Multimedia Robots Market Size

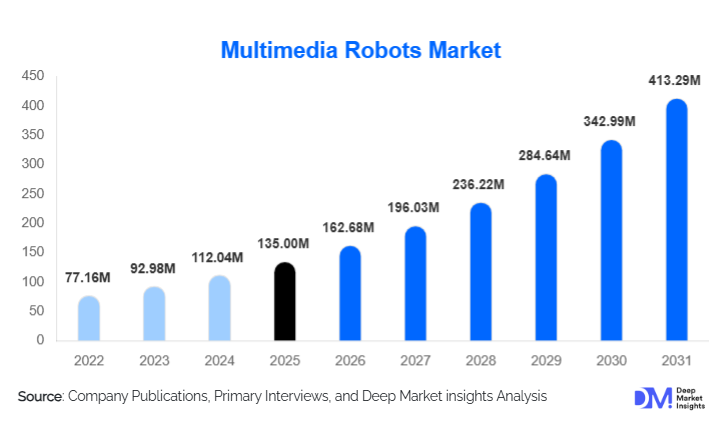

According to Deep Market Insights, the global multimedia robots market size was valued at USD 135.00 million in 2024 and is projected to grow from USD 162.68 million in 2025 to reach USD 413.29 million by 2030, expanding at a CAGR of 20.5% during the forecast period (2025–2030). The multimedia robots market growth is primarily driven by the rising adoption of AI-powered service and educational robots, increasing demand for automated customer interaction, and integration of advanced multimedia technologies across education, healthcare, retail, and public infrastructure sectors.

Key Market Insights

- AI-enabled humanoid robots are leading the market, offering lifelike interaction, speech recognition, and emotion detection, making them essential in education, healthcare, and service applications.

- Asia-Pacific dominates manufacturing and deployment, with China, Japan, and South Korea contributing the largest share due to government initiatives and large-scale industrial and educational robotics adoption.

- North America is a major high-value market, driven by enterprises, healthcare facilities, and educational institutions investing in AI-integrated multimedia robots for operational efficiency and digital engagement.

- Europe is rapidly adopting interactive robots, with Germany, the U.K., and France leading growth through smart city projects, AI labs, and public infrastructure deployments.

- Emerging opportunities in elder care and therapy robots are creating a surge in demand, particularly in Japan and Europe, due to aging populations and rising interest in companion robots.

- Technological integration, including cloud robotics, IoT connectivity, emotion AI, and generative AI content delivery, is reshaping how users interact with robots in both commercial and personal contexts.

What are the latest trends in the multimedia robots market?

AI and Human-Machine Interaction Advancements

Advances in natural language processing, emotion recognition, and computer vision are enabling multimedia robots to communicate more naturally with humans. Robots are now capable of understanding context, responding with adaptive dialogue, and delivering personalized content in education, retail, and healthcare. Institutions are increasingly adopting AI-enabled robots as teaching assistants, receptionists, and therapy companions, while entertainment applications are leveraging interactive storytelling, gamified learning, and digital performance features to engage users more effectively.

Cloud-Connected and IoT-Integrated Robotics

Cloud connectivity allows multimedia robots to access vast data resources, software updates, and AI analytics, improving performance and personalization. IoT integration enables robots to interact with other smart devices, from classroom projectors to smart hospital systems, creating seamless experiences across multiple touchpoints. This trend is attracting commercial and institutional buyers who require scalable and remotely manageable robotics solutions, boosting adoption in education, healthcare, and corporate sectors.

What are the key drivers in the multimedia robots market?

Rising Adoption Across Service and Educational Sectors

The global shift toward automation in service industries and digital learning initiatives is driving demand for multimedia robots. Retail, hospitality, and educational institutions are deploying robots for customer engagement, personalized learning, and administrative tasks. Robots reduce labor dependency while delivering consistent, high-quality interaction. Governments and private enterprises are investing in pilot programs, particularly for AI-enabled humanoid and companion robots, fueling further market expansion.

Government Initiatives and Smart Infrastructure Programs

National programs such as China’s “Made in China 2025,” India’s “Make in India,” and Japan’s “Society 5.0” are accelerating adoption by funding public infrastructure projects, educational robotics, and healthcare automation. Policy support, subsidies, and research grants are creating favorable conditions for both domestic and international players to expand their presence, driving innovation and deployment at scale.

Technological Advancements and AI Integration

Breakthroughs in AI technologies, including natural language processing, emotion AI, computer vision, and generative content engines, are significantly enhancing multimedia robot capabilities. These robots are now capable of delivering personalized interactions, adaptive content, and immersive multimedia experiences. Integration of cloud robotics, IoT, and real-time analytics further supports scalability, performance monitoring, and remote management, accelerating adoption across multiple end-use sectors.

What are the restraints for the global market?

