Luxury E-Tailing Market Size

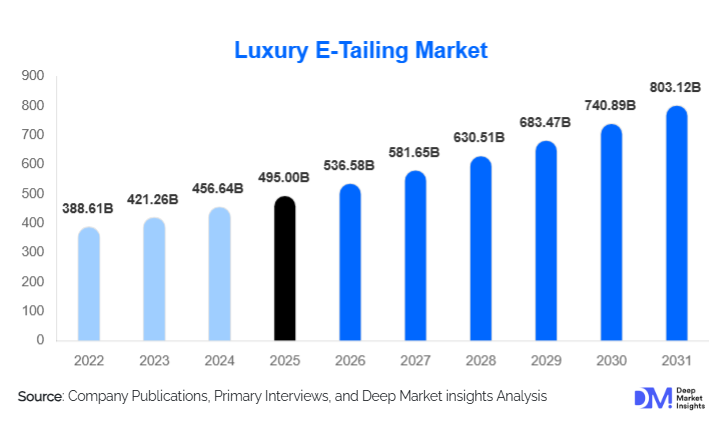

According to Deep Market Insights, the global luxury e-tailing market size was valued at USD 495.00 billion in 2024 and is projected to grow from USD 536.58 billion in 2025 to reach USD 803.12 billion by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). The luxury e-tailing market growth is driven by the rapid digitalization of luxury retail, rising comfort among affluent consumers with high-value online purchases, and increasing adoption of direct-to-consumer (DTC) digital channels by luxury brands.

Key Market Insights

- Luxury fashion and accessories dominate online luxury sales, supported by frequent product refresh cycles and strong brand loyalty.

- Asia-Pacific represents the largest market share, driven by China, Japan, and South Korea, while India is the fastest-growing country.

- Mobile-first luxury shopping accounts for over half of digital luxury transactions, reflecting app-based engagement and impulse purchasing.

- Brand-owned DTC platforms are gaining share, as luxury brands prioritize margin expansion and customer data ownership.

- Blockchain authentication, AI personalization, and AR/VR try-ons are reshaping consumer trust and experience in luxury e-commerce.

- Cross-border luxury e-commerce continues to rise, supported by improved logistics, localized payments, and duty optimization.

What are the latest trends in the luxury e-tailing market?

Acceleration of Direct-to-Consumer (DTC) Luxury Platforms

Luxury brands are increasingly prioritizing brand-owned digital storefronts over third-party marketplaces. This shift allows brands to capture higher gross margins, maintain tighter control over pricing and brand storytelling, and leverage first-party customer data for personalization. DTC platforms now offer exclusive online-only collections, early access drops, and loyalty-based personalization, significantly increasing repeat purchase rates. This trend is particularly strong in Europe and North America, where established luxury houses are integrating online and offline customer journeys.

Technology-Driven Trust and Immersion

Advanced technologies are transforming luxury e-tailing experiences. Blockchain-based product authentication is gaining traction in luxury watches, jewelry, and handbags to combat counterfeiting. AI-powered recommendation engines and virtual personal shoppers are enhancing conversion rates, while AR and VR-based virtual try-ons are reducing return rates in fashion and beauty categories. These technologies are particularly appealing to younger affluent consumers who value transparency and immersive digital experiences.

What are the key drivers in the luxury e-tailing market?

Rising Digital Affluence Among High-Income Consumers

The global increase in high-net-worth and affluent consumers is directly fueling luxury e-tailing growth. Digitally native millennials and Gen Z consumers with rising disposable incomes are more comfortable purchasing luxury goods online, even in high-ticket categories such as watches and fine jewelry. This demographic shift is expanding the online share of luxury consumption globally.

Omnichannel Integration by Luxury Brands

Luxury brands are seamlessly integrating physical boutiques with digital platforms, enabling services such as click-and-collect, virtual consultations, and online appointment booking. This omnichannel approach enhances customer convenience while preserving the exclusivity associated with luxury retail, supporting sustained online growth.

What are the restraints for the global market?

High Fulfillment and Reverse Logistics Costs

Luxury e-tailing requires premium packaging, insured shipping, and white-glove delivery services, which significantly increase fulfillment costs. High return rates in fashion categories further pressure margins, particularly for platforms operating across borders.

Counterfeit Risks and Brand Protection Challenges

Despite advancements in authentication technologies, concerns around counterfeit products persist in certain regions. Maintaining consumer trust requires continuous investment in verification systems, increasing operational complexity for luxury e-tailers.

What are the key opportunities in the luxury e-tailing industry?

Emerging Market Demand in Asia-Pacific and the Middle East

Rapid wealth creation in China, India, Southeast Asia, and the Middle East is creating a new generation of luxury consumers with limited access to physical luxury retail. Localized luxury e-commerce platforms and cross-border delivery models present significant expansion opportunities for global brands.

Personalization and Data-Driven Luxury Experiences

AI-driven personalization, predictive styling, and curated digital experiences offer strong opportunities to increase customer lifetime value. Platforms that successfully combine personalization with exclusivity are expected to outperform the broader market.

