Luxury Bath Oils Market Size

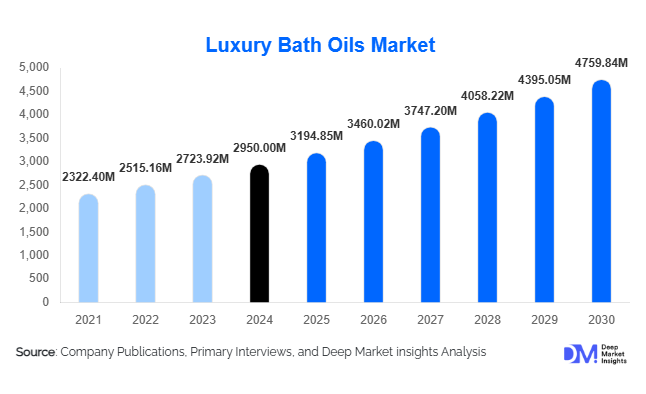

According to Deep Market Insights, the global luxury bath oils market size was valued at USD 2,950 million in 2024 and is projected to grow from USD 3,194.85 million in 2025 to reach USD 4,759.84 million by 2030, expanding at a CAGR of 8.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness of wellness and aromatherapy, the premiumization of personal care routines, and the rising popularity of natural and herbal ingredients in luxury skincare products.

Key Market Insights

- Premiumization of personal care is accelerating demand for luxury bath oils, with consumers willing to pay higher prices for products that provide both skin and wellness benefits.

- Online retail dominates distribution channels, expanding market reach globally through subscription models, direct-to-consumer websites, and personalized product offerings.

- North America and Europe are key markets, accounting for over 60% of 2024 demand due to high consumer awareness, disposable incomes, and the presence of established luxury brands.

- Asia-Pacific is emerging as the fastest-growing region, fueled by urbanization, rising middle-class income, and increasing interest in holistic wellness.

- Sustainability and eco-friendly packaging are becoming major differentiators, with consumers favoring biodegradable, cruelty-free, and ethically sourced products.

- Technological adoption, including AI-based personalized formulations, e-commerce platforms, and digital marketing, is reshaping consumer engagement and product discovery.

What are the latest trends in the luxury bath oils market?

Natural and Herbal Ingredients Gaining Popularity

Luxury bath oils are increasingly formulated with essential oils, herbal extracts, and vitamins that offer dual benefits for skincare and relaxation. Consumers prefer products that combine aromatherapy, moisturizing, and therapeutic properties. Brands are leveraging trends in organic and cruelty-free products to differentiate themselves, particularly in North America and Europe. This trend also aligns with rising consumer awareness of ingredient safety, ethical sourcing, and environmental sustainability.

Technology-Enhanced Personalization

Companies are adopting digital solutions to enhance customer experience and product customization. AI-driven product recommendations, online quizzes for personalized formulations, and subscription models allow consumers to select oils tailored to skin type, mood, or therapeutic needs. E-commerce platforms provide convenience, real-time reviews, and home delivery, making luxury bath oils more accessible across regions. This trend particularly resonates with younger, tech-savvy consumers seeking premium and personalized self-care experiences.

What are the key drivers in the luxury bath oils market?

Rising Wellness and Self-Care Awareness

Growing focus on mental health, stress relief, and holistic wellness has boosted the adoption of bath oils for aromatherapy and relaxation. Consumers are increasingly integrating luxury self-care routines into daily life, supporting sustained growth across household, spa, and hospitality segments.

Premiumization and Disposable Income Growth

Higher disposable incomes, urbanization, and changing lifestyle preferences are encouraging consumers to invest in premium and ultra-luxury bath oils. Products priced above $50 are gaining traction, particularly for gifting, spa usage, and high-end home consumption, reinforcing the premiumization trend.

Expansion of E-commerce and Direct-to-Consumer Channels

Online retail is driving market expansion by offering convenience, a wider selection, and personalized experiences. Subscription services and targeted digital marketing strategies are attracting new consumers and retaining brand loyalty in a competitive landscape.

What are the restraints for the global market?

High Cost of Premium Ingredients

Luxury bath oils often use rare essential oils, herbal extracts, and high-quality packaging, resulting in higher production costs. This restricts adoption in price-sensitive regions and limits the ability of brands to scale beyond niche consumer segments.

Regulatory Compliance Challenges

Different international regulations for cosmetic and therapeutic claims increase compliance costs and complicate global expansion. Strict labeling, ingredient approvals, and safety standards can slow product launches and innovation in new markets.

