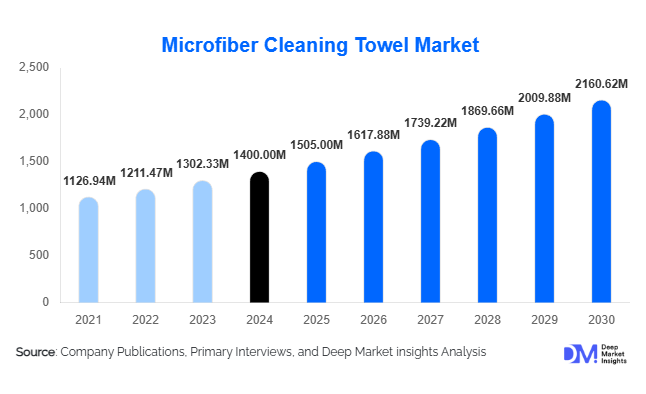

Microfiber Cleaning Towel Market Size

According to Deep Market Insights, the global microfiber cleaning towel market was valued at USD 1,400 million in 2024 and is projected to grow from USD 1,505.00 million in 2025 to reach USD 2,160.62 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). Market expansion is driven by increasing demand for high-performance cleaning materials, the growing emphasis on hygiene and sustainability, and widespread adoption of reusable cleaning products in both residential and commercial environments.

Key Market Insights

- Global shift toward reusable and eco-friendly cleaning textiles is significantly boosting microfiber towel adoption across households, institutions, and industries.

- Asia-Pacific dominates global supply and leads growth, driven by strong manufacturing ecosystems in China and India and rising regional demand.

- Multi-component microfiber blends account for over 50% of the market, owing to superior durability, absorbency, and streak-free cleaning performance.

- E-commerce channels contribute nearly 40% of global sales, as consumers increasingly buy microfiber towel sets online.

- Household cleaning applications represent approximately half of total demand, while automotive detailing and commercial cleaning are the fastest-growing end-uses.

- Product innovation, including recycled fibers and antimicrobial finishes, is reshaping brand competitiveness and pricing strategies.

What are the latest trends in the microfiber cleaning towel market?

Eco-Sustainability and Circular Production Models

Manufacturers are embracing sustainable production practices by using recycled polyester and polyamide blends to create eco-friendly microfiber towels. These initiatives align with the global sustainability agenda and support corporate procurement policies emphasizing waste reduction and product reuse. Circular design concepts, where towels are manufactured, collected, and recycled into new textiles, are gaining attention. Certification programs such as OEKO-TEX® and Global Recycled Standard (GRS) are increasingly used to validate sustainability claims, building consumer trust and supporting premium positioning. Sustainability-oriented buyers in hospitality, healthcare, and facility management are prioritizing suppliers that can demonstrate reduced environmental impact.

Premiumization and Specialty Applications

Premium microfiber towels featuring higher GSM ratings, edgeless laser-cut designs, and specialty weaves for glass, automotive, or electronic surfaces are gaining traction. Automotive detailing professionals and industrial cleaning firms prefer high-density towels for their enhanced absorbency and scratch-free finish. This premiumization trend is pushing average selling prices upward and expanding the mid- to high-end market segment. Companies are differentiating through advanced fiber technologies, antimicrobial coatings, and long-life performance warranties, positioning microfiber towels as high-value cleaning assets rather than disposable consumables.

What are the key drivers in the microfiber cleaning towel market?

Rising Hygiene Awareness and Performance Expectations

Post-pandemic hygiene awareness and consumer education regarding effective cleaning are accelerating microfiber towel demand. Microfiber’s superior ability to capture bacteria and fine dust particles without chemicals positions it as the preferred material for modern cleaning protocols across homes, offices, and healthcare facilities. This driver is reinforced by facility managers and cleaning contractors increasingly specifying microfiber-based systems for compliance with hygiene standards.

Expansion of Commercial and Institutional Cleaning Sectors

The rapid growth of the global commercial cleaning industry, covering hospitality, retail, offices, and healthcare, is a key demand catalyst. Professional cleaning services are standardizing microfiber products due to their durability and long-term cost efficiency. Multi-color towel systems, which help prevent cross-contamination between different cleaning zones, are becoming standard practice in hospitals and commercial kitchens, further driving institutional adoption.

Shift Toward Sustainable and Reusable Cleaning Products

Governments and corporations are introducing sustainability guidelines aimed at reducing disposable waste and promoting reusable alternatives. Microfiber towels, being washable and long-lasting, meet these objectives effectively. As procurement departments adopt environmental criteria, microfiber towels are replacing single-use wipes and paper-based cleaning products, helping organizations meet environmental, social, and governance (ESG) targets.

What are the restraints for the global market?

Raw Material Price Volatility

The cost of polyester and polyamide, the core components of microfiber, fluctuates with oil prices and supply chain dynamics. These price swings compress manufacturer margins and limit the ability to offer competitive pricing, particularly in lower-end segments. Smaller producers are more vulnerable to these shifts, which can affect production continuity and profitability.

Micro-Plastic Shedding and Environmental Scrutiny

Despite being reusable, microfiber fabrics can release microplastics during washing, raising environmental concerns. Governments are increasingly examining regulations that could limit certain fiber types or require filtration technology in washing systems. Companies must invest in research and development to mitigate fiber shedding and maintain eco-friendly positioning, adding cost pressures to the value chain.

