Mobile Value-Added Services (MVAS) Market Size

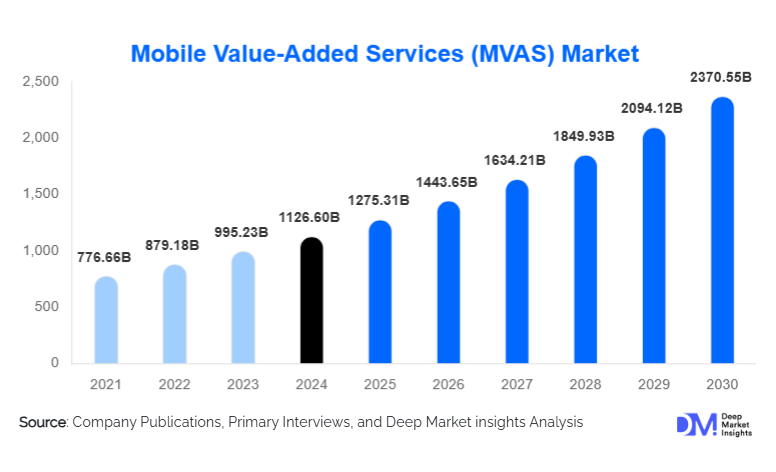

According to Deep Market Insights, the global mobile value-added services market size was valued at USD 1,126.60 billion in 2024 and is projected to grow from USD 1,275.31 billion in 2025 to reach USD 2,370.55 billion by 2030, expanding at a CAGR of 13.20% during the forecast period (2025–2030). Market growth is fueled by surging smartphone penetration, widespread mobile internet access, rapid digital payments adoption, and increased demand for mobile content, enterprise mobility solutions, and app-based services. MVAS has evolved from basic SMS/MMS into a multi-trillion-dollar ecosystem powering infotainment, mobile banking, mobile advertising, and location-based services across both consumer and enterprise applications.

Key Market Insights

- Mobile infotainment and multimedia services dominate global MVAS revenues, driven by explosive growth in streaming, gaming, and social-media usage.

- Smartphone-based VAS accounts for nearly 80% of the market as feature-phone usage continues to decline worldwide.

- Asia-Pacific leads the global market, contributing 30–35% of 2024 revenue due to massive digital adoption in China, India, and Southeast Asia.

- Mobile money and fintech-based VAS are the fastest-growing categories, especially in emerging economies with low banking penetration.

- Enterprise and vertical-specific VAS solutions in retail, BFSI, healthcare, and government services are rapidly expanding in demand.

- 5G deployment, AI-driven personalization, IoT-linked VAS, and cloud-based content delivery are reshaping the scalability and monetization potential of mobile services.

What are the latest trends in the Mobile Value-Added Services Market?

Rapid Expansion of Mobile Financial Services (Mobile Money & Payments)

Mobile-money ecosystems are becoming central to MVAS growth, especially in Asia and Africa. Services such as digital wallets, peer-to-peer remittances, QR-based payments, and micro-financial services are accelerating financial inclusion. Telecom operators are forming partnerships with fintech players and banks to enable secure, interoperable, and low-cost mobile-payment systems. As governments push digital payments adoption, transaction volumes continue to expand, positioning mobile money as one of the most profitable VAS segments. With rising cross-border remittances, mobile-money platforms are also scaling internationally, giving operators new revenue streams beyond national boundaries.

Content & Multimedia VAS Surging with 5G Adoption

High-bandwidth mobile entertainment, streaming video, cloud gaming, live events, and music apps have become the single largest VAS revenue generator. 5G networks allow ultra-low latency, enabling AR/VR experiences, high-definition content, immersive gaming, and interactive entertainment. Subscription-based content models, ad-supported streaming apps, and hybrid monetization strategies are proliferating across markets. Younger demographics are driving increased screen time and higher ARPU (average revenue per user), making infotainment a core strategic priority for telecom operators and digital-content companies.

What are the key drivers in the Mobile Value-Added Services Market?

Explosive Smartphone & Mobile-Internet Penetration

Affordable smartphones, expanding 4G and 5G networks, and low-cost internet packages have significantly expanded the global MVAS user base. As billions of users gain access to data-enabled devices, service consumption shifts heavily toward app-based services, streaming, instant messaging, and mobile payments. This structural shift has accelerated MVAS monetization, especially in price-sensitive markets where mobile is the primary digital access channel.

Growing Demand for Digital Entertainment & Real-Time Communication

Consumers increasingly prefer personalized, on-demand entertainment across mobile channels. The rising popularity of OTT platforms, mobile gaming, social apps, and content-sharing tools fuels the need for scalable VAS infrastructure. Real-time messaging and voice/video calling also continue to expand, raising data consumption and supporting ancillary VAS such as mobile advertising, cloud storage, and content bundles.

Rise of Mobile Payments & Fintech Integration

Digital payments have become a fundamental component of mobile ecosystems. Mobile-wallet transactions, bill payments, micro-loans, and merchant payments are witnessing massive adoption. Telecom operators and fintech players are co-developing secure transaction environments, boosting user trust and accelerating market expansion. This shift from cash to digital payments is especially impactful in emerging economies, making mobile financial services a major MVAS growth engine.

What are the restraints for the global market?

