Nail Art Printer Market Size

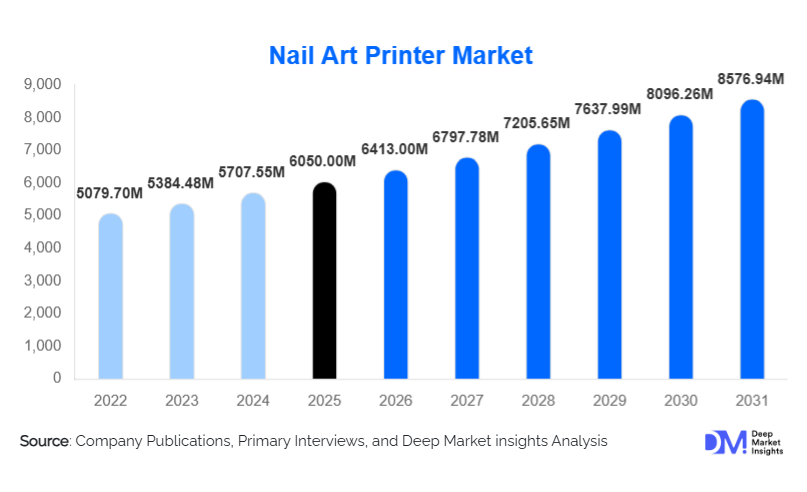

According to Deep Market Insights, the global nail art printer market size was valued at USD 6050 million in 2025 and is projected to grow from USD 6413.0 million in 2026 to reach USD 8576.94 million by 2031, expanding at a CAGR of 6.0% during the forecast period (2026–2031). The nail art printer market growth is primarily driven by rising demand for customized nail designs, increasing automation in professional beauty services, and growing adoption of beauty-tech devices across salons and home users worldwide.

Key Market Insights

- Digital nail customization is becoming mainstream, as consumers increasingly prefer personalized, intricate nail designs delivered quickly and consistently.

- Professional nail salons dominate demand, leveraging nail art printers to improve service speed, reduce labor dependency, and standardize design quality.

- Asia-Pacific leads the global market, supported by strong manufacturing presence, high salon density, and rapid beauty industry expansion in China, Japan, and South Korea.

- North America represents a mature but high-value market, driven by premium salons, tech-savvy consumers, and strong spending on beauty devices.

- Online distribution channels are gaining traction, with direct-to-consumer sales and brand-owned platforms accelerating adoption among home users.

- Integration of AI, mobile apps, and cloud-based design libraries is reshaping product differentiation and long-term customer engagement.

What are the latest trends in the nail art printer market?

AI-Enabled and App-Controlled Nail Art Printers

The nail art printer market is witnessing rapid adoption of AI-enabled systems integrated with mobile applications. These platforms allow users to upload custom designs, access cloud-based libraries, and receive AI-driven recommendations based on fashion trends and personal preferences. Smartphone connectivity has become a standard feature, enabling remote operation, design previews, and software updates. This trend is particularly attractive to younger consumers and professional salons seeking efficiency, design consistency, and enhanced customer experience.

Growth of DIY and Home-Use Nail Printing

Compact and portable nail art printers designed for personal use are gaining popularity, supported by influencer marketing, social media trends, and the rise of at-home beauty routines. Consumers are increasingly investing in entry-level printers that offer professional-quality results without requiring advanced nail art skills. Subscription-based design content, affordable consumables, and e-commerce availability are further supporting this trend, expanding the consumer base beyond traditional salon users.

What are the key drivers in the nail art printer market?

Rising Demand for Customization and Speed in Nail Services

Consumers increasingly expect fast, personalized nail services with complex designs inspired by social media and celebrity trends. Nail art printers significantly reduce application time while delivering high-resolution, repeatable designs, making them an attractive solution for salons aiming to increase throughput and profitability. The ability to instantly replicate trending designs has become a critical driver of adoption.

Expansion of the Global Beauty and Personal Care Industry

The steady growth of the global beauty services industry, supported by rising disposable incomes and urbanization, is directly benefiting the nail art printer market. Nail salons, beauty chains, and aesthetic centers are expanding rapidly, particularly in emerging economies, creating sustained demand for advanced nail art equipment. Increasing investments in salon modernization and service differentiation are reinforcing this driver.

