Motorsports Market Size

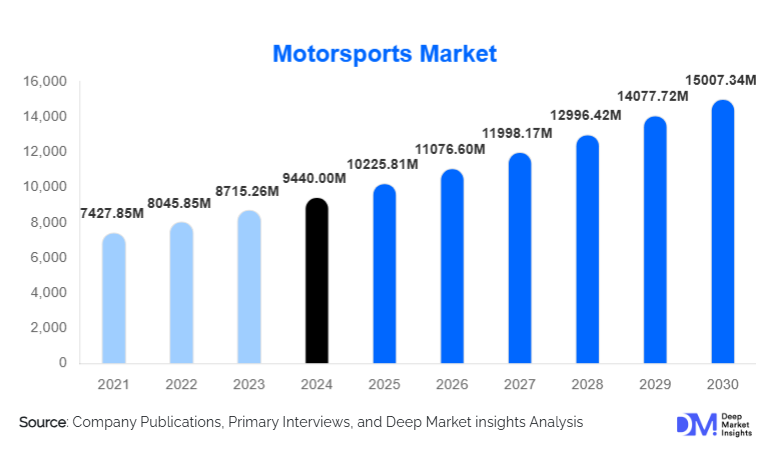

According to Deep Market Insights, the global motorsports market size was valued at USD 9,440.00 million in 2024 and is projected to grow from USD 10,225.81 million in 2025 to reach USD 15,007.34 million by 2030, expanding at a CAGR of 8.32% during the forecast period (2025–2030). The motorsports market growth is primarily driven by the increasing global fan base, rising investments in electric and hybrid racing technologies, and the expansion of professional and recreational motorsports events across emerging regions.

Key Market Insights

- Racing cars remain the dominant segment, accounting for 42% of the global market in 2024, due to Formula 1, NASCAR, and touring car competitions drawing significant sponsorship and viewership revenue.

- Telemetry and electronics adoption is increasing, representing 18% of the market, as real-time performance data, AI analytics, and race strategy optimization become critical for competitive teams.

- Professional motorsport events dominate applications, contributing 55% of the global market, driven by ticketing, broadcast rights, and merchandise sales.

- Racing teams and drivers are key end users, representing 48% of the market, investing heavily in high-performance vehicles, training, and safety equipment.

- Asia-Pacific is emerging as the fastest-growing regional market, led by China, India, and Japan, driven by rising disposable income, new race circuits, and growing fan engagement.

- Technological adoption, including electric racing vehicles, telemetry systems, and simulation-based motorsports, is reshaping the competitive landscape and fan experiences.

What are the latest trends in the motorsports market?

Growth of Electric and Hybrid Racing

Electric and hybrid racing categories, such as Formula E and electric motocross, are gaining momentum globally. These platforms provide automotive OEMs with an opportunity to showcase sustainable mobility solutions while catering to environmentally conscious fans. Government incentives for electric vehicles, along with fan demand for green technologies, are accelerating this shift. Racing teams are increasingly investing in battery technology, lightweight materials, and hybrid powertrains, positioning electric racing as a strategic segment of the motorsports market.

Simulation and e-Motorsports Integration

Simulation-based racing and virtual motorsports leagues are becoming mainstream, offering fans immersive digital experiences. Platforms using VR and AR allow players to experience professional racing tracks virtually, while AI-driven analytics enable skill improvement and competitive e-racing tournaments. e-Motorsports provides an additional revenue stream through sponsorships, merchandise, and subscriptions. Integration of gaming with live racing events enhances fan engagement and introduces younger demographics to motorsports.

What are the key drivers in the motorsports market?

Rising Global Fan Engagement

The expanding global fan base for professional racing leagues, including Formula 1, MotoGP, and NASCAR, is driving revenue through ticket sales, broadcasting rights, and sponsorship deals. Fans are increasingly engaging with races via live streaming, social media, and mobile apps, creating new commercial opportunities for event organizers and OEMs. Increased viewership in emerging regions such as APAC and LATAM is further fueling market expansion.

Technological Advancements in Vehicles and Equipment

Innovations in telemetry, AI analytics, aerodynamics, hybrid powertrains, and safety equipment are enhancing vehicle performance and overall race competitiveness. Advanced analytics enable teams to optimize strategies in real time, increasing fan excitement and market appeal. Adoption of these technologies also supports OEMs in showcasing their products and driving brand loyalty among motorsports enthusiasts.

