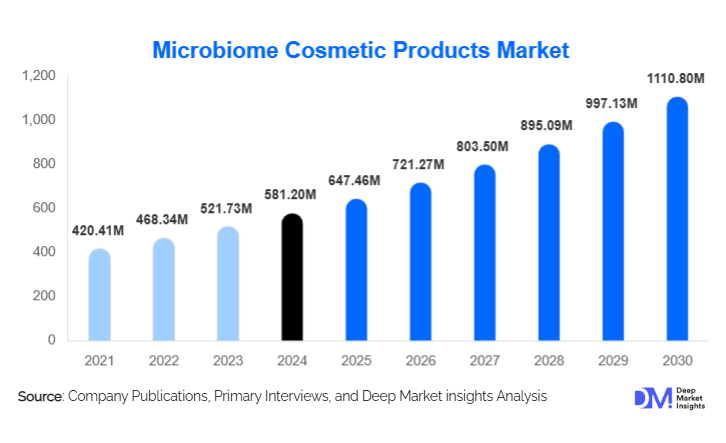

Microbiome Cosmetic Products Market Size

According to Deep Market Insights, the global microbiome cosmetic products market size was valued at USD 581.2 million in 2024 and is projected to grow to USD 647.46 million in 2025 and reach USD 1,110.80 million by 2030, expanding at a CAGR of 11.4% during the forecast period (2025–2030). Market growth is driven by rising consumer awareness of skin microbiome health, rapid innovation in postbiotic and probiotic-derived formulations, and strong uptake of premium skincare products emphasizing barrier repair, sensitivity reduction, and clinically validated performance.

Key Market Insights

- Microbiome-friendly skincare is rapidly transitioning from niche to mainstream, supported by dermatologist endorsement and increasing consumer trust in barrier-repair science.

- Postbiotics and stabilized probiotic lysates dominate formulation innovation, offering enhanced stability, safety, and regulatory clarity compared to live probiotics.

- North America leads global adoption, driven by premium skincare demand and advanced dermocosmetic retail channels.

- Asia-Pacific is the fastest-growing region, fueled by K-beauty and J-beauty trends and rising awareness of microbiome-focused formulations.

- E-commerce and D2C channels command a significant share of sales, enabling education-heavy marketing and personalized skincare routines.

- Brands are increasingly integrating clinical validation and digital microbiome testing to strengthen scientific credibility and differentiate premium products.

Latest Market Trends

Clinical-Grade Microbiome Validation Accelerating Premiumization

Leading brands are incorporating advanced clinical testing, including microbiome sequencing, biomarker tracking, and TEWL assessments, to validate claims for skin barrier repair, reduced sensitivity, and anti-acne performance. This trend is pushing microbiome cosmetics into a quasi-dermaceutical space, enabling premium pricing and partnership opportunities with dermatologists and aesthetic clinics. The inclusion of quantified microbiome endpoints increases consumer trust and is rapidly becoming a differentiating factor. Several manufacturers now co-develop products with research institutes to strengthen regulatory compliance and secure first-mover advantage in standardized microbiome label claims.

Postbiotic and Stabilized Probiotic Technologies Transforming Formulation Strategies

The shift from live probiotics to postbiotics and stabilized lysates is redefining formulation practices across the industry. Postbiotics offer longer shelf life, improved formulation compatibility, and fewer regulatory hurdles. These ingredients allow brands to scale globally without requiring cold-chain storage, reducing manufacturing and logistics costs. Additionally, encapsulation technologies and anhydrous formulations are enabling more potent delivery of microbiome-modulating actives. As ingredient suppliers innovate new peptides, ferments, and lysate-based actives, brands are increasingly able to differentiate products with multifunctional skin-health claims across serums, moisturizers, and scalp treatments.

Microbiome Cosmetic Products Market Drivers

Heightened Consumer Awareness of Skin Barrier and Microbiome Health

Growing consumer understanding of the skin microbiome’s role in barrier function, inflammation control, and skin sensitivity is directly fueling demand for microbiome-friendly skincare. Influencers, dermatologists, and scientific content creators have amplified awareness of postbiotic-based barrier repair regimens, significantly boosting adoption. This trend is especially pronounced among Millennials and Gen Z consumers who actively seek evidence-backed skincare solutions.

Rapid Innovation in Ingredient Technologies

Advancements in postbiotic fermentation, microencapsulation, and stabilized probiotic derivatives have expanded formulation possibilities across leave-on serums and creams. Brands now deliver potent actives without compromising safety or stability. Ingredient suppliers and CMOs have invested in fermentation and clean-room capabilities, resulting in rapid expansion of microbiome-focused product pipelines. These technologies have opened up new premium-priced segments, especially in anti-aging, redness reduction, and scalp microbiome care.

Expansion of Premium and Dermatology-Backed Skincare

The rising demand for clinical-grade skincare is propelling premium microbiome products into dermatology clinics, pharmacies, and aesthetic centers. Dermatologist-recommended brands are increasingly adopting microbiome claims to differentiate themselves from conventional skincare. This clinical endorsement has increased consumer confidence, supported higher ASPs, and broadened adoption across mid- to high-income segments globally.

Market Restraints

Regulatory Ambiguity Around Microbiome Claims

Inconsistent global regulations for probiotic and microbiome-related claims create compliance challenges for brands. Some jurisdictions regulate live probiotics as biologics, while others impose strict rules around therapeutic claims. These inconsistencies elevate compliance costs and complicate cross-border distribution, restricting market penetration for smaller brands. Emerging standardization efforts may help, but regulatory friction will remain a near-term barrier.

