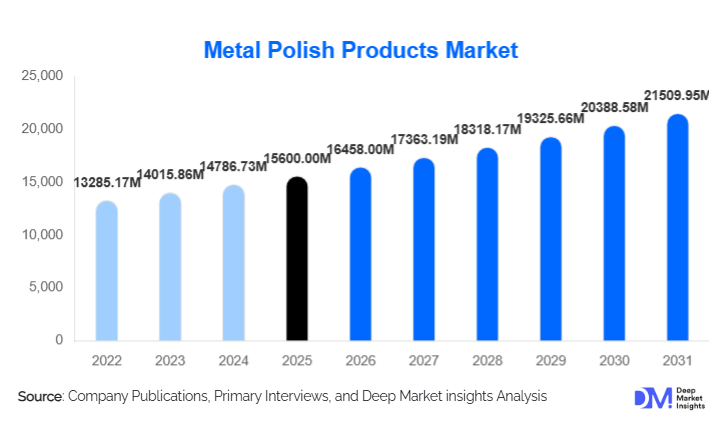

Metal Polish Products Market Size

According to Deep Market Insights, the global electrical protection glove market size was valued at USD 1,520.00 million in 2025 and is projected to grow from USD 1,617.28 million in 2026 to reach USD 2,205.43 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). Growth in the metal polish products market is primarily supported by rising demand from automotive manufacturing and aftermarket detailing, expanding industrial fabrication activities, increasing use of architectural metals in construction, and consistent household consumption for surface maintenance and aesthetic enhancement.

Key Market Insights

- Automotive and transportation applications remain the largest demand contributor, driven by vehicle detailing, chrome finishing, and aftermarket maintenance requirements.

- Liquid metal polish products dominate globally due to ease of application, faster coverage, and suitability across both industrial and consumer use cases.

- Asia-Pacific leads global consumption, supported by large-scale manufacturing, construction expansion, and rising vehicle ownership in China and India.

- Environmentally compliant formulations are gaining traction, particularly water-based and low-VOC polishes in North America and Europe.

- Industrial manufacturing demand is becoming increasingly export-driven, especially from Asia-based fabrication hubs supplying global markets.

- E-commerce and direct-to-consumer sales channels are expanding, improving accessibility of premium and specialized metal care products.

What are the latest trends in the metal polish products market?

Rising Adoption of Low-VOC and Water-Based Formulations

Environmental regulations and sustainability commitments across industrial and consumer markets are driving a structural shift toward water-based and low-VOC metal polish formulations. Manufacturers are investing in reformulation to reduce solvent content while maintaining polishing efficiency and surface protection performance. This trend is particularly strong in North America and Europe, where regulatory compliance and corporate ESG mandates are influencing procurement decisions. Bio-based abrasives and biodegradable additives are also being incorporated into premium product lines, improving brand positioning and long-term market competitiveness.

Premiumization in Automotive and Industrial Applications

Demand for high-performance, application-specific metal polish products is increasing across automotive detailing, marine maintenance, and industrial fabrication. Premium products offering scratch resistance, longer surface protection, and enhanced gloss retention are gaining market share, particularly among professional users. In the automotive aftermarket, detailing-grade polishes with ceramic compatibility and multi-metal functionality are expanding rapidly, supporting higher average selling prices and margin expansion.

What are the key drivers in the metal polish products market?

Growth in Automotive Production and Aftermarket Services

Global vehicle production recovery and the continued expansion of automotive aftermarket services are major drivers for metal polish products. Polishes are widely used for chrome trims, aluminum wheels, stainless steel components, and aesthetic restoration. Increasing vehicle lifespan and higher consumer spending on vehicle appearance are reinforcing repeat consumption across both professional detailing and DIY segments.

Expansion of Industrial Manufacturing and Metal Fabrication

Rising output from industrial manufacturing, machinery fabrication, and equipment maintenance sectors is sustaining demand for industrial-grade metal polishes. These products are critical for corrosion prevention, surface restoration, and quality finishing in export-oriented manufacturing. Growth in heavy machinery, electrical equipment, and fabricated metal exports from Asia-Pacific continues to support steady volume demand.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in the prices of solvents, abrasives, specialty chemicals, and packaging materials pose a challenge for manufacturers. Rising input costs can compress margins, particularly for mid-sized producers with limited pricing flexibility. This volatility increases pressure on supply chain optimization and long-term sourcing contracts.

Regulatory Compliance and Reformulation Costs

Stringent environmental and chemical safety regulations increase compliance costs, particularly for solvent-based products. Smaller manufacturers may face challenges in funding reformulation, testing, and certification, which can slow innovation and restrict market entry.

What are the key opportunities in the metal polish products industry?

Industrial and Infrastructure Growth in Emerging Economies

Rapid industrialization and infrastructure development in India, Southeast Asia, the Middle East, and Africa present strong growth opportunities. Large-scale investments in transportation infrastructure, commercial buildings, and industrial facilities are increasing demand for stainless steel and aluminum surface maintenance solutions. Localization of production and region-specific formulations offer attractive entry points for new and existing players.

