Luxury Eyewear Market Size

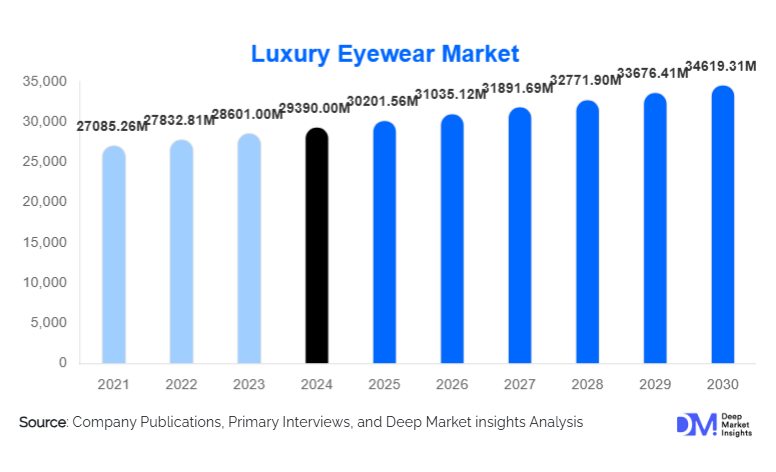

According to Deep Market Insights, the global luxury eyewear market size was valued at USD 29,390.00 million in 2024 and is projected to grow from USD 30,201.56 million in 2025 to reach USD 34,619.31 million by 2030, expanding at a CAGR of 2.76% during the forecast period (2025–2030). The luxury eyewear market growth is driven by the premiumization of optical products, rising fashion consciousness, increasing screen-induced vision issues, and strong demand for high-quality designer frames and sunglasses among affluent consumers globally.

Key Market Insights

- Luxury sunglasses dominate global demand, accounting for over half of total revenue due to faster replacement cycles and strong fashion appeal.

- Core luxury price-tier eyewear (USD 350–1,000) represents the largest value segment, balancing exclusivity with accessibility.

- Europe leads global production and design, supported by strong manufacturing clusters in Italy and France.

- Asia-Pacific is the fastest-growing region, driven by rising luxury consumption in China, India, and South Korea.

- Women’s luxury eyewear remains the leading demographic segment, supported by high product variety and frequent style refreshes.

- Digital-first and DTC luxury eyewear models are accelerating adoption through virtual try-ons and personalised retail experiences.

What are the latest trends in the luxury eyewear market?

Sustainable and Bio-Based Luxury Frames

Sustainability has emerged as a defining trend in the luxury eyewear market. Leading brands are increasingly adopting bio-acetate, recycled metals, and ethically sourced materials to align with evolving consumer preferences. Eco-luxury eyewear appeals strongly to millennials and Gen Z buyers, who prioritise environmental responsibility alongside aesthetics. Many luxury brands are also enhancing supply chain transparency and reducing carbon footprints through localised production and sustainable packaging, positioning sustainability as a core brand differentiator.

Technology-Integrated Smart Luxury Eyewear

Smart and tech-enabled luxury eyewear is gaining traction, integrating features such as blue-light filtering, augmented reality, and health monitoring. Premium brands are collaborating with technology providers to develop smart glasses that maintain luxury aesthetics while offering enhanced functionality. This trend is particularly strong in urban markets, where screen exposure and digital lifestyles are driving demand for high-performance luxury eyewear solutions.

What are the key drivers in the luxury eyewear market?

Rising Premiumization and Brand Consciousness

Consumers increasingly perceive eyewear as a fashion accessory and status symbol rather than a functional necessity. This shift has driven higher average selling prices, increased brand loyalty, and frequent product upgrades. Limited-edition launches, celebrity endorsements, and designer collaborations continue to fuel demand for premium eyewear across mature and emerging luxury markets.

Growth in Vision Correction and Eye Wellness Demand

Rising prevalence of myopia, digital eye strain, and blue-light exposure has significantly boosted demand for luxury prescription eyewear. Consumers are willing to invest in premium frames and advanced lenses that combine visual performance with design excellence. This dual role of luxury eyewear as both a healthcare and lifestyle product is a key long-term growth driver.