Regulatory, Privacy, and Security Challenges

As financial services, location-based apps, and enterprise solutions become more deeply integrated with mobile ecosystems, regulatory requirements around data protection, identity verification (KYC/AML), and cybersecurity have intensified. Compliance with regional regulations increases operational costs, and inconsistencies between countries make cross-border services difficult to scale. Consumer concerns around data misuse can reduce uptake of advanced VAS applications.

Digital Divide & Limitations in Network Infrastructure

Despite rapid technological advancement, many regions still lack reliable internet or smartphone access. Rural areas, low-income populations, and developing economies face affordability barriers, affecting the adoption of advanced VAS like streaming and mobile payments. Infrastructure limitations, particularly in Africa, South Asia, and parts of Latin America, continue to restrict MVAS scalability.

What are the key opportunities in the Mobile Value-Added Services Industry?

Mobile-Money Expansion Across Emerging Markets

With millions still unbanked, mobile money presents transformative potential. Operators can scale mobile wallets, micro-loans, remittance products, and SME-focused payment tools across Africa, South Asia, and Southeast Asia. Government-led digital inclusion programs create an environment ripe for expansion. As secure digital payment ecosystems mature, VAS platforms will gain new revenue channels through transaction fees, merchant services, and value-added fintech features.

Enterprise & Vertical-Specific Mobile VAS

Industries such as healthcare, retail, BFSI, education, and government are rapidly adopting mobile-first workflows. This opens significant opportunities for enterprise-level VAS: mobile identity solutions, telemedicine platforms, enterprise messaging, m-learning, and digital customer-engagement tools. Vendors who develop secure, API-enabled, sector-specific mobility offerings will capture large B2B revenue pools as organizations digitize operations globally.

Product Type Insights

Mobile Infotainment & Multimedia leads the MVAS market with approximately 28–32% share in 2024. Streaming video, cloud gaming, music apps, and immersive content increasingly dominate user engagement. Subscription and ad-supported models both contribute significantly to revenue, with 5G enabling richer experiences. Mobile Money & Payments represent the fastest-growing VAS category, particularly across Asia and Africa. Mobile Advertising continues to expand as brands shift budgets toward mobile-first campaigns. Traditional services such as SMS/MMS remain relevant in some enterprise applications but represent a shrinking share of global revenue.

Application Insights

Consumer services such as entertainment, messaging, social media, and mobile payments dominate demand, accounting for 65–70% of total MVAS revenue in 2024. Enterprise applications, mobile banking APIs, enterprise mobility solutions, mobile authentication, and workforce management tools are expanding rapidly, driven by digital transformation trends. Government and public-sector adoption of mobile identity, alert systems, and mobile-governance services (m-governance) is growing across Asia and the Middle East.

Distribution Channel Insights

Smartphone app stores (Google Play, Apple App Store) lead MVAS distribution globally, enabling direct-to-consumer subscription models. Telecom operator platforms continue to hold a significant share in regions with low app-store penetration, offering bundled VAS packages. Fintech platforms dominate mobile-money and payment-VAS distribution. Enterprise platforms are becoming major channels for vertical-specific VAS adoption.

End-User Insights

The consumer segment remains the largest, driven by entertainment consumption and mobile-payments adoption. The enterprise segment is the fastest-growing, boosted by rapid digitization initiatives, especially in BFSI, retail, healthcare, education, and logistics. Government users adopt VAS for citizen engagement and national digital-ID initiatives, contributing to stable long-term demand.

Age Group Insights

18–35 years drive mobile-content consumption, gaming, and fintech VAS. 31–50 years adopt mobile money, enterprise tools, and productivity applications. 50+ are increasingly using mobile banking, health-related VAS, and government service apps, assisted by improved smartphone usability.

| By Service Type | By Device Type | By End User | By Industry Vertical |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 20–25% of the global MVAS market in 2024, driven by high smartphone penetration, advanced telecom networks, and strong adoption of streaming services, mobile payments, and enterprise mobility solutions. The U.S. remains a global hub for digital-content companies, fintech innovators, and mobile-advertising platforms, supporting strong regional demand.

Europe

Europe demonstrates steady adoption of mobile entertainment, fintech VAS, and enterprise mobility solutions. Countries such as the U.K., Germany, and France lead VAS spending, supported by strong regulatory frameworks for digital payments and consumer data protection. Demand for mobile banking and content services remains high in mature markets.

Asia-Pacific

Asia-Pacific leads with 30–35% market share in 2024. China and India dominate global MVAS consumption due to massive populations and accelerating digital adoption. Southeast Asia experiences strong growth in mobile payments, entertainment VAS, and social apps. APAC is the fastest-growing region due to ongoing smartphone penetration and government-led digital initiatives.

Latin America

LATAM is an emerging MVAS market with growing demand in Brazil, Mexico, and Argentina. Mobile-money adoption, social media usage, and entertainment VAS are driving regional expansion, although infrastructure constraints remain a challenge.

Middle East & Africa

MEA shows strong potential, especially in mobile-money and government mobile-service adoption. Africa is a global leader in mobile-money penetration, while Gulf countries drive high-end demand for advanced mobile services and digital-content consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mobile Value-Added Services Market

- Vodafone Group Plc

- AT&T Inc.

- Verizon Communications Inc.

- China Mobile Ltd.

- Bharti Airtel Ltd.

- Orange S.A.

- NTT DOCOMO Inc.

- Telefonica S.A.

- MTN Group

- T-Mobile International

- SK Telecom

- Singtel Group

- Tencent Holdings

- Paytm / One97 Communications

- Safaricom