Major Appliances Market Size

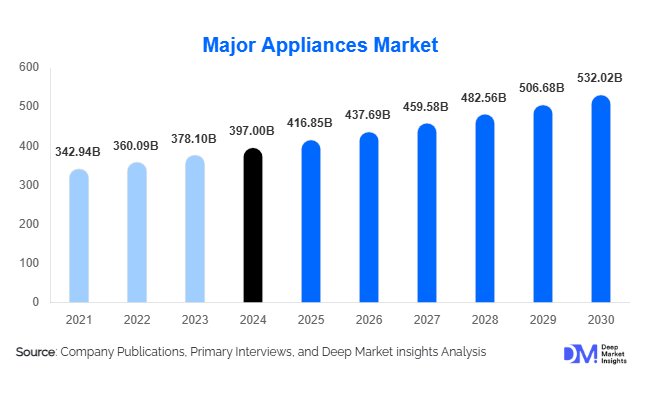

According to Deep Market Insights, the global major appliances market size was valued at USD 397.00 billion in 2024 and is projected to grow from USD 416.85 billion in 2025 to reach USD 532.02 billion by 2030, expanding at a CAGR of 5.00% during the forecast period (2025–2030). The major appliances market growth is primarily driven by rising disposable incomes across emerging economies, accelerating urbanization and new housing construction, increasing replacement cycles in mature markets, and strong demand for smart, energy-efficient appliances across residential and commercial end users.

Key Market Insights

- Asia-Pacific dominates the major appliances market, contributing nearly 45% of global revenue owing to rapid urbanization, rising middle-class populations, and large-scale housing development.

- Smart and connected appliances are the fastest-growing category, driven by IoT integration, energy-efficient technologies, and consumer demand for automation and convenience.

- Refrigerators and freezers lead product demand, accounting for roughly 25% of the global market in 2024 due to their universal necessity and frequent upgrade cycles.

- Traditional retail channels continue to command over 40% of global sales, especially in emerging markets, where electronic stores remain consumers’ preferred purchasing avenue.

- Energy-efficiency regulations in Europe and North America are accelerating demand for inverter-based and eco-labeled appliances.

- Online sales of major appliances are rising at double-digit rates, supported by expanding e-commerce infrastructure and manufacturer D2C strategies.

What are the latest trends in the major appliances market?

Rapid Adoption of Smart & Connected Appliances

Manufacturers are increasingly integrating IoT functionality, AI-powered sensors, and remote monitoring capabilities into refrigerators, washing machines, HVAC systems, and cooking appliances. Consumers are drawn to the convenience of app-based control, smart diagnostics, predictive maintenance, and energy optimization. As smart-home penetration expands globally, appliance manufacturers are forming strategic partnerships with technology companies to provide seamless ecosystem integration. This trend is particularly strong in North America, Europe, China, and South Korea, where smart-home adoption is accelerating. Smart appliances also support premium pricing, improving manufacturer margins and customer lifetime value.

Energy-Efficient Appliances Gain Mainstream Adoption

With rising electricity costs and stricter environmental regulations, energy-efficient appliances have emerged as a central market trend. Inverter-based cooling systems, eco-labeled refrigerators, and low-water-consumption washers are increasingly demanded by environmentally conscious consumers. Governments worldwide are launching incentive programs and imposing minimum efficiency standards, pushing manufacturers toward sustainable product design. Europe continues to lead this trend, while Asia-Pacific and Latin America are rapidly catching up. Enhanced insulation materials, advanced motors, and low-GWP refrigerants are becoming standard in next-generation appliances.

What are the key drivers in the major appliances market?

Growing Urbanization and Housing Development

Rapid growth in urban housing, especially in China, India, Southeast Asia, and parts of Africa, is driving first-time purchases of major appliances. Each newly constructed residential unit typically includes refrigerators, washing machines, ACs, and cooking appliances, creating a stable, structural source of demand. Governments promoting affordable housing programs further amplify this growth, making urbanization a key catalyst for both volume and value expansion.

