LED Lanterns Market Size

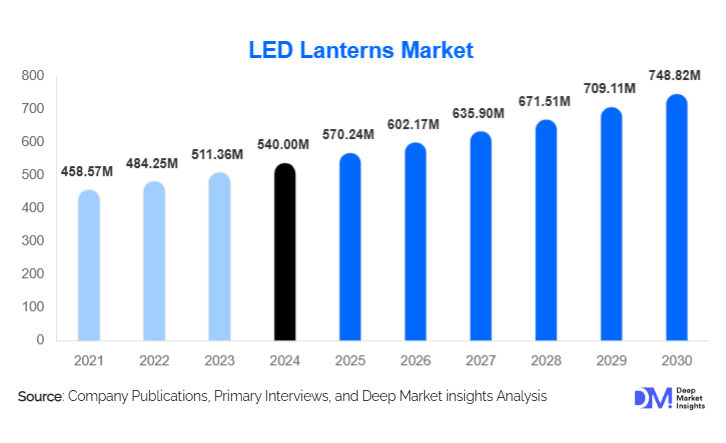

According to Deep Market Insights, the global LED lanterns market size was valued at USD 540.00 million in 2024 and is projected to grow from USD 570.24 million in 2025 to reach USD 748.82 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The LED lanterns market growth is primarily driven by rising demand for energy-efficient portable lighting, increasing adoption of off-grid and solar-powered solutions, and expanding applications across residential, outdoor, emergency, and commercial sectors.

Key Market Insights

- Rechargeable and solar-powered LED lanterns dominate demand, supported by falling battery costs and sustainability-driven consumer preferences.

- Asia-Pacific leads global consumption, driven by rural electrification programs, disaster preparedness needs, and high population density.

- Outdoor recreation and emergency preparedness are high-growth applications, particularly in North America and Europe.

- Residential backup lighting remains the largest application segment, fueled by grid instability and rising awareness of energy resilience.

- E-commerce is the fastest-growing distribution channel, enabling wider product access and price transparency.

- Technological advancements, including fast charging, hybrid power sources, and high-lumen efficiency, are reshaping product differentiation.

What are the latest trends in the LED lanterns market?

Rising Adoption of Solar and Hybrid LED Lanterns

Solar-powered and hybrid LED lanterns are gaining significant traction as governments and consumers prioritize renewable energy solutions. These lanterns are widely adopted in off-grid regions across Asia-Pacific, Africa, and Latin America, where access to reliable electricity remains limited. Hybrid models combining solar charging with rechargeable batteries are increasingly preferred, as they offer uninterrupted lighting during adverse weather conditions. This trend is also supported by declining solar panel costs and government-backed clean energy initiatives, positioning solar LED lanterns as a long-term growth pillar.

Technology-Driven Product Innovation

Manufacturers are integrating advanced features such as USB-C fast charging, power bank functionality, adjustable lumen settings, and rugged waterproof designs. Smart LED lanterns with battery indicators and extended runtime optimization are becoming popular among outdoor enthusiasts and commercial users. Improvements in lithium-ion battery energy density and LED chip efficiency are enabling higher brightness with longer operational life, enhancing value propositions across premium and mid-range product categories.

What are the key drivers in the LED lanterns market?

Growing Demand for Energy-Efficient Portable Lighting

LED lanterns offer significantly lower energy consumption, longer lifespan, and improved safety compared to traditional kerosene and incandescent lanterns. Rising electricity costs and sustainability awareness are accelerating the replacement of conventional lighting with LED-based solutions. This driver is particularly strong in residential and emergency preparedness segments, where reliability and cost efficiency are critical purchasing factors.

Expansion of Off-Grid and Emergency Lighting Applications

Frequent power outages, natural disasters, and climate-related emergencies are increasing reliance on portable LED lanterns. Governments, disaster relief agencies, and households are stockpiling LED lanterns as essential emergency equipment. Additionally, rural electrification initiatives across developing economies are boosting large-scale deployment of solar LED lanterns, reinforcing long-term demand stability.