What are the key opportunities in the luxury bath oils industry?

Integration of Advanced Formulations

Emerging opportunities exist for incorporating functional ingredients such as CBD, adaptogens, and probiotics to create dual-benefit products. Personalized formulations leveraging AI-driven consumer insights can attract premium customers seeking tailored wellness and skincare solutions.

Expansion in Emerging Markets

Rapidly growing middle-class populations in the Asia-Pacific and LATAM present strong opportunities for market penetration. Localized marketing, affordable luxury pricing, and e-commerce distribution can drive adoption in India, China, Brazil, and Mexico. Wellness tourism initiatives in these regions further support demand growth.

Sustainability and Eco-Friendly Packaging

Consumers are increasingly favoring environmentally responsible products. Luxury bath oil brands offering biodegradable bottles, refillable packs, and ethically sourced ingredients can differentiate themselves and capture a growing eco-conscious consumer segment in North America and Europe.

Product Type Insights

Aromatherapy bath oils lead the market, accounting for 32% of 2024 sales. Consumers prioritize relaxation, stress relief, and therapeutic benefits, particularly in spa and wellness applications. Essential and herbal oils are also popular due to their natural skin care benefits, aligning with current consumer preferences for organic and eco-friendly products.

Application Insights

Skin care and moisturizing applications represent 28% of the market, driven by consumers seeking hydrating, luxury formulations. Therapeutic and aromatherapy-focused oils are expanding rapidly, particularly in hospitality and wellness centers where enhancing guest experience is critical. Mood enhancement applications are emerging, leveraging essential oil blends for stress relief and relaxation.

Distribution Channel Insights

Online retail is the leading channel, accounting for 35% of 2024 sales. Convenience, product variety, and personalized subscription offerings drive this dominance. Specialty stores and spas remain critical for in-store experiences and premium gifting. Hypermarkets, supermarkets, and D2C channels complement market reach and support growth in emerging regions.

Price Range Insights

Ultra-luxury bath oils priced above $50 dominate with 40% of market share, driven by gifting, spa, and high-end home use. Premium products ($20–$50) remain popular for household consumption, offering a balance between quality and affordability.

End-Use Insights

Hospitality, including hotels, resorts, and spas, represents 30% of market share and is the fastest-growing segment, leveraging bath oils to enhance guest wellness experiences. Household consumption is steadily rising, fueled by increasing self-care awareness. Emerging applications in corporate gifting and wellness centers present additional growth opportunities. Export-driven demand is strong from Europe and North America to emerging markets with growing premium hospitality infrastructure.

| By Product Type | By Application | By Distribution Channel | By Packaging Type | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 38% of the 2024 market share, with strong demand in the U.S. and Canada. High disposable income, wellness-focused consumers, and established luxury retail infrastructure drive growth. E-commerce adoption and interest in natural, organic products further enhance market potential.

Europe

Europe accounts for 25% of the market share, led by the U.K., Germany, France, and Italy. Consumers prioritize eco-friendly, ethically sourced, and natural products. Luxury spas and gifting markets also support sustained growth. Sustainability and green certifications are key differentiators for European consumers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and Australia. Urbanization, rising disposable incomes, and growing wellness tourism drive adoption. Social media influence and e-commerce penetration are increasing product awareness and demand, particularly in China and India.

Latin America

Brazil, Mexico, and Argentina are emerging markets. Affluent consumers are driving demand for premium and ultra-luxury bath oils, while e-commerce platforms are facilitating access to global brands. Adventure wellness and gifting applications are key growth drivers.

Middle East & Africa

Luxury hospitality and spa industries in the UAE, Saudi Arabia, and Qatar are fueling growth. Africa remains an important production and export hub for essential oils, supporting regional and international supply. Intra-regional demand from high-income populations is also contributing to market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Bath Oils Market

- L’Occitane

- The Body Shop

- Molton Brown

- Jo Malone

- Aesop

- Rituals

- Neom Organics

- Penhaligon’s

- Aromatherapy Associates

- Kiehl’s

- Crabtree & Evelyn

- Elemis

- Forest Essentials

- Thymes

- Le Labo

Recent Developments

- In May 2025, L’Occitane expanded its product portfolio with a new line of CBD-infused luxury bath oils, targeting wellness-conscious consumers in North America and Europe.

- In April 2025, Molton Brown launched a sustainable packaging initiative, introducing biodegradable bottles and refillable gift sets for high-end markets.

- In February 2025, Jo Malone introduced a personalized luxury bath oil service in select regions, allowing customers to customize scent blends and therapeutic properties.