Emergence of Electric Vehicle Racing

Formula E and electric motorcycle racing are rapidly expanding, particularly in Europe and APAC. Electric racing attracts new sponsorships and audience segments while aligning with global sustainability goals. Increasing government incentives for EV adoption further strengthen this growth driver.

What are the restraints for the global market?

High Entry Costs

The development of competitive racing vehicles, maintenance, and participation in international events involves significant capital investment. These high costs restrict market entry to well-funded teams and OEMs, limiting overall industry expansion and innovation potential among smaller participants.

Regulatory and Safety Challenges

Strict safety standards and environmental regulations can increase operational costs and delay event approvals. Compliance with FIA and FIM rules, as well as emissions standards for vehicles, remains a challenge, potentially slowing market growth and raising barriers for new entrants.

What are the key opportunities in the motorsports industry?

Expansion in Emerging Regions

Rising disposable incomes in APAC (China, India, Southeast Asia) and LATAM (Brazil, Mexico) are creating significant opportunities for motorsports events, training academies, and recreational motorsports. Investment in racing circuits and local motorsports infrastructure allows OEMs and event organizers to tap into new fan bases and drive participation growth.

Integration of Electric and Sustainable Technologies

Electric and hybrid racing is creating new high-growth segments. Manufacturers can leverage electric racing to showcase sustainable mobility innovations, while government incentives for green technology adoption increase investment attractiveness. This trend also aligns with fan interest in environmentally conscious motorsports.

Digital Engagement and e-Motorsports

Virtual racing and gaming-based motorsports are rapidly expanding, particularly among younger audiences. Integrating AR/VR, simulation platforms, and interactive mobile apps enhances fan engagement and provides new sponsorship, merchandising, and revenue opportunities. This represents a scalable market opportunity for technology-driven entrants.

Product Type Insights

Racing cars dominate the motorsports market, offering high revenue potential through sponsorships, merchandise, and event-driven revenues. Motorcycles and electric vehicles are emerging segments, driven by rising participation in motocross and Formula E. Go-karts, while smaller in market share, cater to recreational and amateur users, creating entry-level growth opportunities. Telemetry and electronics are increasingly adopted across all vehicle types, emphasizing performance optimization and data-driven strategies.

Application Insights

Professional motorsport events remain the primary application, generating 55% of revenue in 2024 through tickets, broadcasting, and sponsorship. Recreational motorsports, amateur racing clubs, and e-motorsports are expanding rapidly, particularly in APAC and LATAM. These applications serve both fan engagement and revenue diversification needs. Simulation and virtual racing events are also becoming popular for training and fan interaction.

Distribution Channel Insights

Direct sales to racing teams, event organizers, and OEM partnerships dominate the motorsports market. Online platforms and digital tools facilitate engagement for e-motorsports and amateur racing. Sponsorship-driven marketing, merchandising, and live broadcasting provide additional revenue streams. Specialty distributors for telemetry, safety, and performance equipment continue to play a critical role in component distribution.

End-Use Insights

Racing teams and professional drivers represent the largest end-use segment, accounting for 48% of the market. Recreational users and theme parks are emerging as growth drivers, especially in APAC and LATAM. OEMs and manufacturers leverage motorsports as a testbed for new technologies, while event organizers create additional fan engagement revenue through ticketing, merchandise, and media rights. Export demand for high-performance vehicles and racing components is also contributing to global revenue.

| By Product Type | By Component/Equipment | By Application | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global motorsports market, led by the U.S. with NASCAR, IndyCar, and Formula 1 events. Strong sponsorships, high fan engagement, and established racing infrastructure support continued growth. Canada also contributes via local racing circuits and amateur motorsports participation.

Europe

Europe contributes 30% of the market, driven by Formula 1, MotoGP, and electric racing. Germany, the UK, and Italy are the largest contributors due to automotive industry presence, high fan engagement, and advanced racing infrastructure. Europe also leads in sustainable and electric racing adoption.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, and Australia. Rising middle-class affluence, new racing circuits, e-motorsports, and social media influence are accelerating demand. China and India are particularly driving growth in mid-range and recreational motorsports, while Japan and Australia focus on professional and electric racing.

Latin America

Brazil and Mexico are leading LATAM markets, with increasing interest in professional and recreational racing. Outbound motorsports events and domestic racing circuits are expanding, though the region remains smaller in overall market share (8%).

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are investing in racing infrastructure and professional motorsports events. Africa hosts circuits for international events and contributes to 7% of the global market. Luxury motorsports and recreational circuits are increasingly attracting high-income local and international participants.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|