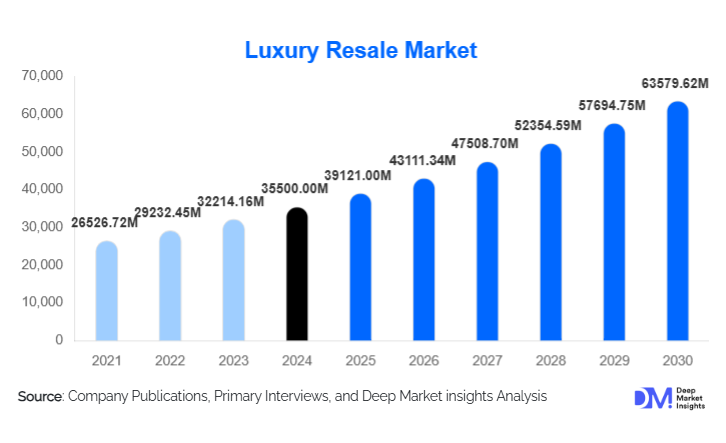

Luxury Resale Market Size

According to Deep Market Insights, the global luxury resale market size was valued at USD 35,500.00 million in 2024 and is projected to grow from USD 39,121.00 million in 2025 to reach USD 63,579.62 million by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). The luxury resale market growth is primarily driven by rising sustainability awareness, increasing value-conscious luxury consumption, growing acceptance of pre-owned premium goods among younger demographics, and rapid expansion of digital resale platforms supported by advanced authentication technologies.

Key Market Insights

- Luxury resale is transitioning from a secondary channel to a core component of the luxury ecosystem, supported by brand-owned resale initiatives and circular economy strategies.

- Handbags and luxury watches dominate resale value retention, driven by iconic designs, limited supply, and strong global brand recognition.

- Online resale platforms account for over 60% of transactions, fueled by digital-native consumers and improved cross-border logistics.

- North America leads global demand, supported by high disposable income and early adoption of resale platforms.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class wealth in China, Japan, and South Korea.

- Technology-led authentication and pricing analytics are becoming critical differentiators among market participants.

What are the latest trends in the luxury resale market?

Brand-Owned and Circular Luxury Resale Models

Luxury brands are increasingly launching proprietary resale platforms to retain control over brand equity, pricing, and customer experience. These initiatives support sustainability goals by extending product lifecycles while unlocking new revenue streams. Brand-owned resale programs also improve inventory traceability, enhance customer trust, and align with ESG-driven governance expectations. This shift is redefining resale from a third-party aftermarket to a strategically integrated luxury offering.

Technology-Driven Authentication and Pricing

Advanced technologies such as AI-based image recognition, blockchain-backed provenance tracking, and digital product passports are transforming the luxury resale market. These tools significantly reduce counterfeit risks and enable dynamic pricing models that reflect real-time demand, product condition, and rarity. Enhanced authentication capabilities are increasing consumer confidence, particularly for high-value watches, handbags, and fine jewelry, thereby accelerating transaction volumes.

What are the key drivers in the luxury resale market?

Rising Sustainability and Ethical Consumption

Global consumers are increasingly prioritizing sustainable purchasing decisions. Luxury resale aligns with environmental goals by reducing waste and minimizing the carbon footprint associated with new product manufacturing. Millennials and Gen Z consumers, in particular, view resale as both a responsible and aspirational consumption model, driving sustained demand growth.

Strong Value Retention and Investment Appeal

Luxury goods such as high-end watches, iconic handbags, and fine jewelry often retain or appreciate. This investment-driven behavior has attracted collectors and high-net-worth individuals seeking alternative assets. Limited-edition and discontinued items command premium resale prices, reinforcing luxury resale as a financially attractive market.

What are the restraints for the global market?

Counterfeit Risks and Trust Barriers

Despite advancements in authentication, counterfeit goods remain a challenge, particularly in cross-border transactions. Perceived risks may deter first-time buyers and limit market penetration in emerging regions where regulatory oversight is less stringent.

Regulatory and Taxation Complexities

Luxury resale operations face varying import duties, VAT structures, and resale compliance requirements across regions. These regulatory complexities increase operational costs and can limit seamless global expansion for resale platforms.

What are the key opportunities in the luxury resale industry?

Emerging Market Expansion and Cross-Border Trade

Rising luxury consumption in Asia-Pacific, the Middle East, and Latin America presents significant growth opportunities. Cross-border resale enables platforms to capitalize on regional price differentials and limited local availability of luxury goods, particularly in watches and handbags.

Advanced Digital and Blockchain Integration

The adoption of blockchain-based authentication, AI-powered valuation engines, and digital ownership certificates represents a major opportunity. Platforms that invest in proprietary technology can command higher commissions, attract premium inventory, and strengthen consumer trust.

