Men Formal Shoe Market Size

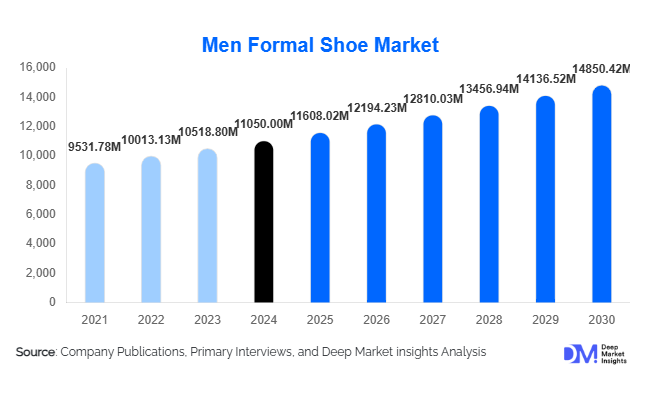

According to Deep Market Insights, the global men formal shoe market size was valued at USD 11,050.00 million in 2024 and is projected to grow from USD 11,608.02 million in 2025 to reach USD 14,850.42 million by 2030, expanding at a CAGR of 5.05% during the forecast period (2025–2030). The men formal shoe market growth is primarily driven by rising white-collar employment, the return of in-person and hybrid work models, increasing fashion consciousness among urban men, and the rapid expansion of branded and premium offerings across emerging markets.

Key Market Insights

- Oxfords remain the dominant product type, accounting for the largest share of global men formal shoe revenue due to their central role in corporate, legal, and ceremonial dress codes.

- Leather uppers still command the majority of value, with full-grain, top-grain, and patent leather representing roughly two-thirds of category revenue, even as high-quality synthetics gain traction in mid and entry price tiers.

- Asia-Pacific leads the market, contributing roughly the mid-40% range of global men formal shoe sales, supported by large urban populations, growing middle classes, and strong manufacturing capabilities.

- Corporate, hospitality, and wedding segments anchor demand, with uniforms and ceremonial uses providing stable baseline consumption alongside fashion-driven replacement purchases.

- Offline channels remain dominant but omnichannel is scaling quickly, as brand-owned e-commerce and digital-native D2C players reshape how men research, try, and buy formal footwear.

- The competitive landscape is fragmented, with the top five players together accounting for only about one-fifth to one-quarter of global revenue, leaving significant room for regional brands and niche specialists.

- Comfort, sustainability, and hybrid styling are the leading trends, as consumers increasingly demand sneaker-like comfort, traceable materials, and versatile designs that transition from office to social settings.

What are the latest trends in the men formal shoe market?

Comfort-First and Hybrid Dress-Casual Designs

One of the most pronounced trends in the men formal shoe market is the shift toward comfort-first designs and hybrid dress-casual silhouettes. Traditional Oxfords, Derbies, and loafers are being re-engineered with cushioned insoles, lightweight EVA or hybrid outsoles, and ergonomic last shapes inspired by athletic footwear. This allows brands to offer shoes that satisfy corporate dress codes while improving all-day wearability for commuting, travel, and long office hours. At the same time, hybrid “dress-sneaker” concepts and sleek loafers blur the lines between formal and casual, enabling men to style a single pair across office, business-casual, and social occasions. This versatility is particularly appealing for younger professionals and urban consumers who prioritize both comfort and style, supporting higher average selling prices and more frequent upgrades.

Sustainable Materials and Digital-First Branding

Sustainability is rapidly reshaping product development and brand positioning in men’s formal footwear. Manufacturers are introducing chrome-free or metal-free tanning, certified leathers, recycled content linings, and bio-based synthetics to reduce environmental impact while maintaining the polished aesthetics required for formal wear. Brands are also providing greater transparency on sourcing and production practices, often highlighting “made in” stories and artisan craftsmanship alongside environmental credentials. In parallel, digital-first branding is becoming crucial: social media, influencer collaborations, and online reviews now heavily influence purchase decisions, especially in the mid and premium price tiers. Virtual try-on tools, detailed size guidance, and 360-degree product visuals are improving online conversion for formal shoes, while omnichannel experiences—such as buying online and adjusting fit in store—are setting new expectations for convenience and service.

