Mortuary Equipment Market Size

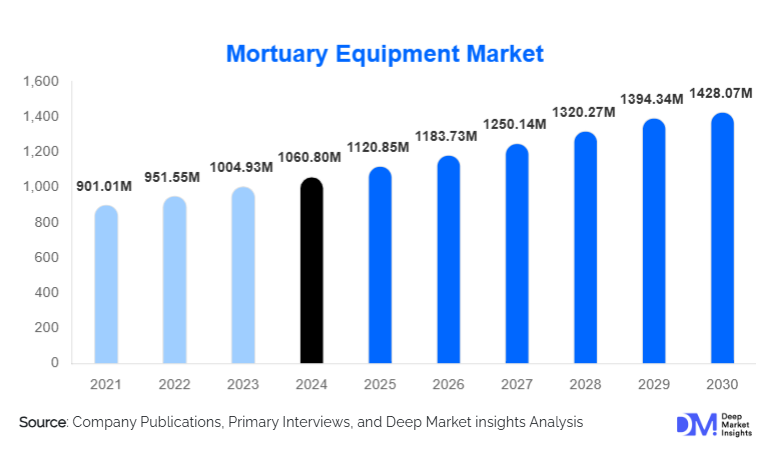

According to Deep Market Insights, the global mortuary equipment market size was valued at USD 1,060.80 Million in 2024 and is projected to grow from USD 1,120.85 Million in 2025 to reach USD 1,428.07 Million by 2030, expanding at a CAGR of 5.61% during the forecast period (2025–2030). Market growth is primarily driven by the rising number of hospital deaths worldwide, the expansion of forensic and medical education infrastructure, and the growing adoption of automated and digitally enabled mortuary systems across hospitals, morgues, and forensic laboratories.

Key Market Insights

- Refrigeration units dominate the global market, accounting for 30–40% of total 2024 revenues due to the essential demand for cadaver preservation.

- Hospitals remain the largest end-use segment, accounting for 40–45% of global market share in 2024, driven by regulatory compliance and high patient volumes.

- North America leads the global market with a 30–36% share in 2024, supported by advanced healthcare infrastructure and strict mortuary handling regulations.

- Asia-Pacific is the fastest-growing region, fueled by rapidly expanding hospital capacity and a rising population base demanding modern mortuary facilities.

- Automation and digital mortuary management systems are accelerating adoption, especially among private morgues and large hospitals.

- Forensic and academic institutions are emerging as high-growth buyers due to increased investments in pathology, anatomy, and medico-legal research.

What are the latest trends in the mortuary equipment market?

Smart, Automated Mortuary Systems Gaining Traction

Automation is reshaping modern mortuary operations. Hospitals, morgues, and forensic centers are adopting motorized body lifts, digitally monitored refrigeration chambers, RFID-enabled body tracking, and IoT-connected mortuary management software. These solutions reduce manual handling risks, enhance hygiene, and ensure compliance with global temperature and cadaver-handling standards. Automated systems with remote temperature alerts and digital access logs are increasingly standard in developed markets, while emerging economies are rapidly modernizing with low-cost automated suites. This shift is supported by regulatory pressure for documented chain-of-custody and safe storage practices.

Expansion of Forensic & Medical Education Infrastructure

Global growth in forensic science and medical education is driving demand for advanced autopsy platforms, dissection tables, embalming workstations, and specimen storage units. Governments in Asia, Latin America, and Africa are investing in modern forensic labs to improve medico-legal systems, crime investigation, and public health preparedness. Medical colleges are expanding cadaver-based training, boosting demand for standardized mortuary equipment. This trend is supported by rising awareness of infectious disease management, necessitating updated infrastructure for safe cadaver handling.

What are the key drivers in the mortuary equipment market?

Rising Mortality Rates and Chronic Disease Burden

Increasing global death rates, driven by aging populations, chronic illnesses, and public health crises, are significantly increasing demand for mortuary facilities. Hospitals are expanding cold-storage capacity, upgrading mortuary rooms, and adopting specialized transport and embalming equipment to handle higher caseloads. This consistent base demand forms one of the strongest long-term growth drivers.

Growth in Forensic Investigations and Medico-Legal Infrastructure

Governments worldwide are expanding forensic capabilities to address crime investigation gaps, disaster-response preparedness, and public-health surveillance. This expansion requires autopsy suites, pathology equipment, and refrigerated chambers. Academic institutions are similarly increasing investments in anatomy laboratories and pathology departments, further driving demand for high-quality mortuary equipment.

Adoption of Automation and Digital Monitoring Systems

Advanced mortuary facilities increasingly rely on automated trolleys, electric lifts, temperature-controlled cold rooms, and digital mortuary management software. Automation enhances worker safety, reduces manual handling injuries, and ensures regulatory compliance. The shift from manual to semi-automated or fully automated equipment is accelerating replacement cycles, supporting sustainable market growth.

What are the restraints for the global market?

High Cost of Advanced Mortuary Equipment

Digitally enabled and automated mortuary systems come with high initial costs, limiting adoption among smaller hospitals, rural facilities, and low-income countries. Budget constraints often push buyers toward manual, low-cost alternatives, slowing penetration of advanced technologies. Limited government funding in some regions further restricts the modernization of public-sector mortuaries.

