Medical Spa Market Size

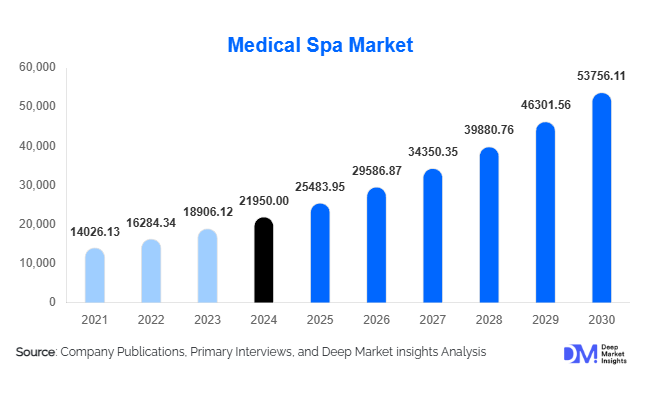

According to Deep Market Insights, the global medical spa market size was valued at USD 21,950.00 million in 2024 and is projected to grow from USD 25,483.95 million in 2025 to reach USD 53,756.11 million by 2030, expanding at a CAGR of 16.1% during the forecast period (2025–2030). The medical spa market growth is primarily driven by the rising demand for minimally invasive aesthetic treatments, expanding wellness tourism, and the increasing integration of advanced technologies such as AI-based skin diagnostics, laser systems, and body-contouring devices.

Key Market Insights

- Facial aesthetic treatments dominate the global market, accounting for over 35% of total revenue in 2024, led by high consumer adoption of injectables, chemical peels, and anti-aging procedures.

- North America leads the global medical spa market, representing approximately 40–42% of global revenues, owing to high disposable incomes and strong technological adoption.

- Asia-Pacific is the fastest-growing regional market, driven by increasing middle-class affluence, expanding wellness tourism, and rising consumer interest in non-invasive treatments.

- Female clientele represent about 80% of total consumers, although male participation is increasing rapidly through targeted marketing and specialized men’s skincare services.

- Technological integration, AI skin imaging, RF, cryolipolysis, and AR-based previews are transforming consumer engagement and operational efficiency in medical spas.

- Wellness-focused service diversification, including IV therapy, hormone balancing, and longevity programs, is driving customer retention and higher profit margins.

What are the latest trends in the medical spa market?

Technology-Integrated Aesthetic Experiences

Medical spas are embracing advanced technologies such as AI-powered skin diagnostics, augmented reality (AR) treatment previews, and personalized digital skincare analysis. These innovations allow practitioners to provide more accurate treatment planning and improve patient satisfaction through data-driven insights. The use of connected devices and smart imaging tools enhances before-and-after tracking, while teleconsultation platforms expand reach beyond local markets. As younger, tech-savvy clients demand transparency and customization, digital innovation has become a key differentiator for leading medical spa brands.

Wellness and Preventive Aesthetics Merge

There is a clear shift from corrective to preventive and holistic wellness solutions. Modern medical spas are blending aesthetic medicine with integrative wellness practices, offering IV nutrient therapy, stress management, hormone optimization, and lifestyle consultations. This holistic approach not only broadens the customer base but also increases client lifetime value. Facilities that combine beauty and wellness are reporting higher repeat visits and premium price realization, positioning the medical spa industry at the intersection of healthcare, beauty, and lifestyle management.

Rise of Wellness Tourism and Global Expansion

Countries in the Asia-Pacific, the Middle East, and Latin America are witnessing a surge in inbound medical spa tourism. Tourists are combining rejuvenation and aesthetic procedures with travel experiences, particularly in destinations like Thailand, South Korea, the UAE, and Mexico. Governments in these regions are promoting wellness tourism through investment incentives and infrastructure development. This trend is expanding the addressable market for global medical spa brands seeking international franchise or partnership opportunities.

What are the key drivers in the medical spa market?

Increasing Demand for Minimally Invasive Aesthetic Treatments

Consumers are increasingly opting for non-surgical procedures with minimal downtime, such as dermal fillers, laser skin resurfacing, and non-invasive body contouring. The convenience, affordability, and immediate results of these treatments have broadened the market beyond traditional cosmetic surgery patients, propelling overall industry growth.

Growing Awareness of Self-Care and Appearance Enhancement

Social media and influencer culture have normalized aesthetic treatments and self-care, fostering a broader acceptance of medical spa services. Consumers now perceive these procedures as routine maintenance rather than luxury indulgence, contributing to repeat business and consistent year-round demand.

