Multimedia Projectors Market Size

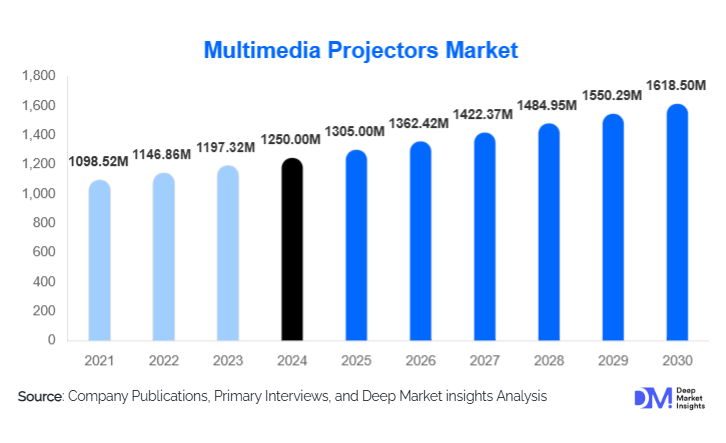

According to Deep Market Insights, the global multimedia projectors market size was valued at USD 1,250.00 million in 2024 and is projected to grow from USD 1,305.00 million in 2025 to reach USD 1,618.50 million by 2030, expanding at a CAGR of 4.4% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of projectors in education, corporate, and home entertainment sectors, rising demand for interactive and high-resolution projection systems, and technological advancements in laser, LED, and 4K UHD projectors.

Key Market Insights

- DLP projectors dominate the technology segment, accounting for around 40% of the 2024 market share due to superior image quality and reliability for corporate and educational applications.

- Educational institutions are the largest end-use segment, holding 32% of the market in 2024, driven by government initiatives for smart classrooms and e-learning platforms.

- Asia-Pacific is the fastest-growing region, led by China and India, where digital education expansion and corporate infrastructure development are boosting demand.

- Portable projectors are gaining traction, with a 28% market share, due to rising adoption in hybrid workplaces and remote education setups.

- Technological innovation, including laser projection, ultra-short-throw projectors, and AI-enabled interactive systems, is reshaping the market by offering energy-efficient, high-performance solutions.

- Export demand is increasing, with North America and Europe importing high-specification projectors for education, corporate, and home entertainment applications.

What are the latest trends in the multimedia projectors market?

Shift Toward Laser and LED Projection Technologies

Manufacturers are increasingly focusing on laser and LED projectors due to their longer lifespan, energy efficiency, and superior brightness compared to traditional lamp-based projectors. This trend is particularly prominent in corporate, educational, and home entertainment applications where long-term cost-effectiveness and low maintenance are crucial. Ultra-short-throw projectors, which can produce large images from minimal distances, are also gaining popularity in classrooms and small offices, improving usability in space-constrained environments.

Integration with Smart and Interactive Solutions

Interactive projectors with touch capabilities, wireless connectivity, and integration with collaboration tools are becoming standard in modern classrooms and boardrooms. AI-based projection systems that automatically adjust brightness and color based on ambient conditions are being adopted, enhancing visual clarity and user experience. This trend is particularly appealing to educational institutions and corporate clients seeking immersive, interactive environments.

What are the key drivers in the multimedia projectors market?

Rising Adoption in Education

The global push for smart classrooms and digital learning tools is a major driver of projector demand. Schools, universities, and training centers are adopting high-resolution and portable projectors to enhance student engagement and facilitate remote learning. Interactive projectors are enabling collaborative teaching, which is increasingly critical in modern educational setups.

Corporate Digital Transformation

Hybrid work models are driving the need for high-performance projectors in conference rooms and collaborative spaces. Companies are investing in projectors that support 4K resolution, wireless content sharing, and ultra-short-throw functionality to facilitate seamless presentations, video conferencing, and team collaboration. This trend is particularly strong in North America and Europe.

Technological Advancements

Innovation in projector technologies, including laser light sources, 4K and 3D projection, and ultra-portable designs, is enhancing product performance, durability, and appeal. Manufacturers that integrate AI, IoT, and cloud-based management systems are gaining a competitive advantage, meeting growing customer demands for convenience, interactivity, and energy efficiency.

What are the restraints for the global market?

