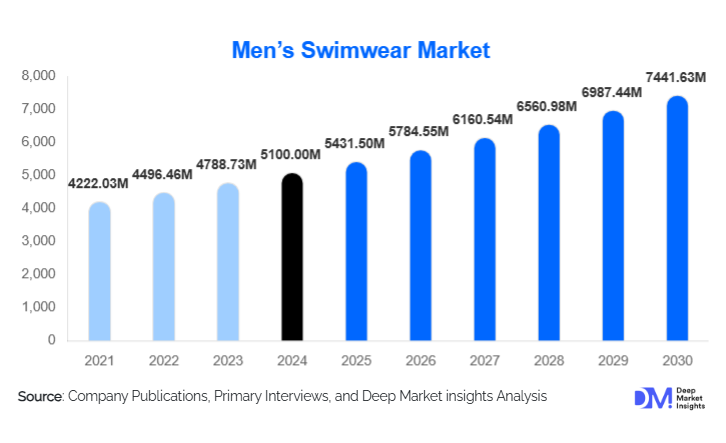

Men’s Swimwear Market Size

According to Deep Market Insights, the global men's swimwear market size was valued at USD 5,100.00 million in 2024 and is projected to grow from USD 5,431.50 million in 2025 to reach USD 7,441.63 million by 2030, expanding at a CAGR of 6.50% during the forecast period (2025–2030). The men’s swimwear market growth is primarily driven by expanding global beach tourism, rising participation in fitness and aquatic sports, and increasing preference for multifunctional, stylish, and sustainable swimwear among male consumers worldwide.

Key Market Insights

- Men’s swimwear demand is shifting toward performance-oriented and eco-friendly materials, driven by rising sustainability awareness and advancements in textile technology.

- Hybrid swimwear (swim-to-street styles) is rapidly gaining traction as consumers seek versatile apparel suited for both water and casual wear.

- Asia-Pacific is the fastest-growing region, propelled by increasing middle-class income, expanding tourism, and strong e-commerce penetration.

- North America remains a dominant market due to high leisure travel spending and strong interest in fitness, swimming, and water sports.

- Digital retail channels and direct-to-consumer (D2C) models are reshaping the global marketplace, allowing brands to scale rapidly and reach younger demographics.

- Sustainable swimwear made from recycled polyester and nylon is emerging as a premium market opportunity, attracting environmentally conscious buyers.

What are the latest trends in the men’s swimwear market?

Performance & Technology-Integrated Swimwear Rising

Men’s swimwear is increasingly incorporating high-performance materials offering UV protection, compression, quick-dry properties, and chlorine resistance. These innovations cater to both everyday swimmers and athletes involved in triathlons, surfing, diving, and aquatic fitness. Enhanced elastane blends, bonded stitching, and hydrodynamic fabric technologies are now common across mid-tier and premium segments. Tech-enabled sizing tools, AR fitting rooms, and AI-driven personalization used by brands are improving consumer experience and reducing online return rates, boosting profitability.

Sustainable Swimwear & Circular Fashion

The market is experiencing strong growth in eco-friendly swimwear made from recycled ocean plastics, regenerated nylon (such as ECONYL), and low-impact dyeing processes. Brands are adopting closed-loop production and highlighting sustainability certifications to improve consumer trust. Younger demographics, particularly millennials and Gen Z, over-index in purchasing sustainable swimwear, making this one of the fastest-growing strategic focus areas in the category.

What are the key drivers in the men’s swimwear market?

Growing Beach Tourism & Leisure Travel

With international tourism rebounding, beach vacations, cruises, and resort travel continue to rise. This directly boosts men’s swimwear sales, as travelers increasingly purchase new swim shorts and trunks for vacations. Warmer climates, longer summers, and increased outdoor leisure activities in major markets further support long-term demand. Premium holiday destinations in Asia-Pacific, Europe, and the Caribbean are influencing global swimwear fashion trends, fueling higher spending.

Expansion of Fitness Swimming & Water Sports

Swimming has become one of the most popular recreational exercises globally due to its low-impact benefits and suitability across age groups. Active participation in water sports, such as surfing, scuba diving, paddle-boarding, and triathlons, is driving demand for performance swimwear such as jammers, rash guards, and compression-resistant fabrics. This segment recorded some of the fastest growth in 2023–2024 and is expected to continue outpacing leisure swimwear through 2030.

What are the restraints for the global market?

Seasonality of Demand

Unlike other apparel categories, men’s swimwear demand is highly seasonal, concentrated heavily around summer months or travel periods. Brands face challenges in inventory management and forecasting due to fluctuations caused by weather conditions, holiday seasons, and macroeconomic factors. Seasonal concentration also limits annual revenue potential in certain regions.