High Ingredient and Production Costs

Microbiome-focused products often require specialized actives such as fermented extracts, peptides, and lysates, which are costlier than conventional skincare ingredients. Limited specialized manufacturing capacity and stringent quality-control requirements increase production costs. These factors can compress margins for mass-market players and slow adoption in price-sensitive regions.

Microbiome Cosmetic Products Market Opportunities

Science-Backed Premium Skincare Expansion

Brands that invest in clinical validation and publish microbiome-endpoint data stand to capture significant premium market share. As consumers shift toward evidence-based skincare, clinically proven serums, barrier-repair creams, and scalp treatments present enormous growth potential. Premium and luxury retailers increasingly prioritize brands with robust scientific narratives, creating a lucrative niche for science-forward players.

Postbiotic and Advanced Formulation Technologies

Postbiotics, encapsulated actives, and fermentation-derived peptides offer scalable opportunities for ingredient suppliers, CMOs, and finished-goods brands. These technologies eliminate the stability and regulatory challenges associated with live probiotics, enabling broader distribution and lower manufacturing risk. Suppliers who standardize these actives can secure long-term partnerships with global CPG companies and rapidly growing indie brands.

Regional Expansion in APAC and Latin America

Asia-Pacific markets, including South Korea, Japan, China, and India, represent high-growth opportunities driven by strong skincare cultures and influencer-led consumer education. Meanwhile, Latin American markets such as Brazil and Mexico are adopting microbiome-focused skincare as part of the broader shift toward premium beauty. Cross-border e-commerce, localized variants, and K-beauty collaborations provide strong pathways for market entry and expansion.

Product Type Insights

Skin care moisturizers and creams dominate the microbiome cosmetic products market, accounting for approximately 38 percent of the total 2024 revenue. Their widespread daily use, high formulation flexibility, and strong alignment with barrier-repair claims make them the category’s flagship segment. Serums follow closely due to their concentrated actives and premium positioning. Scalp-care products are emerging rapidly, supported by rising interest in microbiome-driven hair health. Sun care, body care, and color cosmetics remain smaller but fast-evolving niches with increasing postbiotic inclusion.

Application Insights

Barrier repair and sensitivity reduction represent the largest application segment, contributing roughly 33 percent of 2024 demand. Anti-aging, hydration, and acne management are also significant growth drivers, with scalp microbiome applications becoming a high-potential niche. Anti-pollution positioning resonates strongly in urban Asia-Pacific markets, while anti-inflammatory claims appeal to European consumers prioritizing sensitive-skin solutions.

Distribution Channel Insights

E-commerce and direct-to-consumer platforms dominate distribution, accounting for nearly 40 percent of global 2024 revenues. These channels enable science-heavy storytelling, personalized routines, and subscription replenishment. Dermatology clinics and pharmacy retail chains represent strong secondary channels driven by rising consumer preference for clinically validated products. Specialty beauty retailers are expanding microbiome-specific shelves, while professional spa and salon channels are integrating microbiome treatments into in-clinic service menus.

End-User Insights

Millennial and Gen Z women aged 25 to 40 make up the largest consumer group, accounting for nearly 50 percent of category sales. Their demand is shaped by high skincare literacy and willingness to experiment with evidence-based regimens. Men’s grooming is becoming a meaningful growth segment, particularly in scalp and sensitive-skin care. Professional users such as aestheticians and dermatologists are increasingly adopting microbiome formulations to complement procedures and aftercare routines.

| By Product Type | By Ingredients and Technology | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, representing 36 to 40 percent of global 2024 revenue. The United States leads in premium dermocosmetics consumption, robust direct-to-consumer adoption, and high dermatologist influence. Canada shows rapid uptake of postbiotic products and strong retail expansion across pharmacies and specialty stores.

Europe

Europe is a mature but steadily expanding market driven by strict regulatory standards, high consumer focus on clean beauty, and strong demand for sensitive-skin formulations. Key markets include Germany, France, the United Kingdom, and Nordic countries, each emphasizing clinically tested, eco-conscious ingredients.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, supported by K-beauty innovation, Japan’s dermocosmetic legacy, and China’s premium beauty boom. South Korea leads in microbiome formulation innovation, while China drives volume growth. India’s rising middle class and growing skincare culture create long-term opportunity.

Latin America

Key markets in Latin America include Brazil, Mexico, and Argentina. Demand is growing due to increasing beauty spending, emerging dermocosmetic retail, and rising awareness of barrier repair and anti-acne microbiome solutions. Social-media-driven beauty trends strongly influence adoption.

Middle East and Africa

The Middle East shows rising premium demand, particularly in the United Arab Emirates and Saudi Arabia, where affluent consumers prioritize luxury dermocosmetics and imported premium skincare. Africa’s emerging beauty markets, led by South Africa and Nigeria, show increasing consumer education and pharmacy-led distribution.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Microbiome Cosmetic Products Market

- L’Oréal

- Unilever

- The Estée Lauder Companies

- Procter and Gamble

- Johnson and Johnson

- Shiseido

- Amorepacific

- Beiersdorf

- Kao Corporation

- Colgate-Palmolive

- DSM-Firmenich

- Givaudan

- BASF

- Gallinée (parent-owned)

- TULA, Aurelia, and Esse (leading specialist brands within parent portfolios)

Recent Developments

- In 2025, several major CPG companies expanded their microbiome-focused skincare lines, integrating postbiotic actives and clinically validated barrier-repair formulations into premium product portfolios.

- In early 2025, multiple ingredient suppliers launched next-generation postbiotic peptides and stabilized lysates, enabling improved efficacy and longer shelf life for global brands.