Male Toiletries Market Size

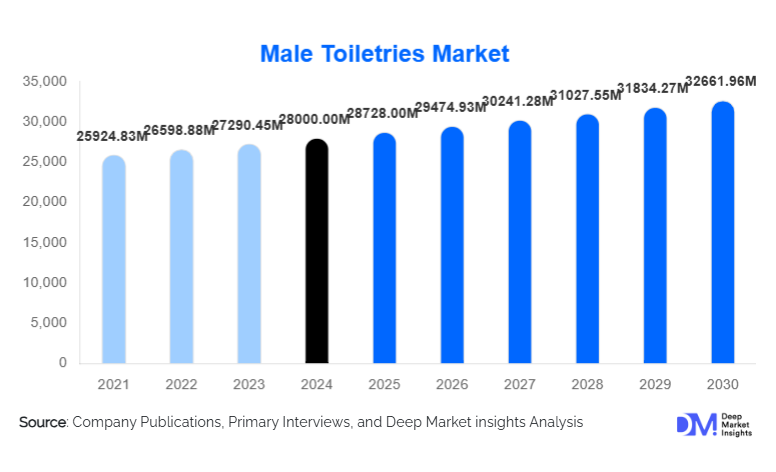

According to Deep Market Insights, the global male toiletries market size was valued at USD 28,000.00 million in 2024 and is projected to grow from USD 28,728.00 million in 2025 to reach USD 32,661.96 million by 2030, expanding at a CAGR of 2.6% during the forecast period (2025–2030). Market growth is primarily driven by rising male grooming consciousness, premiumization of products such as fragrances and skincare, and the rapid expansion of online retail channels offering personalized and high-quality grooming solutions.

Key Market Insights

- Male grooming is shifting toward advanced skincare and clean-label formulations, as consumers increasingly seek natural, organic, and dermatologically tested products.

- Fragrances remain the largest and most resilient product category, driven by strong global brand penetration and high repeat-purchase behavior.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, urbanization, and shifting cultural attitudes toward male grooming.

- North America leads in premium and luxury male toiletries, particularly in skincare, beard care, and high-end fragrances.

- E-commerce and D2C platforms are reshaping buying behavior, enabling subscription models, AI-driven product recommendations, and influencer-led brand discovery.

- Technological integration, including smart trimmers, personalized grooming apps, and AI-based skin diagnostics, is driving innovation and helping brands differentiate in a competitive landscape.

What are the latest trends in the male toiletries market?

Surge in Natural, Organic, and Clean-Label Grooming Products

Global consumer preference is rapidly shifting toward clean grooming solutions free from parabens, sulfates, microplastics, and synthetic fragrances. Brands are increasingly adopting botanical extracts, essential oils, and vegan formulations, particularly in skincare and beard care categories. Regulatory momentum supporting sustainability, especially in Europe, has accelerated innovation in biodegradable packaging, plant-based preservatives, and ethical sourcing frameworks. This trend is also fueled by younger male consumers who prioritize ingredient transparency and eco-friendly values. As more brands incorporate certifications and highlight cruelty-free attributes, natural and organic male toiletries are expected to command a steadily rising share of the premium and mid-range segments.

Technology-Driven Personalization and Smart Grooming Devices

Technological adoption is reshaping how men discover and use toiletries. AI-powered skin assessments, virtual try-on tools for beard styles, and data-driven grooming recommendations enhance both product discovery and user experience. Smart grooming devices, such as precision trimmers with sensors, heat-controlled shavers, and beard-mapping tools, are gaining momentum in high-income markets. Moreover, grooming apps offering personalized regimens, automated replenishment reminders, and subscription-based kits are strengthening brand loyalty. Online platforms integrating sustainability ratings, skin-type analysis, and community reviews are strongly appealing to tech-savvy consumers seeking high-efficacy solutions.

What are the key drivers in the male toiletries market?

Growing Awareness of Male Grooming and Skincare

Male consumers worldwide are increasingly adopting structured grooming routines, influenced by social media, celebrity endorsements, workplace aesthetics, and heightened awareness of skincare health. Anti-aging creams, moisturizers, sunscreens, and beard-care regimens are rapidly transitioning into daily-use essentials, particularly among men aged 18–35. This shift toward personal grooming as a lifestyle aligns with broader wellness and self-care trends.

Premiumization and Demand for High-Performance Products

Premium toiletries featuring advanced active ingredients such as hyaluronic acid, niacinamide, retinol, charcoal, and natural oils are gaining significant traction. Men are increasingly willing to invest in high-quality grooming solutions that offer visible results, long-lasting fragrances, and enhanced sensory experiences. Luxury grooming kits, designer fragrances, and salon-grade skincare are expanding rapidly in mature markets such as the U.S., the U.K., Japan, and South Korea.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Despite rising grooming awareness, many consumers in Latin America, Africa, and parts of Asia remain highly price-sensitive. Premium brands struggle to achieve deep penetration due to lower purchasing power and preference for mass-market or economy-range toiletries. This limits revenue growth potential in fast-growing but cost-conscious regions.