Competition from Large Displays

High-resolution LED/LCDs are increasingly replacing projectors in corporate and home entertainment settings. Large displays offer comparable image quality with simplified installation and minimal maintenance, presenting a competitive challenge for projector adoption.

High Upfront Costs

Advanced projectors, particularly laser and ultra-high-lumen devices, require significant initial investment. This can limit adoption in SMEs, price-sensitive educational institutions, and developing markets. Additionally, maintenance costs for lamp-based projectors may deter potential buyers, slowing market penetration.

What are the key opportunities in the multimedia projectors industry?

Smart Classroom and EdTech Integration

Government initiatives promoting digital education and smart classroom infrastructure are driving opportunities for interactive and portable projectors. EdTech companies are collaborating with manufacturers to integrate AR/VR-enabled projection and cloud-based content delivery, expanding the scope for high-tech educational solutions.

Corporate Collaboration and Hybrid Work Solutions

Hybrid and remote working trends are fueling demand for projectors with advanced connectivity, high brightness, and portability. Companies can tap into this growing segment by offering integrated solutions that enhance collaboration and productivity in distributed work environments.

Technological Innovation and Product Differentiation

There is a strong opportunity for manufacturers to differentiate through laser projection, 4K/8K resolution, AI-based image optimization, and interactive touch functionality. Combining these features with energy efficiency and low maintenance helps capture premium segments in education, corporate, and home entertainment markets.

Product Type Insights

DLP projectors dominate the market with 40% share in 2024 due to superior brightness and reliability, particularly in the corporate and education segments. Laser and LED projectors are gaining traction due to longer lifespans and energy efficiency, while ultra-short-throw projectors are expanding adoption in space-constrained environments. Portable projectors, suitable for hybrid work and on-the-go education, accounted for 28% of the market, reflecting increasing demand for mobility and convenience.

Application Insights

Education is the leading application, holding 32% market share in 2024, driven by smart classroom initiatives and e-learning adoption. Corporate use for presentations, video conferencing, and training is growing rapidly. Home entertainment is emerging as a key application due to the rising popularity of home theaters and immersive gaming setups. Government and retail signage applications are gradually gaining traction, further diversifying the market.

Distribution Channel Insights

Direct sales, authorized distributors, and online platforms dominate projector distribution. Online channels such as manufacturer websites and e-commerce portals provide transparency, competitive pricing, and real-time availability, appealing to educational institutions and corporate buyers. Distributor networks ensure reach in developing regions and smaller markets. Integration of subscription models and service contracts is enhancing recurring revenue streams for manufacturers.

End-User Insights

Large enterprises represent 38% of the market, using projectors for high-resolution presentations and hybrid collaboration. Educational institutions are rapidly increasing their adoption of digital classrooms. Individual consumers are driving demand for home entertainment projectors. SMEs are gradually adopting portable and cost-effective projectors for training and presentations. Emerging applications in healthcare, government, and retail are creating additional end-use opportunities.

Age Group Insights

Educational and corporate users aged 25–50 years dominate adoption, as this demographic values immersive experiences, collaboration, and interactive learning. Younger users (18–25 years) influence demand for portable and low-cost solutions, while older users (50–65 years) focus on ease of use, reliability, and premium features in high-end applications.

| By Product Type | By Brightness (Lumens) | By Application | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for 30% of the 2024 market, driven by strong corporate and educational adoption. The U.S. and Canada lead demand, supported by digital classroom initiatives and hybrid work environments. The region also imports advanced projectors for high-end applications.

Europe

Europe holds 25% market share in 2024, with Germany, the U.K., and France driving adoption in corporate, education, and home entertainment. Eco-friendly and energy-efficient projectors are gaining traction, while budget-conscious markets are expanding portable projector adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region with an 8–9% CAGR. China and India lead adoption due to digital education expansion and corporate infrastructure development. Japan and Australia maintain steady demand for high-end and interactive projectors, while emerging markets are embracing portable and affordable solutions.

Latin America

Brazil, Mexico, and Argentina are emerging markets for multimedia projectors, primarily in education and corporate applications. Export-driven demand is increasing as local adoption remains nascent.

Middle East & Africa

Africa is both a manufacturing hub and a growing consumer market, while the Middle East, led by the UAE and Saudi Arabia, is witnessing rising corporate and government adoption. Regional infrastructure development and high-income populations support premium projector demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|