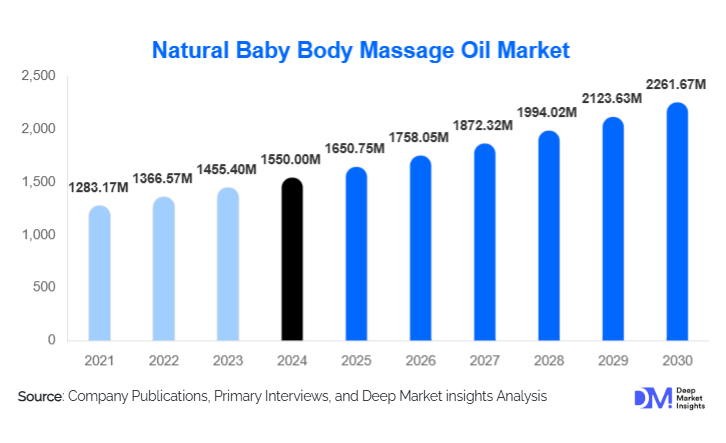

Natural Baby Body Massage Oil Market Size

According to Deep Market Insights, the global natural baby body massage oil market size was valued at USD 1,550.00 million in 2024 and is projected to grow from USD 1,650.75 million in 2025 to reach USD 2,261.67 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing parental awareness of infant skin health, rising preference for chemical-free and plant-based baby care products, and the premiumization of baby personal care across both developed and emerging economies.

Key Market Insights

- Rising preference for natural and organic baby care products is accelerating the replacement of mineral-oil-based formulations with plant-derived alternatives.

- Asia-Pacific dominates global demand due to deep-rooted infant massage traditions in countries such as India, China, and Indonesia.

- Premium and super-premium baby oils are expanding rapidly, particularly in North America and Europe, supported by dermatologist and pediatric endorsements.

- E-commerce and direct-to-consumer (D2C) channels are reshaping distribution, enabling brands to reach parents directly with educational and transparent marketing.

- Certified organic oils represent the fastest-growing sub-segment, despite higher price points, as clean-label trust becomes a decisive factor.

- Blended and herbal-infused formulations are gaining popularity over single-ingredient oils due to perceived multifunctional benefits.

What are the latest trends in the natural baby body massage oil market?

Shift Toward Certified Organic and Clean-Label Formulations

One of the most significant trends shaping the natural baby body massage oil market is the rapid shift toward certified organic and clean-label products. Parents are increasingly scrutinizing ingredient lists, avoiding parabens, synthetic fragrances, mineral oils, and preservatives. Certifications such as USDA Organic, COSMOS, and Ecocert are becoming strong purchase drivers, particularly in North America and Europe. Brands are responding by emphasizing cold-pressed extraction methods, single-origin sourcing, and full ingredient traceability. Packaging is also evolving to support clean-label positioning, with greater use of recyclable materials, glass bottles, and minimalist labeling that highlights transparency and safety.

Premiumization and Pediatric-Endorsed Products

Premiumization is accelerating as parents view baby care as a non-negotiable investment rather than a discretionary expense. Products positioned as pediatrician-tested, dermatologist-approved, or clinically formulated are witnessing higher adoption and command premium pricing. This trend is particularly visible in urban markets, where working parents favor trusted, scientifically validated products. In parallel, brands are launching specialized formulations for newborns, premature babies, and sensitive-skin infants, further segmenting the market and increasing average selling prices.

What are the key drivers in the natural baby body massage oil market?

Increasing Awareness of Infant Skin Sensitivity

Infant skin is significantly thinner and more permeable than adult skin, making it highly susceptible to irritation and chemical absorption. Growing awareness of this vulnerability has led parents to actively avoid synthetic ingredients and petroleum-derived oils. Educational campaigns, pediatric guidance, and digital parenting platforms have reinforced the perception that natural oils are safer and more nourishing. This heightened awareness is a primary driver behind the steady global shift toward plant-based massage oils.

Growth of Baby Care Premiumization and Wellness Culture

The broader wellness movement has extended strongly into baby care. Parents increasingly associate infant massage with improved sleep, digestion, circulation, and emotional bonding. Natural baby massage oils, positioned as wellness-enhancing products rather than basic toiletries, are benefiting from this shift. Rising disposable income, especially in Asia-Pacific and the Middle East, is further supporting demand for premium and super-premium baby oils that promise holistic benefits.

