Mattress in a Box Market Size

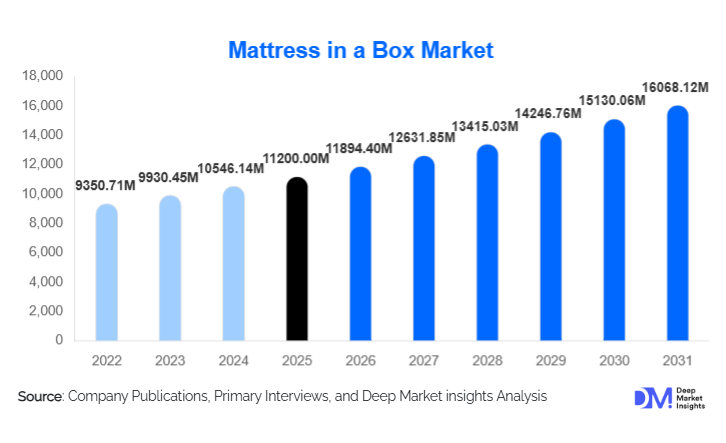

According to Deep Market Insights, the global mattress in a box market size was valued at USD 11,200.00 million in 2025 and is projected to grow from USD 11,894.40 million in 2026 to reach USD 16,068.12 million by 2031, expanding at a CAGR of 6.2% during the forecast period (2026–2031). The mattress-in-a-box market growth is primarily driven by increasing consumer preference for convenience and affordable sleep solutions, rising adoption of online direct-to-consumer (DTC) channels, and technological innovations in foam and hybrid mattress materials.

Key Market Insights

- Memory foam and hybrid mattresses dominate the market, offering superior comfort and spinal support, which are highly sought after in residential and hospitality sectors.

- Online direct-to-consumer sales channels are rapidly expanding, providing easy access, competitive pricing, and home delivery solutions that appeal to urban consumers globally.

- North America leads the global market, driven by high disposable income, e-commerce penetration, and increasing focus on sleep wellness.

- Asia-Pacific is the fastest-growing region, supported by rising urbanization, expanding middle-class populations, and growing awareness of premium sleep solutions in countries like India and China.

- Sustainability trends are influencing product development, with eco-friendly and organic mattresses gaining traction among environmentally conscious consumers.

- Technological integration, including smart mattresses, gel-infused foams, and temperature regulation features, is reshaping consumer expectations and driving premium product adoption.

What are the latest trends in the mattress-in-a-box market?

Rise of Direct-to-Consumer E-Commerce Models

The mattress-in-a-box industry has witnessed a paradigm shift toward online sales and DTC models, allowing consumers to order mattresses conveniently with home delivery and easy returns. Companies are increasingly using digital marketing, subscription services, and online customization options to enhance consumer engagement. This model reduces dependency on brick-and-mortar retail while increasing access to mid-range and premium mattresses globally. Emerging markets in APAC and LATAM are adopting these models rapidly due to growing internet penetration and smartphone usage.

Innovation in Sleep Technology

Smart sleep solutions, including adjustable firmness, memory foam with gel infusion, and AI-enabled sleep monitoring, are shaping the mattress-in-a-box market. Premium consumers are willing to pay higher prices for mattresses that integrate ergonomic support, temperature regulation, and sleep tracking. These innovations help manufacturers differentiate products, drive brand loyalty, and target the health-conscious segment of the population. Additionally, the incorporation of eco-friendly materials aligns with consumer preferences for sustainability.

What are the key drivers in the mattress-in-a-box market?

Urbanization and Smaller Living Spaces

Rapid urbanization and the rise of compact apartments have increased demand for space-efficient mattresses that are easy to transport and install. Mattress-in-a-box products are ideal for urban households, dormitories, and co-living spaces due to their compact packaging and convenience. The trend is particularly strong in Asia-Pacific and LATAM, where high population density and limited living space drive adoption.

Rising Awareness of Sleep Health

Consumers worldwide are becoming increasingly aware of the health impacts of poor sleep. Ergonomic and memory foam mattresses are in high demand for their ability to reduce pressure points, improve spinal alignment, and enhance overall sleep quality. This awareness is driving both residential and hospitality sector demand, especially in regions with growing disposable incomes such as North America and Europe.

Expansion of E-Commerce and DTC Channels

The growth of online marketplaces and brand-owned websites has revolutionized mattress sales. Direct-to-consumer channels reduce costs, provide flexible delivery options, and allow brands to build a direct relationship with customers. These channels are driving rapid adoption in both developed and emerging markets, especially among tech-savvy consumers.

What are the restraints for the global market?

Fluctuating Raw Material Costs

Variations in foam, latex, and packaging material prices can impact production costs and squeeze profit margins. Manufacturers must implement efficient sourcing and cost-control measures to maintain competitive pricing while ensuring high-quality products.

Logistics and Returns Management

While mattress delivery is convenient for consumers, shipping, handling, and returns can create operational challenges for manufacturers. Large-scale returns can increase costs and reduce overall profitability, particularly for companies expanding into new international markets.

What are the key opportunities in the mattress-in-a-box industry?

Emerging Market Expansion

Rapid urbanization, growing disposable incomes, and e-commerce penetration in APAC (India, China, Southeast Asia) and LATAM (Brazil, Mexico) offer significant growth opportunities. Companies can target residential housing, co-living, and hospitality sectors, where compact, conveniently delivered mattresses are increasingly in demand.

Integration of Smart Sleep Technology

Innovations such as adjustable firmness, temperature regulation, and AI-enabled sleep tracking offer differentiation in the premium segment. Smart mattresses attract health-conscious and tech-savvy consumers, allowing companies to command higher margins and improve brand loyalty.

