Luxury Tourism Market Size

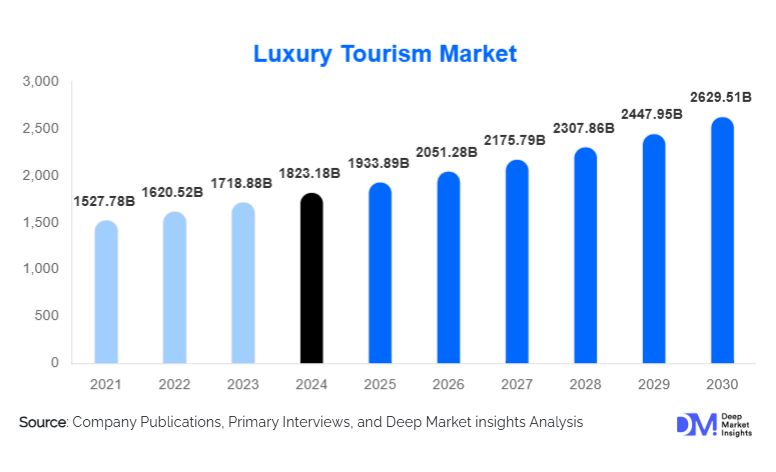

According to Deep Market Insights, the global luxury tourism market size was valued at USD 1,823.18 billion in 2024 and is projected to grow from USD 1,933.89 billion in 2025 to reach USD 2,629.51 billion by 2030, expanding at a CAGR of 6.07% during the forecast period (2025–2030). The luxury tourism market growth is primarily driven by rising global wealth, increasing demand for personalized and experiential travel, and the expansion of luxury travel services, including high-end accommodations, bespoke cultural experiences, and private transport offerings tailored for affluent travelers.

Key Market Insights

- Luxury tourism increasingly emphasizes personalized and immersive experiences, catering to high-net-worth individuals and affluent millennials seeking bespoke itineraries and exclusive offerings.

- Urban luxury destinations dominate, with major cities offering high-end hotels, fine dining, cultural experiences, and premium shopping, contributing to consistent revenue streams.

- North America holds the largest market share, led by the U.S. and Canada due to high disposable incomes anda mature luxury travel infrastructure.

- Asia-Pacific is the fastest-growing region, driven by rising domestic wealth in China, India, and Thailand and increasing outbound travel demand for premium experiences.

- Europe remains a strong market for cultural and heritage luxury tourism, supported by historic cities, high service standards, and a strong interest in sustainable travel.

- Technology integration, including AI-powered personalization, virtual reality previews, and digital concierge services, is transforming traveler engagement and service delivery in luxury tourism.

What are the latest trends in the luxury tourism market?

Experiential and Sustainable Tourism

Luxury tourism operators are increasingly focusing on eco-conscious and experiential travel. High-end resorts and travel services are integrating sustainability into operations through renewable energy, waste reduction, and community engagement initiatives. Travelers are drawn to cultural immersion, wellness-focused programs, and adventure-based experiences that go beyond conventional sightseeing. Sustainable luxury tourism initiatives, such as carbon offset programs and local community involvement, not only improve brand perception but also align with affluent travelers’ environmental and social values.

Technology-Enhanced Travel Experiences

Emerging technologies are enhancing both pre-travel and on-ground luxury experiences. AI-driven itinerary customization, virtual reality previews of destinations, and digital concierge services allow affluent travelers to plan seamless and highly personalized journeys. Mobile apps offer real-time updates, personalized recommendations, and immersive content. Blockchain-enabled bookings and loyalty platforms are also gaining traction, ensuring security, transparency, and convenience for high-net-worth clients. Technology adoption is particularly appealing to younger luxury travelers seeking interactive and efficient services.

What are the key drivers in the luxury tourism market?

Rising Global Wealth

The increasing population of high-net-worth and ultra-high-net-worth individuals worldwide is a key growth driver. Affluent travelers prioritize exclusivity, bespoke services, and unique experiences, resulting in higher spending on premium accommodations, private jets, yachts, and curated tours. Emerging wealth hubs in Asia-Pacific and the Middle East are accelerating international luxury travel, further fueling market growth.

Shift Toward Experiential Travel

Travelers are moving away from conventional sightseeing toward immersive experiences, including cultural, gastronomic, wellness, and adventure-based itineraries. Demand for bespoke tours, eco-luxury resorts, and adventure travel has expanded the scope of luxury tourism offerings. This trend encourages operators to differentiate through curated experiences and high-quality services.

Digitalization and Convenience

Technology has simplified access to luxury travel services, enabling travelers to plan and book complex itineraries with ease. AI-powered trip planners, VR previews, and mobile apps offering real-time service updates enhance convenience and satisfaction. Digital platforms also facilitate direct engagement with luxury operators, reducing intermediaries and increasing personalized offerings.

What are the restraints for the global market?

High Operational Costs

Delivering premium, bespoke services entails significant investments in infrastructure, staff training, and technology. High operational costs may restrict profitability for smaller players and limit market entry, posing challenges to broader expansion.

