Magazine Publishing Market Size

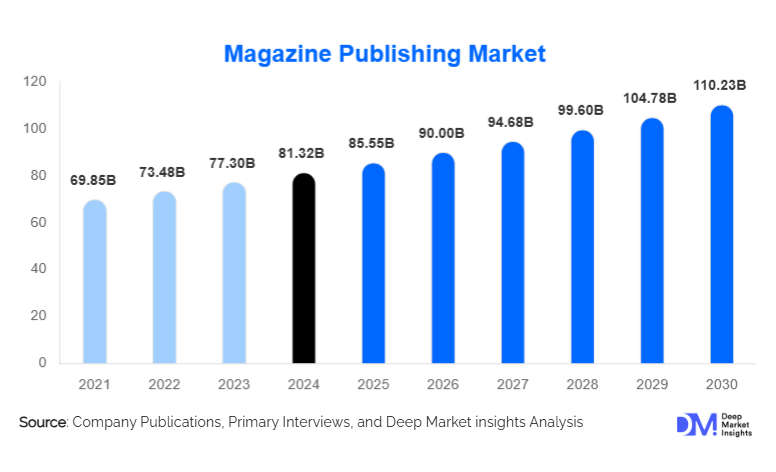

According to Deep Market Insights, the global magazine publishing market was valued at USD 81.32 billion in 2024 and is projected to grow from USD 85.55 billion in 2025 to reach USD 110.23 billion by 2030, expanding at a CAGR of 5.20% during the forecast period (2025–2030). Market growth is driven by accelerating digital adoption, the expansion of hybrid publishing models, increased investment in niche and specialized content, and rising demand for targeted digital advertising across consumer and trade segments.

Key Market Insights

- Digital magazines now account for nearly half of global revenues, supported by rising smartphone penetration, improved broadband access, and consumer preference for mobile-first reading experiences.

- Hybrid business models combining subscriptions and advertising are emerging as the most profitable strategy for publishers, offering diversified revenue streams.

- North America dominates the global market, contributing 30–35% of total 2024 revenues due to its mature advertising ecosystem and strong consumer spending capacity.

- Asia-Pacific is the fastest-growing region, propelled by expanding middle-class populations, regional-language publishing, and a surge in digital readership.

- Niche and special-interest magazines in areas such as health, fitness, technology, and hobbies are outperforming general-interest magazines in subscription retention and reader loyalty.

- Data-driven advertising and audience analytics are transforming publisher strategies, enabling precision targeting and higher-margin ad placements.

What are the latest trends in the magazine publishing market?

Rapid Digitalization and Interactive Content Expansion

Magazine publishers are increasingly shifting from print-first to digital-first strategies, producing content optimized for mobile apps, web readers, and tablet editions. Interactive elements such as embedded videos, animations, hyperlinks, and personalized reading suggestions are redefining user engagement. Digital issues now integrate real-time updates, targeted advertising, and multimedia storytelling, allowing publishers to extend content life cycles and improve reader retention. Subscription bundles that combine digital access with premium content, podcasts, or community memberships are becoming major growth drivers, especially among millennials and Gen Z readers.

Growth of Niche, Premium, and Special-Interest Magazines

As competition from social media and free online content intensifies, the magazine industry is experiencing a strong shift toward niche verticals. Special-interest magazines, covering areas such as wellness, luxury lifestyle, sustainability, tech innovation, home décor, and professional industries, are seeing higher subscription loyalty and advertiser demand. Niche readerships tend to value curated, high-quality content that delivers depth and expertise. Premium editions, limited-run print issues, and collector’s editions are emerging as high-margin revenue opportunities, especially in fashion, design, and cultural commentary categories.

What are the key drivers in the magazine publishing market?

Accelerating Digital Advertising and Data Monetization

As advertisers redirect budgets toward digital channels, magazine publishers benefit from advanced targeting capabilities, programmatic ad sales, and audience segmentation tools. Digital magazines offer measurable engagement metrics, making them attractive platforms for brands seeking high-precision audience reach. Native advertising, sponsored content, and influencer collaborations are also increasing publisher profitability and driving strong growth within the digital segment.

Growing Demand for On-the-Go Content Consumption

Rising smartphone penetration and mobile browsing behavior have made digital magazines more accessible than ever. Consumers expect instantly accessible, visually rich content that is easy to read across devices. This shift toward mobile-optimized content is driving adoption of app-based subscriptions, micro-payments for single articles, and AI-powered reading recommendations. As commuting and remote work habits normalize, on-the-go consumption continues to fuel market expansion.

What are the restraints for the global market?

Declining Print Circulation and Rising Production Costs

Print magazines face ongoing challenges due to decreasing circulation, rising paper and logistics costs, and shrinking retail newsstand presence. Many publishers struggle to maintain profitability in print-only or print-heavy formats as consumers increasingly transition to digital content. This has accelerated the need for structural transformation and technology investment across the industry.

Competition from Free and Alternative Digital Media

Magazines must now compete with social media platforms, blogs, newsletters, streaming services, and user-generated content for consumer attention. The abundance of free content online reduces willingness to pay for subscriptions, forcing publishers to differentiate through strong editorial value, premium content, and deeper niche focus. Retention is especially challenging among younger audiences with shorter attention spans and diverse entertainment options.

What are the key opportunities in the magazine publishing industry?

