Motorcycle Navigation System Market Size

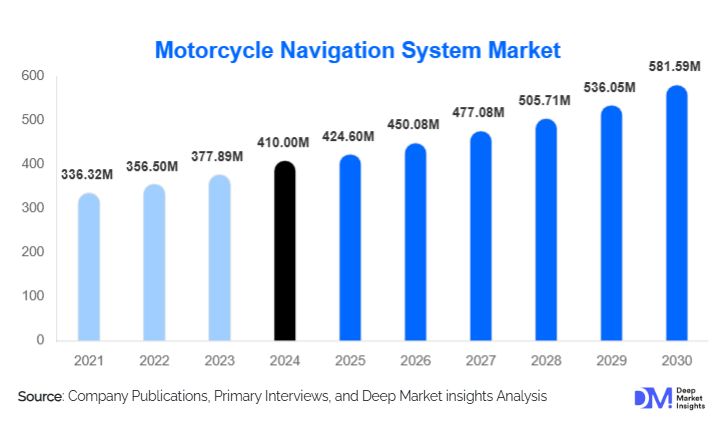

According to Deep Market Insights, the global motorcycle navigation system market size was valued at USD 410.00 million in 2024 and is projected to grow from USD 434.60 million in 2025 to reach USD 581.59 million by 2030, expanding at a CAGR of 6.00% during the forecast period (2025–2030). The motorcycle navigation system market growth is fueled by the rising popularity of long-distance touring, rapid adoption of digital cockpit technologies, and increasing integration of connected navigation capabilities into mid-range and premium motorcycles worldwide.

Key Market Insights

- Smartphone-based navigation solutions dominate global adoption, driven by affordability, improved mount technology, and the ubiquity of mobile navigation apps.

- OEM-integrated navigation systems are growing rapidly as motorcycle manufacturers embed digital TFT dashboards and connected features into new models.

- Adventure and touring motorcycles represent the highest navigation usage, driven by demand for terrain routing, waypoint tracking, and off-road mapping.

- Asia-Pacific is the fastest-growing region, supported by high motorcycle ownership in India, Indonesia, Vietnam, and Thailand.

- Europe remains the largest market for premium navigation systems, driven by strong demand for touring and adventure bikes.

- Connected and AI-enhanced navigation features such as predictive routing, hazard alerts, and terrain intelligence are reshaping product innovation.

What are the latest trends in the motorcycle navigation system market?

AI-Driven and Predictive Navigation Capabilities

Navigation system providers are increasingly shifting toward AI-enhanced routing features that analyze rider behavior, terrain conditions, weather patterns, and traffic density. Modern motorcycle navigation devices now incorporate predictive hazard alerts, personalized waypoint recommendations, and adaptive route optimization designed to enhance safety and riding efficiency. This trend is especially strong among adventure and touring riders who demand high-accuracy, terrain-sensitive navigation. OEMs are partnering with navigation software companies to offer cloud-based updates, machine learning–enhanced maps, and features like incident detection and real-time vehicle diagnostics integrated into the navigation interface.

Connected Dashboards and Smartphone Integration

Digital TFT dashboards with built-in navigation capability are becoming standard in mid- to high-end motorcycles. These connected dashboards support Bluetooth, Wi-Fi, and in some cases LTE/5G modules that enable seamless smartphone mirroring and app-based navigation. The rise of connected helmets, wearables, and voice-controlled interfaces is further enhancing rider interaction with navigation systems. Manufacturers are leveraging over-the-air (OTA) updates, app-linked navigation, and turn-by-turn instructions displayed on digital clusters, offering a premium rider experience that combines safety with convenience. As smartphone navigation apps grow more sophisticated, riders increasingly expect their motorcycles to support full digital integration.

What are the key drivers in the motorcycle navigation system market?