Application-Specific and Premium Product Development

There is increasing demand for metal polish products tailored to specific metals and performance requirements. Specialized solutions for aerospace alloys, marine environments, and architectural finishes command higher margins. Companies that focus on product differentiation through performance enhancements and targeted marketing are well positioned to capture premium market segments.

Product Form Insights

Liquid metal polish products account for approximately 38% of global market share in 2024, driven by ease of use, faster application times, and strong compatibility with both manual and machine-assisted polishing processes. Their versatility across automotive, household, and light industrial applications supports widespread adoption. Paste and cream polishes follow closely, favored in industrial and professional environments where controlled abrasion and consistent surface finishing are required. Powder and solid bar polishes are primarily used in heavy industrial finishing, fabrication, and metalworking operations, where high material removal is necessary. Aerosol and spray formats are gaining popularity in consumer and automotive detailing segments due to application convenience, uniform coverage, and reduced labor intensity.

Chemical Composition Insights

Solvent-based metal polishes hold the largest share at around 42% of the 2024 market, reflecting their strong cleaning performance, rapid action, and effectiveness on heavily oxidized surfaces. These formulations remain widely used in automotive, industrial maintenance, and restoration applications. Water-based formulations represent the fastest-growing sub-segment, supported by tightening environmental regulations, workplace safety requirements, and sustainability initiatives. Abrasive-enhanced polishes continue to play a critical role in industrial restoration and surface preparation, while bio-based and low-VOC formulations are expanding steadily within premium consumer, automotive detailing, and professional markets.

End-Use Insights

Automotive and transportation applications represent nearly 29% of global demand in 2024, driven by vehicle maintenance, aftermarket detailing, and refurbishment activities. Industrial manufacturing and fabrication form the second-largest end-use segment, supported by routine equipment maintenance and metal surface finishing requirements. Household and consumer care applications provide a stable demand base, driven by regular upkeep of appliances, fixtures, cookware, and decorative metal surfaces. Construction and architectural metals are emerging as a key growth area, particularly in commercial real estate developments and urban infrastructure projects requiring long-term surface protection and aesthetic maintenance.

Distribution Channel Insights

Direct industrial sales account for approximately 36% of global distribution, supported by bulk procurement, customized formulations, and long-term supply agreements with manufacturers and maintenance contractors. Specialty chemical distributors play a critical role in reaching industrial and professional users by providing technical support and product variety. Retail and DIY stores dominate consumer sales through wide product availability and established brand presence. Meanwhile, e-commerce and direct-to-consumer platforms are expanding rapidly, particularly for premium, branded, and specialty metal polish products, supported by rising online purchasing and targeted digital marketing.

| By Product Form | By Chemical Composition | By Metal Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global metal polish products market with an estimated 36% share in 2024. China and India are the largest contributors, supported by large-scale manufacturing, ongoing infrastructure development, and steadily rising vehicle ownership. Strong export-oriented metal fabrication activity and demand from automotive components, machinery, and consumer goods manufacturing continue to sustain high consumption levels across the region.

North America

North America accounts for approximately 27% of global demand, led by the United States. Robust automotive aftermarket activity, high per-capita spending on vehicle care and maintenance, and widespread adoption of premium surface care products support regional performance. Increasing preference for environmentally compliant and low-toxicity formulations further reinforces demand stability.

Europe

Europe represents around 23% of the global market, with demand concentrated in Germany, the U.K., France, and Italy. Strict regulatory standards promoting low-VOC and eco-labeled formulations influence product development and purchasing decisions. Consistent demand from industrial maintenance, automotive refinishing, and heritage building upkeep supports steady regional growth.

Latin America

Latin America holds close to 6% of global market share, led by Brazil and Mexico. Market growth is driven by automotive manufacturing expansion, increasing construction activity, and gradual modernization of industrial maintenance practices. Rising availability of branded consumer products is also improving market penetration.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% of global demand. Ongoing infrastructure investments, industrial diversification initiatives, and rising commercial construction activity are supporting consumption. Demand is particularly strong in the UAE, Saudi Arabia, and South Africa, where industrial facilities and large-scale construction projects require regular metal surface maintenance.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The metal polish products market is moderately fragmented, with the top five players collectively accounting for approximately 35% of global market share. Leading companies benefit from strong brand recognition, diversified product portfolios, and established distribution networks across industrial and consumer segments.

Key Players in the Metal Polish Products Market

- 3M Company

- Henkel AG & Co. KGaA

- Reckitt

- Rust-Oleum Corporation

- Illinois Tool Works Inc.

- Turtle Wax Inc.

- SC Johnson Professional

- Würth Group

- Mothers Polishes Waxes Cleaners

- Menzerna Polishing Compounds

- Autoglym

- Sonax GmbH

- Liqui Moly GmbH

- Flitz International

- Blue Magic Inc.