Mammography Biopsy Chair Market Size

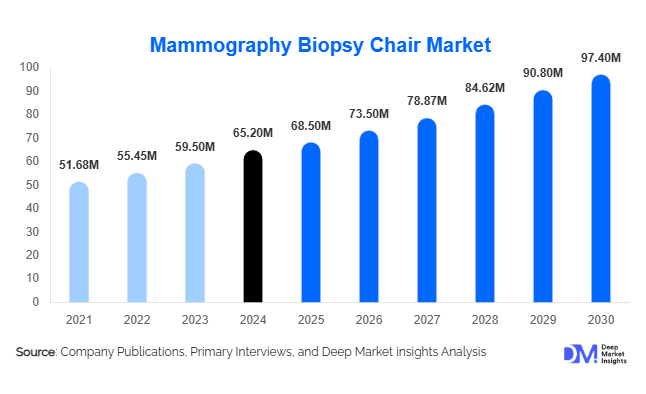

According to Deep Market Insights, the global mammography biopsy chair market size was valued at USD 65.2 million in 2024 and is projected to grow from USD 68.5 million in 2025 to reach USD 97.4 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The market growth is driven by the rising prevalence of breast cancer worldwide, increasing demand for advanced diagnostic infrastructure, and the growing adoption of ergonomic, patient-friendly biopsy systems across hospitals and imaging centers.

Key Market Insights

- Rising global breast cancer incidence is accelerating the adoption of mammography biopsy chairs for enhanced procedural accuracy and patient comfort.

- Integration of motorized and height-adjustable biopsy chairs improves workflow efficiency, supporting precise positioning during image-guided breast biopsies.

- Hospitals dominate market demand, driven by their focus on integrated diagnostic suites and comprehensive oncology departments.

- North America leads the global market due to strong healthcare infrastructure, high screening rates, and early adoption of advanced imaging systems.

- Asia-Pacific is the fastest-growing region, supported by expanding healthcare expenditure and increasing breast cancer awareness programs.

- Technological innovation, including modular designs and compatibility with digital mammography systems, is reshaping equipment ergonomics and patient experience.

Latest Market Trends

Integration of Smart and Motorized Features

Manufacturers are increasingly integrating automation and electronic controls into biopsy chairs to enhance procedural precision. Features such as motorized height adjustment, programmable positioning, and remote-control interfaces allow clinicians to optimize workflow and patient alignment during biopsies. These innovations improve safety, reduce operator fatigue, and ensure consistent image quality. Advanced models are now incorporating memory presets for repeatable positioning and touchless control mechanisms that enhance hygiene in clinical settings.

Shift Toward Patient-Centric Design

Modern mammography biopsy chairs are being designed with patient comfort and psychological well-being in mind. Padded armrests, modular head supports, and adjustable backrests help minimize anxiety and discomfort during long or invasive procedures. This trend aligns with the growing emphasis on patient-centered healthcare delivery, particularly in women’s imaging. Furthermore, lightweight, mobile chairs are enabling flexible installation in smaller diagnostic centers, expanding access to biopsy capabilities beyond tertiary hospitals.

Mammography Biopsy Chair Market Drivers

Increasing Breast Cancer Screening and Diagnostic Rates

The global rise in breast cancer incidence and the expansion of national screening programs are key growth drivers. Early diagnosis initiatives supported by government health agencies have boosted the number of mammography and biopsy procedures performed annually. The availability of specialized biopsy chairs designed for guided imaging workflows ensures that these diagnostic procedures are carried out efficiently and with improved patient outcomes.

Technological Advancements in Imaging and Biopsy Systems

Integration with 3D mammography, ultrasound-guided, and stereotactic biopsy systems has driven the need for compatible and ergonomically optimized biopsy chairs. Advanced chairs provide enhanced positioning accuracy, supporting minimally invasive biopsy techniques. The increasing deployment of hybrid breast imaging centers combining mammography, MRI, and biopsy capabilities further contributes to market expansion.

Market Restraints

High Cost of Advanced Equipment

Premium biopsy chairs with motorized and smart positioning features entail high upfront and maintenance costs, limiting adoption among smaller diagnostic centers. In developing countries, constrained healthcare budgets and limited reimbursement structures remain major barriers to market penetration. Additionally, the integration of biopsy chairs with imaging systems often requires specialized infrastructure, adding to installation complexity and cost.

