Lingerie Market Size

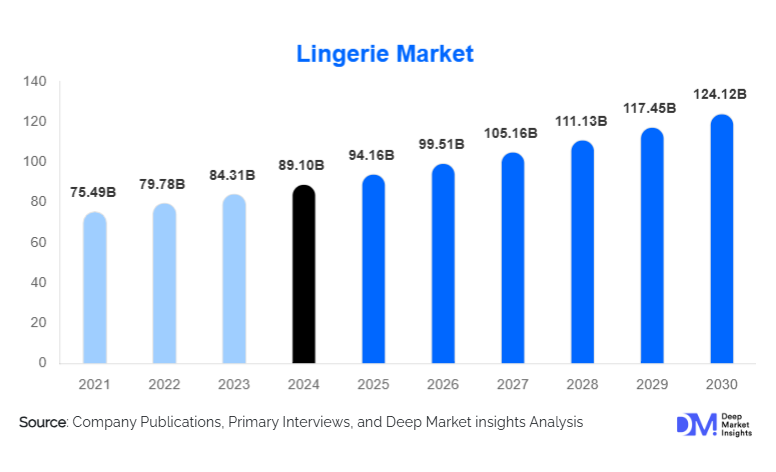

According to Deep Market Insights, the global lingerie market was valued at USD 89.10 billion in 2024 and is projected to grow from USD 94.16 billion in 2025 to reach USD 124.12 billion by 2030, expanding at a CAGR of 5.68% during the forecast period (2025–2030). The lingerie market’s growth is driven by rising fashion consciousness, increasing adoption of premium and functional lingerie, widening e-commerce penetration, and a stronger focus on inclusivity and sustainability across global brands.

Key Market Insights

- Bras remain the largest product segment, accounting for over 41% of global market share due to higher purchase frequency and expanding sports and bralette categories.

- Online retail channels dominate growth, contributing 36% of global sales in 2024, supported by virtual fittings, personalized recommendations, and D2C brand expansion.

- Asia-Pacific is the fastest-growing region, led by rising female workforce participation, urbanization, and digital retail adoption in China and India.

- North America and Europe lead premium and luxury lingerie demand, driven by high disposable incomes and a preference for sustainable, high-quality materials.

- Material innovation in sustainable fibers, including bamboo, recycled polyester, and organic cotton, is rapidly reshaping product development.

- Functional lingerie, such as sports bras and shapewear, continues to outperform traditional categories as consumers prioritize comfort and utility.

What are the latest trends in the lingerie market?

Inclusive and Body-Positive Lingerie Gaining Traction

Brands across the globe are shifting toward inclusive sizing, diverse body representation, and comfort-first design philosophies. Plus-size, petite, and maternity lingerie ranges are expanding rapidly as brands adopt universal sizing systems and advanced fit technologies such as 3D body scanning and AI-assisted pattern design. This trend is also supported by social media movements encouraging realistic beauty standards. Major companies are increasing their product lines to accommodate cup sizes beyond conventional ranges, reflecting a more consumer-centric approach to fit, comfort, and diversity.

Technology-Enhanced Lingerie Design and Retailing

Technology is becoming integral across the lingerie value chain, from 3D-knitted lingerie to moisture-wicking smart fabrics and virtual try-on experiences. AI-driven sizing recommendations are reducing return rates, while AR-based fitting rooms are transforming online shopping engagement. Digital product passports, QR-based transparency labels, and sustainability ratings are being adopted by brands to communicate ethical sourcing practices. E-commerce platforms now integrate personalized curation tools, while D2C players rely on AI styling assistance and predictive analytics to refine inventory and boost conversion rates.

What are the key drivers in the lingerie market?

Premiumization and Fashion-Forward Lingerie Demand

Consumers are increasingly favoring aesthetically appealing, fashion-oriented lingerie over basic functional products. Premium and luxury ranges are seeing strong adoption in Europe, North America, and urban Asia. Designer collaborations, limited-edition collections, and high-performance fabrics amplify the appeal of premium categories. This shift is reinforced by rising income levels, lifestyle evolution, and the growing willingness to spend on intimate apparel as part of personal style expression.

Rise of E-Commerce and D2C Lingerie Brands

E-commerce has transformed the lingerie sector, enabling privacy, wider assortment access, and improved fit guidance. D2C brands such as Aerie, ThirdLove, and Savage X Fenty have gained massive traction by leveraging inclusive marketing, subscription models, and data-driven personalization. Online lingerie sales now represent over one-third of global revenue, with double-digit growth expected in emerging markets.

What are the restraints for the global market?

Volatile Raw Material Costs

Fluctuating prices of cotton, nylon, spandex, lace, and other fibers create significant cost pressures for manufacturers. Cotton crop variability, rising oil prices impacting synthetics, and supply disruptions in textile hubs increase production costs and compress margins. These challenges particularly affect small and mid-sized manufacturers operating in price-sensitive markets.