Intense Price Competition & Fast-Fashion Pressure

The presence of low-cost manufacturers and fast-fashion retailers creates downward price pressure across the mid-tier and mass-market segments. Brands must constantly update designs to remain competitive, increasing operational and marketing costs. Margin compression is a significant challenge, particularly for mid-range players competing with both premium brands and low-cost newcomers.

What are the key opportunities in the men’s swimwear industry?

Expansion of Hybrid & Athleisure Swimwear

The blending of swimwear with everyday apparel, swim shorts that can double as streetwear or gym shorts, offers major growth potential. Consumers value comfort and versatility, especially younger buyers who prefer minimal wardrobes and multifunctional garments. Brands investing in quick-dry fabrics, premium finishes, and fashion-forward designs are capturing this emerging segment.

Sustainable & Eco-Friendly Swimwear Lines

Eco-conscious consumers are driving demand for swimwear made from recycled plastics, ocean waste, and environmentally responsible fabrics. Brands incorporating circular fashion, low-impact processes, and transparent sustainability commitments have strong market differentiation. The eco-friendly segment is expected to grow more than twice as fast as the conventional swimwear segment through 2030.

Product Type Insights

Swim trunks and boardshorts dominate the market, accounting for nearly 35–40% of global revenue in 2024. These products are favored due to their versatility, comfort, and suitability for both casual beachwear and resort holidays. Swim shorts and jammers are growing rapidly within the fitness and performance segment, driven by increased usage in competitive swimming and water sports. Rash guards and long-sleeved swim tops are expanding in regions with high UV exposure, reflecting rising consumer awareness of sun protection. Hybrid swimwear that functions as both casual shorts and swim apparel is gaining adoption among younger consumers and urban travelers.

Application Insights

Leisure and resort wear represents the largest application segment, driven by global tourism growth and high spending on beach vacations. Sports and fitness swimwear is one of the fastest-growing segments, fueled by swimming classes, pool fitness, surfing culture, and rising aquatic sports events. Multi-purpose and athleisure swimwear applications are also expanding as consumers look for performance, comfort, and style in a single garment.

Distribution Channel Insights

Online platforms, including brand-owned websites and e-commerce marketplaces, dominate global sales, accounting for 30–35% of 2024 demand. Digital-first brands are thriving due to their lower overhead costs, targeted marketing capabilities, and global reach. Offline retail, including department stores, specialty sports outlets, and brand stores, continues to be significant, particularly in North America, Europe, and tourist-heavy markets. Hybrid retail models and subscription-based swimwear services are emerging, offering seasonal packages and styling personalization.

End-Use Insights

Leisure and holiday applications account for over half of global demand, driven by consumers purchasing new swimwear for vacations and summer activities. Sports and aquatic fitness applications are growing rapidly, supported by global health trends. New end-use categories, including water recreation parks, adventure tourism outfits, and aquatic training academies, are contributing incremental demand. Growth in exports to tourism-driven nations and coastal economies further strengthens global consumption patterns.

| By Product Type | By Fabric / Material | By Distribution Channel | By End Use / Application | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 25–30% of the global market share in 2024. The U.S. drives most of the region’s demand due to high levels of holiday travel, strong fitness culture, and consistent interest in premium swimwear. Canada also shows steady growth with rising participation in swimming and aquatic sports.

Europe

Europe accounts for 20–25% of the global market. Demand is strong in coastal and tourism-oriented countries such as Spain, Italy, France, and Greece. Sustainability-focused consumers in the U.K., Germany, and the Nordics are fueling the rapid expansion of eco-friendly swimwear lines.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing 20–25% of global demand and expected to surpass Europe by 2030. China, India, Japan, Australia, and Southeast Asia show explosive growth due to rising middle-class travel, increasing beach tourism, and high digital commerce adoption.

Latin America

Latin America holds roughly 8–10% market share. Brazil and Mexico are the largest contributors, supported by strong beach culture, warm climates, and rising demand for both premium and affordable swimwear options.

Middle East & Africa

MEA accounts for 5–7% of global demand, with the UAE, Saudi Arabia, and South Africa leading consumption. Expanding tourism infrastructure and high disposable income levels in the Gulf region drive purchases of premium swimwear and resort wear.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Men’s Swimwear Market

- Speedo International

- Nike, Inc.

- Adidas AG

- Arena Italia

- Quiksilver (Boardriders)

- Hurley

- O’Neill

- Lululemon Athletica

- Decathlon S.A.

- Puma SE

- Patagonia

- TYR Sport

- Billabong

- Roxy (Boardriders

- Columbia Sportswear

Recent Developments

- In January 2025, Speedo launched a new chlorine-resistant performance line made from recycled polyester, targeting competitive swimmers and training athletes.

- In March 2025, Adidas introduced a sustainable men’s swimwear collection made from ocean-recovered plastics and low-impact dyes.

- In April 2025, Lululemon expanded its men’s swim-to-street hybrid shorts category, leveraging the growth of multi-functional athleisure swimwear.