Location-Based Entertainment Market Size

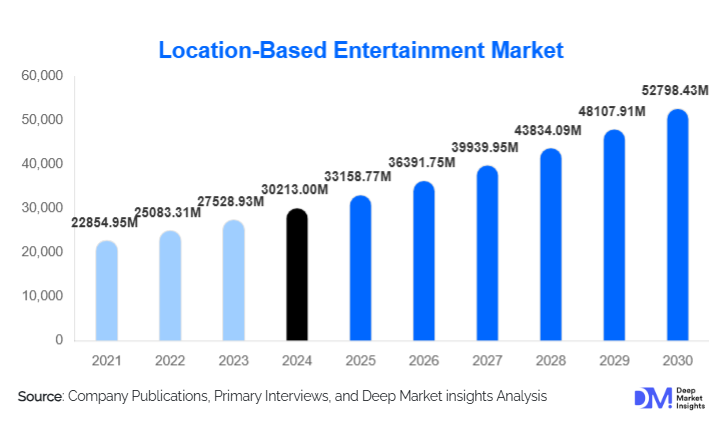

According to Deep Market Insights, the global location-based entertainment market size was valued at USD 30,213.00 million in 2024 and is projected to grow from USD 33,158.77 million in 2025 to reach USD 52,798.43 million by 2030, expanding at a CAGR of 9.75% during the forecast period (2025–2030). The growth of the location-based entertainment market is primarily driven by rising consumer demand for immersive and social entertainment experiences, increasing integration of advanced technologies such as VR, AR, MR, and projection mapping, and the rapid expansion of entertainment infrastructure across urban centers, malls, and tourism destinations globally.

Key Market Insights

- Immersive technologies such as VR, AR, and mixed reality are transforming entertainment venues, enabling highly interactive, repeat-visit-driven experiences.

- Asia-Pacific dominates the global LBE market, supported by large-scale investments in theme parks, malls, and digital entertainment hubs.

- Shopping malls and mixed-use developments are emerging as high-growth venues, using LBE to increase footfall and dwell time.

- Young adults (20–35 years) represent the largest consumer base, driven by strong spending on experiential and social entertainment.

- Pay-per-experience remains the dominant revenue model, though subscription-based formats are gaining traction in urban markets.

- AI-driven personalization and cloud-based content delivery are reshaping operational efficiency and customer engagement.

What are the latest trends in the location-based entertainment market?

Rapid Adoption of Immersive Reality Experiences

One of the most prominent trends in the location-based entertainment market is the accelerated adoption of immersive reality technologies. VR-based attractions, free-roam arenas, and mixed-reality simulations are becoming mainstream across theme parks, family entertainment centers, and standalone LBE venues. Operators are focusing on multiplayer, social, and story-driven experiences to increase visit frequency and session duration. Continuous improvements in headset comfort, motion tracking, and real-time rendering are enhancing realism while reducing operational friction. As a result, immersive reality attractions are increasingly viewed as core revenue drivers rather than experimental add-ons.

Integration of LBE into Retail and Hospitality Spaces

Retail malls, hotels, and resorts are increasingly integrating LBE attractions to counter declining foot traffic and differentiate their offerings. Immersive gaming zones, interactive digital art installations, and projection-based experiences are being deployed as anchor attractions. This trend reflects a broader shift where entertainment is used as a strategic tool for real estate monetization. Hospitality-led LBE, including resort-based immersive theaters and cruise ship VR zones, is also gaining momentum, expanding the market beyond traditional amusement venues.

What are the key drivers in the location-based entertainment market?

Shift Toward Experiential Consumption

Consumers across age groups are increasingly prioritizing experiences over physical goods, driving sustained demand for location-based entertainment. LBE offers social interaction, immersion, and novelty that cannot be replicated by home-based digital entertainment. This experiential shift is particularly strong among millennials and Gen Z, who value shareable, interactive activities. The ability of LBE venues to refresh content and introduce new narratives further strengthens repeat visitation and long-term demand.

Advancements and Cost Reduction in Entertainment Technologies

Technological advancements in VR hardware, motion platforms, and immersive media systems have significantly reduced deployment and maintenance costs. Modular and scalable systems allow operators to update content without major infrastructure overhauls, improving ROI. Cloud rendering and AI-driven analytics are also enabling operators to optimize capacity utilization and personalize experiences, further accelerating market growth.

