Live Streaming Pay-Per-View Market Size

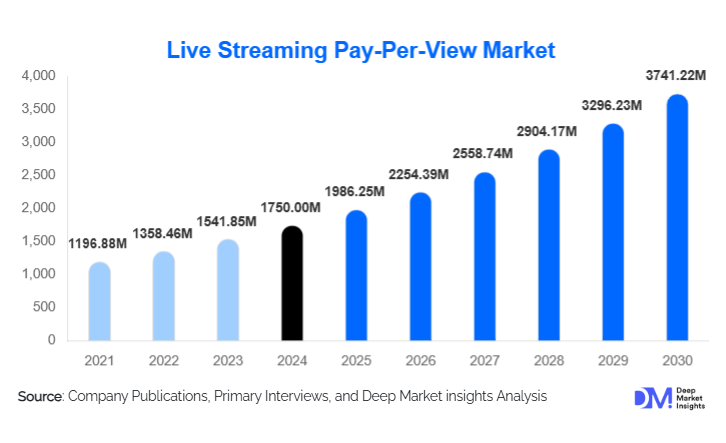

According to Deep Market Insights, the global live streaming pay-per-view market size was valued at USD 1,750.00 million in 2024 and is projected to grow from USD 1,986.25 million in 2025 to reach USD 3,741.22 million by 2030, expanding at a CAGR of 13.5% during the forecast period (2025–2030). The live streaming PPV market growth is primarily driven by the rapid shift toward digital-first content consumption, increasing willingness to pay for exclusive live events, and the expanding monetization strategies of sports leagues, entertainment companies, and independent creators.

Key Market Insights

- Sports and live entertainment dominate PPV revenues, driven by high-value exclusive events such as combat sports, football leagues, concerts, and festivals.

- Mobile-based PPV consumption leads globally, supported by widespread smartphone adoption and integrated digital payment systems.

- North America holds the largest market share, led by the U.S., due to high consumer spending power and mature digital infrastructure.

- Asia-Pacific is the fastest-growing region, fueled by esports, mobile-first audiences, and expanding middle-class demand.

- Hybrid monetization models combining PPV, subscriptions, and advertising are reshaping revenue strategies.

- Advanced streaming technologies such as AI analytics, ultra-HD streaming, and interactive features are improving conversion rates and viewer engagement.

What are the latest trends in the live streaming pay-per-view market?

Rise of Creator-Led and Direct-to-Consumer PPV Platforms

One of the most prominent trends in the live streaming PPV market is the rapid rise of creator-led and direct-to-consumer platforms. Independent creators, musicians, educators, and fitness professionals are increasingly bypassing traditional broadcasters and social media platforms by hosting exclusive PPV events on owned or white-label platforms. This shift allows creators to retain a higher share of revenues, control pricing, and access detailed audience analytics. The trend is supported by easy-to-deploy streaming infrastructure, integrated payment gateways, and scalable cloud-based delivery systems, making PPV accessible even to small-scale content producers.

Interactive and Immersive Viewing Experiences

Platforms are increasingly enhancing PPV offerings through interactive and immersive features. Multi-camera angle selection, live chats, real-time polls, audience tipping, and virtual meet-and-greet sessions are becoming standard for premium PPV events. Additionally, early adoption of AR and VR technologies for concerts and sports events is enabling platforms to offer differentiated premium tiers. These innovations significantly increase viewer engagement, justify higher pricing, and improve customer retention, particularly among younger and tech-savvy audiences.

What are the key drivers in the live streaming pay-per-view market?

Growing Willingness to Pay for Exclusive Live Content

Consumers are increasingly willing to pay for exclusive, real-time content that cannot be easily replicated on on-demand platforms. High-profile sports matches, championship fights, and limited-availability concerts drive urgency and perceived value, making PPV a preferred monetization model. The emotional and communal nature of live events further reinforces consumer demand, supporting consistent revenue generation across regions.

Expansion of High-Speed Internet and 5G Networks

The global rollout of high-speed broadband and 5G connectivity has significantly improved streaming reliability, reduced latency, and enabled ultra-HD live broadcasts. These advancements have expanded the addressable PPV audience, particularly in emerging markets where mobile networks are the primary access point for digital content. Improved infrastructure directly supports higher-quality PPV experiences and larger concurrent viewership.

What are the restraints for the global market?

Piracy and Unauthorized Content Distribution

Content piracy remains a major restraint for the live streaming PPV market. Illegal streaming links and unauthorized rebroadcasts of premium events can significantly erode revenues, particularly for sports and entertainment content with high production costs. Despite advancements in DRM and watermarking technologies, piracy continues to pose a structural challenge to sustainable monetization.