What are the key drivers in the men formal shoe market?

Growing White-Collar Employment and Urban Middle Classes

Expansion of white-collar employment and urban middle-class populations remains a fundamental driver of the men formal shoe market. In both mature and emerging economies, professional services, IT, finance, healthcare administration, government, and corporate headquarters continue to employ large numbers of men for whom formal or smart-formal footwear is either mandatory or strongly preferred. Even where hybrid work models have reduced the number of days in the office, those days tend to be more formal, reinforcing the importance of polished shoes for meetings, presentations, and client interactions. In emerging markets such as China, India, and Southeast Asia, rapid urbanization and growth in services industries are steadily increasing the addressable base of formal footwear users, creating long-term, structural demand in the entry, mid, and premium tiers.

Rising Fashion Consciousness and Brand Premiumization

Men around the world are increasingly fashion-conscious, treating footwear as a key expression of personal style and professional identity. This shift is encouraging trading-up from unbranded or basic products to recognized labels that offer refined design, consistent quality, and a clear brand story. Branded men formal shoes with distinctive silhouettes, premium materials, and comfort features can command significant price premiums and enjoy better shelf visibility both online and offline. Premium and luxury brands leverage heritage, craftsmanship narratives, and limited editions to attract affluent consumers, while mid-market brands focus on trend-responsive designs that suit contemporary office environments and formal events. As disposable incomes rise and exposure to global fashion grows through digital channels, this premiumization trend is expected to remain a major growth driver for the category.

What are the restraints for the global market?

Workplace Casualization and Sneaker Competition

The primary structural restraint for the men formal shoe market is the ongoing casualization of workplace dress codes and the pervasive popularity of sneakers. Many technology, creative, and digital-native companies have relaxed expectations around formal attire, allowing smart sneakers and casual shoes in contexts that previously required leather Oxfords or Derbies. Athleisure and lifestyle sneakers, supported by strong marketing and comfort advantages, are capturing share of wallet and reducing the frequency with which men replace formal footwear. Even in sectors where suits remain common, there is greater acceptance of minimalist leather sneakers or hybrid casual shoes, which can displace traditional formal models. This trend shortens replacement cycles for strictly formal shoes and pushes brands to rethink product mix, styling, and in some cases, their core identity.

Trade, Tariff, and Cost Volatility in Global Supply Chains

The men formal shoe industry is heavily exposed to global trade dynamics, as a large portion of production is concentrated in Asia and exported to markets in North America, Europe, and beyond. Changes in import tariffs, anti-dumping measures, and trade agreements can quickly alter cost structures and margin profiles for brands and retailers. Rising labour costs in key manufacturing hubs, fluctuations in raw material prices (especially leather and high-performance synthetics), and currency volatility add further uncertainty. For price-sensitive segments, these pressures restrict the ability to pass on cost increases to end consumers, potentially compressing margins. For smaller manufacturers and brands, navigating complex regulatory requirements and documentation can also be challenging, limiting cross-border expansion and slowing the pace at which new players can scale internationally.

What are the key opportunities in the men formal shoe industry?

Premiumization and Technology-Enhanced Formal Footwear

The intersection of premiumization and comfort technology presents a powerful opportunity for both established brands and new entrants. By integrating advanced cushioning systems, lightweight construction, breathable linings, and ergonomic last engineering into classic silhouettes, companies can position their products as “all-day formal” or “boardroom-to-travel” solutions. This approach supports higher price points and stronger brand loyalty, particularly among professionals who value both aesthetics and health. There is further scope to differentiate through specialized collections for frequent travelers, long-distance commuters, and executives, offering features like enhanced arch support, anti-odor treatments, and easy-care finishes. Limited-edition collaborations with designers, tailors, or watch and suit brands can also create buzz and justify premium pricing, especially in urban centres and luxury retail environments.