What are the restraints for the global market?

Price Sensitivity in Developing Economies

Despite strong demand, the higher cost of natural and organic baby massage oils remains a restraint in price-sensitive markets. Certified organic oils can be 20–50% more expensive than conventional alternatives, limiting adoption among low- and middle-income households. In rural and semi-urban regions, traditional homemade oils still compete strongly with branded products, slowing volume growth.

Volatility in Raw Material Prices

The market is exposed to fluctuations in the prices of key raw materials such as coconut oil, almond oil, olive oil, and sesame oil. Climatic variability, crop yield disruptions, and geopolitical factors can impact supply and pricing, affecting profit margins and pricing stability for manufacturers. Smaller brands are particularly vulnerable to such volatility.

What are the key opportunities in the natural baby body massage oil industry?

Expansion in Emerging Markets with Cultural Adoption

Emerging markets in Asia-Pacific, the Middle East, and Africa present substantial growth opportunities due to strong cultural acceptance of infant massage. As urbanization and disposable incomes rise, parents are transitioning from unbranded oils to trusted packaged products. Brands that localize formulations using regionally familiar ingredients and traditional wellness concepts are well-positioned to capture this demand.

Medical and Institutional Channel Penetration

Hospitals, maternity clinics, and neonatal care centers represent an underpenetrated but high-potential channel. Products endorsed or supplied through medical institutions benefit from strong trust and repeat household usage. Partnerships with healthcare providers and inclusion in postnatal care kits offer long-term brand-building opportunities.

Product Type Insights

Blended and multi-ingredient baby massage oils dominate the market, accounting for approximately 42% of global revenue in 2024. These products combine multiple plant oils, herbal extracts, and vitamins to deliver multifunctional benefits such as hydration, nourishment, and soothing effects. Single-ingredient oils, such as coconut and almond oil, continue to hold strong demand in traditional markets but are gradually losing share to blended formulations that offer enhanced positioning and differentiation.

Ingredient Nature Insights

Natural (non-certified) oils account for around 63% of the market, driven by affordability and wider availability. However, certified organic oils are the fastest-growing segment, particularly in North America and Europe, as regulatory trust and clean-label awareness influence purchasing decisions. Organic oils are increasingly preferred for newborns and sensitive-skin infants.

Distribution Channel Insights

Offline retail channels, including pharmacies, baby specialty stores, and supermarkets, account for approximately 58% of global sales, reflecting the continued importance of trust-based purchasing for baby care products. However, online channels are growing at a faster pace, supported by D2C brand strategies, subscription models, and digital parenting communities. E-commerce is particularly influential among urban millennials and Gen Z parents.

End-Use Insights

Household consumers represent over 82% of total demand, driven by daily infant care routines. Hospitals and maternity clinics are a smaller but rapidly expanding segment, particularly in developed markets where natural oils are increasingly integrated into postnatal care practices. Baby spas and wellness centers, though niche, are emerging as high-value end users in urban Asia.

| By Product Type | By Ingredient Nature | By Formulation | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 42% of the global market in 2024, led by India and China. Strong cultural traditions of infant massage, high birth rates, and expanding middle-class populations underpin regional dominance. India alone contributes nearly 18% of global demand, supported by widespread acceptance of Ayurvedic formulations.

North America

North America holds around 26% of the global market share, driven by premium product adoption, pediatric endorsements, and high awareness of ingredient safety. The U.S. is the largest market in the region, with strong growth in organic and dermatologist-tested products.

Europe

Europe accounts for about 21% of global demand, with Germany, France, and the U.K. leading consumption. Strict cosmetic regulations and sustainability preferences support strong demand for certified organic and eco-friendly baby oils.

Latin America

Latin America represents nearly 5% of the market, with Brazil and Mexico driving demand through urbanization and growing middle-class income. Market growth is gradual but stable.

Middle East & Africa

The Middle East & Africa region contributes approximately 6% of global revenue, led by the UAE and Saudi Arabia. Demand is supported by premium imports and high purchasing power in Gulf countries, alongside traditional infant care practices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|