Medical Tourism Market Size

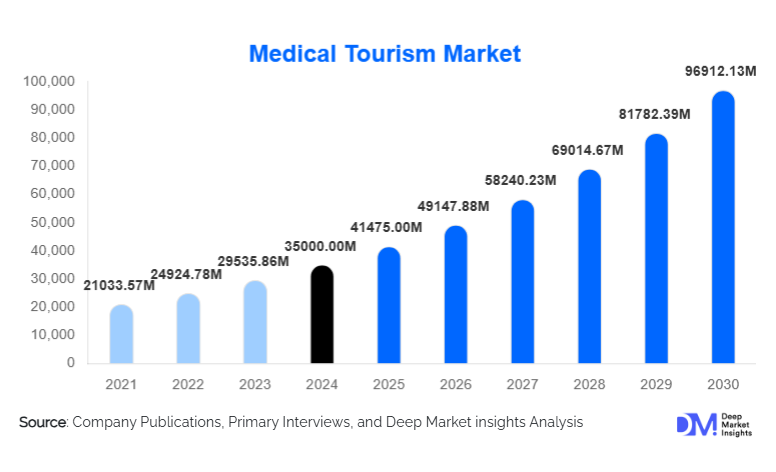

According to Deep Market Insights, the global medical tourism market size was valued at USD 35,000.00 million in 2024 and is projected to grow from USD 41,475.00 million in 2025 to reach USD 96,912.13 million by 2030, expanding at a CAGR of 18.50% during the forecast period (2025–2030). The medical tourism market growth is primarily driven by increasing demand for affordable, high-quality healthcare, the rise of internationally accredited hospitals, and accelerating patient mobility for specialized treatments unavailable or unaffordable in home countries.

Key Market Insights

- Asia-Pacific remains the global leader in medical tourism, driven by India, Thailand, Singapore, and Malaysia, offering advanced care at significantly lower costs.

- Cosmetic, dental, orthopedic, cardiac, and fertility treatments account for the largest share of medical travel demand globally.

- Telemedicine-integrated medical tourism is rapidly growing, enabling pre- and post-treatment continuity of care for international patients.

- Private hospitals dominate the market, holding approximately 65–70% of international patient volume due to advanced infrastructure and specialized departments.

- Wellness and preventive healthcare tourism is expanding as aging populations seek rehabilitation, physiotherapy, and holistic recovery programs.

- Digital platforms, AI-enabled diagnostics, and virtual consultations are transforming the patient journey, making medical tourism highly personalized and efficient.

What are the latest trends in the medical tourism market?

Rise of Integrated Wellness–Medical Tourism Models

Medical tourism is evolving beyond procedure-oriented travel into a comprehensive wellness ecosystem. Hospitals and hospitality groups are designing integrated care pathways combining treatment, recovery, physiotherapy, mental wellbeing, nutrition programs, and tourism experiences. Ageing populations from North America, Europe, and East Asia are increasingly seeking long-stay rehabilitation, lifestyle disease management, and preventive health packages abroad. Destinations like India, Thailand, and Bali are pioneering hybrid medical–wellness resorts that include medical evaluations, yoga, Ayurveda, post-operative physiotherapy, and chronic disease management. This trend aligns with the global shift toward preventive medicine and is reshaping destination competitiveness.

Digital Transformation of Pre- and Post-Care

Technology is becoming central to medical tourism. Hospitals are providing AI-based diagnostics, remote consultations, virtual pre-treatment assessments, and post-operative telehealth follow-ups. This minimises patient travel, enhances coordination with home-country physicians, and ensures continuity of care. Blockchain-enabled health records, AI-driven treatment recommendations, virtual hospital tours, and patient scheduling systems are improving transparency and trust. Digital tools also reduce language barriers, streamline documentation, and enable seamless remote monitoring, making long-distance medical travel significantly safer and more predictable for patients.

What are the key drivers in the medical tourism market?

