Mauritia Flexuosa Fruit Oil Market Size

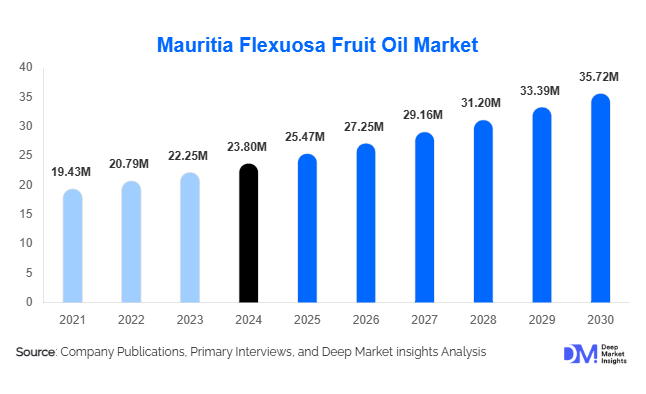

According to Deep Market Insights, the global Mauritia flexuosa fruit oil market size was valued at USD 23.80 million in 2024 and is projected to grow from USD 25.47 million in 2025 to reach USD 35.72 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for natural and plant-based cosmetic ingredients, increasing adoption of antioxidant-rich oils in nutraceutical formulations, and growing emphasis on sustainably sourced bio-based raw materials across global industries.

Key Market Insights

- Cosmetics and personal care applications dominate global demand, accounting for over half of total market revenue due to strong use in skincare, sun-care, and anti-aging formulations.

- Certified organic Mauritia flexuosa fruit oil is gaining rapid traction, supported by clean-label trends and regulatory preference for traceable botanical ingredients.

- Latin America remains the primary production hub, led by Brazil, while consumption growth is strongest in North America and Europe.

- Asia-Pacific is the fastest-growing consumption region, driven by expanding beauty, wellness, and functional food industries in China, Japan, and South Korea.

- Sustainability certifications and ethical sourcing are emerging as key competitive differentiators among suppliers.

- Advancements in cold-press extraction and refining technologies are improving the yield, consistency, and shelf life of Mauritia flexuosa fruit oil.

What are the latest trends in the Mauritia Flexuosa Fruit Oil market?

Rising Adoption in Premium and Clean Beauty Formulations

The global shift toward clean beauty and botanical-based personal care products has significantly increased demand for Mauritia flexuosa fruit oil. Its exceptionally high carotenoid and antioxidant content make it a preferred ingredient in premium skincare, sun protection, and anti-aging products. Cosmetic manufacturers are increasingly replacing synthetic antioxidants with natural oils such as Mauritia flexuosa to align with consumer preferences for transparency, safety, and sustainability. Luxury and dermocosmetic brands are particularly driving this trend, positioning the oil as a high-value functional ingredient rather than a commodity input.

Expansion into Nutraceutical and Functional Food Applications

Beyond cosmetics, Mauritia flexuosa fruit oil is witnessing growing interest in nutraceutical and functional food formulations. Its anti-inflammatory properties and lipid profile align well with preventive healthcare trends, particularly in North America and Europe. Supplement manufacturers are incorporating the oil into capsules, blends, and wellness products targeting immune health and oxidative stress reduction. Although food-grade adoption remains niche, regulatory advancements and improved refining standards are enabling gradual expansion into specialty food applications.

What are the key drivers in the Mauritia Flexuosa Fruit Oil market?

Growing Demand for Natural and Bio-Based Ingredients

One of the strongest growth drivers for the Mauritia flexuosa fruit oil market is the accelerating shift away from petrochemical-derived ingredients toward plant-based alternatives. Consumers across cosmetics, wellness, and food industries are prioritizing natural ingredients with proven functional benefits. This trend is reinforced by stricter regulations on synthetic additives and increasing transparency requirements from global brands.

Rising Focus on Sustainability and Ethical Sourcing

Global manufacturers are increasingly aligning procurement strategies with ESG objectives. Mauritia flexuosa fruit oil, when sourced responsibly from Amazonian regions, supports biodiversity conservation and community livelihoods. Ethical sourcing, fair-trade practices, and traceability initiatives are enhancing supplier credibility and driving long-term purchasing agreements with multinational buyers.

