Music Festival Market Size

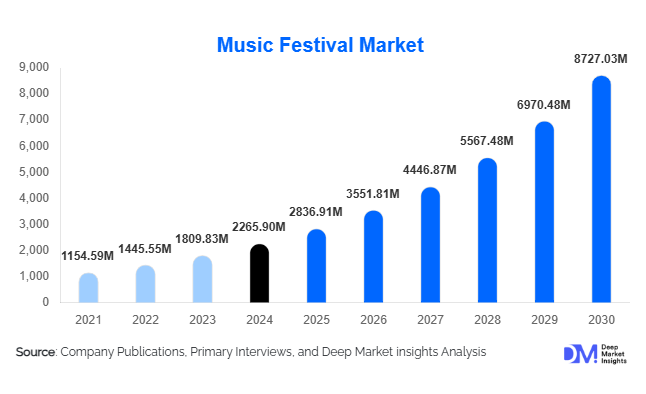

According to Deep Market Insights, the global music festival market size was valued at USD 2,265.90 million in 2024 and is projected to grow from USD 2,836.91 million in 2025 to reach USD 8,727.03 million by 2030, expanding at a CAGR of 25.20% during the forecast period (2025–2030). The rapid expansion of the music festival market is driven by rising consumer demand for live entertainment experiences, increased sponsorship investments, hybrid/virtual festival adoption, and the resurgence of tourism-linked attendance across global festival destinations.

Key Market Insights

- Hybrid and digitally integrated music festivals are expanding global audience reach, enabling monetization beyond physical venue capacities.

- Pop, Electronic Dance Music (EDM), and mainstream festivals dominate revenues, driven by mass appeal and strong sponsor interest.

- North America leads the global market, supported by a mature live entertainment ecosystem and high per-capita spending.

- Asia-Pacific remains the fastest-growing region, fueled by rising disposable incomes and rapid urban youth population growth.

- Brand activations at festivals are increasing sharply, with experiential marketing becoming a central revenue stream.

- Technology adoption, including cashless payments, mobile apps, AI crowd management, and VR livestreaming, is transforming festival operations and attendee engagement.

What are the latest trends in the music festival market?

Hybrid & Digitally Enhanced Festival Experiences

Music festivals are increasingly adopting hybrid business models that combine physical attendance with livestreaming, VR-based stages, and virtual meet-and-greets. These enhancements enable global access, expand revenue through digital ticketing, and provide tiered virtual experiences for fans unable to travel. Festival operators are integrating personalized mobile apps offering real-time scheduling, artist interactions, digital collectibles, and loyalty reward systems. The shift toward tech-enabled festivals appeals strongly to younger demographics seeking immersive and shareable experiences across social platforms. This digital layer is also helping festival brands maintain year-round engagement through exclusive content, online communities, and pre/post festival merchandising.

Sustainability & Eco-Conscious Festival Operations

A major trend reshaping the market is the focus on sustainability. Festivals worldwide are implementing eco-friendly initiatives such as solar-powered stages, waste segregation systems, water refill stations, reusable cup programs, and carbon offset ticketing. European festivals lead this shift, with many adopting Green Festival Accreditation standards. Sponsors increasingly demand ESG-aligned event partnerships, prompting operators to prioritize reduced environmental footprints. Attendees—especially Millennials and Gen Z—are also showing preference for brands and events demonstrating social and ecological responsibility, driving higher adoption of sustainable festival models.

What are the key drivers in the music festival market?

Growing Global Demand for Live Experiences

Consumers across all age groups, particularly Millennials and Gen Z, are prioritizing experiences over goods. This shift, supported by rising disposable incomes and social-media-driven lifestyle aspirations, significantly boosts attendance at music festivals. The desire for community-based entertainment, cultural identity, and multi-day immersive experiences contributes to rising ticket revenue, premium upgrade adoption, and festival tourism growth.

Surging Sponsorship Investments & Experiential Branding

Brands increasingly view music festivals as ideal experiential marketing platforms to reach engaged and youthful audiences. Sponsorships across beverage, fashion, technology, automobile, and lifestyle sectors now account for a major revenue share. Branded stages, interactive zones, augmented reality booths, and product-launch partnerships are becoming central features of major festivals. This corporate engagement strengthens the financial stability of festival organizers and enhances attendee experiences.

Technology Integration Improving Festival Delivery

Cashless RFID wristbands, digital ticketing, AI-enabled crowd flow management, interactive apps, and personalized scheduling tools are transforming festival operations. Technology helps optimize logistics, reduce wait times, increase attendee safety, and enable data-driven decision-making. This enhances attendee satisfaction and increases festival scalability, profitability, and operational efficiency.

What are the restraints for the global market?

High Operational Costs & Financial Risks

Music festival production involves substantial expenses, encompassing artist fees, staging, lighting, security, staff, logistics, and insurance. Rising global travel and talent costs further strain budgets. Many small to mid-size festivals struggle to maintain profitability or break even, particularly without strong sponsorship support. Volatility in weather and last-minute cancellations add to financial risks, making long-term planning challenging.

Regulatory, Environmental & Community Barriers

Tightening regulations on mass gatherings, noise levels, crowd control, and environmental impact present significant constraints. Obtaining permits can be complex and costly. Festivals must also manage waste, prevent ecosystem damage, and address community concerns regarding noise and congestion. Climate change impacts, such as heatwaves and storms, are causing increased schedule disruptions and raising operational uncertainties.