What are the restraints for the global market?

High Price Sensitivity in Emerging Markets

The premium pricing of luxury eyewear limits market penetration in price-sensitive regions. While demand is growing, high import duties, taxation, and limited access to luxury retail infrastructure constrain adoption in parts of Latin America, Africa, and Southeast Asia.

Counterfeit and Grey Market Products

The proliferation of counterfeit luxury eyewear, particularly through online channels, poses challenges to brand reputation and revenue protection. Grey market sales undermine pricing integrity and create trust issues among consumers, requiring brands to invest heavily in authentication technologies and controlled distribution.

What are the key opportunities in the luxury eyewear industry?

Expansion in Asia-Pacific Luxury Consumption

Asia-Pacific represents the most significant growth opportunity, driven by expanding middle- and high-income populations in China, India, and Southeast Asia. Investments in localized product design, regional influencers, and omnichannel retail strategies are enabling luxury eyewear brands to rapidly scale presence in this high-growth region.

Eco-Luxury and Circular Eyewear Models

Opportunities are emerging around circular economy initiatives, including recyclable frames, take-back programs, and refurbished luxury eyewear. Brands that successfully integrate sustainability with craftsmanship are well-positioned to capture younger luxury consumers and strengthen long-term brand equity.

Product Type Insights

Luxury sunglasses account for approximately 52% of the global luxury eyewear market in 2024, supported by strong fashion demand and seasonal replacement cycles. Luxury prescription frames follow, driven by rising vision correction needs and premium lens adoption. Smart luxury eyewear remains a niche but fast-growing segment, supported by innovation in AR, wellness, and connectivity features.

Application Insights

Vision correction remains the largest application, contributing nearly 46% of total market demand. Fashion and lifestyle applications are closely aligned, as eyewear increasingly serves dual purposes. Sports and performance luxury eyewear is expanding rapidly among affluent consumers engaged in golf, skiing, and water sports, while wellness-focused eyewear addressing digital eye strain is emerging as a high-growth niche.

Distribution Channel Insights

Multi-brand luxury optical retailers dominate distribution, accounting for over 40% of sales, supported by professional eye care services and curated brand portfolios. Exclusive brand boutiques remain critical for brand positioning, while online DTC channels are the fastest-growing, driven by virtual try-on technologies, personalization, and premium home delivery services.

Consumer Demographic Insights

Women represent the largest consumer segment, accounting for approximately 38% of global demand, driven by fashion-led purchasing behavior. Men’s luxury eyewear follows closely, supported by rising acceptance of premium accessories. Unisex and gender-neutral designs are gaining popularity, reflecting evolving fashion norms and inclusivity trends.

| By Product Type | By Frame Material | By Consumer Demographics | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe holds the largest market share at approximately 34% in 2024, led by Italy, France, and Germany. The region benefits from strong heritage brands, advanced manufacturing, and high export volumes. Italy remains the global hub for luxury eyewear production.

North America

North America accounts for nearly 29% of global demand, driven primarily by the United States. High disposable income, strong brand awareness, and insurance-supported optical purchases support steady market growth.

Asia-Pacific

Asia-Pacific represents around 24% of the market and is the fastest-growing region, with China recording double-digit growth. Urbanization, rising luxury awareness, and expanding retail infrastructure are key growth drivers.

Latin America

Latin America contributes approximately 6% of global revenue, led by Brazil and Mexico. Growth is gradual but supported by expanding affluent populations and increasing brand penetration.

Middle East & Africa

The Middle East & Africa account for about 7% of the market, driven by high per-capita luxury spending in the UAE and Saudi Arabia. Africa also plays a critical role as a production and export region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Eyewear Market

- EssilorLuxottica

- Safilo Group

- Kering Eyewear

- Marcolin Group

- De Rigo Vision

- LVMH Eyewear

- Marchon Eyewear

- Charmant Group

- Mykita

- Lindberg

- Maui Jim

- Barton Perreira

- Cutler and Gross

- Oliver Peoples

- Persol