High Initial Costs

Despite declining hardware prices, advanced multimedia robots remain expensive due to the integration of AI processors, high-resolution displays, sensors, and actuators. High upfront investment limits adoption among smaller institutions, emerging markets, and budget-conscious organizations, slowing widespread market penetration. Cost constraints are particularly acute in educational and small commercial deployments where return on investment is closely scrutinized.

Data Privacy and Compliance Concerns

Multimedia robots often collect sensitive data such as voice, video, and behavioral patterns. Compliance with regulations such as GDPR and regional privacy laws adds operational and legal complexities for manufacturers and deployers. Organizations must implement secure architectures and data protection protocols, creating additional cost and deployment barriers that can restrain growth in sensitive applications such as healthcare and public services.

What are the key opportunities in the multimedia robots industry?

Expansion in Education and Personalized Learning

Educational robotics is emerging as a high-growth opportunity, particularly for AI-enabled humanoid robots that act as teaching assistants, language tutors, and STEM instructors. Governments and private institutions are integrating multimedia robots into classrooms to enhance engagement and improve learning outcomes. Emerging markets present high-volume adoption opportunities with scalable, low-cost educational robots designed for digital literacy programs and hybrid learning models.

Healthcare and Elder Care Applications

Multimedia robots are increasingly deployed in hospitals, elder care facilities, and therapy centers. Robots offering cognitive engagement, emotional support, medication reminders, and telehealth interfaces are addressing workforce shortages and improving patient outcomes. Aging populations in Japan, Europe, and North America make this sector one of the fastest-growing applications, with high potential for subscription-based AI services and content updates.

Public Infrastructure and Smart Cities

Governments are investing in smart public services where multimedia robots provide customer assistance in airports, museums, libraries, and transport hubs. Multilingual communication, real-time information delivery, and interactive guides offer operational efficiency and improved citizen engagement. Long-term contracts and public-private partnerships represent substantial revenue opportunities for established robotics companies.

Product Type Insights

Humanoid multimedia robots dominate the market, representing approximately 38% of the 2024 market, due to their superior human-like interaction capabilities, broad adoption in education and service industries, and enhanced engagement potential. Non-humanoid interactive robots are growing steadily, particularly in retail and hospitality, while animal-inspired and display-integrated robots are niche but expanding rapidly for therapy, entertainment, and promotional applications.

Application Insights

Customer interaction and service robots account for the largest functionality segment, representing roughly 32% of 2024 revenues. Education robots follow closely at 27%, driven by EdTech investments and digital literacy programs. Healthcare and therapy applications are rapidly expanding, particularly in elder care and rehabilitation. Entertainment and media delivery robots are emerging as a high-growth niche, incorporating gamification, augmented reality, and live interactive content features.

Distribution Channel Insights

Direct enterprise sales and government contracts dominate distribution, particularly for high-value AI-integrated robots. Online sales, including manufacturer D2C portals, are growing for mid-range and personal-use robots, enabling smaller institutions and individual consumers to access scalable solutions. Service contracts, software subscriptions, and maintenance packages are increasingly bundled with hardware, creating recurring revenue streams for manufacturers.

End-Use Industry Insights

Education is the largest end-use industry, followed by healthcare and retail. Corporate offices and smart buildings are adopting robots for interactive information delivery and employee engagement. Emerging applications include immersive media events, corporate training, and residential companion robots. Export-driven demand is strong in the Asia-Pacific, supplying North America and Europe with high-value AI and cloud-connected robots.

| By Product Type | By Core Functionality | TBy echnology Stack | By End-Use Industry | By Deployment Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 28% of the 2024 market, led by the U.S., where enterprise, healthcare, and educational deployments are high. AI-enabled robots for customer engagement and therapy applications dominate. Canada contributes modestly, focusing on smart education and elder care applications.

Europe

Europe represents 21% of the market, with Germany, the U.K., and France leading adoption. Smart city projects, AI research initiatives, and public infrastructure robotics are key growth drivers. Europe is rapidly adopting ethical and AI-compliant robots for healthcare and education.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, holding 41% market share in 2024. China dominates manufacturing and deployment, while Japan leads in elder care and healthcare robotics. South Korea and India are emerging as significant adopters in education and public infrastructure.

Middle East & Africa

Smaller but growing, with the UAE, Saudi Arabia, and Qatar investing in smart city projects and public service robots. Intra-African deployments in South Africa and Nigeria are increasing, targeting commercial and educational applications.

Latin America

Brazil, Mexico, and Argentina are gradually adopting multimedia robots, primarily in education and retail. Growth is slower due to infrastructure constraints, but emerging middle-class demand is supporting pilot programs and niche deployments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Multimedia Robots Market

- SoftBank Robotics

- UBTECH Robotics

- Hanson Robotics

- PAL Robotics

- Toyota Robotics

- Honda Robotics

- Furhat Robotics

- Engineered Arts

- Blue Frog Robotics

- Temi (RoboTeam)

- Ecovacs Robotics

- Xiaomi Robotics

- RoboKind

- Sanbot (Qihan Technology)

- Pudu Robotics