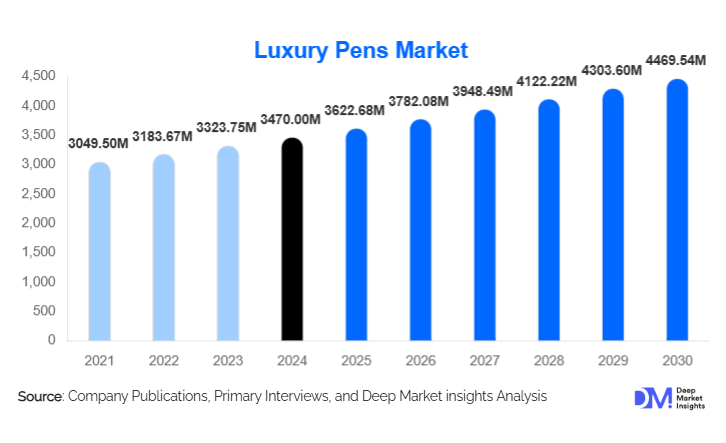

Luxury Pens Market Size

According to Deep Market Insights, the global luxury pens market size was valued at USD 3,470.00 million in 2024 and is projected to grow from USD 3,622.68 million in 2025 to reach USD 4,469.54 million by 2030, expanding at a CAGR of 4.4% during the forecast period (2025–2030). The luxury pens market growth is primarily driven by rising demand for premium writing instruments as status symbols, increasing corporate and institutional gifting, and growing interest in collectible and heritage-based luxury accessories among high-net-worth individuals globally.

Key Market Insights

- Fountain pens dominate the luxury pens market due to their heritage appeal, customization potential, and strong collector demand.

- Mid-luxury price tier (USD 151–500) accounts for the largest market share, supported by aspirational buyers and corporate gifting programs.

- Europe leads global demand, driven by strong manufacturing heritage in Germany, Switzerland, Italy, and France.

- Asia-Pacific is the fastest-growing region, fueled by rising high-net-worth populations in China, India, and Southeast Asia.

- Corporate and institutional gifting contributes nearly one-third of global demand, ensuring stable and recurring volumes.

- E-commerce and direct-to-consumer channels are expanding rapidly, reshaping how younger luxury consumers discover and purchase premium pens.

What are the latest trends in the luxury pens market?

Rising Demand for Limited Editions and Collectibles

Limited-edition luxury pens and heritage-inspired collections are gaining strong traction among collectors and high-net-worth individuals. Brands are increasingly launching numbered editions, artist collaborations, and pens inspired by historical figures, cultural icons, or milestone anniversaries. These products often command significant price premiums and demonstrate strong resale value in secondary markets, reinforcing luxury pens as collectible investment assets rather than purely functional tools.

Personalization and Bespoke Craftsmanship

Customization has become a defining trend in the luxury pens market. Consumers are seeking engraved nibs, personalized barrel materials, custom grip designs, and bespoke packaging. Advances in laser engraving, modular nib systems, and small-batch manufacturing are enabling brands to scale personalization without compromising craftsmanship. This trend is particularly prominent in the ultra-luxury segment, where exclusivity and individuality drive purchasing decisions.

What are the key drivers in the luxury pens market?

Growth in High-Net-Worth and Ultra-High-Net-Worth Populations

The expanding global population of affluent consumers is a major driver of the luxury pens market. High-net-worth individuals increasingly view luxury pens as symbols of professional success, cultural refinement, and legacy. Rising wealth concentration in Asia-Pacific and the Middle East has significantly increased demand for ultra-luxury pens priced above USD 500, making this the fastest-growing price tier globally.

Expansion of Corporate and Institutional Gifting

Luxury pens remain one of the most accepted and prestigious forms of corporate and diplomatic gifting. Financial institutions, consulting firms, government bodies, and multinational corporations regularly procure premium pens for executive recognition, awards, and milestone events. This segment contributes approximately 28–30% of total market demand and provides volume stability for manufacturers.

What are the restraints for the global market?

Declining Everyday Handwriting Usage

The widespread adoption of digital devices has reduced daily handwriting activity, particularly among younger consumers. While luxury pens are less affected than mass-market writing instruments, brands must continuously reposition products as lifestyle, collectible, or ceremonial items to remain relevant.

Volatility in Precious Metal Prices

Fluctuations in the prices of gold, platinum, and silver impact production costs and margin stability. Managing price sensitivity in the mid-luxury segment while maintaining premium positioning remains a key challenge for manufacturers.

What are the key opportunities in the luxury pens industry?

Emerging Demand from Asia-Pacific and the Middle East

Rapid growth in luxury consumption across China, India, Southeast Asia, and the Gulf countries presents a significant opportunity. Localized designs, region-exclusive editions, and culturally symbolic engravings allow brands to tap into strong gifting traditions and aspirational luxury demand.

Technology-Enabled Authentication and Sustainability

Blockchain-based authentication, digital certificates of ownership, and sustainability-focused material sourcing are emerging as differentiation opportunities. Brands investing in ethically sourced metals, refillable designs, and carbon-neutral manufacturing can strengthen appeal among environmentally conscious luxury consumers.