Hospitality, Weddings, and Export-Oriented Manufacturing

Rapid growth in hospitality, aviation, and event industries creates substantial B2B opportunities for men formal shoe suppliers. Hotels, resorts, airlines, cruise operators, and fine-dining chains require standardized, durable formal footwear for uniforms, often via multi-year contracts that provide volume stability. Similarly, rising spending on weddings and social events in markets such as India, China, and the Middle East supports demand for special-occasion dress shoes, including patent leather, embellished loafers, and handcrafted designs. On the supply side, export-oriented manufacturing clusters—particularly in Asia-Pacific—benefit from policy support, infrastructure investments, and incentive schemes aimed at upgrading leather and footwear production. Brands that strategically partner with these clusters, or invest directly in modernized facilities, can combine cost efficiency with improved quality, traceability, and speed to market.

Product Type Insights

By product type, Oxford shoes dominate the men formal shoe market, accounting for roughly one-third of global revenue. Their clean lines, closed lacing, and compatibility with business suits and formalwear make them the default choice for corporate offices, legal and financial professions, and high-formality events. Derbies represent the next major category, appealing to men who prefer a slightly roomier fit or a more relaxed formal aesthetic. Loafers, including penny and bit styles, are increasingly popular in business-casual environments and warmer climates, while dress boots (such as Chelsea and lace-up dress boots) are gaining prominence in cooler regions and fashion-forward urban segments. Specialty types like monk straps and brogues serve niche but profitable segments, especially within premium and luxury price bands, where design differentiation and craftsmanship are key.

Application Insights

In application terms, corporate and white-collar employment remains the single largest use case, encompassing daily office wear, client meetings, conferences, and business travel. Banks, consulting firms, law practices, and government agencies typically maintain relatively formal dress codes, ensuring consistent baseline demand. Uniformed segments—such as hospitality, airlines, retail chains, and certain public services—also rely on formal shoes that meet specific comfort, safety, and visual standards. Weddings and ceremonial events represent a vibrant growth segment, especially in markets where multi-day celebrations and high guest counts are common; demand here skews toward premium and fashion-forward designs. Academic institutions and other organizations with formal uniforms create additional recurring demand, particularly for standardized black or brown styles, while cultural and religious events sustain niche demand for traditional or regionally specific formal footwear.

Distribution Channel Insights

Offline retail still accounts for the majority of men formal shoe sales, with department stores, mono-brand outlets, multi-brand footwear chains, and factory outlets all playing important roles. Customers often prefer to try formal shoes in person to assess fit, comfort, and aesthetic details under real conditions. However, online channels are growing rapidly, especially for mid-range and premium products, as consumers become more comfortable with digital size guides, return policies, and detailed product imagery. Brand-owned websites and apps support direct-to-consumer sales and higher margins, while large online marketplaces provide scale and visibility. Click-and-collect, in-store returns for online purchases, and virtual fitting tools are further integrating offline and online journeys, making omnichannel capabilities a key competitive differentiator.

Customer Type Insights

The men formal shoe market serves several distinct customer types. Corporate professionals form the core segment, purchasing shoes for daily office wear and client-facing roles, typically in mid-range, comfort-enhanced styles. Uniformed staff in hospitality, aviation, retail, and government often buy via institutional contracts or approved supplier lists, prioritizing durability, comfort, and safety compliance over fashion trends. Fashion-conscious urban consumers, including younger professionals and creatives, seek more expressive designs—such as coloured leathers, broguing, and contemporary silhouettes—often within premium or accessible luxury price tiers. Occasional buyers, such as students or gig workers who need formal shoes primarily for interviews, ceremonies, or special events, tend to favour budget or mid-priced products, but can be nudged towards higher-quality options through styling advice and bundled offers with suits or accessories.

Age Group Insights

Men aged 20–34 years and 35–54 years account for the bulk of men formal shoe consumption. The 20–34 segment drives growth in trend-led and hybrid formal styles, leveraging online research, peer recommendations, and influencer content to make purchasing decisions; they often own fewer pairs but replace them more frequently as fashion evolves. The 35–54 segment typically exhibits higher purchasing power and gravitates toward comfort-enhanced, durable shoes suitable for long working hours, business travel, and formal occasions, with a greater willingness to invest in premium or branded products. Older consumers aged 55+ represent a smaller but valuable segment, often prioritizing orthopaedic support, wider fits, and slip-resistance; they offer opportunities for specialized comfort and health-focused formal shoe ranges. Teenage consumers contribute modestly, mainly via school or college uniforms and entry-level corporate wear.