What are the restraints for the global market?

Intense Price Competition and Margin Pressure

The LED lanterns market faces strong price competition from unorganized and regional manufacturers, particularly in emerging economies. Low-cost alternatives exert downward pricing pressure, impacting profitability for established brands. Maintaining quality differentiation while remaining cost-competitive remains a key challenge for market participants.

Battery Disposal and Environmental Concerns

Environmental concerns related to battery disposal and recycling infrastructure pose challenges, especially for battery-operated and rechargeable lanterns. Regulatory scrutiny around battery waste management could increase compliance costs unless manufacturers adopt sustainable battery technologies and recycling programs.

What are the key opportunities in the LED lanterns industry?

Government-Led Rural Electrification and Clean Energy Programs

Public-sector initiatives promoting solar lighting and energy access present significant opportunities for LED lantern manufacturers. Large-scale procurement programs in Asia-Pacific and Africa provide stable, high-volume demand. Partnerships with NGOs and government agencies enable market penetration into underserved regions while supporting social and environmental goals.

Growth in Outdoor Recreation and Adventure Tourism

The expanding global outdoor recreation industry is driving demand for high-performance, rugged LED lanterns. Camping, hiking, fishing, and adventure sports participants increasingly prefer durable, weather-resistant lanterns with high lumen output. This segment offers premium pricing potential and strong brand loyalty for manufacturers targeting outdoor enthusiasts.

Product Type Insights

Portable LED lanterns account for the largest share of the market, representing approximately 38% of global revenue in 2024, due to their affordability and versatility. Rechargeable LED lanterns lead by power configuration, holding nearly 42% market share, driven by lower operating costs and convenience. Solar-powered and hybrid lanterns are the fastest-growing sub-segments, supported by sustainability trends and off-grid demand.

Application Insights

Residential and household applications dominate the market with around 34% share, reflecting widespread use as backup lighting. Outdoor and recreational applications are the fastest-growing, expanding at over 11% CAGR, while emergency and disaster relief applications continue to gain importance due to climate volatility. Commercial and industrial usage, including construction and defense, provides stable institutional demand.

Distribution Channel Insights

Offline retail channels account for approximately 61% of global sales, supported by a strong presence in rural and semi-urban areas. However, online distribution is growing rapidly, driven by e-commerce expansion, direct-to-consumer strategies, and improved logistics. Digital platforms enable better product comparison, competitive pricing, and broader geographic reach.

| By Product Type | By Power Source | By Light Output | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the LED lanterns market with nearly 39% market share in 2024. China and India are the primary contributors, supported by large rural populations, government electrification programs, and strong manufacturing ecosystems. India is the fastest-growing country, with growth exceeding 12% CAGR, driven by solar adoption and residential demand.

North America

North America accounts for approximately 24% of global demand, led by the United States. Strong outdoor recreation culture, emergency preparedness awareness, and preference for premium lighting products drive regional growth. High-lumen and rechargeable lanterns dominate sales in this region.

Europe

Europe represents around 21% of the market, driven by sustainability regulations, consumer preference for energy-efficient products, and strong outdoor leisure activities. Germany, the U.K., and France are key markets, with steady demand for high-quality rechargeable lanterns.

Latin America

Latin America contributes a moderate demand, led by Brazil and Mexico. Growth is supported by improving access to electricity, rising outdoor activity participation, and increasing adoption of affordable LED lighting solutions.

Middle East & Africa

The Middle East & Africa region shows strong long-term growth potential, driven by off-grid lighting needs and disaster preparedness. Africa, in particular, is a major importer of solar LED lanterns due to limited grid infrastructure and strong NGO involvement.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the LED Lanterns Market

- Signify (Philips)

- Panasonic Corporation

- Energizer Holdings

- Osram GmbH

- Ledlenser

- Black Diamond Equipment

- Coleman Company

- Goal Zero

- Fenix Lighting

- Streamlight

- Nitecore

- Duracell

- Eveready Industries

- GE Lighting

- Varta AG