Sustainability and Eco-Friendly Products

Growing consumer preference for environmentally responsible products encourages manufacturers to adopt organic, recyclable, and natural materials. Government incentives for green manufacturing and increasing awareness about carbon footprints create a favorable environment for sustainable mattress production.

Product Type Insights

Memory foam mattresses dominate the global mattress-in-a-box market, accounting for 42% of the total market share in 2024. This leadership is primarily driven by their superior pressure relief, body-contouring properties, and ability to support spinal alignment, making them highly suitable for long-duration residential use as well as hospitality environments where guest comfort is a key differentiator. Memory foam mattresses are also well-suited to compression and roll-pack packaging, which significantly reduces logistics and shipping costs, further reinforcing their dominance in the mattress-in-a-box format.

Hybrid mattresses, which combine memory foam or latex layers with innerspring coils, are emerging as a fast-growing sub-segment due to their ability to balance comfort and structural support. These products are increasingly preferred by consumers seeking the responsiveness of traditional mattresses with the pressure relief of foam-based designs, particularly in North America and Europe. Additionally, advancements in lightweight coil technology have made hybrids more compatible with boxed delivery models, supporting their expanding adoption.

Application Insights

Residential applications remain the primary demand driver for the mattress-in-a-box market, accounting for approximately 60% of global demand in 2024. Growth in this segment is fueled by increasing urbanization, rising homeownership among younger demographics, and greater awareness of sleep health and ergonomic bedding solutions. Consumers increasingly favor mattress-in-a-box products for their convenience, easy installation, and competitive pricing, particularly in urban apartments and co-living spaces.

Healthcare facilities and student housing are emerging application areas, leveraging the portability, hygienic packaging, and ergonomic benefits of mattress-in-a-box products. Hospitals, nursing homes, and rehabilitation centers increasingly use foam-based mattresses for patient comfort and pressure management, while universities and private student housing providers prefer boxed mattresses for ease of bulk procurement and installation. Export-driven demand from North America to Europe and Asia-Pacific further supports global market expansion, particularly in residential and institutional segments.

Distribution Channel Insights

Online direct-to-consumer (DTC) channels dominate the mattress-in-a-box market, accounting for approximately 55% of global sales in 2024. The leadership of this channel is driven by consumer preference for convenience, transparent pricing, extensive product information, and home delivery with trial periods and flexible return policies. Digital-native mattress brands have successfully leveraged social media marketing, influencer partnerships, and data-driven personalization to accelerate online adoption.

Offline retail channels continue to play a significant role, particularly in the premium and mid-range segments, where consumers prefer to physically test mattresses before purchase. Specialty mattress stores and furniture retailers act as experience centers, complementing online sales rather than competing directly with them. Omni-channel strategies are increasingly being adopted by leading manufacturers, integrating online ordering with physical showrooms, click-and-collect models, and in-store returns. This hybrid approach enhances customer trust, improves brand visibility, and supports higher conversion rates, especially in mature markets such as North America and Europe.

| By Product Type | By Application | By Distribution Channel | By Price Range |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market for mattress-in-a-box products, holding approximately 38% of the global market share in 2024. Growth in this region is driven by high disposable incomes, advanced e-commerce infrastructure, and strong consumer awareness of sleep health and wellness. The U.S. dominates regional demand due to the presence of major direct-to-consumer mattress brands, widespread adoption of online shopping, and high replacement rates for mattresses. Additionally, strong demand from the hospitality and short-term rental sectors supports sustained growth across both residential and commercial applications.

Europe

Europe accounts for approximately 28% of the global mattress-in-a-box market in 2024, with Germany, the U.K., and France leading regional demand. Growth in Europe is supported by increasing preference for eco-friendly and sustainably manufactured mattresses, strict product quality standards, and rising awareness of ergonomic sleep solutions. European consumers show a strong inclination toward premium and hybrid mattresses, while government emphasis on sustainable manufacturing and circular economy practices further drives innovation and adoption across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of approximately 12% during the forecast period. Growth is driven by rapid urbanization, expanding middle-class populations, and accelerating e-commerce penetration across major economies such as China, India, Japan, and Southeast Asia. Increasing demand for mid-range mattresses in urban households, co-living spaces, and student accommodations is a key growth driver. Additionally, rising awareness of sleep health and the entry of global mattress brands into local markets through localized manufacturing and pricing strategies are strengthening regional demand.

Latin America

Latin America is experiencing moderate but steady growth, led by Brazil and Mexico, with a regional CAGR of approximately 10%. Urbanization, rising middle-income households, and improving digital commerce infrastructure are driving demand for affordable and easy-to-deliver mattress solutions. Consumers in this region are increasingly shifting from traditional mattress retail toward online purchasing models, supported by competitive pricing and flexible financing options offered by manufacturers.

Middle East & Africa

The Middle East & Africa region represents a smaller but steadily expanding market, growing at a CAGR of approximately 8%. Growth is primarily supported by hospitality sector expansion, luxury residential developments, and increasing tourism activity in countries such as the UAE, Saudi Arabia, and South Africa. Rising disposable incomes, premium housing projects, and investments in hotel infrastructure are key drivers of mattress-in-a-box adoption in this region, particularly for mid-range and premium mattress categories.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mattress in a Box Market

- Tempur-Pedic

- Casper Sleep

- Purple Innovation

- Saatva

- Nectar Sleep

- Leesa

- Tuft & Needle

- Emma

- IKEA (Global Mattress Division)

- DreamCloud

- Puffy

- Simba Sleep

- Avocado Green Mattress

- Koala Sleep

- Dormeo