Mountain and Ski Resorts Market Size

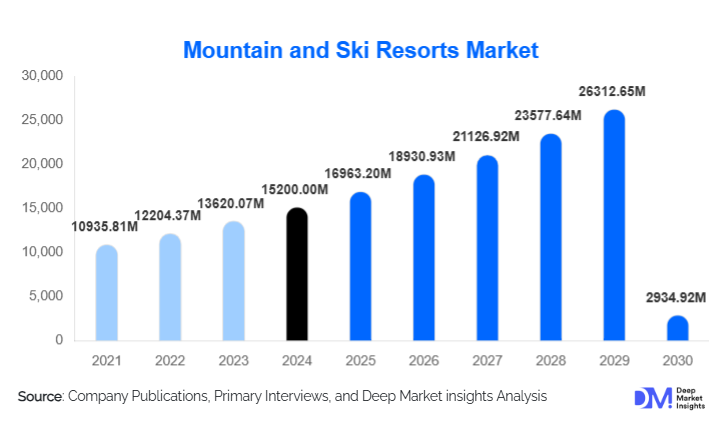

According to Deep Market Insights, the global mountain and ski resorts market size was valued at USD 15,200.00 million in 2024 and is projected to grow from USD 16,963.20 million in 2025 to reach USD 29,364.92 million by 2030, expanding at a CAGR of 11.6% during the forecast period (2025–2030). The market growth is primarily driven by rising tourism, increasing interest in winter sports, the expansion of luxury and all-inclusive resorts, and growing investments in sustainable and technology-enhanced resort operations.

Key Market Insights

- Alpine ski resorts dominate globally, offering premium facilities, extensive slopes, and high-spending tourist appeal, particularly in Europe and North America.

- Luxury accommodations and integrated services are expanding, with resorts offering wellness, adventure activities, and all-inclusive packages to attract both domestic and international tourists.

- Europe and North America collectively hold around 65% of the global market share, driven by well-established ski destinations in the Alps, Rockies, and Sierra Nevada.

- Asia-Pacific is the fastest-growing region, led by Japan, South Korea, and China, fueled by rising domestic tourism and winter sports popularity.

- Technological integration, including ski tracking apps, AI-assisted lifts, and digital booking platforms, is reshaping customer engagement and operational efficiency.

- Sustainable and eco-friendly resorts are increasingly preferred by environmentally conscious travelers, encouraging green investments and regulatory incentives.

What are the latest trends in the mountain and ski resorts market?

Diversification into Year-Round and Adventure Offerings

Mountain and ski resorts are expanding beyond winter sports to include year-round recreational activities, such as hiking, mountain biking, wellness retreats, and adventure parks. This strategy reduces dependence on seasonal snowfall and extends occupancy periods, increasing profitability. Resorts in Europe and North America are integrating luxury spa facilities, wellness programs, and multi-activity packages, appealing to tourists seeking immersive experiences. Adventure tourism elements, including zip-lining, guided treks, and alpine climbing, are becoming standard offerings, particularly in emerging APAC destinations.

Technology-Driven Guest Experiences

Advanced technology adoption is transforming mountain and ski resort operations. Mobile booking apps, AI-driven slope management, ski pass automation, and snow condition monitoring systems are enhancing customer convenience and operational efficiency. Resorts are also leveraging VR previews, online ski tutorials, and personalized itinerary planning to attract younger, tech-savvy travelers. Smart infrastructure and real-time data analytics are being used to optimize lift operations, reduce congestion, and monitor visitor behavior, offering both a safer and more engaging experience.

What are the key drivers in the mountain and ski resorts market?

Rising Disposable Income and Adventure Tourism

The increasing global middle-class population and high-net-worth individuals are driving growth in mountain and ski tourism. Travelers are willing to spend more on premium packages that combine skiing, luxury lodging, and adventure experiences. The trend of experiential travel has increased demand for immersive and recreational mountain activities, further boosting resort occupancy and revenue streams.

Infrastructure Development and Connectivity Improvements

Enhanced road, rail, and air connectivity to mountain regions has made ski resorts more accessible. Investments in modern lifts, snowmaking systems, and hospitality infrastructure have also contributed to higher tourist inflows. Government-backed winter tourism initiatives in Europe, North America, and the Asia-Pacific are further strengthening this driver by promoting regional resorts and incentivizing investments in amenities and safety standards.

Integration of Sustainability Practices

Resorts incorporating eco-friendly practices, such as renewable energy, waste management, and conservation programs, are attracting environmentally conscious travelers. Sustainable operations are increasingly linked with premium pricing, improved brand perception, and access to government incentives, making eco-conscious development a strong growth driver.

What are the restraints for the global market?

Seasonal Dependence and Climate Vulnerability

Ski resorts are highly dependent on winter snowfall, which is increasingly impacted by climate change. Reduced snow coverage, unpredictable weather patterns, and shorter winters affect slope usability, operational planning, and revenue. Resorts are investing in artificial snowmaking and diversification strategies to mitigate this risk, but climate-related limitations remain a significant restraint.

High Operational and Maintenance Costs

Mountain and ski resorts require substantial capital expenditure for lift infrastructure, slope maintenance, and luxury lodging operations. High fixed and variable costs can constrain profitability, particularly for smaller operators or emerging-market resorts with limited funding and experience in resort management.