What are the restraints for the global market?

Raw Material Supply Volatility

The market faces supply-side challenges due to the seasonal nature of Mauritia flexuosa fruit harvesting and its dependence on ecologically sensitive regions. Climate variability, deforestation concerns, and limited plantation-scale cultivation can disrupt supply consistency and pricing stability.

Limited Large-Scale Processing Infrastructure

In several producing regions, extraction and refining remain largely artisanal. This results in inconsistent quality, lower yields, and challenges in meeting pharmaceutical- and food-grade standards, limiting broader industrial adoption.

What are the key opportunities in the Mauritia Flexuosa Fruit Oil industry?

Sustainable Supply Chain Development

There is a significant opportunity for investment in vertically integrated and certified sustainable supply chains. Companies that invest in long-term sourcing partnerships, traceability systems, and community-based harvesting models can secure a stable supply while commanding premium pricing in developed markets.

High-Growth Demand from Asia-Pacific

Asia-Pacific represents a major growth opportunity as beauty, wellness, and functional food consumption expand rapidly. Rising disposable incomes, strong demand for exotic botanical ingredients, and innovation in K-beauty and J-beauty formulations are accelerating regional adoption.

Product Type Insights

Cold-pressed Mauritia flexuosa fruit oil dominates the global market, accounting for approximately 48% of total market value in 2024. Its leadership is driven by superior nutrient retention and strong demand from clean beauty brands. Refined oil represents a significant share in pharmaceutical and food applications due to improved stability and standardization, while organic-certified variants are the fastest-growing sub-segment, supported by premium pricing and regulatory preference.

Application Insights

Cosmetics and personal care applications account for nearly 55% of global demand, with skincare products leading consumption. Pharmaceutical and nutraceutical applications represent around 18% of the market and are growing at a faster pace. Functional food and industrial applications remain smaller but are expanding steadily as regulatory clarity improves and formulation technologies advance.

Distribution Channel Insights

Direct B2B sales dominate the Mauritia flexuosa fruit oil market, accounting for approximately 46% of total distribution. Large cosmetic and nutraceutical manufacturers prefer direct sourcing to ensure quality consistency and cost efficiency. Specialty ingredient distributors play a critical role in Europe and North America, while online and private-label channels are gaining traction among smaller buyers.

End-Use Industry Insights

Beauty and personal care manufacturers represent the largest end-use segment, contributing about 51% of total market revenue. Pharmaceutical and nutraceutical companies are the fastest-growing end users, driven by rising preventive healthcare consumption. Aromatherapy, wellness, and specialty industrial users collectively account for less than 10% but provide long-term diversification potential.

| By Product Type | By Nature | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Latin America

Latin America accounts for approximately 38% of the global market in 2024, led by Brazil, Peru, and Colombia. Brazil alone contributes over 25% of global production due to abundant raw material availability and growing processing capacity.

North America

North America represents around 24% of global demand, with the United States being the largest importing country. Strong demand from clean beauty and nutraceutical brands supports steady growth.

Europe

Europe holds approximately 22% market share, led by France, Germany, and the United Kingdom. Regulatory support for bio-based ingredients and advanced cosmetic manufacturing capabilities drive consumption.

Asia-Pacific

Asia-Pacific accounts for about 12% of the market but is the fastest-growing region, with a CAGR exceeding 12%. China, Japan, and South Korea are key demand centers.

Middle East & Africa

The Middle East & Africa region contributes roughly 4% of global demand, driven by luxury personal care consumption in the UAE and Saudi Arabia.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mauritia Flexuosa Fruit Oil Market

- Beraca Ingredients

- Croda International

- OLVEA Group

- AAK AB

- BASF SE

- Symrise AG

- Givaudan Active Beauty

- Vantage Specialty Ingredients

- Ashland Global

- Clariant AG

- Evonik Industries

- Provital Group

- Natura &Co

- Hallstar

- DSM-Firmenich