Increasing Disposable Income and Expanding Middle Class

Rising purchasing power in emerging economies is accelerating appliance penetration. Millions of households transitioning into middle-income brackets are acquiring essential appliances for the first time or upgrading to higher-capacity, better-performing models. This demographic shift not only increases demand for essential appliances but also drives a gradual move from entry-level to mid-range and premium segments.

Technological Advancements and Product Innovation

The market is benefiting from rapid innovation, including inverter compressors, smart diagnostics, voice assistant integration, and AI-enabled load management. Improved energy efficiency, enhanced durability, and greater aesthetic customization are influencing purchase decisions. Innovation also boosts replacement cycles, as consumers increasingly upgrade older, less efficient appliances for advanced technology platforms.

What are the restraints for the global market?

Volatility in Raw Material Prices

Major appliances rely heavily on steel, aluminum, copper, plastics, and electronic components. Fluctuations in commodity prices, supply shortages, and geopolitical uncertainties significantly increase manufacturing costs. This pressures profit margins for manufacturers, particularly in price-sensitive emerging markets. Supply chain disruptions, such as semiconductor shortages, can further delay production and inflate costs, posing a persistent challenge.

High Entry Barriers Due to Logistics & After-Sales Complexity

Major appliances require complex logistics, installation services, and extensive after-sales networks involving technicians, spare parts, and service centers. New entrants often struggle to build this infrastructure, limiting competition and market fluidity. The high capital investment required for manufacturing facilities also raises barriers for smaller or regional companies aiming to scale globally.

What are the key opportunities in the major appliances industry?

Explosion of Demand in Emerging Markets

Asia-Pacific, Latin America, and Africa present vast untapped potential. Rapid urban growth, rising incomes, and government-backed housing projects are creating millions of new middle-class consumers requiring essential appliances. Manufacturers launching affordable, durable appliances tailored for regional needs stand to capture significant market share. Bulk procurement partnerships with real estate developers and rental housing operators further expand opportunities.

Growth of E-Commerce & Direct-to-Consumer Channels

Online sales of major appliances are growing rapidly as manufacturers adopt D2C platforms, transparent pricing, and bundled installation services. E-commerce improves geographic reach, especially in smaller cities where brick-and-mortar presence is limited. This shift reduces distribution costs, enables advanced personalization through data insights, and enhances consumer trust through digital reviews and virtual product demonstrations.

Premiumization Through Smart & Energy-Efficient Technologies

As consumers increasingly prioritize convenience, sustainability, and long-term energy savings, premium and smart appliances are gaining traction. Manufacturers offering high-end connected product lines, eco-friendly refrigerants, and intelligent control systems can command higher margins and foster brand loyalty. This opportunity is especially strong in North America, Europe, China, and South Korea, where smart-home ecosystems are rapidly evolving.

Product Type Insights

Refrigerators and freezers dominate the major appliances market, accounting for nearly 25% of total revenue in 2024. Their universal necessity, continuous usage, and frequent replacement cycles support sustained demand. Washing machines and dryers represent another key segment, driven by rising hygiene awareness and increasing household dual-income levels. Air conditioners are witnessing explosive adoption in warmer climates across Asia-Pacific and the Middle East, where rising temperatures are accelerating AC penetration. Cooking appliances, ovens, stoves, and cooktops remain essential in both new and existing homes, especially in urbanizing regions where modular kitchens are gaining popularity.

Application Insights

Residential applications represent the largest share of the major appliances market, driven by global housing expansion and rising homeownership rates. Replacement cycles in mature economies (U.S., Europe, Japan) contribute significantly to market stability, with consumers upgrading to more efficient, feature-rich appliances. Commercial applications, including rental housing, hospitality, and serviced apartments, are rapidly growing, fueled by rising tourism, urban rental culture, and property management companies adopting bulk procurement practices. Institutional demand is increasing in student accommodation, hospitals, and government housing programs worldwide.