High Cost of Healthcare in Developed Countries

The dramatic cost differential between advanced nations and medical tourism hubs is the strongest growth driver. Treatments in the U.S., Canada, Japan, and parts of Western Europe can cost 50–80% more compared to India, Thailand, Turkey, or Mexico, even when performed by equally qualified surgeons. This economic gap, combined with long waiting times in public healthcare systems, continues to push patients to seek treatment abroad for urgent surgeries, dental care, elective procedures, and chronic disease interventions.

Global Availability of Accredited, High-Quality Healthcare

Many destination countries have extensively upgraded their hospital infrastructure, attracting international certifications such as JCI accreditation. These facilities employ globally trained surgeons, invest in minimally invasive and robotic technologies, and build international patient departments that provide translators, concierge services, transport, and customised care pathways. Improved quality and trust have expanded the medical tourism market beyond cosmetic procedures to include oncology, cardiology, neurology, and organ transplant-related services.

Demographic Shifts and Rising Chronic Diseases

An ageing global population combined with widespread chronic diseases, obesity, diabetes, cardiovascular disorders, orthopaedic degeneration, and infertility, is increasing global demand for specialised, cost-effective treatments. Medical tourism hubs cater to these conditions with accessible and timely treatment options, attracting long-term patients and increasing average treatment value.

What are the restraints for the global market?

Regulatory, Legal, and Quality Assurance Issues

The absence of standardised global regulations for cross-border healthcare poses risks to patients. Variations in malpractice laws, accreditation standards, follow-up responsibilities, and post-operative complications create legal uncertainties. Patients may struggle to obtain follow-up care or insurance reimbursement once they return home, limiting adoption among risk-averse travellers.

Logistical & Travel-Related Challenges

Medical tourism involves extensive logistics: visas, long-distance travel, accommodation, recovery environments, and aftercare. Patients with severe conditions may not be able to fly for the required durations. Travel costs, unexpected medical complications, and the need for family assistance add complexity. These factors restrain demand, especially for older or critically ill patients requiring long-term care.

What are the key opportunities in the medical tourism industry?

Digital-First Cross-Border Healthcare Ecosystems

The integration of telemedicine, remote diagnostics, wearable health monitoring, and AI-based clinical decision tools presents substantial opportunities. Hospitals adopting hybrid virtual + travel models can serve larger international patient pools and reduce perceived travel risks. Digital health ecosystems also enable continuity between home-country doctors and foreign hospitals, increasing trust and accelerating patient acquisition.

Expansion of Emerging Medical Hubs in APAC, the Middle East & LATAM

Countries such as India, UAE, Saudi Arabia, Malaysia, Turkey, Mexico, and Brazil are rapidly investing in high-end hospitals and wellness centres. These developments create opportunities for hospital chains, investors, travel facilitators, insurers, and wellness brands to enter new markets. Governments in these regions are offering incentives, streamlined visas, medical tourism corridors, and public–private partnership programs to attract foreign patients.

Product (Treatment Type) Insights

Cosmetic & aesthetic procedures dominate the market, accounting for nearly 22–25% of global medical tourism revenue in 2024. These procedures are typically elective, high-margin, and widely sought after due to global aesthetic trends and affordability in tourism hubs. Dental treatments, fertility services, orthopedic surgeries, cardiovascular interventions, and bariatric procedures also form rapidly growing treatment clusters. Oncology and neurology treatments are expanding due to improved global diagnostic capabilities and specialist availability.

Application Insights

Medical tourism applications range from elective treatments (cosmetic, dental, ophthalmology) to necessary or semi-urgent medical interventions (cardiac, orthopedic, oncology). Wellness and rehabilitative tourism are emerging as one of the fastest-growing application categories. Many patients now combine surgery with wellness retreats, physiotherapy, dietary therapy, and holistic recovery programs. Post-operative rehabilitation packages are especially popular among orthopedic, cardiac, and bariatric patients. Fertility tourism is also rising, supported by lenient regulations and advanced IVF technologies in select countries.