What are the restraints for the global market?

High Initial Equipment and Maintenance Costs

Commercial-grade nail art printers involve relatively high upfront costs, along with ongoing expenses for proprietary inks, cartridges, and maintenance. This acts as a barrier for small and independent salons, particularly in price-sensitive markets. Cost concerns also limit rapid penetration in developing regions where manual nail art remains significantly cheaper.

Technical Limitations and Consumable Dependency

Dependence on specific consumables and software ecosystems restricts flexibility for end users. Printer downtime, ink compatibility issues, and limited third-party support can affect operational efficiency, especially in high-usage salon environments. These challenges may slow adoption among risk-averse operators.

What are the key opportunities in the nail art printer industry?

Expansion in Emerging Markets and Tier-2 Cities

Emerging economies in Asia-Pacific, Latin America, and the Middle East offer significant untapped potential. Rising middle-class populations, increasing beauty awareness, and the rapid growth of small salons and home-based beauty businesses create opportunities for affordable and portable nail art printers. Localization of pricing and product features can further accelerate penetration in these markets.

Partnerships with Beauty Chains and Training Institutes

Strategic collaborations with salon chains, nail academies, and cosmetic brands present scalable growth opportunities. Nail art printers are increasingly used for standardized service delivery and professional training, enabling manufacturers to secure bulk orders, recurring consumable sales, and long-term brand loyalty.

Product Type Insights

Compact and portable nail art printers dominate the market, driven by strong adoption among small salons and home users. Desktop printers represent a significant share in professional settings, offering higher precision and durability. Industrial-grade printers, while smaller in volume, cater to high-end salons and beauty chains that require faster output and higher reliability. The market is gradually shifting toward fully automatic models with minimal manual intervention.

Technology Insights

Inkjet printing technology leads the nail art printer market due to its cost efficiency, high-resolution output, and compatibility with a wide range of nail inks. UV-curable printing is gaining traction in premium applications, offering enhanced durability and faster curing times. Thermal transfer technology remains limited to niche use cases due to lower design flexibility.

Distribution Channel Insights

Online channels account for a growing share of global sales, supported by direct-to-consumer models, brand websites, and global e-commerce platforms. Direct sales remain critical for commercial buyers such as salons and beauty chains, where product demonstrations and after-sales support influence purchasing decisions. Specialty beauty equipment retailers continue to serve as important offline touchpoints in mature markets.

End-Use Insights

Professional nail salons and spas represent the largest end-use segment, accounting for nearly half of total demand in 2025. Individual consumers are the fastest-growing segment, supported by DIY beauty trends and affordable entry-level devices. Nail training institutes and academies are emerging as a niche but stable demand segment, using printers for skill development and standardized learning.

| By Product Type | By Technology | By Functionality | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global nail art printer market with approximately 38% share in 2025. China leads both manufacturing and consumption, followed by Japan and South Korea, where advanced beauty technology adoption is high. India and Southeast Asia are the fastest-growing markets, driven by rapid salon expansion and increasing beauty entrepreneurship.

North America

North America accounts for around 27% of the global market, led by the United States. High consumer spending on beauty services, strong presence of premium salons, and early adoption of beauty-tech devices support sustained demand. The region also leads in home-use nail art printer adoption.

Europe

Europe represents approximately 22% of global demand, with strong markets in Germany, France, the U.K., and Italy. Emphasis on premium beauty services and technological sophistication drives steady growth across the region.

Latin America

Latin America is an emerging market, led by Brazil and Mexico. Growth is supported by expanding urban salon networks and increasing influence of global beauty trends, although price sensitivity remains a constraint.

Middle East & Africa

The Middle East shows growing demand, particularly in the UAE and Saudi Arabia, supported by luxury beauty services and high disposable incomes. Africa remains a nascent market, with demand concentrated in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nail Art Printer Market

- O’2NAILS

- Presto (Korea)

- Tuoshi

- Nail Printer Inc.

- Funai Electric

- Ricoh Beauty Systems

- Canon Beauty Solutions