What are the key opportunities in the microfiber cleaning towel industry?

Growth in Emerging Markets

Emerging economies across Asia-Pacific, Latin America, and Africa are undergoing rapid urbanization and industrial expansion, creating a large addressable market for high-performance cleaning tools. Rising disposable incomes, expanding hospitality sectors, and growth in automotive ownership support microfiber towel penetration. Establishing local manufacturing facilities and distribution networks offers new entrants significant cost advantages and export potential.

Integration of Smart Textiles and Antimicrobial Technologies

Advancements in textile engineering are enabling integration of silver-ion or copper-based antimicrobial coatings that inhibit bacterial growth, making towels more suitable for medical and food service applications. Smart textiles capable of monitoring towel wear and contamination levels are on the horizon. Such innovations provide premium differentiation and create long-term partnerships with institutional buyers.

Institutional Sustainability Procurement Programs

Governmental and corporate sustainability initiatives are mandating eco-certified cleaning supplies. Suppliers that can offer microfiber towels with documented life-cycle benefits, such as lower water use and reduced detergent dependency, will benefit from long-term supply contracts with public institutions and multinational corporations.

Product Type Insights

General-purpose microfiber towels dominate the global market, accounting for approximately 45% of total demand in 2024. Their versatility for household and multipurpose cleaning ensures consistent volume sales across retail and B2B channels. However, specialized microfiber towels for automotive detailing and glass cleaning are expanding fastest, supported by rising vehicle maintenance and aesthetic care trends. Heavy-duty industrial towels are gaining share in manufacturing and clean-room environments, as companies seek lint-free and durable cleaning solutions that withstand harsh chemicals and repeated laundering.

Material Insights

Multi-component microfiber blends represent over 55% of global revenue, offering optimal absorbency and softness. The blend of polyester and polyamide creates micro-capillaries that enhance water and dust pickup. Recycled microfiber fabrics made from post-consumer plastics are the fastest-growing sub-segment, projected to grow at more than 10% CAGR through 2030, as sustainability-driven demand surges among institutional buyers.

End-Use Insights

Household cleaning remains the largest end-use segment with about 50% share of the 2024 market, driven by consumer adoption of reusable alternatives to disposable wipes. Automotive detailing is the fastest-growing application, supported by the global expansion of car-wash franchises and detailing studios. Healthcare and industrial cleaning segments are also expanding rapidly as hygiene standards become more stringent, driving the use of lint-free, antimicrobial microfiber towels for critical environments.

Distribution Channel Insights

Online retail and e-commerce channels now account for approximately 40% of global microfiber towel sales, as consumers prefer the convenience of online multipack purchases and product comparisons. Offline channels, such as supermarkets, home-improvement stores, and contract distributors, continue to dominate in institutional supply but face growing competition from digital platforms offering direct-to-consumer (D2C) options. Subscription-based procurement models are emerging among cleaning contractors for periodic supply replenishment.

| By Product Type | By Material Type | By End-Use Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for around 30% of the global market in 2024 ( USD 420 million). The United States drives demand through strong household consumption and the expanding professional cleaning sector. The region’s established e-commerce infrastructure and preference for high-quality, branded microfiber towels sustain steady growth, while sustainability certifications influence institutional purchases.

Europe

Europe holds a roughly 20% share ( USD 280 million). Germany, the U.K., and France are key consumers, emphasizing eco-certified cleaning textiles aligned with EU waste-reduction goals. Corporate cleaning contractors increasingly mandate microfiber products to comply with hygiene and sustainability regulations, ensuring consistent institutional demand.

Asia-Pacific

Asia-Pacific leads the global market with about a 35% share ( USD 490 million) and remains the fastest-growing region. China’s manufacturing dominance and India’s expanding consumer base are major growth contributors. The region also serves as the principal exporter of microfiber towels to North America and Europe. Rapid urbanization and the proliferation of modern retail formats will continue to propel demand.

Latin America

Latin America represents roughly 8% of the global market ( USD 110 million). Brazil and Mexico drive demand, supported by rising middle-class purchasing power and industrial cleaning needs. Local manufacturing initiatives are emerging to reduce reliance on imports and strengthen supply security.

Middle East & Africa

This region captures around 7% share ( USD 100 million). The Gulf Cooperation Council (GCC) countries are seeing strong institutional demand from the hospitality and healthcare sectors. Africa’s market is smaller but expanding rapidly due to infrastructure growth and regional distribution improvements.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Microfiber Cleaning Towel Market

- 3M Company

- Toray Industries, Inc.

- Vileda Group

- Norwex USA

- Medline Industries, Inc.

- Welcron Co., Ltd.

- Atlas Graham Furgale Inc.

- Zwipes LLC

- Eurow NV

- Unger Germany GmbH

- Gamex Inc.

- CMA (Cleanroom Manufacturing Associates)

- E-Cloth Ltd.

- Tricol Textrends Pvt. Ltd.

- North Textile Philippines Inc.

Recent Developments

- In June 2025, 3M Company launched a new line of biodegradable microfiber cleaning towels under its Scotch-Brite Eco series, aimed at professional cleaning contractors and institutional buyers.

- In April 2025, Toray Industries announced the expansion of its recycled microfiber fabric production capacity in Japan to meet rising global demand for sustainable cleaning textiles.

- In February 2025, Vileda Group introduced its “Green Care” microfiber range made entirely from post-consumer PET bottles, aligning with EU circular economy objectives.