Prevalence of Counterfeit and Low-Quality Imports

The lingerie industry faces widespread issues with counterfeit products, especially across developing regions. Low-quality imports undermine brand value, distort pricing dynamics, and reduce consumer trust. Premium brands experience the greatest impact, as knockoff versions imitate designs at lower prices without maintaining quality standards.

What are the key opportunities in the lingerie industry?

Expansion of Sustainable & Eco-Friendly Lingerie

The sustainability wave presents one of the strongest opportunities for market differentiation. Growing environmental awareness is driving demand for eco-conscious materials such as bamboo fibers, organic cotton, recycled nylon, and biodegradable lace. Brands adopting circular design principles, water-efficient dyeing, and transparent supply chains are increasingly favored by environmentally conscious consumers. EU textile regulations and Asian eco-manufacturing incentives further support this shift.

Technology-Led Customization & Smart Lingerie

AI-driven fit personalization, 3D-knit lingerie, and smart fabrics enable brands to offer better comfort, enhanced durability, and tailored performance features. Moisture management, temperature regulation, antimicrobial finishing, and seamless designs are gaining traction, especially in sports bras and shapewear categories. Tech-enabled customization improves customer satisfaction and reduces returns, critical advantages in e-commerce-driven markets.

Product Type Insights

Brands dominate the product landscape, holding 41% of the global market share in 2024. Their leading position is driven by higher purchase frequency, expansion of sports and comfort-focused designs, and rising consumer awareness around correct fit. Panties and briefs follow closely due to multipack purchases and growing preference for comfort-driven styles such as hipsters and high-waist briefs. Shapewear continues to gain relevance with rising adoption in everyday fashion, driven by improved material technology and wider body acceptance campaigns. Nightwear and loungewear are expanding rapidly through online retail and the global shift towards comfort-centric fashion following work-from-home culture.

Material Insights

Cotton remains the most widely used lingerie material, accounting for 33% of 2024 demand due to its breathability, comfort, skin-friendliness, and cultural relevance in Asian markets. Synthetic blends like nylon, polyester, and elastane dominate fashion-forward and performance categories due to their stretchability and durability. Sustainable materials are the fastest-growing sub-segment, with double-digit adoption driven by eco-conscious consumers and regulatory support for green textile production.

Distribution Channel Insights

Online channels contribute 36% of total market revenue, supported by personalised recommendations, privacy preferences, and data-driven fit tools. D2C brands thrive via influencer marketing, subscription models, and curated collections. Offline retail, department stores, speciality lingerie outlets, and hypermarkets continue to dominate in emerging markets where physical try-on is preferred. Hybrid retail models, combining online browsing with in-store pickups and curated fittings, are gaining global traction.

End-User Insights

Women account for 92% of total lingerie consumption, reflecting the category’s core demographic. The rise of comfortable, gender-neutral lingerie is expanding unisex adoption. Men’s lingerie and shapewear represent a niche but steadily growing segment, driven by rising awareness of fit, support, and athleisure trends. Maternity wear is also experiencing robust growth due to increasing global childbirth rates and enhanced functional design innovation in nursing bras and support garments.

| By Product Type | By Material Type | By Distribution Channel | By Price Range | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America held 28% of the global market share in 2024, led by the U.S. The region’s strong purchasing power, high adoption of premium and inclusive lingerie, and dominance of e-commerce platforms foster continued growth. Size-inclusive collections and sustainable materials have strong resonance among U.S. consumers.

Europe

Europe captured 26% of the global share, with major markets including Germany, the U.K., France, and Italy. European buyers prioritize craftsmanship, comfort, and sustainability. Luxury lingerie and eco-friendly materials are particularly popular in Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a projected CAGR of 7.8%. China alone accounts for around 18% of global lingerie consumption, while India represents the fastest-growing national market (CAGR 9%). Rising incomes, urbanization, and e-commerce expansion underpin this growth.

Latin America

Brazil, Mexico, and Colombia lead LATAM consumption, driven by a mix of domestic manufacturing and growing fashion consciousness. The region leans toward mid-range and affordable premium segments with rising interest in shapewear.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa dominate lingerie demand across the MEA region. Premiumization trends, cultural shifts, and global brand penetration support strong market expansion. African markets are experiencing increasing adoption of mass-market lingerie due to urbanization.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Lingerie Market

- Victoria’s Secret

- Hanesbrands

- Triumph International

- PVH Corp (Calvin Klein)

- L Brands

- Wacoal Holdings

- Jockey International

- Hunkemöller

- Chantelle Group

- MAS Holdings

- Ralph Lauren

- AEO (Aerie)

- La Perla

- Wolford AG

- Marks & Spencer

Recent Developments

- In March 2025, Victoria’s Secret expanded its inclusive lingerie line with extended sizes and eco-friendly materials.

- In January 2025, Wacoal launched a 3D-knit seamless lingerie collection aimed at comfort-focused younger consumers.

- In April 2025, Aerie introduced a new AI-powered virtual fitting tool to reduce return rates and improve customer satisfaction.