Technological Advancements and Equipment Innovation

The development of next-generation laser, RF, cryotherapy, and ultrasound-based devices has enhanced treatment safety and effectiveness. Manufacturers are integrating AI and data analytics into devices to optimize treatment outcomes, while ergonomic, portable systems enable smaller clinics to offer advanced services at lower capital costs.

What are the restraints for the global market?

Regulatory and Safety Challenges

Medical spas operate at the intersection of healthcare and beauty, leading to inconsistent regulatory oversight. Licensing, practitioner qualification, and procedural safety vary by region, potentially limiting cross-border expansion and creating liability risks. Ensuring compliance and staff training increases operational costs and slows growth for smaller operators.

Market Saturation and Price Competition

In developed markets such as the U.S. and parts of Europe, the rapid proliferation of new medical spas has intensified competition, leading to price discounting and reduced margins. Clinics must differentiate through superior technology, service quality, and brand positioning to maintain profitability in an increasingly crowded marketplace.

What are the key opportunities in the medical spa industry?

Digitalization and Smart Clinics

The rise of digital booking, AI-driven skincare assessments, and CRM-enabled loyalty programs presents major opportunities for enhancing operational efficiency and customer engagement. Clinics adopting technology-driven ecosystems can streamline workflows, deliver personalized services, and command premium pricing.

Emerging Market Expansion

Asia-Pacific, Latin America, and the Middle East offer high-growth potential with expanding middle-class populations and supportive government policies for wellness tourism. Establishing partnerships or franchises in these regions allows operators to capture first-mover advantages and diversify revenue streams.

Integrative Health and Longevity Services

Expanding into holistic health and longevity programs, including hormone therapy, detox treatments, and regenerative medicine, provides a new revenue frontier. This integration aligns with global trends in preventive healthcare and positions medical spas as long-term wellness partners rather than short-term aesthetic providers.

Service Type Insights

Facial treatments continue to dominate the global medical spa market, accounting for approximately 35–40% of total revenue in 2024. Their leadership stems from high repeat-purchase frequency, visible results, and continuous innovation in non-invasive skin rejuvenation, hydration, and anti-aging protocols. The demand for aesthetic and cosmetic procedures, particularly non-surgical injectables and laser-based facial rejuvenation, is fueled by the desire for quick, low-downtime results, a trend magnified by social media and the “Instagram-ready” aesthetic culture. The integration of AI-powered skin diagnostics and personalized treatment mapping is further elevating consumer trust and satisfaction in this segment.

Body shaping and contouring represent the fastest-growing segment, expanding rapidly on the back of evolving consumer preferences for non-invasive fat reduction, muscle toning, and body sculpting technologies. This growth is underpinned by advancements in cryolipolysis, radiofrequency, and electromagnetic stimulation systems that deliver measurable outcomes without surgical recovery periods. Younger demographics, in particular, are driving this trend through lifestyle-focused body enhancement and preventive wellness motivations.

Hair removal and scar reduction treatments maintain stable global demand, supported by recurring service cycles and improved treatment safety across different skin types. Meanwhile, medical dermatology and treatments, such as acne management, pigmentation correction, and skin disorder therapies, are gaining momentum due to rising consumer awareness of dermatologic health and the credibility added by physician-supervised protocols. These services benefit from physician referrals and integration with dermatology clinics, improving both volume and trust.

End-Use Insights

The adult demographic (18–64 years) represents the largest consumer segment, accounting for nearly 70% of the global clientele in 2024. This group seeks aesthetic rejuvenation, stress relief, and holistic wellness solutions aligned with professional and lifestyle goals. Female consumers remain dominant, representing approximately 80% of total demand; however, male participation is rising through targeted campaigns highlighting confidence, grooming, and fitness benefits of aesthetic procedures.

Corporate wellness programs and medical tourism packages are emerging as key end-use growth drivers, linking aesthetic enhancement with preventive health and rejuvenation experiences. Countries like Thailand, the UAE, and Mexico are capitalizing on this trend, with international clientele contributing up to 30% of premium medical spa revenues in select destinations. These facilities leverage global-quality service standards, multi-specialty integration, and luxury positioning to attract affluent medical tourists.

| By Service Type | By End-Use | By Gender |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global medical spa market, capturing approximately 40–42% share (USD 8.5–9.0 billion in 2024). The United States dominates regional performance, supported by advanced reimbursement systems, widespread insurance integration for therapeutic skin services, and high consumer willingness to pay for premium, result-oriented aesthetic treatments. The region benefits from a dense network of board-certified practitioners, early adoption of new technologies, and a sophisticated regulatory ecosystem that ensures patient safety and efficacy standards.