| Shoe Type | Material Type | Price Range | Distribution Channel | Application | Age Group |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America is a mature market characterized by high per-capita footwear spending and strong penetration of international brands. The United States remains one of the largest importers of footwear globally, with men’s formal shoes sourced from both Asian manufacturing hubs and premium European producers. Corporate, government, and hospitality segments underpin ongoing demand, though casualization and the widespread adoption of sneakers create competitive pressure. Premium and luxury formal shoe brands perform well in major metropolitan areas, supported by affluent consumers and a robust department-store and specialty-retail infrastructure. E-commerce and direct-to-consumer models are particularly advanced in this region, enabling brands to target niche segments and personalize marketing.

Europe

Europe has a rich heritage in men’s formal shoemaking, with Italy, Spain, Portugal, and the U.K. hosting many of the world’s most respected brands and manufacturing clusters. The region plays a dual role as both a key consumer base and a source of high-end and luxury formal footwear for global markets. European consumers are highly receptive to sustainability, traceability, and craftsmanship narratives, supporting demand for certified leathers, eco-friendly tanning, and locally made products. At the same time, regulatory frameworks around chemicals, labour, and environmental impact are pushing the industry toward higher technical standards and more transparent supply chains. Major fashion capitals and financial centres maintain strong demand for premium men’s formal shoes despite broader casualization trends.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region in the men formal shoe market, driven by demographic scale, rising incomes, and expanding service economies. China and India are the main engines of growth, with millions of new white-collar workers entering sectors that still value formal or smart-formal attire. Urban consumers in these markets are increasingly brand-conscious, with strong interest in both international labels and aspirational domestic brands. Beyond consumption, the region is also the global manufacturing powerhouse, with China, Vietnam, Indonesia, and India producing a substantial share of the world’s formal footwear exports. As governments invest in footwear clusters and export incentives, Asia-Pacific’s role in shaping global design, pricing, and supply dynamics will continue to strengthen.

Latin America

Latin America represents a mid-sized but important market for men’s formal shoes, anchored by Brazil and Mexico. Formal footwear is integral to professional and government dress codes, as well as to religious and social events. Local manufacturers supply a significant portion of demand, particularly in budget and mid-price tiers, while international brands compete in premium segments. Currency volatility, inflation, and macroeconomic fluctuations can affect consumer spending patterns and import costs, but the long-term outlook is supported by urbanization, demographic youth bulges, and the gradual penetration of global fashion and lifestyle brands. There is also scope for regional players to increase exports to neighbouring markets and beyond.

Middle East & Africa

The Middle East & Africa region offers strong growth potential, combining high-income markets in the Gulf with expanding urban populations across Africa. In the Gulf Cooperation Council (GCC) countries, high disposable incomes and a preference for luxury fashion support strong demand for premium and luxury men’s formal shoes—often imported from Europe and leading global brands. In Africa, growing financial services, telecommunications, and government employment are gradually expanding the formal footwear customer base, although informal markets and low-cost imports remain prevalent. Across the region, weddings, religious ceremonies, and cultural events also contribute meaningful demand, particularly for embellished and traditional-inspired formal designs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The men formal shoe market is moderately to highly fragmented, with thousands of regional and local manufacturers alongside a limited set of global brands. The top five players together are estimated to account for roughly 20–25% of global revenue, with the remainder split among mid-tier brands, luxury fashion houses, and unorganized or private-label producers. This fragmentation intensifies competition on design, price, and comfort features, while leaving ample room for niche brands and new entrants to build share in specific regions, price segments, or style niches.

Top Players in the Men Formal Shoe Market

- C. & J. Clark International Ltd.

- ECCO Sko A/S

- Salvatore Ferragamo S.p.A.

- Guccio Gucci S.p.A.

- Prada S.p.A.

- Allen Edmonds

- Johnston & Murphy (Genesco, Inc.)

- Geox S.p.A.

- Bata Group

- Aldo Group

Recent Developments

- In June 2024, Santoni launched its “Easy” collection of men’s formal shoes featuring flexible construction and sneaker-inspired comfort enhancements.