Male Aesthetics Market Size

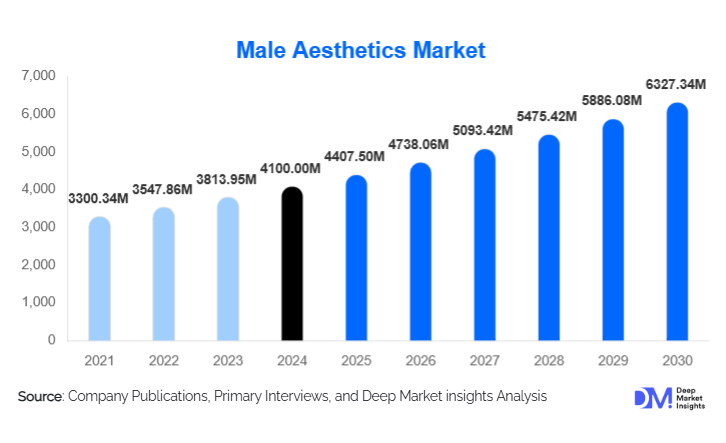

According to Deep Market Insights, the global male aesthetics market size was valued at USD 4,100.00 million in 2024 and is projected to grow from USD 4,407.50 million in 2025 to reach USD 6,327.54 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The male aesthetics market growth is primarily driven by increasing social acceptance of cosmetic procedures among men, rising disposable incomes, advancements in minimally invasive aesthetic technologies, and growing demand for facial rejuvenation, hair restoration, and body contouring treatments.

Key Market Insights

- Minimally invasive procedures dominate the market, supported by strong demand for injectables such as botulinum toxin and dermal fillers among men aged 30–50.

- Hair restoration and facial aesthetics remain the most sought-after indications, reflecting rising concerns over aging, hair loss, and professional appearance.

- North America leads the global market, driven by high procedure awareness, advanced clinical infrastructure, and premium pricing models.

- Asia-Pacific is the fastest-growing region, supported by medical tourism, expanding middle-class populations, and cultural shifts toward male grooming.

- Medical spas are emerging as high-growth service providers, offering bundled, affordable, and discreet aesthetic treatments.

- Technological innovation, including AI-based facial mapping, advanced laser platforms, and regenerative therapies, is reshaping treatment personalization and outcomes.

What are the latest trends in the male aesthetics market?

Rapid Adoption of Minimally Invasive and Non-Invasive Treatments

Men increasingly prefer aesthetic procedures that offer natural-looking results with minimal downtime. Injectable treatments, laser-based skin rejuvenation, and non-surgical body contouring are gaining traction due to convenience and repeat usability. These procedures align well with busy professional lifestyles and are often marketed as maintenance solutions rather than cosmetic alterations, further increasing acceptance among male consumers.

Male-Specific Product Innovation and Branding

The market is witnessing a shift toward male-specific injectables, skincare formulations, and energy-based devices designed for thicker skin, stronger facial musculature, and hair-bearing areas. Companies are investing in gender-focused branding, discreet clinical environments, and outcome-driven messaging that emphasizes confidence, performance, and aging well rather than cosmetic enhancement.

What are the key drivers in the male aesthetics market?

Changing Social Perceptions and Lifestyle Aspirations

Modern masculinity increasingly embraces self-care and appearance enhancement. Social media exposure, professional competitiveness, and longer working lives are encouraging men to invest in facial aesthetics, hair restoration, and body sculpting. This cultural shift has significantly expanded the addressable male consumer base across age groups.

Technological Advancements in Aesthetic Medicine

Innovations in injectables, laser platforms, and regenerative medicine, such as PRP therapy, have improved safety, precision, and outcomes. These advancements reduce treatment risks and downtime, enabling wider adoption and repeat procedures, thereby driving recurring revenues for clinics and device manufacturers.

What are the restraints for the global market?

High Cost of Procedures and Limited Insurance Coverage

Most male aesthetic procedures are elective and not covered by insurance, making affordability a key barrier in price-sensitive regions. Premium devices and branded injectables further increase treatment costs, limiting penetration beyond urban and high-income demographics.