Cultural and Regulatory Constraints

Mortuary practices vary widely due to religious, cultural, and legal differences. In many regions where burial is immediate, long-term body storage equipment sees lower demand. Inconsistent regulations for cadaver handling, embalming, and autopsy procedures also pose operational challenges for manufacturers seeking uniform product deployment across global markets.

What are the key opportunities in the mortuary equipment industry?

Growing Demand for Modern Mortuary Infrastructure in Emerging Economies

Rapid hospital expansion, urbanization, and rising mortality in Asia-Pacific, Latin America, and Africa present major opportunities for suppliers of affordable mortuary equipment. Governments are increasingly upgrading public mortuaries and forensic labs, creating multi-year procurement pipelines for refrigeration units, transport systems, and autopsy equipment. Vendors offering modular, budget-friendly systems and tender-compliant equipment can gain substantial market presence.

Digital Mortuary Management and IoT Integration

Smart mortuary environments equipped with digital access logs, remote-controlled refrigeration, RFID body tracking, and cloud-based documentation systems are emerging as next-generation solutions. Hospitals and private morgues seek automation to improve safety, reduce operational risk, and enhance transparency. Vendors integrating IoT, AI-driven monitoring, and automated body-handling pathways will benefit from premium pricing and high-margin opportunities.

Product Type Insights

Refrigeration units lead the global market with a 30–40% share in 2024 due to their essential role in cadaver preservation. Modern cold-storage systems feature digital temperature control, alarm systems, and modular multi-body chambers. Autopsy platforms and embalming equipment are the second-largest categories, driven by expanded forensic capabilities and academic anatomical studies. Body transporters, trolleys, and hydraulic lifts follow, supported by hospital modernisation programs and enhanced safety standards for manual handling. Cremation and crematorium equipment form a growing niche driven by urbanisation and rising acceptance of electric crematoriums in Asia and Europe.

Application Insights

Hospitals dominate global demand, accounting for 40–45% of 2024 revenues due to high patient turnover and mandated mortuary facilities. Forensic laboratories and medical examiners’ offices form a rapidly expanding application segment, driven by increasing autopsy volumes and government-led forensic capacity enhancement. Private morgues and funeral homes are upgrading equipment to provide dignified, hygienic services, fueling demand for automated lifts, stainless-steel autopsy stations, and digitally controlled refrigeration units. Academic and research institutions represent a stable but growing segment, supported by rising investments in anatomy and pathology education.

Technology Insights

Automated and digitally enabled mortuary equipment holds the largest share within technology-based segmentation, representing 35–45% of 2024 revenue. This includes motorised trolleys, powered lifts, automated autopsy tables, and IoT-integrated cold storage. Manual equipment remains important in lower-income regions due to its affordability, while semi-automated systems serve mid-tier hospitals transitioning toward digital modernisation. Facilities with higher compliance requirements increasingly deploy digital body-tracking, temperature alerts, and cloud-linked mortuary management solutions.

| By Product Type | By Application | By Technology |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest regional market with a 30–36% share in 2024. The U.S. accounts for the majority of demand, supported by advanced hospital systems, high autopsy rates, and strict handling regulations. Regular facility upgrades and adoption of automated mortuary systems drive sustained demand. Canada shows rising procurement due to investments in forensic modernization.

Europe

Europe represents a mature but sizeable market, contributing about 20–25% of global revenue. Countries such as Germany, the U.K., France, and Italy have well-established forensic systems and rising investments in digital mortuary modernization. The region's aging population and hospital renovation programs continue to support equipment upgrades.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for 25–30% of the market in 2024. China and India are leading the demand due to large population bases and rapid hospital expansion. Japan, South Korea, and Southeast Asia are adopting advanced mortuary technologies to improve healthcare quality and forensic capacity. Increased government expenditure on disaster-response preparedness also drives demand.

Latin America

Latin America shows steady growth led by Brazil, Mexico, and Argentina. Government efforts to improve hospital infrastructure and forensic systems are pushing demand for refrigeration units and autopsy equipment. Private funeral homes are modernizing facilities, creating new procurement cycles.

Middle East & Africa

MEA represents a smaller but high-potential market. Gulf countries such as Saudi Arabia and the UAE are investing in modern mortuary facilities integrated into large hospital expansion projects. Africa is witnessing increased donor funding and government-led healthcare upgrades, stimulating demand for basic and mid-range mortuary equipment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mortuary Equipment Market

- Mopec Inc.

- Mortech Manufacturing Inc.

- LEEC Limited

- Kugel Medical GmbH & Co. KG

- Hygeco

- Roftek Ltd.

- Span Surgical Co.

- Mortuary Lift Company Inc.

- Thermo Fisher Scientific Inc.

- Ferno-Washington Inc.

- Fiocchetti

- Affordable Funeral Supply

- Barber Medical

- SM Scientific Instruments

- Autopsy Solutions

Recent Developments

- In February 2024, Mopec introduced an upgraded IoT-enabled mortuary refrigeration suite featuring remote temperature monitoring and smart diagnostics.

- In September 2024, LEEC Limited expanded its European manufacturing facility to enhance production of modular mortuary cold rooms.

- In July 2024, Kugel Medical launched a new touch-panel autopsy table with integrated airflow management and pathogen-control systems.