Product Category Insights

Luxury fashion and apparel account for the largest share of the luxury e-tailing market, representing approximately 34% of total revenue in 2024. This dominance is driven by frequent seasonal launches, strong brand loyalty, and the increasing comfort of consumers purchasing high-value apparel online. Luxury accessories and leather goods closely follow, supported by sustained demand for handbags, small leather items, and statement accessories that complement digital fashion trends. Jewelry and watches, while smaller in total volume, represent high-value transactions and are among the fastest-growing online categories due to improved authentication technologies, enhanced logistics, and consumers’ willingness to invest in verified, premium items digitally. Luxury beauty and personal care products are also experiencing rapid growth, fueled by repeat purchases, subscription-style models, influencer-led marketing, and the rise of personalized online beauty experiences. Overall, these drivers, frequent product refresh cycles, premium pricing, repeat consumption, and technological adoption, are reinforcing product category growth across global luxury e-tailing.

Consumer Segment Insights

Affluent and aspirational consumers represent the largest demand segment, accounting for nearly 46% of online luxury purchases. These consumers are increasingly digitally savvy, combining disposable income with comfort in online luxury transactions. High-net-worth individuals drive premium and ultra-luxury sales, particularly in jewelry, watches, and bespoke fashion, leveraging digital platforms to access exclusive online offerings and personalized services. Ultra-high-net-worth individuals, while smaller in volume, contribute disproportionately to revenue due to their high average order values, often purchasing rare or limited-edition items. The growth in these segments is propelled by a combination of rising wealth, digital adoption, and consumer desire for exclusive, convenient, and personalized luxury experiences online.

Platform Insights

Mobile-first luxury e-tailing dominates the market, accounting for approximately 58% of total transactions in 2024. The convenience of mobile apps, push notifications for limited edition drops, integrated payment gateways, and social media-driven discovery are key drivers of mobile adoption. Desktop platforms remain relevant for high-consideration purchases, such as watches or luxury jewelry, where consumers prefer larger visuals and detailed product information. Overall, mobile platforms are enhancing engagement, accelerating repeat purchases, and increasing conversion rates by offering personalized experiences, AR/VR try-ons, and seamless checkout flows.

| By Product Type | By Consumer Demographics | By Price Tier | By Device Platform | By the Fulfillment & Ownership Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest regional market, accounting for approximately 38% of global luxury e-tailing revenue in 2024. China alone contributes over 22% of global demand, supported by robust digital ecosystems such as integrated e-commerce apps, seamless mobile payments, and influential local social media marketing. Japan and South Korea represent mature markets with high online luxury penetration, driven by brand-conscious consumers seeking convenience and exclusive products. India, meanwhile, is the fastest-growing country, with a CAGR exceeding 15%, fueled by the rise of affluent millennials, increasing digital literacy, and the expansion of cross-border luxury delivery networks. Key regional drivers include rapid urbanization, the growth of online-only luxury marketplaces, influencer and social commerce integration, and rising demand for authenticated premium goods, which collectively strengthen the region’s leadership in global luxury e-tailing.

North America

North America holds around 27% market share, led by the United States. High online penetration, extensive digital infrastructure, and advanced logistics capabilities are primary growth enablers. Consumers in North America increasingly favor convenience, fast delivery, and digital personalization for luxury fashion, beauty, and accessories. The growing adoption of mobile shopping, AR-based virtual try-ons, and brand-exclusive online collections is further driving e-tailing growth. Additionally, cross-border shopping trends and affinity for limited-edition products encourage premium digital consumption.

Europe

Europe accounts for approximately 24% of the global market, with strong adoption of brand-owned DTC platforms in the U.K., France, and Italy. European consumers demonstrate a high preference for authenticated and sustainable luxury products, emphasizing provenance and ethical sourcing. Drivers of growth include mature e-commerce infrastructure, high mobile and desktop penetration, and a cultural focus on quality and heritage brands. Consumers are increasingly leveraging online platforms for convenience while maintaining a desire for curated and premium experiences, particularly in fashion, accessories, and jewelry.

Middle East & Africa

The Middle East & Africa region represents about 7% of global demand, led by the UAE and Saudi Arabia. Growth is driven by high-income populations with strong preferences for ultra-luxury items, coupled with increasing digital adoption and mobile-first shopping behaviors. Exclusive digital collections, premium delivery services, and culturally tailored luxury campaigns are further stimulating online luxury consumption. Additionally, government initiatives to enhance digital trade infrastructure and tourism-driven luxury consumption support market expansion in this region.

Latin America

Latin America contributes around 4% of the market, with Brazil and Mexico emerging as key demand centers. Market growth is supported by rising affluent populations, improving cross-border e-commerce access, and increasing awareness of global luxury brands. Drivers include mobile penetration, social media influence on fashion trends, and a growing appetite for premium lifestyle products, particularly in fashion and beauty categories. Cross-border logistics improvements and localized payment solutions are also enabling more consumers to engage with international luxury e-tailers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|