AI-Enabled Personalization and Content Automation

Artificial intelligence presents opportunities to enhance reader experience through personalized content feeds, predictive topic recommendations, and dynamic paywalls. Publishers can automate workflows, accelerate content production, and optimize ad placements using machine learning. AI-enabled design tools and automated translation services also support global expansion and multilingual publishing.

Expansion into Emerging Markets and Regional-Language Publishing

Asia-Pacific, Latin America, and Africa present large untapped reader communities, particularly within regional-language ecosystems. Digital distribution reduces cost barriers, enabling publishers to reach millions of new readers without heavy print infrastructure. Affordable digital subscriptions, localized content, and partnerships with telecom companies can unlock high-growth revenue streams and attract new advertisers targeting these fast-growing markets.

Product Type Insights

Digital magazines dominate growth, benefiting from recurring subscription models, lower production costs, and rising advertiser demand for interactive and targeted placements. Print magazines continue to hold value in luxury, fashion, design, and premium lifestyle categories where tactile quality and visual aesthetics remain important. Hybrid formats, offering bundled print and digital access, are becoming popular among legacy publishers seeking to retain long-term subscribers. Special editions, collectible issues, and premium print runs continue to generate strong margins in fashion, art, and culture segments.

Application Insights

Consumer magazines, particularly in lifestyle, fashion, fitness, home décor, and entertainment, remain the largest application segment, generating strong advertiser demand. Trade and B2B magazines maintain steady growth due to professional readership loyalty, industry relevance, and stable subscription revenues. Niche magazines serving hobbies, eco-living, gaming, sustainability, and technology communities are among the fastest-growing applications, driven by a surge in community-based content consumption. Digital-exclusive applications such as multimedia editions, interactive guides, and mobile-first micro-magazines are emerging as new revenue avenues.

Distribution Channel Insights

Online platforms and mobile apps dominate distribution, enabling global accessibility, dynamic content updates, and targeted advertising. Subscription platforms, digital newsstands, and publisher-owned apps are gaining traction among younger audiences. Retail distribution for print magazines is declining but remains relevant in airports, bookstores, supermarkets, and specialty outlets. Direct-to-consumer models via publisher websites and membership bundles strengthen customer relationships and reduce dependency on intermediaries.

Reader Type Insights

General consumers represent the largest readership segment, especially within lifestyle, entertainment, and cultural categories. Professional readers, subscribing to B2B and industry-specific magazines, exhibit the highest retention rates due to content relevance and career utility. Younger readers prefer digital-first experiences, multimedia integration, and short-form editorial styles, while older demographics continue to support premium print editions. Affluent audiences drive demand for fashion, luxury lifestyle, and design magazines, sustaining high-margin product lines.

Age Group Insights

Readers aged 25–45 years account for the largest share of digital subscriptions, driven by mobile consumption habits and interest in lifestyle and professional content. The 18–24 demographic prefers bite-sized, interactive, and visually rich digital content, often consuming magazines through social media extensions and mobile apps. Older demographics (45–65+ years) remain key buyers of print magazines, especially in home décor, travel, health, and traditional news categories. This age distribution supports a hybrid print-digital strategy across major publishers.

| By Format Type | By Revenue Model | By Content Genre | By Distribution Channel | By End-User / Audience Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, contributing 30–35% of global revenue. The U.S. leads digital subscription adoption, niche magazine creation, and premium lifestyle publishing. Strong advertising spending, high consumer purchasing power, and advanced digital infrastructure continue to reinforce regional dominance. Major publishers such as Condé Nast and Hearst maintain significant influence across both print and digital ecosystems.

Europe

Europe accounts for 20–25% of global market share, with strong cultural readership habits and high-quality editorial standards. The U.K., Germany, and France lead the digital transition, while Scandinavian markets show high per-capita digital subscription rates. Sustainability-driven publishing and regulatory compliance (including GDPR) shape innovative content strategies across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising middle-class populations, expanding regional-language publishing, and rapid digital adoption. China and India lead demand growth, supported by mobile-first consumption and increasing advertiser investment. Japan, South Korea, and Australia maintain strong mature markets with high digital penetration and stable subscription bases.

Latin America

Latin America is gradually expanding, with Brazil and Mexico showing increasing demand for entertainment, lifestyle, and regional-language content. Economic fluctuations create challenges for print circulation, but digital distribution is emerging as a cost-effective growth channel. Localized content and influencer-led editorial formats are shaping market evolution.

Middle East & Africa

The region holds a smaller share but exhibits strong potential in luxury, fashion, and cultural magazines. The UAE and Saudi Arabia drive premium content consumption, while South Africa hosts a diverse magazine ecosystem spanning consumer and trade segments. Improved digital infrastructure is accelerating readership expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Magazine Publishing Market

- Condé Nast

- Hearst Communications

- Meredith Corporation (Dotdash Meredith)

- Bauer Media Group

- Axel Springer SE

- Future plc

- The New York Times Company (magazine publishing division)

- Time USA LLC

- Vogue Group International

- Forbes Media

- IDG Communications

- Hachette Filipacchi Media

- Penguin Random House (magazine imprints)

- Bloomberg Media

- National Geographic Partners

Recent Developments

- In 2025, Condé Nast expanded its digital subscription ecosystem, integrating AI-driven personalisation and multi-title bundles across Vogue, GQ, Wired, and Architectural Digest.