Moto Taxi Service Market Size

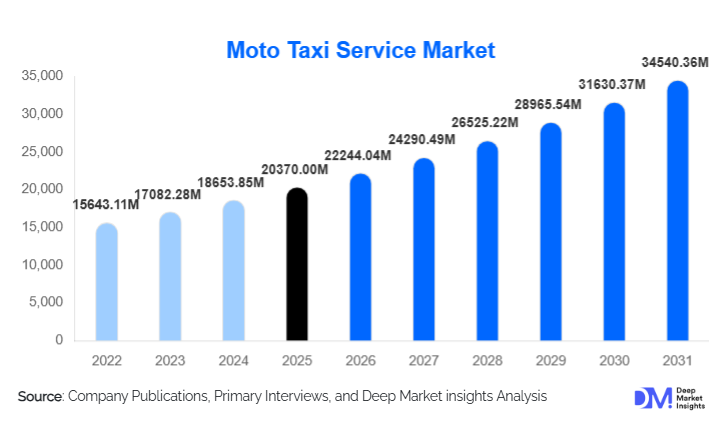

According to Deep Market Insights, the global moto taxi service market size was valued at USD 20,370.00 million in 2025 and is projected to grow from USD 22,244.04 million in 2026 to reach USD 34,540.36 million by 2031, expanding at a CAGR of 9.2% during the forecast period (2026–2031). The moto taxi service market growth is primarily driven by rising urban congestion, increasing adoption of digital ride-hailing platforms, and the shift toward electric two-wheeler fleets for sustainable urban mobility.

Key Market Insights

- Asia Pacific dominates the market, accounting for approximately 48% of the global market in 2024, fueled by high population density, entrenched two-wheeler culture, and rapid urbanization in countries like India, Indonesia, and Vietnam.

- Electric motorcycle integration is accelerating, with governments providing EV incentives and charging infrastructure, creating cost-efficient and environmentally friendly fleet operations.

- E-hailing services remain the largest service type, representing 62% of the 2024 market, due to convenience, digital booking, and fast, on-demand urban mobility.

- Individual commuter end-users dominate, comprising 70% of the market, driven by daily urban transport demand.

- Digital platforms and AI adoption, including predictive demand, dynamic pricing, and GPS optimization, are reshaping operational efficiency and customer experience.

- Africa is the fastest-growing regional market, supported by the formalization of informal motorcycle taxi services and increasing smartphone penetration.

What are the latest trends in the moto taxi service market?

Electrification of Moto Taxi Fleets

Operators are increasingly integrating electric motorcycles into fleets to reduce emissions and operating costs. Government incentives, subsidies for EV purchases, and investments in charging infrastructure in Asia, Africa, and Latin America are accelerating adoption. Electric fleets also appeal to environmentally conscious riders and align with urban sustainability initiatives, positioning electric moto taxis as a core growth segment of the market.

Integration with Public Transit Systems

Moto taxi services are increasingly being integrated into urban public transport systems for first-mile/last-mile connectivity. Partnerships with transit apps and mobility hubs enhance commuter convenience, reduce traffic congestion, and create predictable demand corridors for operators. This model opens public-private collaboration opportunities and strengthens the role of moto taxis in smart city mobility planning.

Technology-Enhanced Ride Optimization

AI and data-driven technologies are being adopted for dynamic route optimization, predictive demand, and real-time driver allocation. These solutions reduce wait times, improve safety, and increase operational efficiency. Additionally, mobile apps enable digital payments, GPS navigation, ride tracking, and customer loyalty programs, enhancing the overall rider experience and platform competitiveness.

What are the key drivers in the moto taxi service market?

Urban Congestion and Need for Affordable Transport

Rapid urbanization in Asia, Africa, and Latin America has resulted in traffic congestion, making traditional taxis and private cars less efficient. Moto taxis provide an affordable and agile alternative for short-distance trips, enabling commuters to save time and reduce transport costs. High adoption is observed among low- and middle-income urban populations seeking cost-efficient daily mobility.

Digital Platforms and Smartphone Penetration

Mobile apps and digital platforms have transformed moto taxi services, offering on-demand bookings, GPS-based navigation, and cashless payments. Increasing smartphone penetration globally has lowered barriers to entry for both riders and drivers, enabling large-scale adoption and growth of app-based services.

Sustainability and EV Integration

The push for green urban mobility has encouraged operators to adopt electric motorcycles. EV fleets reduce fuel costs, lower emissions, and benefit from government incentives. Sustainability-focused riders increasingly prefer eco-friendly services, making EV adoption a critical driver for market expansion.