Distribution Channel Insights

Online medical travel platforms and direct hospital bookings dominate the market. Digital channels allow patients to compare treatment packages, consult specialists, view procedure videos, and access transparent pricing. Medical facilitators, concierge services, and travel agencies remain important for complex procedures requiring documentation, translators, and long-stay planning. Hospitals are enhancing digital presence via teleconsultations, virtual hospital tours, and AI-driven patient matching tools. Social media, wellness influencers, and patient testimonial videos significantly shape patient decision-making.

Traveler Type Insights

Individual medical travelers constitute 75–85% of all patients, especially for elective and specialized treatments. Couples form a major share in fertility tourism, while family-accompanied travel is common for complex surgeries requiring longer recovery. Group wellness travel is rising among corporate teams and retiree groups seeking preventive health packages abroad. Digital nomads and long-stay remote workers increasingly combine travel with dental, cosmetic, and wellness procedures.

Age Group Insights

Adults aged 26–55 years hold the largest share of medical tourism, representing 50–60% of global demand due to their high spending capacity and greater need for elective procedures. The 56–70 age group drives orthopedic, cardiac, and chronic disease treatments. Younger travelers (18–30) seek dental, cosmetic, and wellness packages, often influenced by social media. Older patients aged 70+ represent a niche but growing segment, supported by medical assistance-equipped travel and premium recovery centers.

| By Treatment Type | By Service Provider Type | By Traveler Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is one of the largest source regions for medical tourists. High domestic costs and long wait times drive patients to destinations such as Mexico, Costa Rica, India, and Thailand. U.S. and Canadian travelers increasingly pursue dental, cosmetic, fertility, orthopedic, and bariatric surgeries abroad. North America accounts for approximately 20–25% of outbound demand in 2024.

Europe

Europe generates substantial outbound medical travel, especially from the U.K., Germany, France, and Italy. Cost savings and shorter waiting periods motivate travelers to seek treatment in Turkey, Poland, Hungary, and India. Europe accounts for 15–20% of the global market. Eastern European countries are also developing into competitive, lower-cost medical hubs for intra-EU travelers.

Asia-Pacific

Asia-Pacific is the leading global destination region, capturing around 30–35% market share in 2024. Thailand, India, Singapore, and Malaysia attract millions of foreign patients annually. APAC offers advanced medical technologies, internationally accredited hospitals, and low-cost surgical procedures. The region is also the fastest-growing medical tourism market due to expanding private healthcare infrastructure and growing government initiatives.

Latin America

Latin America, led by Mexico, Brazil, Costa Rica, and Colombia, has become a preferred destination for North American travelers seeking affordable dental work, bariatric surgery, cosmetic procedures, and orthopedic care. The region accounts for 5–10% of the global market and is expanding due to improved safety standards and medical regulatory reforms.

Middle East & Africa

The Middle East (UAE, Saudi Arabia, Qatar) and parts of Africa (South Africa, Egypt) are emerging as regional hubs. UAE and Saudi Arabia are investing heavily in specialty hospitals targeting inbound patients from Asia and Europe. Africa attracts niche travelers for fertility, orthopedic, and wellness tourism. The region holds a 5–10% share with strong upward potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Medical Tourism Market

- Bumrungrad International Hospital

- Bangkok Dusit Medical Services

- Apollo Hospitals Enterprise Ltd.

- Fortis Healthcare

- KPJ Healthcare

- Raffles Medical Group

- Mount Elizabeth Hospitals

- Samitivej Hospitals

- Gleneagles Global Hospitals

- Max Healthcare Institute

- Asian Heart Institute

- Aditya Birla Health Services

- Dr. B.L. Kapur Memorial Hospital

- BB Healthcare Solutions

- Fortis Malar Hospitals

Recent Developments

- In June 2025, Apollo Hospitals announced a major expansion of its International Patient Center, integrating AI-driven diagnostic tools for global pre-consultation services.

- In March 2025, Thailand’s BDMS launched a regenerative medicine & longevity center targeting premium foreign medical travelers.

- In January 2025, the UAE introduced a unified Medical Tourism Visa Program aimed at attracting long-stay international patients for specialized surgeries and wellness programs.