Product Type Insights

Fountain pens lead the luxury pens market, accounting for approximately 38% of global revenue in 2024. This segment’s dominance is primarily driven by heritage appeal, craftsmanship, and higher average selling prices. Limited editions, artisanal nibs, and collectible series further strengthen demand, particularly among high-net-worth individuals and pen enthusiasts seeking exclusivity. Rollerball and ballpoint pens follow, benefiting from ease of use, reliability, and broader professional adoption, making them popular for corporate gifting and daily executive use. Luxury mechanical pencils, though representing a smaller niche, maintain stable demand among designers, architects, and collectors who value precision, aesthetic appeal, and functional elegance. The fountain pen segment’s leadership reflects an enduring preference for traditional craftsmanship combined with investment value, positioning it as the most profitable category globally.

Price Tier Insights

The mid-luxury segment (USD 151–500) holds nearly 45% of the global market, supported by aspirational buyers, corporate gifting programs, and professional consumers seeking a balance of quality and affordability. The entry luxury segment (USD 50–150) caters to first-time buyers, younger consumers, and emerging markets, providing accessible entry points into the luxury pen ecosystem. Meanwhile, the ultra-luxury segment (above USD 500) is the fastest-growing tier, driven by collectors, high-net-worth individuals, and limited-edition releases that emphasize exclusivity, heritage, and investment potential. Strong brand loyalty and willingness to pay premiums for craftsmanship and personalization are key drivers supporting the ultra-luxury segment.

Distribution Channel Insights

Mono-brand boutiques dominate global sales, accounting for around 42% of market share, particularly in Europe and Japan, where experiential retail, brand heritage, and in-store craftsmanship demonstrations attract high-value buyers. Multi-brand luxury retailers and duty-free outlets remain critical for corporate gifting and travel-driven purchases, providing visibility to a wider affluent audience. E-commerce platforms are the fastest-growing channel, expanding at over 10% CAGR, fueled by direct-to-consumer brand websites, curated luxury marketplaces, and digital marketing campaigns targeting younger, tech-savvy consumers. Online personalization tools, virtual pen previews, and global shipping capabilities have further strengthened e-commerce adoption in this sector.

End-Use Insights

Professionals and executives represent the largest end-use segment, reflecting demand for premium writing instruments as status symbols and functional tools in corporate settings. High-net-worth individuals and collectors are driving growth in limited editions and heritage reissues, particularly in ultra-luxury segments. Enterprises and government institutions constitute a significant B2B segment, with structured corporate gifting programs contributing to nearly one-third of global demand. Collectors and enthusiasts are also instrumental in sustaining secondary market value and brand prestige, highlighting the enduring appeal of pens as both luxury accessories and investment-grade collectibles.

| By Product Type | By Price Tier | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 36% of global luxury pen demand, led by Germany, Switzerland, Italy, and France. The region benefits from a strong heritage of manufacturing excellence, precision craftsmanship, and brand legacy, particularly for fountain pens and precious-metal variants. Established luxury retail networks, experiential boutiques, and export-oriented production contribute to Europe’s dominant position. Growth is further supported by high collector activity, cultural appreciation for heritage items, and strong corporate gifting traditions in financial and professional sectors.

Asia-Pacific

Asia-Pacific holds around 32% market share and is the fastest-growing region. China, Japan, and India are key contributors, driven by rising disposable incomes, urbanization, and increasing high-net-worth populations. Cultural gifting practices, luxury aspirational consumption, and the growing influence of social media and e-commerce are significant growth drivers. Rising corporate gifting budgets, alongside increased appreciation for artisanal and heritage pens among millennials and Gen Z consumers, further boost demand. The region’s growth is also supported by luxury travel retail in hubs such as Singapore, Hong Kong, and Tokyo, enhancing exposure to international brands.

North America

North America represents about 22% of the market, with the United States as the largest contributor. Growth is driven by corporate gifting, professional adoption, and collector culture. The presence of strong luxury retail chains, direct brand boutiques, and e-commerce platforms allows wide access to high-end pen offerings. Additionally, affinity for heritage and limited-edition products among collectors, coupled with a stable high-net-worth population, supports consistent demand. The region’s growth is also enhanced by promotional campaigns targeting executive and professional segments, emphasizing pens as lifestyle accessories and status symbols.

Latin America

Latin America accounts for nearly 4% of global demand, with Brazil and Mexico as primary markets. Growth is supported by increasing luxury consumption among affluent urban populations, expanding corporate gifting budgets, and rising exposure to international luxury brands. Social recognition, urban lifestyle trends, and aspirational purchasing behaviors are driving interest in mid-luxury and collectible segments. Online and boutique retail channels are gradually improving accessibility to global luxury pen brands, enhancing market penetration in this region.

Middle East & Africa

The region holds approximately 6% market share, led by the UAE and Saudi Arabia. Key growth drivers include strong corporate gifting traditions, tourism-driven retail, and high disposable incomes among expatriate and local populations. Luxury pens are often purchased as formal gifts, status symbols, or collector items. Government support for luxury trade zones, free trade areas, and tax-exempt tourism retail further strengthens market access. In Africa, heritage pen collectors and limited-edition enthusiasts in South Africa, Nigeria, and Kenya contribute to a niche but growing demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|