What are the restraints for the global market?

Regulatory and Safety Challenges

Inconsistent regulations and safety standards across cities limit the scalability of moto taxi services. Driver training requirements, insurance, and licensing barriers can slow adoption and deter investment. Policymakers are gradually formalizing regulations, but regulatory uncertainty remains a key restraint.

Competition from Alternative Mobility Solutions

Metro rideshares, e-scooters, and traditional taxis create competitive pressure. Consumers in developed markets expect integrated mobility solutions, which challenge standalone moto taxi operators to differentiate their offerings through technology, pricing, or EV adoption.

What are the key opportunities in the moto taxi service market?

Expansion of Electric Fleets and Green Mobility

Electrification presents opportunities to reduce operating costs and environmental impact. Public subsidies, EV charging infrastructure, and eco-conscious rider preferences make electric moto taxis a growth engine. Partnerships with charging networks and vehicle manufacturers can generate recurring revenue and strengthen brand positioning.

Urban Transit Integration

Collaborating with public transit systems for first-mile/last-mile connectivity creates predictable commuter corridors, reduces congestion, and opens opportunities for long-term contracts with municipal authorities. This integration also improves platform visibility and strengthens user trust.

Technology and AI Adoption

AI-driven solutions in route optimization, predictive demand, and dynamic pricing enhance operational efficiency. Advanced mobile apps with digital payments, ride tracking, and loyalty programs increase user retention. Emerging technologies such as IoT and 5G could enable future innovations like augmented-reality navigation and fleet automation.

Service Type Insights

E-hailing services dominate the global moto taxi service market, accounting for approximately 62% of total market revenue in 2024. The leadership of this segment is driven by the rapid proliferation of smartphone-based ride-hailing applications, real-time ride matching, transparent pricing, and GPS-enabled navigation. E-hailing platforms significantly reduce passenger wait times and optimize driver utilization, making them the preferred choice for urban commuters seeking fast and affordable point-to-point mobility. Another key driver supporting the dominance of e-hailing services is the integration of digital payment systems, in-app safety features, route optimization algorithms, and customer loyalty programs. These features enhance user trust, improve service reliability, and increase ride frequency, particularly in densely populated metropolitan areas. The scalability of e-hailing platforms also allows operators to expand quickly into secondary cities and peri-urban regions, further strengthening market penetration.

Pre-booked services and subscription-based models represent a smaller but steadily growing share of the market. These services are primarily adopted by corporate users, enterprise mobility programs, and frequent commuters who value predictable pricing, guaranteed availability, and scheduled travel. Subscription models are gaining traction in cities with large gig-economy workforces and shift-based employment, as they provide recurring revenue stability for operators while offering cost savings for users.

Vehicle Type Insights

Internal combustion engine (ICE) motorcycles account for approximately 75% of the global moto taxi service market in 2024, maintaining their dominance primarily due to lower upfront vehicle costs, widespread availability, and well-established refueling infrastructure across developing economies. ICE motorcycles remain the preferred choice for operators in Asia, Africa, and Latin America, where charging infrastructure for electric vehicles is still evolving, and capital constraints limit rapid EV adoption. The dominance of ICE vehicles is further supported by their ease of maintenance, availability of spare parts, and familiarity among drivers. In many emerging markets, operators prioritize short-term affordability and operational flexibility, which continues to favor ICE-based fleets despite rising fuel prices.

Electric motorcycles are emerging as the fastest-growing vehicle segment, particularly in urban hubs with supportive government policies. Subsidies, tax incentives, reduced registration fees, and investments in charging infrastructure are accelerating electric moto taxi adoption in major cities across Asia-Pacific and Europe. Electric vehicles offer significantly lower operating costs, reduced emissions, and improved alignment with urban sustainability goals, making them increasingly attractive for fleet operators. Hybrid two-wheelers currently remain limited to pilot deployments and niche markets, primarily due to higher costs and limited model availability. However, they may serve as a transitional solution in regions where full EV infrastructure maturity is still underway.

Application Insights

Passenger mobility remains the dominant application of moto taxi services, accounting for approximately 80% of total market demand in 2024. This leadership is driven by the daily commuting needs of urban populations, particularly in cities facing chronic traffic congestion and limited public transportation coverage. Moto taxis provide a fast, flexible, and cost-efficient solution for short- to medium-distance travel, positioning them as an essential component of urban mobility ecosystems. High demand for passenger mobility is further reinforced by first-mile and last-mile connectivity requirements, where moto taxis complement metro, bus, and rail networks. Their ability to navigate congested streets and narrow urban corridors gives them a structural advantage over four-wheeled transport alternatives.