Fragmented Competitive Landscape

The presence of thousands of regional grooming brands creates market overcrowding, leading to heavy promotional spending and price pressures. This fragmentation challenges new entrants seeking differentiation and forces established brands to continuously innovate while maintaining competitive pricing.

What are the key opportunities in the male toiletries industry?

Expansion into Emerging High-Growth Markets

Countries such as India, Indonesia, Vietnam, Saudi Arabia, and the UAE offer substantial untapped potential due to young demographics, rapid urbanization, and evolving grooming norms. Tailored marketing strategies, region-specific formulations, and strategic partnerships with local retailers can help brands accelerate market penetration.

Personalized Grooming Ecosystems and Subscription Models

The demand for personalized grooming regimens is rising sharply. Brands offering subscription-based grooming kits, data-driven product suggestions, and customized formulation options can unlock higher customer lifetime value. Smart grooming devices also present opportunities for building integrated digital ecosystems around male grooming habits.

Product Type Insights

Fragrances dominate the male toiletries market, accounting for nearly 28% of global market share in 2024. Their universal appeal, strong brand loyalty, and high repeat purchase rates continue to drive category leadership. Deodorants, EDTs, and EDPs remain staple products across age groups and regions. Meanwhile, skincare is the fastest-growing category as men increasingly adopt multi-step skincare routines involving cleansers, serums, and moisturizers.

Application Insights

Household and personal grooming account for the majority of product usage, representing over 82% of total demand. Grooming studios and salons are emerging as a high-growth application segment, particularly in APAC and North America. Hotels, gyms, and wellness centers are adopting branded toiletries to enhance user experience, contributing to rising demand for premium and travel-sized grooming products. The integration of men’s grooming products into hospitality amenities is expected to expand over the next decade.

Distribution Channel Insights

Supermarkets and hypermarkets dominate distribution with a 34% global share, offering consumers convenience, promotions, and brand familiarity. However, online retail is the fastest-growing channel, propelled by D2C brands, personalized shopping experiences, subscription models, and influencer-driven marketing. Specialty grooming stores and pharmacies continue to gain traction for premium and dermatologist-recommended products.

End-User Type Insights

Personal-use consumers drive the bulk of market demand as grooming becomes ingrained in everyday routines. Salons and professional grooming centers are witnessing rising adoption of premium shaving products and skincare treatments. The hospitality sector contributes through increased brand partnerships for travel kits and luxury hotel toiletries.

Age Group Insights

Men aged 18–35 are the most influential demographic, driving growth in skincare, beard care, and hairstyling products due to high grooming engagement and social media influence. The 36–50 age group contributes significantly to premium product sales, especially anti-aging and fragrance categories. Older consumers (50+) prefer high-performance, dermatologist-tested products and often exhibit strong loyalty to established brands.

| By Product Type | By Price Range | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 28% of the global market share, with demand driven by premium grooming products, sophisticated e-commerce penetration, and strong adoption of specialty skincare. The U.S. remains the largest market, followed by Canada, where clean-label grooming products are gaining popularity.

Europe

Europe accounts for 25% of the male toiletries market, supported by a mature grooming culture and strong consumer inclination toward natural and organic formulations. Germany, the U.K., and France lead demand, with Scandinavia exhibiting high adoption of eco-friendly and vegan grooming options.

Asia-Pacific

APAC is the fastest-growing region, expanding at 8.2% CAGR. China and India dominate growth due to rising middle-class affluence, increasing male grooming awareness, and rapid online retail expansion. Japan and South Korea continue to lead in innovative male skincare solutions.

Latin America

Brazil and Mexico drive regional demand, with high usage of fragrances, deodorants, and hair styling products. Cultural emphasis on appearance and expanding youth populations contribute to market growth despite economic volatility.

Middle East & Africa

MEA shows strong demand for premium fragrances and shaving products. Saudi Arabia and the UAE lead consumption, supported by high-income populations and strong retail infrastructure. Africa is gradually adopting grooming routines, with rising interest in deodorants and mass-market skincare.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Male Toiletries Market

- Procter & Gamble

- Unilever

- L’Oréal

- Beiersdorf

- Edgewell Personal Care

- Colgate-Palmolive

- Natura & Co.

- Kao Corporation

- Henkel

- Shiseido

- Church & Dwight

- Coty Inc.

- Revlon

- Godrej Consumer Products

- Amorepacific

Recent Developments

- In May 2024, L’Oréal announced the expansion of its men’s skincare R&D center in Japan, aiming to accelerate innovation in anti-aging and dermatological grooming solutions.

- In April 2024, Unilever launched a new line of natural and vegan male grooming products under its flagship Dove Men+Care brand.

- In February 2024, Procter & Gamble introduced AI-powered skin analysis tools integrated into its online grooming platform to deliver personalized male skincare regimens.