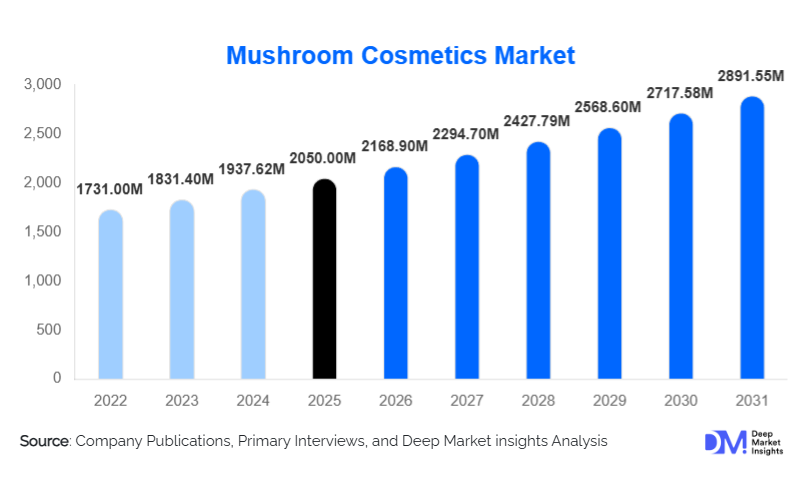

Mushroom Cosmetics Market Size

According to Deep Market Insights, the global mushroom cosmetics market size was valued at USD 2,050 million in 2025 and is projected to grow from USD 2,168.9 million in 2026 to reach USD 2,891.55 million by 2031, expanding at a CAGR of 5.8% during the forecast period (2026–2031). The mushroom cosmetics market growth is primarily driven by rising consumer preference for natural and clean beauty products, growing adoption of bioactive mushroom ingredients in skin and hair care, and rapid expansion of online and direct-to-consumer distribution channels across global markets.

Key Market Insights

- Consumer demand for natural, sustainable, and multifunctional cosmetic ingredients is surging, with mushroom-derived bioactives being perceived as safe, effective, and eco-friendly alternatives to synthetic compounds.

- Skin care dominates the product category, accounting for approximately 65% of market revenue due to high demand for anti-aging, hydration, and anti-inflammatory solutions.

- North America leads the mushroom cosmetics market, driven by mature beauty markets, strong e-commerce penetration, and high consumer awareness of functional skincare ingredients.

- Asia Pacific is the fastest-growing region, fueled by rising disposable incomes, cultural acceptance of mushroom-based traditional remedies, and rapid digital retail adoption.

- Premium mushroom cosmetics are expanding globally, with products leveraging clinical validation and bioactive potency attracting higher consumer spend.

- Technological integration, including advanced extraction methods, nano-encapsulation, and biotech-enabled formulations, is enhancing ingredient stability, efficacy, and product differentiation.

What are the latest trends in the mushroom cosmetics market?

Clean Beauty and Sustainability Driving Formulations

Brands are increasingly focusing on eco-friendly and clean formulations that replace synthetic additives with natural mushroom extracts such as tremella, reishi, and shiitake. Certifications like COSMOS and ECOCERT are being adopted to reinforce product credibility. Consumers are attracted to products that deliver therapeutic benefits while adhering to ethical sourcing and sustainability guidelines, reinforcing mushroom cosmetics as a mainstream clean beauty option. Packaging innovations using recyclable and biodegradable materials complement ingredient trends, strengthening consumer perception of brand responsibility.

Technology-Enhanced Extraction and Delivery

Advanced extraction technologies, such as enzymatic and green extraction methods, are improving the concentration and stability of mushroom bioactives. Nano-encapsulation and other delivery systems enhance skin penetration, efficacy, and shelf-life. Biotech integration allows for the development of customized formulations and nutricosmetic applications, combining cosmetic benefits with ingestible wellness supplements. Digital platforms are being leveraged to educate consumers on ingredient efficacy and provide personalized recommendations, boosting adoption across global e-commerce channels.

What are the key drivers in the mushroom cosmetics market?

Rising Demand for Clean and Natural Beauty Products

Global consumers are increasingly prioritizing natural and plant-based skincare ingredients, particularly those with multifunctional benefits. Mushroom extracts are valued for their antioxidant, anti-inflammatory, and hydrating properties. Skin care routines integrating mushroom actives for anti-aging and barrier repair are becoming widely popular, particularly among urban, health-conscious consumers. The trend spans premium and mid-tier products, ensuring broad market adoption.

Growth of E-commerce and Direct-to-Consumer Channels

Online retail platforms are driving accessibility and global reach for mushroom cosmetic brands. Direct-to-consumer sales provide a platform for indie and niche brands to build awareness, educate consumers on ingredient benefits, and offer personalized products. Social media, influencer campaigns, and digital content are playing a pivotal role in shaping purchase decisions, particularly among younger demographics.