Vulnerability to Economic and Geopolitical Fluctuations

Luxury tourism demand can be impacted by economic downturns, political instability, or global crises, such as pandemics. Travel restrictions, visa complexities, and fluctuating exchange rates may temporarily suppress demand, particularly for international luxury travel segments.

What are the key opportunities in the luxury tourism industry?

Emerging Regional Markets

Emerging economies in the Asia-Pacific, the Middle East, and Latin America present significant growth opportunities. Rising disposable incomes, improved infrastructure, and government initiatives promoting tourism enable luxury operators to tap into previously underserved markets. Customized experiences tailored to local preferences and culture-driven itineraries are key to capturing this segment.

Integration of Technology for Personalization

Luxury operators can leverage AI, virtual reality, and digital concierge platforms to deliver highly personalized experiences. This enhances customer satisfaction and loyalty, while also providing operational efficiencies. Travel companies that invest in technology-driven services can differentiate themselves and capture the premium market effectively.

Experiential and Sustainable Offerings

Eco-luxury and wellness-focused travel are growing rapidly. Travelers are increasingly seeking sustainable, socially responsible, and immersive experiences. Operators incorporating sustainability certifications, wellness retreats, adventure tourism, and community-based activities can capture high-margin opportunities and align with evolving consumer preferences.

Service Type Insights

Luxury accommodation, including five-star hotels, resorts, and private villas, dominates the market with around 45% share of the 2024 market revenue. These offerings attract consistently high-spending travelers seeking exclusivity, comfort, and premium service. Luxury transport, including private jets, yachts, and first-class flights, contributes significantly to overall revenue, catering to international travelers. Curated tours and experiences, focusing on adventure, wellness, and culture, are rapidly expanding, especially in emerging markets where experiential tourism is on the rise.

Application Insights

Urban luxury destinations lead global demand, driven by high-end hotels, cultural experiences, and shopping. Beach and island resorts attract affluent travelers seeking relaxation and wellness programs, while adventure and nature destinations, including safaris and eco-lodges, are growing due to demand for immersive experiences. Cultural and heritage destinations benefit from historical attractions and bespoke guided tours, creating high-value niche offerings.

Distribution Channel Insights

Direct bookings through operator websites, online travel agencies, and digital concierge platforms dominate the luxury tourism market. Specialist luxury travel agencies remain critical for high-net-worth clients seeking curated experiences. Social media marketing, influencer collaborations, and subscription-based travel clubs are emerging as effective channels to engage affluent and experience-driven travelers. Personalized service and real-time booking transparency are key differentiators in this segment.

Traveler Type Insights

High-net-worth individuals represent the largest segment, accounting for approximately 55% of global luxury tourism spending. Ultra-high-net-worth travelers seek private and ultra-exclusive experiences. Affluent millennials are increasingly driving demand for experiential and adventure-focused luxury tourism, leveraging digital platforms for booking and planning. Couples and honeymooners prioritize privacy and high-value experiences, while families are seeking child-friendly luxury accommodations and multi-generational travel options.

Age Group Insights

Travelers aged 31–50 dominate the market due to high disposable income and preference for experience-driven travel. The 18–30 segment is driving growth in adventure and wellness tourism, particularly via digital engagement. Older demographics, aged 51–65, focus on premium and guided travel, while the 65+ segment represents a niche for high-value, comfort-focused luxury travel, including wellness and medical tourism.

| By Service Type | By Application | By Distribution Channel | By Traveler Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for the largest market share (35% in 2024), led by the U.S. and Canada. High disposable incomes, mature luxury infrastructure, and strong outbound travel trends support demand. Customized urban and experiential luxury packages are particularly popular.

Europe

Europe holds 30% market share, led by France, Italy, and the U.K., driven by cultural and heritage tourism. Demand is increasing for sustainable and experiential travel options, particularly among younger, eco-conscious travelers.

Asia-Pacific

Asia-Pacific is the fastest-growing region (8.5% CAGR), led by China, India, Thailand, and Japan. Rising affluence, digital travel adoption, and outbound travel demand are key growth drivers. Luxury wellness resorts and adventure packages are particularly in demand.

Latin America

Brazil, Mexico, and Argentina are emerging markets for luxury tourism. Outbound travel to North America, Europe, and Asia-Pacific is growing, with a focus on experiential and family-friendly luxury packages.

Middle East & Africa

Home to both travelers and premium destinations, the Middle East (UAE, Saudi Arabia, Qatar) is driving luxury outbound tourism. Africa, particularly South Africa, Kenya, and Morocco, remains central for inbound luxury tourism due to established high-end resorts, safari experiences, and cultural tourism.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Tourism Market

- Marriott International

- Hilton Worldwide

- Accor

- Four Seasons Hotels

- Aman Resorts

- Hyatt Hotels

- Ritz-Carlton

- Mandarin Oriental

- Belmond

- Rosewood Hotels

- Shangri-La Hotels

- Kempinski Hotels

- Banyan Tree Hotels & Resorts

- Taj Hotels

- Relais & Châteaux