Mosquito Repellent Candles Market Size

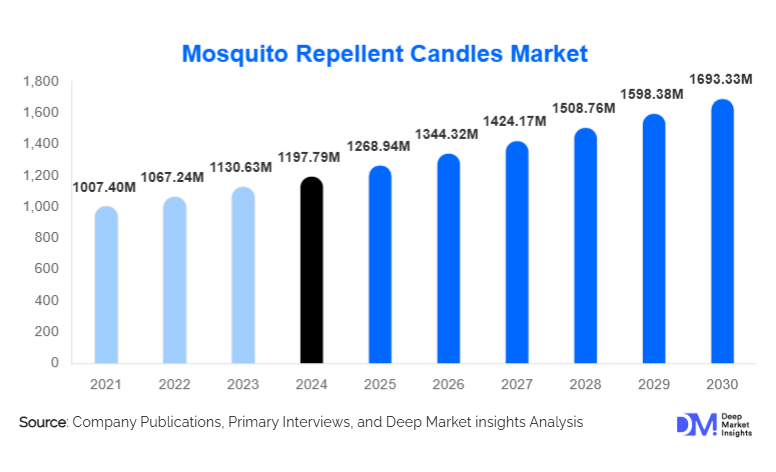

According to Deep Market Insights, the global mosquito repellent candles market size was valued at USD 1,197.79 million in 2024 and is projected to grow from USD 1,268.94 million in 2025 to reach USD 1,693.33 million by 2030, expanding at a CAGR of 5.94% during the forecast period (2025–2030). The market growth is primarily driven by the rising prevalence of mosquito-borne diseases, increasing adoption of outdoor living and leisure activities, and a strong consumer shift toward natural, chemical-free insect repellent solutions that combine functionality with lifestyle and décor appeal.

Key Market Insights

- Natural and plant-based mosquito repellent candles are gaining strong traction as consumers move away from synthetic aerosols and coils.

- Residential outdoor applications dominate demand, particularly for gardens, patios, balconies, and camping activities.

- North America holds the largest market share, supported by premium candle consumption and high outdoor leisure spending.

- Asia-Pacific is the fastest-growing region, driven by tropical climates, high mosquito prevalence, and rising middle-class income.

- E-commerce and direct-to-consumer channels are expanding rapidly, enabling niche and premium brands to scale globally.

- Product innovation focused on longer burn time, sustainable wax, and aesthetic design is reshaping the competition.

What are the latest trends in the mosquito repellent candles market?

Rising Demand for Natural and Eco-Friendly Candles

Consumers are increasingly prioritizing health-conscious and environmentally safe alternatives to traditional mosquito repellents. This has accelerated demand for candles made with essential oils such as citronella, lemongrass, eucalyptus, lavender, and neem, combined with soy or beeswax bases. Clean-label positioning, biodegradable packaging, and cruelty-free sourcing are becoming key purchase drivers, particularly in North America and Europe. Brands emphasizing sustainability credentials are gaining pricing power and stronger brand loyalty.

Premiumization and Lifestyle-Oriented Product Design

Mosquito repellent candles are transitioning from purely functional products to lifestyle and décor items. Decorative jars, premium fragrances, multi-wick formats, and designer packaging are increasingly popular, especially in urban households and hospitality settings. Premium candles are often marketed as dual-purpose products offering both insect protection and ambiance enhancement, supporting higher margins and year-round demand beyond seasonal mosquito control.

What are the key drivers in the mosquito repellent candles market?

Growing Incidence of Mosquito-Borne Diseases

The increasing global prevalence of diseases such as dengue, malaria, chikungunya, and Zika is driving preventive spending on mosquito control solutions. Government awareness campaigns and public health initiatives indirectly support household-level adoption of mosquito repellents, including candles, especially in tropical and subtropical regions.

Expansion of Outdoor Living and Leisure Activities

Rising consumer investment in outdoor living spaces, camping, backyard gatherings, and open-air dining is boosting demand for mosquito repellent candles. These products are favored over sprays in social and hospitality settings due to their ease of use, aesthetic appeal, and minimal odor intrusion.

What are the restraints for the global market?

Limited Efficacy in Open and Windy Conditions

Compared to topical sprays and electronic repellents, mosquito repellent candles provide localized protection and reduced effectiveness in open or windy environments. This limits adoption in high-risk or large outdoor areas and restricts their use as a standalone mosquito control solution.

Seasonal Demand Volatility

Demand for mosquito repellent candles is highly seasonal, peaking during warmer months. This creates inventory management challenges and revenue fluctuations for manufacturers, particularly in temperate regions with shorter mosquito seasons.

What are the key opportunities in the mosquito repellent candles market?

Hospitality and Commercial Outdoor Applications

Hotels, resorts, cafés, event venues, and outdoor dining spaces increasingly prefer mosquito repellent candles over chemical repellents to enhance guest experience. Customized branding, private-label production, and bulk B2B supply contracts represent high-margin growth opportunities for manufacturers.

E-commerce and Direct-to-Consumer Expansion

The rapid growth of e-commerce enables brands to reach global consumers without heavy reliance on traditional retail. Subscription-based seasonal packs, bundled outdoor kits, and influencer-led digital marketing are emerging as effective strategies to drive repeat purchases and brand differentiation.

Product Type Insights

Citronella-based candles dominate the global mosquito repellent candles market, accounting for the largest share of total revenue. Their leadership is primarily driven by high consumer awareness, proven mosquito-repelling efficacy, regulatory acceptance, and affordability. Citronella oil has long been recognized as an effective natural repellent, making these candles the preferred choice for mass-market residential use, especially in outdoor settings such as gardens, patios, and balconies. Their widespread availability across supermarkets and hypermarkets further reinforces their dominance.

