Leisure and Defense Power Boats Market Size

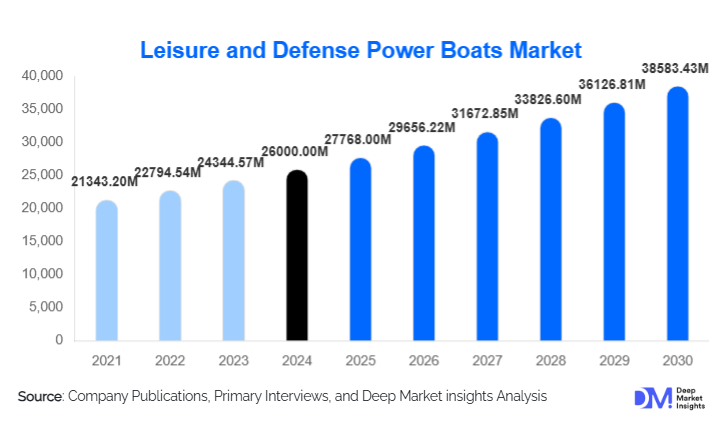

According to Deep Market Insights, the global leisure and defense power boats market size was valued at USD 26,000.00 million in 2024 and is projected to grow from USD 27,768.00 million in 2025 to reach USD 38,583.43 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). Market growth is driven by rising recreational boating participation, expanding marine tourism, and increasing global investments in naval modernization and coastal security. The dual nature of the market, combining discretionary leisure spending with mission-critical defense procurement, provides resilience against economic cycles and supports long-term demand stability.

Key Market Insights

- Leisure power boats account for over 60% of the total market value, supported by rising disposable incomes and growth in coastal and inland water tourism.

- Defense power boats generate higher margins due to specialized designs, advanced electronics, and long-term government contracts.

- North America dominates global demand, led by the U.S. leisure boating ecosystem and sustained naval expenditure.

- Asia-Pacific is the fastest-growing region, driven by defense fleet expansion and an emerging leisure boating culture.

- Outboard propulsion systems lead adoption, favored for flexibility, maintenance ease, and cost efficiency.

- Electrification and hybrid propulsion are gaining traction, particularly in Europe and North America.

What are the latest trends in the leisure and defense power boats market?

Electrification and Hybrid Marine Propulsion

Electric and hybrid propulsion systems are increasingly being integrated into leisure power boats to meet emission regulations and sustainability goals. European markets are leading adoption due to stringent environmental norms, while North America is seeing growing demand for electric pontoon and recreational boats. In defense applications, hybrid propulsion is being explored to reduce acoustic signatures and fuel dependency, especially for surveillance and special operations vessels.

Advanced Materials and Digital Navigation

Manufacturers are adopting lightweight composites such as carbon fiber and hybrid materials to improve speed, fuel efficiency, and durability. Digital navigation systems, AI-assisted radar, and integrated command-and-control platforms are becoming standard, particularly in defense and high-end leisure boats. These technologies enhance situational awareness, operational safety, and lifecycle efficiency.

What are the key drivers in the leisure and defense power boats market?

Rising Global Defense and Coastal Security Spending

Governments worldwide are increasing investments in patrol, interceptor, and fast attack craft to address maritime security threats such as piracy, smuggling, and territorial disputes. Defense power boats benefit from long-term procurement programs, modernization cycles, and export demand, particularly from the Asia-Pacific, the Middle East, and Africa.

Growth in Recreational Boating and Marine Tourism

Leisure boating participation has increased significantly post-pandemic, with consumers prioritizing outdoor and experiential recreation. Growth in yacht charters, water sports tourism, and private boat ownership is driving demand for recreational cruisers, sport boats, and luxury yachts, particularly in North America and Europe.

What are the restraints for the global market?

High Capital and Ownership Costs

Power boats involve significant upfront investment, maintenance, insurance, and fuel costs, limiting adoption in price-sensitive markets. Luxury and defense vessels are particularly capital-intensive, which can slow replacement cycles during economic downturns.

Environmental and Regulatory Pressures

Stricter emission, noise, and marine ecosystem protection regulations are increasing compliance costs for manufacturers relying on traditional internal combustion propulsion systems. Regulatory fragmentation across regions also complicates global product standardization.

What are the key opportunities in the leisure and defense power boats industry?

Naval Fleet Modernization in Emerging Economies

Countries in the Asia-Pacific, the Middle East, and Africa are actively upgrading coastal and riverine fleets. Demand for modular, multi-mission power boats presents opportunities for OEMs with flexible design platforms and localized manufacturing strategies.

Expansion of Charter and Shared Ownership Models

The growth of boat chartering and fractional ownership models is expanding access to leisure boating. Charter operators are investing in modern, fuel-efficient fleets, creating recurring replacement demand for mid-sized power boats.

Product Type Insights

Leisure power boats dominate the market with approximately 61% share in 2024, driven by recreational cruising, fishing, and luxury yachting. Defense power boats, while lower in volume, contribute disproportionately to revenue due to advanced systems integration and higher unit prices. Patrol and interceptor boats represent the largest defense sub-segment, reflecting global maritime security priorities.

Propulsion Type Insights

Outboard engines lead the market with nearly 39% share, favored for versatility and maintenance efficiency. Inboard engines and water jet propulsion systems are widely used in larger leisure boats and defense vessels. Hybrid and electric propulsion, though currently a smaller share, represent the fastest-growing category.

End-Use Insights

Private individual owners account for about 42% of total demand, while naval and coast guard forces represent the fastest-growing end-use segment with growth exceeding 9% CAGR. Charter and rental operators are emerging as a high-growth segment, particularly in tourism-centric regions.

| By Application Type | By Hull Material | By Propulsion Type | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the market with approximately 36% share in 2024, driven by the United States’ strong recreational boating culture and sustained defense spending. The U.S. is also the largest importer of leisure and defense power boats globally.

Europe

Europe holds nearly 28% market share, led by Italy, France, Germany, and the U.K. The region is a global hub for luxury yacht manufacturing and is at the forefront of electric and hybrid boat adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 9.5% CAGR. China, Japan, South Korea, and India are investing heavily in naval modernization, while leisure boating is gaining popularity among high-income consumers.

Latin America

Latin America shows moderate growth, led by Brazil and Mexico. Demand is driven by recreational boating and limited but growing defense procurement.

Middle East & Africa

The Middle East, particularly Saudi Arabia and the UAE, demonstrates strong defense-driven demand. Africa sees growing investment in patrol and SAR boats to support maritime security and offshore resource protection.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Leisure and Defense Power Boats Market

- Brunswick Corporation

- Groupe Beneteau

- Ferretti Group

- Damen Shipyards Group

- Fincantieri

- BAE Systems

- Lürssen

- Huntington Ingalls Industries

- Mitsubishi Heavy Industries

- Austal

- Sunseeker International

- Naval Group

- Zodiac Nautic

- Hyundai Heavy Industries

- Damen Fast Crew Suppliers