Furthermore, growing awareness around preventive dermatologic care, combined with demand for non-surgical rejuvenation, continues to drive innovation. In Canada, medical spas are increasingly blending holistic wellness and clinical dermatology models, integrating mindfulness, nutrition, and anti-aging regimens to capture a broader health-focused clientele.

Europe

Europe holds around 25–30% of the global market, led by the U.K., Germany, France, and Italy. The region’s growth is shaped by stringent regulatory oversight, high clinical standards, and the presence of well-established medical tourism corridors, particularly in Eastern Europe, offering cost-effective, physician-supervised aesthetic care. Demand is heavily driven by an aging population seeking anti-aging and rejuvenation solutions, as well as by the region’s rising focus on “clean beauty” and sustainable formulations.

European consumers increasingly prioritize evidence-based and personalized procedures supported by diagnostic imaging, molecular skincare, and AI-assisted consultation platforms. This data-driven approach, combined with a growing emphasis on ethical sourcing and organic ingredients, underpins Europe’s reputation as a benchmark for safe, sustainable, and results-oriented aesthetic services.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the global medical spa market, accounting for roughly 20–25% share and projected to expand at a CAGR exceeding 17% through 2030. This acceleration is fueled by rising disposable incomes, rapid urbanization, and a younger, appearance-conscious demographic that values aesthetic enhancement as part of personal and professional identity. China, South Korea, Japan, and India are leading regional hubs, supported by an expanding network of urban clinics, high social media influence, and strong domestic demand for skin whitening, body contouring, and anti-aging treatments.

Moreover, the cultural emphasis on appearance and self-care, combined with government initiatives promoting medical tourism in Thailand, Singapore, and Malaysia, is positioning the Asia-Pacific as a global powerhouse for cross-border wellness and aesthetic services. Local innovation in skincare, biotechnology, and device miniaturization is also improving accessibility and affordability, extending market reach into tier-2 cities.

Latin America

Latin America contributes 7–9% of the global medical spa market, with Brazil and Mexico at the forefront. The region’s long-standing cosmetic surgery heritage is transitioning toward non-invasive, medical spa-based procedures, creating a robust hybrid ecosystem of clinical aesthetics and beauty wellness. High cultural acceptance of cosmetic enhancement, combined with competitive pricing and increasing practitioner expertise, underpins sustained demand across both domestic and inbound medical tourism channels.

Growth is further supported by a rising middle class and a strong social emphasis on body image. Brazil’s leadership in aesthetic innovation, Mexico’s thriving medical tourism sector, and cross-border patient flows from North America are reinforcing Latin America’s position as a cost-competitive yet high-quality market for aesthetic and wellness services.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for 5–6% of global revenue but demonstrates outsized growth potential, particularly across the Gulf Cooperation Council (GCC) countries. High disposable incomes, luxury lifestyle preferences, and the emergence of wellness-driven tourism in destinations such as the UAE, Saudi Arabia, and Qatar are propelling investment in world-class medical spa infrastructure. Premium service offerings, including advanced anti-aging therapies, regenerative skincare, and integrated wellness experiences, are rapidly gaining traction among affluent consumers.

Government-backed healthcare diversification initiatives and expanding private healthcare investment are also fostering regional growth. However, market expansion remains uneven due to regulatory variability across African markets. South Africa leads the sub-regional landscape with a mature base of dermatology-linked spas and a growing emphasis on inclusive skincare tailored to diverse skin types. Overall, concentrated high-spend consumer clusters and strong tourism synergies continue to position MEA as one of the most lucrative emerging frontiers for luxury medspa expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Medical Spa Market

- Clinique La Prairie

- Lanserhof

- Kurotel Longevity Medical Center and Spa

- SHA Wellness Clinic

- Chic La Vie Med Spa

- The Orchard Wellness Resort

- Allure Medspa

- Biovital Medspa LLC

- Longevity Wellness Worldwide

- Serenity Medspa

- Cocoona Centre of Aesthetic Transformation

- Lily’s Medical Spa

- Lanserhof Group

- VIVAMAYR Health Resort

- Clinique La Prairie Aesthetics Global

Recent Developments

- In June 2025, Lanserhof announced a new medical wellness center in Dubai focusing on longevity medicine, AI-based diagnostics, and integrative aesthetic services.

- In April 2025, SHA Wellness Clinic launched a sister property in Singapore, expanding its holistic anti-aging and wellness offerings into the Asia-Pacific.

- In February 2025, Clinique La Prairie introduced digital consultation tools powered by AI skin analysis to enhance personalized treatment planning across its European centers.