Essential oil–based candles represent the fastest-growing product segment, supported by rising demand for natural, non-toxic, and aromatherapy-oriented solutions. Oils such as lemongrass, eucalyptus, lavender, neem, and cedarwood are increasingly favored by health-conscious consumers seeking chemical-free mosquito control. This segment benefits strongly from premiumization trends, particularly in North America and Europe, where consumers are willing to pay higher prices for sustainability, wellness positioning, and multi-functional products that combine fragrance with repellency.

Wax Type Insights

Paraffin wax candles continue to lead the market due to low production costs, consistent burn performance, and widespread raw material availability. Their cost efficiency makes them particularly attractive for mass-market and economy-priced mosquito repellent candles, especially in developing regions and seasonal demand cycles. However, soy wax and beeswax candles are experiencing rapid growth, driven by increasing consumer preference for sustainable, biodegradable, and low-emission products. Soy wax candles offer cleaner burns, longer burn times, and compatibility with essential oils, making them the preferred wax type for premium and natural mosquito repellent candles. Beeswax, though higher priced, is gaining adoption in niche and luxury segments due to its natural air-purifying properties and minimal smoke emissions.

Vegetable-based and blended wax alternatives, including palm and coconut wax, are emerging within premium and eco-conscious product lines. These wax types support brand differentiation and align with growing environmental regulations and clean-label expectations, particularly in Europe and North America.

Application Insights

Residential outdoor applications represent the largest share of the mosquito repellent candles market, driven by widespread use in gardens, patios, balconies, terraces, and home gatherings. Consumers prefer candles in these settings due to their ease of use, aesthetic appeal, and suitability for social environments where sprays or coils may be undesirable. Commercial outdoor applications are the fastest-growing segment, supported by increasing adoption across hotels, resorts, cafés, restaurants, event venues, and outdoor dining spaces. Hospitality operators favor mosquito repellent candles as they enhance guest comfort while complementing ambience and décor. This segment is also benefiting from bulk procurement, private labeling, and customized branding opportunities.

Institutional and public space applications remain relatively niche but are expanding steadily. Parks, recreational camps, tourist sites, and community spaces in mosquito-prone regions are increasingly using repellent candles as supplementary mosquito control measures, particularly where chemical fogging or electrical repellents are restricted.

Distribution Channel Insights

Supermarkets and hypermarkets account for the largest share of global sales, benefiting from high foot traffic, strong brand visibility, and impulse purchasing behavior. These channels are especially dominant for citronella-based and economy-priced products.

E-commerce and direct-to-consumer (D2C) channels are the fastest-growing distribution segment, driven by convenience, broader product assortments, subscription-based seasonal offerings, and competitive pricing. Digital platforms enable niche and premium brands to reach global consumers, support product education, and promote sustainability narratives effectively. Specialty home décor, garden, and lifestyle stores continue to play a crucial role in premium and design-oriented mosquito repellent candles. These outlets cater to consumers seeking aesthetic appeal, high-quality fragrances, and eco-friendly formulations, reinforcing their importance in the mid-range and premium market segments.

| By Product Type | By Wax Type | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global mosquito repellent candles market, led by the United States. Regional growth is driven by high consumer spending on outdoor living, widespread adoption of premium candles, and strong e-commerce penetration. The popularity of backyard entertaining, camping, and patio dining fuels consistent demand. Additionally, increasing consumer preference for natural, soy-based, and decorative candles supports premium segment expansion. Regulatory scrutiny on chemical insecticides further accelerates the adoption of candle-based alternatives.

Europe

Europe represents a mature but steadily growing market, with strong demand from Germany, the United Kingdom, France, and Italy. Growth is driven by strict regulations on chemical repellents, strong environmental awareness, and high demand for eco-friendly and clean-label products. European consumers prioritize sustainability, biodegradable materials, and low-emission solutions, favoring essential oil–based and soy wax candles. The region also benefits from strong hospitality demand, particularly in outdoor cafés and tourism-driven economies.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by India, China, Indonesia, Thailand, and other Southeast Asian countries. Growth is supported by high mosquito prevalence, tropical climates, rapid urbanization, and rising disposable incomes. Expanding middle-class populations are increasing spending on household mosquito control products, while government-led public health awareness campaigns indirectly boost demand. The region shows strong adoption of affordable citronella and synthetic candles, alongside rising interest in natural alternatives in urban centers.

Latin America

Latin America is witnessing moderate growth, primarily supported by Brazil and Mexico. Regional demand is driven by warm climates, high incidence of mosquito-borne diseases, and increasing urban outdoor living. Growing awareness of preventive mosquito control and the gradual expansion of modern retail and e-commerce platforms are improving product accessibility. Price-sensitive consumers continue to favor economy and mid-range products, while premium segments are emerging in urban markets.

Middle East & Africa

Demand in the Middle East & Africa is supported by tourism growth, outdoor hospitality expansion, and public health initiatives. Warm climates and extended outdoor seasons drive consistent usage in hospitality venues and residential spaces. In Africa, mosquito repellent candles are increasingly used as complementary solutions in mosquito-prone regions. In the Middle East, high-income consumers and luxury hospitality establishments are driving demand for premium and decorative mosquito repellent candles.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mosquito Repellent Candles Market

- SC Johnson

- Spectrum Brands

- Reckitt

- Godrej Consumer Products Ltd.

- Candle-lite Company

- Yankee Candle

- Bath & Body Works

- Coleman Company

- Murphy’s Naturals

- Tender Corporation