Increasing Consumer Awareness and Education

Consumers are seeking transparency, safety, and scientific backing for cosmetic ingredients. Educational campaigns and influencer-driven content on the benefits of mushroom-derived polysaccharides and beta-glucans are building trust, enabling brands to command premium pricing. Growing awareness also contributes to cross-category adoption in hair care, body care, and nutricosmetics.

What are the restraints for the global market?

Ingredient Standardization Challenges

Variability in mushroom sourcing, extraction quality, and active concentration creates inconsistencies in product efficacy. Limited clinical validation compared to well-established actives such as vitamin C or retinol can hinder adoption in high-end and dermatologically sensitive segments.

Raw Material Supply and Cost Fluctuations

Mushroom cultivation and extraction are subject to seasonal and geographic constraints, affecting ingredient availability and pricing. Supply chain disruptions can impact mass-market and mid-tier brands more significantly, constraining production scalability and cost-effectiveness.

What are the key opportunities in the mushroom cosmetics industry?

Expansion into Emerging Markets

Asia Pacific, Latin America, and the Middle East are showing robust growth potential. Rising disposable income, urbanization, and digital adoption make these regions attractive for new entrants and established brands. India, China, and South Korea represent significant growth hubs for premium and mid-tier mushroom cosmetics due to cultural acceptance and strong e-commerce infrastructure.

Technological Innovation and Clinical Validation

Investment in advanced extraction technologies and clinical testing provides opportunities to substantiate efficacy claims, differentiate products, and penetrate premium segments. Integration with biotechnology allows for the creation of nutricosmetics, custom formulations, and next-generation mushroom actives, broadening revenue streams.

Integration with Clean and Sustainable Beauty Movements

Government regulations, consumer preference for eco-friendly products, and sustainability certifications create opportunities for mushroom cosmetic brands to position themselves as responsible and innovative. Brands leveraging environmentally responsible sourcing and production gain a competitive advantage in both mature and emerging markets.

Product Type Insights

Skin care dominates the mushroom cosmetics market, accounting for roughly 65% of revenue in 2025. Premium products such as tremella-infused serums, reishi-based moisturizers, and shiitake-enriched masks are leading due to high consumer awareness of bioactive benefits. Hair care and body care segments are smaller but growing steadily, with mushroom-infused shampoos, conditioners, and body lotions gaining popularity in the clean beauty space. Color cosmetics incorporating mushroom extracts remain niche but are gradually expanding through mid-tier and premium product lines.

Application Insights

Skincare applications, including anti-aging, hydration, and barrier repair, account for the greatest demand. Emerging applications include hair scalp health, soothing formulations for sensitive skin, and nutricosmetic oral supplements. Men’s grooming products and family skincare offerings are also gaining traction. Export-driven demand from the Asia Pacific to North America and Europe is fueling global product diversification and broader availability.

Distribution Channel Insights

Online retail dominates due to accessibility, product education, and e-commerce penetration. Specialty beauty stores, hypermarkets, and pharmacies provide offline touchpoints for premium and mid-tier consumers. Direct-to-consumer brand stores, subscription models, and social commerce platforms are increasingly used for personalized engagement and niche product launches.

End-User Insights

Women remain the primary consumer segment, accounting for 70% of market demand, particularly in skincare. Men’s grooming products and unisex formulations are emerging growth segments. Younger demographics drive digital discovery and mid-tier product adoption, while older consumers contribute to premium product sales. Nutricosmetics and wellness-integrated products provide incremental growth across all end-user categories.

| By Product Type | By Functional Ingredient Type | By Distribution Channel | By Price Tier | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 38% of global demand. The U.S. and Canada lead the adoption of mushroom cosmetics, particularly premium skincare and functional products. High consumer awareness, mature e-commerce infrastructure, and demand for clean beauty drive growth.

Europe

Europe represents 25% of the market, led by Germany, France, and the UK. Consumers prioritize organic, eco-certified, and dermatologically validated mushroom cosmetic products. Growth is moderate due to market maturity, but strong for premium segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region (28%), driven by China, India, Japan, and South Korea. Rising disposable incomes, cultural familiarity with mushrooms in traditional remedies, and strong digital retail adoption accelerate market penetration.

Latin America

Latin America (6%) is growing steadily, with Brazil, Mexico, and Argentina showing increasing interest in natural and premium cosmetic products. Outbound demand for imported mushroom-based skincare is expanding.

Middle East & Africa

The region (3%) is emerging, with the UAE, Saudi Arabia, and South Africa adopting mushroom cosmetics in premium skincare and grooming segments. Luxury-focused consumers and growing e-commerce penetration drive adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mushroom Cosmetics Market

- The Estée Lauder Companies, Inc.

- Shiseido Co., Ltd.

- Herbivore Botanicals

- MÁDARA Cosmetics

- Neon Hippie

- The Switch Fix

- Groh Beauty Corp.

- Youth To The People

- Innisfree (AmorePacific brand)

- Volition Beauty

- Kiehl’s (L’Oréal brand)

- Sulwhasoo (AmorePacific premium)

- Shikohin

- Origins (Estée Lauder brand)

- Gnome Wellness