Regulatory and Safety Challenges

Stringent regulatory requirements for injectables and devices can delay product launches and increase compliance costs. Inconsistent practitioner standards and unregulated clinics in certain regions also pose safety concerns, potentially impacting consumer trust.

What are the key opportunities in the male aesthetics industry?

Medical Tourism and Emerging Market Expansion

Countries such as South Korea, Turkey, India, Thailand, Brazil, and Mexico are becoming global hubs for male aesthetic procedures, particularly hair transplantation and body contouring. Competitive pricing, skilled practitioners, and supportive government policies make these regions attractive for both patients and market entrants.

AI-Driven Personalization and Digital Engagement

The integration of AI, 3D facial analysis, and predictive modeling enables highly personalized treatment planning and outcome simulation. Companies leveraging digital diagnostics, tele-consultations, and smart aesthetic devices can enhance patient satisfaction and command premium pricing.

Product Type Insights

Injectables account for the largest share of the male aesthetics market, contributing approximately 38% of total revenue in 2024, driven by high repeat usage and relatively lower treatment costs. Energy-based aesthetic devices represent around 27% of the market, supported by growing demand for laser hair removal, skin tightening, and body contouring. Surgical aesthetic equipment holds nearly 20% share, led by hair transplantation systems and gynecomastia surgery tools. Male-specific cosmeceuticals and medical-grade skincare products account for about 15%, driven by daily maintenance regimens and post-procedure care.

Application Insights

Facial aesthetics dominate application demand, accounting for nearly 40% of market revenue, as men seek solutions for wrinkles, jawline definition, and skin texture improvement. Hair restoration and removal applications contribute around 28%, supported by the rising prevalence of male pattern baldness. Body contouring and fat reduction represent approximately 20%, while skin rejuvenation and anti-aging therapies account for the remaining share, reflecting increasing preventive aesthetics adoption among younger men.

Service Provider Insights

Dermatology clinics lead the market with nearly 45% share due to specialization in injectables and skin treatments. Medical spas are the fastest-growing service providers, expanding at over 13% CAGR, driven by affordability, bundled offerings, and convenience. Hospitals and surgical centers dominate complex procedures such as hair transplantation and gynecomastia surgery, particularly in medical tourism-driven markets.

Age Group Insights

Men aged 31–45 years represent the largest consumer segment, driven by high disposable income and a strong focus on professional appearance. The 46–60 age group contributes significantly to anti-aging and hair restoration demand. The 18–30 segment is growing rapidly, driven by laser hair removal, acne treatments, and preventive skincare. Men above 60 years represent a smaller but premium segment, favoring surgical and corrective procedures.

| By Procedure Type | By Product Category | By Indication | By Age Group | By Service Provider |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of the global male aesthetics market in 2024. The United States dominates regional demand, driven by high awareness, premium pricing, and widespread adoption of minimally invasive procedures. Strong presence of leading aesthetic brands and advanced clinical infrastructure supports sustained growth.

Europe

Europe holds nearly 26% market share, led by Germany, the U.K., France, and Italy. Demand is supported by aging male populations, growing acceptance of cosmetic treatments, and strong regulatory standards that enhance consumer confidence.

Asia-Pacific

Asia-Pacific accounts for around 22% of global revenue and is the fastest-growing region, with a CAGR exceeding 14%. South Korea, China, India, and Japan lead demand, driven by medical tourism, expanding middle-class income, and strong cultural emphasis on grooming.

Latin America

Latin America contributes approximately 9% of the market, with Brazil and Mexico as key demand centers. Growth is driven by aesthetic tourism, cost-competitive procedures, and rising domestic awareness.

Middle East & Africa

The region accounts for about 7% of global demand, led by Turkey and the UAE. High-income populations, growing medical tourism, and expanding private clinic infrastructure support market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Male Aesthetics Market

- AbbVie (Allergan Aesthetics)

- Galderma

- Merz Pharma

- Lumenis

- Cynosure

- Cutera

- Solta Medical

- Alma Lasers

- Revance Therapeutics

- Evolus

- Bausch Health

- Sinclair Pharma

- Candela Medical

- Fotona

- Hugel