Rapid Growth of Adventure and Touring Motorcycles

The surge in global demand for adventure and touring motorcycles is a primary driver of navigation system adoption. These motorcycle categories rely heavily on GPS for off-road routing, terrain mapping, and long-distance trip planning. Riders increasingly seek rugged, highly accurate navigation systems capable of supporting varied terrain and weather conditions. This trend is particularly prominent in Europe and North America but is also rising in emerging markets, where enthusiasts are turning to long-distance motorcycle travel. Adventure motorcycles alone account for over 30% of navigation system usage, significantly boosting aftermarket and OEM demand.

Digital Cockpit Evolution and OEM Integration

The transition from analog motorcycle dashboards to digital TFT and OLED instrument clusters is revolutionizing navigation adoption. Major OEMs, including BMW, KTM, Hero MotoCorp, Harley-Davidson, and Triumph, now integrate factory-installed navigation modules or smartphone mirroring systems. This shift reduces reliance on aftermarket devices while boosting premiumization and increasing product value. The adoption of Bluetooth-enabled dashboards, rider apps, map sync, and OTA updates has positioned OEM integration as one of the strongest growth drivers of the market.

Government Support for Road Safety and Connected Mobility

Governments across Europe, Asia, and North America are promoting intelligent transport systems (ITS), digital mapping initiatives, and rider safety programs that encourage the adoption of reliable navigation tools. Regulations mandating improved visibility, accident prevention technologies, and rider assistance systems indirectly support the integration of navigation within motorcycle dashboards. As cities deploy real-time traffic systems and digital route management, navigation solutions become essential for safe and efficient mobility, directly contributing to the industry’s expansion.

What are the restraints for the global market?

High Cost of Advanced Navigation Devices

Premium motorcycle navigation systems equipped with rugged screens, AI-based routing, and high-precision GNSS modules remain expensive for many riders in emerging markets. While smartphone-based navigation offers an affordable alternative, the pricing gap limits the adoption of dedicated standalone navigation devices. This cost remains a notable barrier in regions where average motorcycle price points are low, limiting penetration of high-value navigation technologies.

Substitution by Smartphone Navigation Apps

Smartphone alternatives such as Google Maps, Waze, and specialized motorcycle apps like Calimoto and Rever continue to act as major substitutes for dedicated GPS units. As weatherproof phone mounts and wireless charging bases become more advanced, many riders opt for smartphone-based navigation. This trend suppresses the growth of standalone navigation systems, particularly in cost-sensitive markets across Asia, Latin America, and Africa.

What are the key opportunities in the motorcycle navigation industry?

Integration with Electric Motorcycles

Electric motorcycles are emerging as a high-potential opportunity for navigation system developers. EV motorcycles rely heavily on digital dashboards and connected systems, making them ideal platforms for integrating navigation features such as charging route optimization, range-aware routing, and battery management insights. As electric motorcycle adoption grows in China, Europe, and India, navigation providers have significant opportunities to partner with EV OEMs and supply integrated cloud-connected navigation modules.

Rapid Expansion in Asian and Latin American Markets

Emerging markets such as India, Indonesia, Vietnam, Brazil, and Thailand present major growth opportunities. These regions account for over 70% of global motorcycle volume but have relatively low penetration of advanced navigation solutions. With rising disposable income and government smart mobility initiatives, demand for low-cost rugged navigation modules and smartphone-based mount solutions is expanding rapidly. Navigation suppliers can capitalize on this by offering region-specific products tailored to high-volume commuter and touring motorcycles.

Product Type Insights

Smartphone-based navigation mount solutions dominate the market, capturing roughly 38% of the global market in 2024. Riders increasingly prefer smartphone navigation due to cost efficiency, app flexibility, real-time updates, and familiarity with mobile interfaces. Standalone GPS units remain relevant among adventure riders needing rugged, weatherproof systems, while OEM-integrated navigation systems are rapidly gaining ground as manufacturers embed connected displays directly into mid-range motorcycles.

Application Insights

Navigation systems are used across commuting, touring, off-road, and delivery applications. Adventure and off-road navigation represent the fastest-growing application, supported by demand for terrain-based routing, altitude tracking, and waypoint navigation. Commuter riders prefer simple smartphone-based navigation, while electric motorcycle users increasingly rely on integrated dashboard-based navigation optimized for battery use. Delivery fleets, particularly in Southeast Asia and Latin America, are emerging as a new application area, adopting navigation to improve route efficiency and reduce fuel/time costs.