Limited Skilled Workforce

The shortage of trained radiologists and biopsy technologists capable of operating advanced mammography systems restricts utilization rates in several regions. Training programs are still unevenly distributed, particularly in low- and middle-income countries, hindering widespread deployment of advanced biopsy chair systems.

Mammography Biopsy Chair Market Opportunities

Expansion in Emerging Markets

Rapid healthcare modernization across Asia-Pacific, Latin America, and the Middle East presents significant opportunities for manufacturers. Growing government investment in diagnostic imaging infrastructure and breast cancer screening programs is driving demand for biopsy-compatible equipment. Affordable, portable, and easy-to-operate chair designs are expected to gain strong traction in these regions.

Rising Adoption of Ambulatory and Outpatient Diagnostic Centers

The global shift toward outpatient imaging and ambulatory diagnostic centers is creating new sales opportunities. Compact, mobile biopsy chairs that integrate seamlessly with digital imaging systems are being increasingly adopted to optimize space and enhance patient throughput. This trend is particularly strong in urban areas where demand for quick, efficient breast diagnostics is growing rapidly.

Product Type Insights

The market is segmented into manual biopsy chairs and motorized biopsy chairs. Motorized chairs dominate due to their superior precision, ease of positioning, and integration capabilities with imaging systems. Manual chairs continue to serve smaller clinics and budget-constrained settings, offering cost-effective solutions without compromising core functionality. The ongoing trend toward digital healthcare transformation is expected to further accelerate the shift toward motorized and programmable chair systems.

Application Insights

Hospitals and diagnostic imaging centers represent the leading end-user segments. Hospitals benefit from high patient volumes and integrated oncology care pathways. Diagnostic centers are increasingly adopting advanced chairs to complement their imaging suites, enhancing efficiency and procedural throughput. Research institutions and specialty breast clinics form an emerging segment, driven by clinical trials and advanced biopsy procedures in academic settings.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market, supported by strong infrastructure, high awareness levels, and established reimbursement frameworks. The U.S. dominates regional demand due to widespread screening initiatives, advanced healthcare facilities, and the presence of key market players.

Europe

Europe holds a substantial share owing to well-developed healthcare systems and government-backed breast cancer detection programs. Countries such as Germany, the U.K., and France are leading adopters of advanced mammography biopsy technologies. EU initiatives promoting women’s health and early detection continue to fuel market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with rising healthcare investments, urbanization, and awareness campaigns encouraging early breast cancer screening. China, India, Japan, and South Korea are emerging as major markets, supported by the expansion of diagnostic imaging centers and increasing private healthcare spending.

Latin America

Latin America is experiencing gradual growth, driven by the modernization of healthcare infrastructure in Brazil, Mexico, and Argentina. Local governments and NGOs are promoting awareness and facilitating access to diagnostic imaging technologies, creating new opportunities for manufacturers.

Middle East & Africa

The Middle East and Africa are witnessing steady adoption due to improved healthcare infrastructure and investments in diagnostic capabilities. GCC countries, particularly Saudi Arabia and the UAE, are key contributors to regional market growth. Efforts to improve women’s healthcare access are boosting biopsy equipment installations across private and public hospitals.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mammography Biopsy Chair Market

- RQL Ultrasound

- Planmed Oy

- Promotal SAS

- AGA Sanitätsartikel GmbH

- BRUMABA GmbH & Co. KG

- Oakworks Medical

- STERIS Healthcare

- LEMI Group

Recent Developments

- In May 2025, Promotal launched a new ergonomic biopsy chair series featuring motorized lateral tilt and integrated foot control to improve clinician accessibility and patient positioning during mammography-guided biopsies.

- In March 2025, Planmed introduced a compact, height-adjustable biopsy chair compatible with its Planmed Clarity 3D mammography system, targeting small imaging centers and mobile screening units.

- In January 2025, Oakworks Medical announced the expansion of its global distribution network to the Asia-Pacific region to meet rising demand for affordable, high-performance biopsy and imaging chairs.