Luxury Electronic Watches Market Size

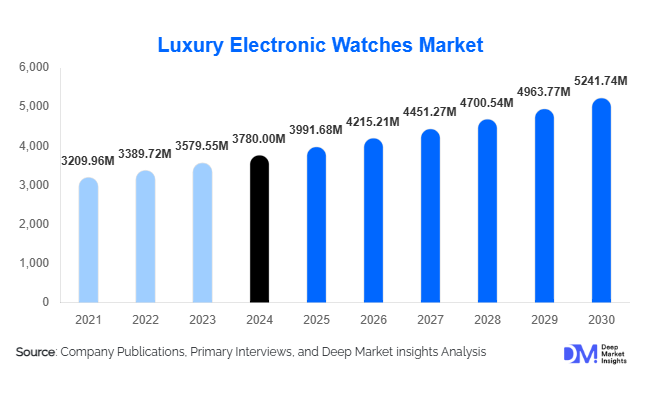

According to Deep Market Insights, the global luxury electronic watches market size was valued at USD 3,780.00 million in 2024 and is projected to grow from USD 3,991.68 million in 2025 to reach USD 5,241.74 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The market growth is primarily driven by the convergence of luxury craftsmanship with advanced wearable technology, rising adoption among high-net-worth individuals, and growing demand for connected, health-enabled, and lifestyle-oriented premium timepieces.

Key Market Insights

- Luxury smartwatches account for the largest share of the market, supported by seamless connectivity, app ecosystems, and lifestyle integration.

- Europe remains the leading manufacturing and consumption hub, driven by Switzerland, France, and Italy’s dominance in luxury watchmaking.

- Asia-Pacific is the fastest-growing region, fueled by rising affluent populations in China, Japan, South Korea, and India.

- Men’s luxury electronic watches dominate demand, although women’s and unisex segments are expanding rapidly.

- Brand-owned boutiques remain the primary sales channel, highlighting the importance of experiential retail and exclusivity.

- Health monitoring, sustainability, and personalization are emerging as key differentiators among premium buyers.

What are the latest trends in the luxury electronic watches market?

Hybridization of Traditional Watchmaking and Digital Technology

Luxury watchmakers are increasingly introducing hybrid models that preserve classic mechanical aesthetics while integrating electronic features such as activity tracking, notifications, and discreet connectivity. This trend appeals strongly to traditional luxury consumers who value heritage but seek modern functionality. Hybrid luxury watches are acting as a gateway product, allowing legacy brands to transition into electronics without diluting brand equity.

Health, Wellness, and Biometric Integration

Advanced health and wellness features are becoming a major trend within the luxury segment. High-end electronic watches now incorporate heart-rate variability monitoring, sleep analytics, stress tracking, and biometric authentication. Unlike mass-market wearables, luxury brands emphasize accuracy, data privacy, and design discretion. This trend is expanding demand among affluent consumers who prioritize wellness without compromising on aesthetics or exclusivity.

What are the key drivers in the luxury electronic watches market?

Expansion of the Global Affluent Consumer Base

The growing population of high-net-worth and ultra-high-net-worth individuals is a key driver for luxury electronic watches. Rising disposable incomes in Asia-Pacific and the Middle East are accelerating demand for premium wearable technology. Consumers in this segment are willing to pay high prices for brand prestige, limited editions, and technological sophistication.

Brand Loyalty and Collectibility

Luxury watch brands benefit from strong brand loyalty and a culture of collectibility. Limited production runs, exclusive collaborations, and heritage-driven storytelling encourage repeat purchases and long-term ownership. This driver continues to support premium pricing and stable demand even during economic fluctuations.

What are the restraints for the global market?

High Product Development and R&D Costs

Developing proprietary operating systems, advanced sensors, and secure software platforms significantly increases costs for luxury watchmakers. Continuous innovation is required to keep pace with consumer expectations, placing pressure on margins, particularly for smaller brands.

Technology Obsolescence Risk

Unlike mechanical watches designed for decades of use, electronic components face faster obsolescence. This creates challenges in resale value and long-term ownership perception, which remains a critical consideration for luxury buyers.

What are the key opportunities in the luxury electronic watches industry?

Growth in Emerging Luxury Markets

Countries such as China, India, Saudi Arabia, and the UAE represent high-growth opportunities due to expanding luxury consumption and younger affluent demographics. Localized product launches, region-specific designs, and exclusive editions can help brands capture untapped demand.

Sustainable and Ethical Luxury Positioning

Sustainability is increasingly influencing luxury purchasing decisions. Brands that adopt recycled materials, ethical sourcing, and carbon-neutral manufacturing can differentiate themselves and command premium pricing, particularly among younger consumers.

Product Type Insights

Luxury smartwatches dominate the market, accounting for approximately 46% of total revenue in 2024, driven by full connectivity and lifestyle functionality. Hybrid luxury watches represent a significant share as they appeal to traditional buyers seeking discreet digital features. Digital luxury sports watches, designed for aviation, diving, and outdoor performance, cater to niche professional and adventure-oriented users. Connected haute horlogerie watches, though limited in volume, command the highest average selling prices due to exclusivity and craftsmanship.

Application Insights

Lifestyle and daily wear applications lead the market, representing around 40% of global demand, as luxury electronic watches increasingly function as everyday accessories. Sports and performance applications are the fastest-growing segment, supported by demand for GPS-enabled and wellness-focused features. Professional applications, including aviation and marine use, maintain steady demand, while collectible and limited-edition watches continue to attract high-value buyers.

Distribution Channel Insights

Brand-owned boutiques account for approximately 42% of global sales, emphasizing personalized service and experiential retail. Authorized multi-brand retailers remain important in established luxury markets. Online brand stores and luxury e-commerce platforms are gaining traction, particularly among younger consumers, while duty-free and travel retail channels benefit from international travel recovery.

End-User Insights

Men account for nearly 62% of total market demand, driven by strong interest in sports, professional, and collectible watches. Women’s luxury electronic watches are growing at a faster rate, supported by increased product diversification and design innovation. Unisex and gender-neutral models are also gaining acceptance among younger demographics.

| By Product Type | By Price Band | By Distribution Channel | By End User | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global market with approximately 34% share in 2024, driven by Switzerland, France, Germany, and Italy. The region benefits from a strong heritage of luxury watchmaking and high domestic and export demand.

North America

North America accounts for around 28% of the global market, led by the United States. High consumer purchasing power and strong adoption of premium smartwatches support demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 13% CAGR. China and Japan are major contributors, supported by rising luxury consumption and digital adoption.

Latin America

Latin America shows steady growth, led by Brazil and Mexico, with demand concentrated in premium urban centers.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, represents a high-value market driven by luxury consumption and gifting culture, while Africa remains a niche but growing market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|