Price Sensitivity and Subscription Fatigue

As consumers face an increasing number of paid digital services, price sensitivity and subscription fatigue are emerging concerns. High PPV prices for frequent events may discourage repeat purchases, especially in price-sensitive markets. Platforms must carefully balance pricing strategies with value-added features to maintain long-term growth.

What are the key opportunities in the live streaming pay-per-view industry?

Rapid Growth of Esports and Competitive Gaming PPV

The esports sector presents a major growth opportunity for live streaming PPV platforms. High-stakes tournaments, championship finals, and influencer-driven gaming events are increasingly adopting PPV models. With a global, digitally native audience and strong brand loyalty, esports PPV is expected to deliver above-average growth rates and attract new platform entrants.

Enterprise and Professional Event Monetization

Corporations and professional organizations are increasingly using PPV for conferences, product launches, certifications, and executive training programs. This creates opportunities for platforms offering secure, scalable, and analytics-driven enterprise streaming solutions. Enterprise PPV events typically command higher price points and predictable demand, enhancing revenue stability.

Content Type Insights

Sports events represent the largest content segment, accounting for approximately 38% of global PPV revenues in 2024, driven by combat sports, football leagues, and championship events. Entertainment and concerts follow closely, supported by global artist fan bases and digital-first performances. Esports content is the fastest-growing segment, expanding at over 20% CAGR, while conferences, education, and religious events represent stable, recurring revenue streams.

Platform Type Insights

Dedicated PPV streaming platforms dominate the market due to superior monetization tools, content security, and scalability. Social media-integrated PPV platforms are gaining traction for creator-led events, while OTT and media network platforms leverage existing subscriber bases to upsell premium live events. Enterprise streaming platforms are emerging as a high-value niche.

Device Insights

Smartphones account for approximately 41% of global PPV consumption, reflecting mobile-first viewing behavior. Smart TVs represent a growing share, particularly for sports and entertainment events, while desktops and laptops remain relevant for enterprise and educational PPV use cases.

End-Use Industry Insights

The media and entertainment industry leads PPV adoption, followed by sports and athletics. Gaming and esports are the fastest-growing end-use segments, while corporate, education, and religious organizations are increasingly adopting PPV models for monetized live events. Export-driven demand is rising as content produced in the U.S., Japan, and South Korea reaches global audiences.

| By Content Type | By Monetization Model | By Platform Type | By Device Type | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global live streaming PPV market in 2024. The United States dominates regional demand, supported by a strong professional sports ecosystem, high per-capita digital content spending, and mature broadband and OTT infrastructure. Exclusive broadcasting rights for major leagues, pay-per-event combat sports, and expanding creator-led PPV formats continue to reinforce monetization and audience retention.

Europe

Europe holds around 21% of global market share, led by the U.K., Germany, and France. Demand is driven by football-related PPV events, live music and cultural performances, and established public-to-private broadcaster partnerships. The region is seeing steady uptake of hybrid monetization models that combine subscriptions, PPV, and ad-supported access.

Asia-Pacific

Asia-Pacific represents roughly 29% of the global live streaming PPV market and remains the fastest-growing region. China, India, Japan, and South Korea are key contributors, fueled by large-scale esports viewership, mobile-first streaming behavior, and rapid adoption of digital wallets and in-app payments. Platform innovation and localized content strategies are accelerating user monetization.

Latin America

Latin America accounts for approximately 9% of the global market, with Brazil and Mexico leading regional demand. Growth is supported by strong interest in football and combat sports PPV, rising smartphone penetration, and improved access to affordable streaming platforms. Local leagues and regional creators are increasingly monetizing live events through PPV formats.

Middle East & Africa

The Middle East & Africa region holds around 7% market share, with the UAE and Saudi Arabia emerging as primary growth hubs. Investments in digital entertainment, international sports hosting, and premium live events are driving PPV adoption. Expanding internet coverage and platform localization are further supporting market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Live Streaming Pay-Per-View Market

- Amazon

- Apple

- Disney

- Comcast

- Netflix

- DAZN Group

- Endeavor Group

- Sony Group

- Warner Bros. Discovery

- Tencent

- ByteDance

- Meta Platforms

- Microsoft

- Rakuten Group

Recent Developments

- In April 2025, Amazon Prime Video introduced new pay-per-view livestreaming options for select global sporting events, expanding its transactional streaming capabilities beyond subscriptions.

- In March 2025, DAZN confirmed additional pay-per-view boxing and combat sports partnerships, reinforcing its hybrid subscription and PPV monetization model.

- In February 2025, YouTube expanded paid live event features for creators and media partners, enabling ticketed livestreams with integrated chat and replay access.