Product Type Insights

Luxury handbags and leather goods dominate the global luxury resale market, accounting for approximately 38% of the 2024 market value. This segment leads primarily due to the strong resale liquidity of iconic handbag models, limited-edition releases, and consistent global demand for heritage luxury brands. Handbags benefit from long product lifecycles, high brand recognition, and relatively standardized condition grading, making them the most actively traded category across online and offline resale platforms.

Luxury watches represent around 27% of the market, driven by strong collector interest, investment-grade appeal, and the increasing perception of high-end timepieces as alternative financial assets. Mechanical and limited-edition watches from established luxury brands often appreciate over time, supported by supply constraints, long waiting lists in primary retail, and robust secondary market pricing transparency. This has positioned watches as one of the fastest-growing value segments within luxury resale.

Application Insights

Personal luxury consumption remains the primary application of the luxury resale market, accounting for the majority of transactions globally. Consumers increasingly view resale as a sustainable and value-driven alternative to purchasing new luxury items, particularly for everyday luxury categories such as handbags, footwear, and accessories. This application is strongly influenced by rising environmental awareness and shifting attitudes toward second-hand luxury.

Investment and collectible applications are growing at a faster pace, particularly within luxury watches and fine jewelry. High-net-worth individuals and seasoned collectors are actively acquiring rare, discontinued, and limited-production items through resale channels, driven by long-term value appreciation and portfolio diversification strategies. Auction houses and curated resale platforms play a significant role in supporting this segment.

Distribution Channel Insights

Online resale platforms dominate the luxury resale market with over 62% market share, driven by their global reach, scalability, transparent pricing mechanisms, and advanced digital authentication processes. These platforms enable cross-border transactions, dynamic pricing, and access to a wider inventory pool, making them the preferred channel for both buyers and sellers.

Offline consignment stores and auction houses continue to play a vital role in high-value and rare-item transactions, particularly for investment-grade watches, fine jewelry, and limited-edition handbags. These channels benefit from personalized customer service, physical authentication, and strong trust among high-net-worth buyers. Brand-owned resale channels are gaining traction, particularly in Europe and North America, as luxury brands seek to regain control over secondary market pricing, customer relationships, and brand positioning. These initiatives also support broader circular economy strategies and sustainability commitments.

Consumer Demographic Insights

Millennials and Gen Z buyers account for approximately 34% of global demand, making them the most influential demographic group in shaping the luxury resale market. This segment is driven by digital-first purchasing behavior, sustainability consciousness, and a preference for access over ownership. Social media influence and peer-to-peer resale culture further amplify demand among younger consumers.

High-net-worth individuals and collectors represent a high-value segment focused on investment-grade luxury assets, particularly watches, fine jewelry, and rare handbags. Their purchasing behavior is less price-sensitive and more driven by rarity, provenance, and long-term value appreciation. Aspirational luxury buyers form a large, volume-driven segment seeking affordable entry into premium brands. This group is especially active in entry-level and mid-tier resale pricing segments, supporting transaction volume growth across online platforms.

| By Product Type | By Application | By Distribution Channel | By Consumer Demographic |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 35% of the global luxury resale market share, led primarily by the United States. Regional growth is driven by high digital adoption, a mature luxury consumer base, and widespread acceptance of second-hand premium goods. Strong platform penetration, advanced authentication infrastructure, and well-developed logistics networks further support market leadership. Additionally, sustainability-driven purchasing behavior and a strong culture of resale and consignment contribute to sustained demand growth.

Europe

Europe accounts for nearly 30% of the global market, driven by key luxury hubs such as France, the U.K., and Italy. Growth in the region is supported by deep-rooted luxury brand heritage, a well-established auction ecosystem, and high consumer awareness of circular fashion principles. European consumers demonstrate strong acceptance of pre-owned luxury as a sustainable lifestyle choice, while increasing brand-led resale initiatives are further accelerating market expansion.

Asia-Pacific

Asia-Pacific represents around 22% of the global luxury resale market and is the fastest-growing region, with a CAGR exceeding 13%. Growth is fueled by rising disposable income, expanding middle-class populations, and increasing exposure to global luxury trends. China, Japan, and South Korea lead demand, supported by strong interest in collectible watches, handbags, and limited-edition items. Cultural emphasis on product condition, brand authenticity, and resale value further strengthens regional adoption.

Latin America

Latin America accounts for approximately 6% of global demand, with Brazil and Mexico emerging as key markets. Growth in the region is driven by increasing online platform penetration, cross-border purchasing, and rising luxury awareness among affluent urban consumers. Limited access to primary luxury retail in certain markets further supports demand for resale channels as a cost-effective alternative.

Middle East & Africa

The Middle East & Africa region holds about 7% of the global market share, led by the UAE and Saudi Arabia. Growth is driven by high-income populations, strong luxury tourism inflows, and increasing acceptance of resale among younger consumers. Dubai’s position as a global luxury trading hub and growing regional interest in sustainable consumption are further strengthening demand for luxury resale platforms.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|