What are the key opportunities in the music festival industry?

Digital Extensions & Global Virtual Access

Hybrid festivals offer new revenue channels through digital passes, exclusive online content, subscription communities, and interactive livestream experiences. As remote consumption grows, organizers can scale globally without physical capacity limits. This model reduces geographic barriers and attracts international sponsors seeking multidimensional marketing exposure.

Festival Tourism & Destination Marketing

Cities and countries are increasingly using music festivals as tourism drivers. Integrated travel packages combining accommodation, local experiences, and festival access are gaining popularity. International tourism for iconic festivals such as Tomorrowland, Coachella, and Glastonbury is rising, benefiting local economies. Governments and tourism boards see festival tourism as a catalyst for job creation and destination branding, presenting strong opportunities for organizers and investors alike.

Product Type Insights

Multi-day and multi-stage festivals dominate the market, capturing a substantial share due to large artist lineups, extended visitor engagement, and high onsite spending. Single-day festivals remain popular in urban regions, offering accessible price points and simplified logistics. Hybrid/virtual festivals are rapidly emerging as a complementary category, driven by tech-savvy fans seeking flexible participation options. Genre-based festivals (Pop, Rock, EDM, Hip-Hop) continue to attract the largest attendance, while niche genres such as classical, jazz, and world music contribute to diversified market growth.

Application Insights

Entertainment-focused festivals remain the backbone of the market, delivering live performances, experiential zones, and premium hospitality offerings. Travel-linked festival tourism is growing at an accelerated pace as fans combine destination experiences with music. Branded activations and media broadcasting rights form a rapidly expanding application segment due to sponsor demand for high-visibility platforms. Livestreaming, VR stages, and digital fan communities are creating new monetization layers, attracting remote audiences and expanding market size beyond physical attendees.

Distribution Channel Insights

Online ticketing platforms and direct-to-consumer (D2C) festival websites dominate global sales, supported by dynamic pricing, seat selection, and secure digital access. Mobile apps increasingly serve as core distribution and engagement channels, offering ticketing, merchandise purchases, scheduling tools, and cashless payment integration. Third-party booking partners, travel portals, and brand-led event collaborations enhance reach, especially for international audiences. Social media influences festival discovery and plays a major role in shaping ticket purchase behavior.

Traveler (Attendee) Type Insights

Group attendees remain a major contributor to festival revenue, driven by social experiences and bundled ticket options. Solo attendees—particularly Millennials and Gen Z—show strong growth, seeking personal enrichment, cultural exploration, and flexible itinerary options. Couples and premium attendees remain core buyers of VIP packages, backstage experiences, and exclusive hospitality add-ons. Family-oriented festivals are expanding as event organizers introduce child-friendly zones, safety enhancements, and multi-generational entertainment.

Age Group Insights

Millennials (25–40 years) represent the largest attendee segment, contributing nearly 40% of total demand due to strong purchasing power and lifestyle preferences favoring cultural and live entertainment experiences. Gen Z drives rapid growth in digital participation, hybrid events, and social-media-driven festival trends. Older age groups (41–65+) remain significant for premium festival packages, comfort-oriented seating, and curated cultural festivals.

| By Festival Type | By Revenue Source | By Age Group | By Booking Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global market, led by major festivals such as Coachella, Lollapalooza, EDC, and Bonnaroo. High disposable incomes, strong sponsorship ecosystems, and advanced festival infrastructure support consistent growth. U.S. consumers show increasing interest in VIP upgrades, destination festivals, and tech-enhanced experiences. Canada contributes through large-scale cultural and jazz festivals that attract diverse international audiences.

Europe

Europe holds around 30% of the global market share and is home to globally renowned festivals, including Tomorrowland, Glastonbury, and Roskilde. The region’s deep-rooted festival culture and tourism demand drive consistent attendance. European markets lead in sustainability, with many festivals adopting carbon-neutral operations and advanced waste management models. Strong air connectivity and cross-border tourism further accelerate festival participation.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing nearly 23% of global revenues. Rising middle-class affluence, expanding youth demographics, and increasing international artist tours bolster demand in China, India, Japan, South Korea, and Australia. APAC festivals blend global artist lineups with regional cultural elements, strengthening domestic and outbound festival tourism. Large population centers offer significant long-term scalability.

Latin America

Latin America is an emerging market for festivals, with strong growth potential in Brazil, Mexico, and Argentina. Demand is driven by cultural vibrancy, local artist popularity, and growing interest from international performers. Economic improvements and expanding music tourism itineraries are expected to boost regional participation.

Middle East & Africa

MEA is gaining attention as GCC nations invest in entertainment infrastructure and international event hosting. The UAE and Saudi Arabia are becoming major hubs for global music festivals, supported by high-income populations and government-backed tourism initiatives. Africa hosts a mix of heritage and modern music festivals, attracting regional and global audiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Music Festival Market

- Live Nation Entertainment

- AEG Presents

- Superstruct Entertainment

- CTS Eventim

- Goldenvoice

- C3 Presents

- SJM Concerts

- ID&T

- Festival Republic

- Q-Dance

- FKP Scorpio

- MJR Group

- Music & Arts

- DHP Family

- SFX Entertainment