Distribution Channel Insights

OEM channels dominate with 46% of global market share in 2024, driven by factory-installed digital dashboards and smartphone integration systems. Aftermarket channels continue to play a significant role, especially in developing countries where riders favor external mounts and standalone navigation devices. Online platforms, including e-commerce stores and OEM accessory portals, are gaining traction due to transparent pricing, easy comparison, and quick delivery. Subscription-based digital navigation services offered through mobile apps and OEM portals are emerging as new revenue channels.

Motorcycle Type Insights

Adventure and off-road motorcycles account for the largest share of navigation adoption, representing 31% of total demand in 2024. These motorcycles require advanced navigation features such as GPX route support, off-road trail mapping, and terrain analysis. Touring motorcycles also represent a strong demand segment due to long-distance travel routes. Commuter motorcycles rely primarily on smartphone navigation, while electric motorcycles are driving the next wave of digital navigation integration with cloud-based route planning and smart charging features.

| By Product Type | By Connectivity | By Display Type | By Navigation Capability | By Motorcycle Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 22% of the global motorcycle navigation system market, driven by high adoption of touring, cruiser, and adventure motorcycles. The U.S. dominates regional demand, with a strong preference for premium navigation technologies and connected dashboards. Consumer demand is shaped by long-distance touring culture and a mature aftermarket ecosystem. Increasing adoption of digital motorcycling electronics supports strong growth prospects over the next decade.

Europe

Europe represents the largest regional market with 28% of the global share in 2024. Germany, the U.K., Italy, France, and Spain lead demand for advanced navigation systems due to high motorcycle ownership and strong touring culture. OEM navigation integration is particularly strong among European brands such as BMW and KTM. Europe is also witnessing the rapid adoption of AI-based navigation, terrain data analytics, and premium digital dashboards. Adventure touring remains the dominant application.

Asia-Pacific

Asia-Pacific holds the largest unit volume share and is the fastest-growing region, with India, China, Indonesia, Vietnam, and Thailand accounting for nearly 34% of global demand. High motorcycle ownership and low-cost smartphone solutions drive widespread adoption of mobile-based navigation. EV motorcycle growth in China and India is accelerating demand for fully integrated navigation systems. The region is expected to record a CAGR of nearly 12% through 2030.

Latin America

Latin America holds around 10% of the global market share, led by Brazil, Mexico, Colombia, and Argentina. Riders in the region heavily rely on smartphone-based navigation due to cost sensitivity, though aftermarket GPS adoption is growing among touring enthusiasts. Urban delivery services in Brazil and Mexico are also increasingly using navigation solutions to improve efficiency.

Middle East & Africa

MEA accounts for approximately 6% of global demand. The UAE and Saudi Arabia lead regional adoption due to a high-income motorcycling culture and preference for premium touring and cruiser motorcycles. In Africa, South Africa and Kenya show growing aftermarket demand for affordable navigation solutions among adventure riders and local courier fleets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Motorcycle Navigation System Market

- Garmin Ltd.

- TomTom International BV

- Bosch Mobility Solutions

- Continental AG

- Panasonic Automotive Systems

- Harman International

- Mapbox Inc.

- Sygic

- NaviSys Technology Corp.

- MiTac Holdings

- HERE Technologies

- Delphi Technologies

- Sena Technologies

- Noodoe Navigation

- BEIDOU Navigation Systems (Commercial)

Recent Developments

- In April 2025, Garmin introduced a new rugged motorcycle GPS with AI-driven terrain prediction and enhanced off-road mapping.

- In March 2025, TomTom expanded its cloud-based navigation API partnerships with major motorcycle OEMs in Europe and North America.

- In January 2025, Bosch launched a next-generation integrated TFT navigation module compatible with mid-range electric motorcycles sold in Asia-Pacific.