What are the key opportunities in the mountain and ski resorts industry?

Emerging Market Expansion

Emerging markets such as China, India, and South Korea present significant opportunities for new resort development. Rising disposable incomes, government-backed winter tourism initiatives, and growing interest in adventure sports are driving demand. Investors can target underdeveloped regions to create high-end resorts and integrated mountain tourism hubs, capturing first-mover advantages.

Luxury and Wellness Integration

Combining wellness tourism with mountain and ski experiences offers niche growth potential. Resorts offering yoga retreats, holistic therapies, and spa treatments alongside skiing and adventure activities are attracting affluent travelers. This trend enhances per-visitor revenue and extends stay duration, positioning resorts as premium lifestyle destinations rather than seasonal recreational hubs.

Technology-Enabled Operations

Adoption of smart technologies, including AI-based lift operations, ski-pass automation, mobile apps, and virtual reality previews, enhances guest experience and operational efficiency. Tech-driven innovations attract younger, digital-first travelers while optimizing resource use, providing a competitive advantage for early adopters in both mature and emerging markets.

Product Type Insights

Alpine ski resorts dominate the market, accounting for approximately 45% of 2024 revenues due to their extensive slope networks, premium services, and international recognition. Nordic and mixed mountain resorts are growing steadily, particularly in APAC regions, offering specialized skiing, adventure, and wellness packages. Accommodation and lodging services contribute around 35% of overall revenue, driven by luxury lodges, chalets, and all-inclusive offerings that cater to domestic and international tourists. Ski passes and recreational activities contribute 30% of revenue, reflecting increasing participation in adventure sports.

Application Insights

Tourism-focused skiing remains the primary application, with luxury, mid-range, and budget packages catering to different income segments. Year-round adventure and wellness activities are emerging as secondary applications, expanding market reach. Photographic tourism, corporate retreats, and ski training camps are also gaining traction, particularly in regions with established resorts. Emerging eco-tourism programs, including conservation-focused resorts and sustainable lodging initiatives, attract environmentally conscious travelers seeking low-impact recreational experiences.

Distribution Channel Insights

Online booking platforms dominate, enabling travelers to compare packages, access reviews, and book services seamlessly. Travel agencies and specialized tour operators focusing on ski tourism remain important for high-value packages and corporate clients. Direct resort bookings are increasing as operators enhance digital presence with interactive websites, real-time availability, and dynamic pricing. Social media campaigns, influencer marketing, and subscription-based loyalty programs are emerging as innovative channels to engage repeat visitors.

Traveler Type Insights

International tourists represent 55% of the market, reflecting the global appeal of renowned ski destinations. Domestic travelers, particularly in APAC countries, are rapidly increasing. Luxury travelers favor high-end resorts with personalized services, while mid-range travelers opt for standardized packages balancing affordability and quality. Group and family travel are significant, driven by organized tours and multi-generational packages. Solo travelers and adventure enthusiasts are increasingly attracted to flexible and niche offerings, including ski training camps and wellness-focused retreats.

Age Group Insights

Travelers aged 31–50 account for the largest share, combining disposable income with interest in experiential travel. The 18–30 segment drives growth in budget and adventure-oriented packages, while the 51–65 age group prefers guided luxury experiences and wellness integration. Above-65 travelers form a niche market for slow-paced, comfortable, and accessible packages, often involving medical support and tailored itineraries.

| By Resort Type | By Facility/Service | By Customer Type / Visitor Type | By Seasonality / Visit Type | ByRevenue Source |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately USD 7.5 billion of the 2024 market, with U.S. resorts in Colorado, Utah, and California leading demand. Canada, particularly Whistler and Banff, also contributes significantly. Growth is driven by luxury packages, corporate retreats, and adventure tourism. Accessibility improvements and infrastructure investments further support expansion in this mature market.

Europe

Europe holds around USD 9.0 billion of the 2024 market, with France, Switzerland, and Austria leading in resort revenue. Established Alps resorts, long winter seasons, and strong international tourist inflow contribute to dominance. Europe remains the largest and most mature market, with growth fueled by eco-conscious and adventure-focused travel trends.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of 8%, driven by Japan, South Korea, and China. Rising domestic tourism, government winter tourism initiatives, and increased adventure and wellness offerings are key growth drivers. Luxury and mid-range resorts are rapidly expanding, particularly around Japanese and Korean ski destinations.

Latin America

Latin America, led by Chile and Argentina, is a developing market with growing demand for Andes resorts. Outbound international travel to Europe and North America also contributes to market expansion, particularly among affluent travelers seeking winter sports and adventure tourism.

Middle East & Africa

Morocco represents a niche demand for mountain tourism, while Africa remains a key adventure and eco-tourism hub. The Middle East, led by the UAE and Saudi Arabia, shows growing interest in winter resorts abroad, supported by high-income populations and luxury travel preferences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mountain and Ski Resorts Market

- Vail Resorts

- Alterra Mountain Company

- Compagnie des Alpes

- Intrawest Resorts Holdings

- Aspen Skiing Company

- Skistar AB

- Crystal Ski

- Club Med

- Espace Killy

- Resorts of the Canadian Rockies

- Powder Mountain

- Snowbird

- Les 3 Vallées

- Mammoth Resorts

- Whistler Blackcomb