What are the restraints for the global market?

High Initial Capital Expenditure

Despite declining technology costs, advanced LBE installations still require substantial upfront investment in hardware, spatial design, and safety systems. This limits participation by smaller operators and increases financial risk in underperforming locations. High CapEx remains a key barrier, particularly for premium VR and mixed-reality attractions.

Rapid Content Obsolescence

The fast pace of technological innovation leads to shorter content life cycles. Experiences can become outdated quickly, requiring frequent reinvestment to maintain consumer interest. Operators that fail to refresh content risk declining footfall and reduced profitability, making continuous innovation a critical challenge.

What are the key opportunities in the location-based entertainment industry?

Government-Backed Urban Entertainment Infrastructure

Governments across Asia-Pacific, the Middle East, and parts of Europe are investing heavily in tourism, smart cities, and mixed-use urban developments. LBE venues are increasingly incorporated as anchor attractions in these projects, benefiting from favorable regulations, long-term leases, and public-private partnerships. This creates scalable expansion opportunities for both global and regional players.

AI-Enabled and Cloud-Based LBE Platforms

The integration of artificial intelligence and cloud technologies presents significant growth opportunities. AI enables adaptive storytelling, dynamic difficulty levels, and personalized user journeys, while cloud-based platforms reduce hardware dependency and enable faster rollout of new content. These innovations improve profitability and open the market to smaller, modular venue formats.

Entertainment Format Insights

VR-based attractions dominate the location-based entertainment market, accounting for approximately 34% of global revenue in 2024. Their dominance is driven by high consumer engagement, scalable footprints, and strong appeal across age groups. Traditional non-digital attractions continue to play a role in family-focused venues, while immersive media and projection-based experiences are gaining traction for large-scale events and exhibitions. Mixed reality and XR attractions represent a fast-growing niche, particularly in premium venues and branded IP-driven experiences.

Venue Type Insights

Theme parks and amusement parks represent the largest venue segment, contributing nearly 29% of total market revenue, supported by high visitor volumes and premium pricing. Shopping malls and retail centers are the fastest-growing venue type, leveraging LBE to boost footfall and dwell time. Standalone LBE centers and family entertainment centers remain popular in urban areas, offering flexible formats and faster ROI.

End-Use Insights

The amusement and theme park industry remains the largest end-use segment, with LBE-driven revenues exceeding USD 24 billion in 2024. Retail and hospitality end uses are growing at double-digit rates, driven by experiential real estate strategies. New applications are emerging in education, exhibitions, and corporate engagement, expanding the market’s addressable base and reducing reliance on traditional entertainment venues.

| By Entertainment Format | By Venue Type | By Consumer Group | By Revenue Model | By Technology Deployment |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global location-based entertainment market with approximately 38% share in 2024. China is the largest contributor, accounting for nearly 18% of global demand, supported by large-scale theme parks and government-backed entertainment infrastructure. Japan and South Korea remain technology-driven markets, while India and Southeast Asia are emerging as high-growth regions due to rising disposable incomes and mall expansion.

North America

North America accounts for around 27% of the global market, led by the United States, which alone contributes about 22%. High consumer spending, strong IP-driven entertainment ecosystems, and rapid adoption of immersive technologies support market maturity and steady growth.

Europe

Europe represents roughly 20% of the global market, with strong demand from the U.K., Germany, and France. The region emphasizes immersive cultural experiences, museums, and projection-based entertainment, supported by tourism-driven demand.

Latin America

Latin America contributes close to 8% of global revenue, led by Brazil and Mexico. Growth is driven by mall-based entertainment centers and increasing investment in urban leisure infrastructure.

Middle East & Africa

The Middle East & Africa region accounts for about 7% of the market, with the UAE and Saudi Arabia emerging as high-growth hubs due to large-scale tourism and entertainment investments. Africa shows growing adoption of LBE in tourism-focused developments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Location-Based Entertainment Market

- Disney Parks, Experiences, and Products

- Universal Parks & Resorts

- Merlin Entertainments

- Wanda Group

- Six Flags Entertainment

- Comcast NBCUniversal

- Village Roadshow Theme Parks

- Sega Sammy Holdings

- Bandai Namco Holdings

- Sony Group Corporation

- HTC Corporation

- Meta Platforms (Oculus Studios)

- Simworx

- Holovis International

- Triotech