Distribution Channel Insights

Brick-and-mortar stores continue to dominate global sales, holding over 40% market share due to consumer preference for in-person evaluation, installation support, and bundled service packages. However, online distribution is emerging as the fastest-growing channel, driven by platform convenience, transparent pricing, virtual demos, and free installation services. Manufacturers are increasingly adopting hybrid retail strategies, combining retail presence with D2C fulfillment, to maximize reach. Wholesale and B2B channels serve large buyers such as builders, hotels, and institutional clients, offering bulk discounts and installation contracts.

End-User Insights

The residential sector remains the core end user, driven by new home purchases, rising urban populations, and increasing living standards. Commercial demand is accelerating as hotels, co-living spaces, and rental housing providers invest in durable, energy-efficient appliances to enhance customer experience. Institutional buyers, including government housing agencies and healthcare facilities, are expanding procurement volumes. Export-driven end-user markets, especially in Africa, the Middle East, and Latin America, are creating large-scale opportunities for Asia-based manufacturers.

| By Product Type | By Technology Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is a mature but resilient market driven by replacement cycles and high demand for smart, premium appliances. Consumers prioritize energy efficiency and advanced features such as smart diagnostics, AI load sensing, and adaptive climate control. The U.S. leads demand, supported by steady housing starts and premiumization trends. Canada demonstrates strong growth in energy-efficient cooling and heating appliances due to climatic variations and stringent building codes.

Europe

Europe exhibits a strong preference for eco-friendly, low-energy-consuming appliances due to strict EU regulations. Replacement demand dominates the region, with consumers upgrading aging appliances to meet new efficiency standards. Germany, the U.K., France, and Italy are major markets. Built-in kitchen appliances are particularly popular in European urban centers due to space-efficient housing designs.

Asia-Pacific

Asia-Pacific leads the global market with approximately 45% share, driven by massive population density, rising incomes, and rapid urban development. China remains the world’s largest producer and consumer of major appliances. India, Indonesia, Vietnam, and the Philippines are experiencing accelerated demand as homeownership expands and appliance penetration increases. Smart appliances and mid-range models are gaining traction among upwardly mobile consumers.

Latin America

Latin America is experiencing steady appliance adoption in Brazil, Mexico, Chile, and Argentina. Economic recovery, urbanization, and increased investment in energy-efficient household goods are driving growth. Brazilian consumers favor affordable refrigerators, washers, and cooking ranges, while Mexico shows rising demand for air conditioners and mid-range appliances.

Middle East & Africa

MEA demand is rising sharply, particularly for cooling appliances, due to extreme climates and rapid construction of residential and commercial buildings. Gulf nations (UAE, Saudi Arabia, Qatar) lead premium appliance demand, while African nations show strong growth potential in essential appliances such as refrigerators and washers. Imports dominate the market, creating opportunities for Asia-based manufacturers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Major Appliances Market

- Whirlpool Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Haier Smart Home Co., Ltd.

- Electrolux AB

- Midea Group

- BSH Hausgeräte GmbH (Bosch)

- Panasonic Corporation

- Miele & Cie. KG

- Daikin Industries Ltd.

- Sharp Corporation

- Hitachi Global Life Solutions

- Toshiba Lifestyle

- Godrej Appliances

- Arcelik A.Ş.

Recent Developments

- In January 2025, LG Electronics launched a new line of AI-powered washing machines with predictive load sensing and automated detergent dispensing.

- In March 2025, Haier Smart Home announced the expansion of its energy-efficient refrigerator plant in India, aimed at meeting rising domestic and export demand.

- In May 2025, Samsung Electronics introduced a new IoT-enabled HVAC system designed for integration with smart-home ecosystems across North America and Europe.

- In August 2025, Whirlpool Corporation invested in advanced manufacturing robotics to enhance production efficiency and reduce carbon emissions at its U.S. facilities.