Goods and parcel delivery applications are emerging as a high-growth segment, driven by the rapid expansion of e-commerce, food delivery, and on-demand logistics platforms. Moto taxis are increasingly deployed for last-mile delivery due to their speed, low operating costs, and ability to meet same-day and instant delivery expectations in dense urban environments. Tourism-focused moto taxi services represent a niche but growing application, particularly in urban tourism corridors and emerging travel destinations. Tourists increasingly use moto taxis for short-distance sightseeing and local mobility, especially in cities with high congestion and limited parking availability.

End-User Insights

Individual commuters dominate the moto taxi service market, representing approximately 70% of total end-user demand. This segment is driven by daily urban travelers seeking affordable, time-efficient transportation for commuting to workplaces, educational institutions, and commercial hubs. Price sensitivity, convenience, and reliability make moto taxis an attractive alternative to traditional taxis and private vehicles.

Corporate and enterprise users are an expanding end-user segment, particularly in cities with large organized workforces and gig-economy participation. Companies increasingly partner with moto taxi platforms to provide employee transportation, shift-based mobility solutions, and cost-controlled travel programs. Subscription-based offerings and corporate accounts are strengthening this segment’s contribution to overall market revenue. Logistics companies and e-commerce platforms are rapidly emerging as key end users, leveraging moto taxis for last-mile delivery operations. The ability of moto taxis to navigate traffic efficiently and complete high-volume deliveries at lower cost is driving increased adoption across urban logistics networks, further diversifying market demand.

| By Service Type | By Vehicle Type | By Application | By End User | By Payment Mode |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 14% of the global moto taxi service market and demonstrates steady growth driven by urban mobility innovation rather than necessity-based adoption. Demand is concentrated in major metropolitan areas across the United States and Canada, where traffic congestion, limited parking availability, and high car ownership costs encourage alternative mobility solutions. Regional growth is supported by the integration of moto taxi services into multimodal transport ecosystems, including partnerships with public transit authorities and shared mobility platforms. Sustainability initiatives, pilot electric two-wheeler programs, and rising consumer acceptance of micro-mobility solutions are key drivers shaping long-term adoption in the region.

Europe

Europe represents approximately 12% of the global market, with adoption driven primarily by sustainability-focused urban mobility policies and emissions reduction targets. Western European countries emphasize electric moto taxi fleets, stringent safety standards, and regulated ride-hailing frameworks, which support controlled but stable market growth. Eastern Europe experiences comparatively faster growth, driven by affordability considerations and increasing urban congestion. Across the region, government-backed green mobility initiatives, low-emission zones, and investments in smart city infrastructure act as major drivers of moto taxi service adoption.

Asia-Pacific

Asia Pacific is the largest and fastest-growing regional market, accounting for approximately 48% of global revenue in 2024. Growth is driven by rapid urbanization, high population density, deeply embedded two-wheeler culture, and widespread use of app-based ride-hailing platforms. India, Indonesia, Vietnam, and the Philippines lead regional adoption due to daily commuter reliance on motorcycles, limited public transport capacity in secondary cities, and price-sensitive consumer bases. Strong platform competition, aggressive fleet expansion, and increasing EV adoption further reinforce Asia-Pacific’s market leadership.

Latin America

Latin America holds approximately 8% of the global market, with Brazil and Colombia emerging as key growth markets. Regional growth is driven by severe urban congestion, rising middle-class populations, and the affordability of moto taxi services compared to traditional taxis. Weak public transportation infrastructure in certain cities, combined with increasing smartphone penetration, supports continued expansion. Moto taxis are increasingly positioned as practical short-distance mobility solutions for both commuters and informal sector workers.

Middle East & Africa

Africa represents the fastest-growing region in CAGR terms, driven by the formalization of historically informal motorcycle taxi services and rapid smartphone adoption. Moto taxis play a critical role in urban and semi-urban mobility, filling gaps left by underdeveloped public transport networks. In the Middle East, countries such as the UAE and Saudi Arabia contribute through app-based ride-hailing demand, premium mobility services, and smart city initiatives. High disposable income levels, strong digital infrastructure, and government-backed transport modernization programs support market growth across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Moto Taxi Service Market

- Gojek

- Grab

- Uber Technologies Inc.

- Rapido

- Bolt Technology OU

- ANI Technologies Pvt. Ltd.

- Didi Chuxing

- Pathao Ltd.

- SafeBoda

- Baxi

- Bikxie

- Jugnoo

- Mopedo

- Wunder Mobility

- Dunzo