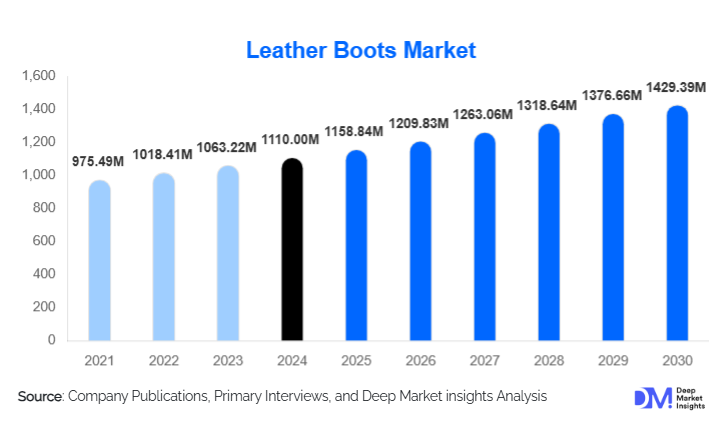

Leather Boots Market Size

According to Deep Market Insights, the global leather boots market size was valued at USD 1,110.00 million in 2024 and is projected to grow from USD 1,158.84 million in 2025 to reach USD 1,429.39 million by 2030, expanding at a CAGR of 4.4% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for durable and fashion-forward footwear, rising consumer preference for premium and sustainable leather boots, and the expansion of digital retail channels enabling personalized and direct-to-consumer purchases worldwide.

Key Market Insights

- Sustainability and eco-conscious production are gaining traction, with consumers increasingly favoring vegetable-tanned, recycled, and ethically sourced leather products.

- Casual and fashion-oriented leather boots dominate global demand, catering to lifestyle and urban fashion trends while maintaining functional versatility.

- Asia Pacific leads in volume consumption, driven by China and India, supported by urbanization, rising disposable incomes, and growing outdoor activity participation.

- North America and Europe remain key premium markets, propelled by outdoor lifestyles, fashion trends, and industrial safety requirements.

- Digital and direct-to-consumer channels are reshaping purchasing behavior, enabling customization, virtual try-on experiences, and enhanced consumer engagement.

- Technological integration, including AR-enabled fittings, AI-driven recommendations, and sustainable supply chain tracking, is redefining the consumer experience.

What are the latest trends in the leather boots market?

Sustainable and Eco-Friendly Leather Adoption

Manufacturers are increasingly adopting sustainable production methods to address environmental and ethical concerns. Vegetable-tanned, recycled, and traceable leather sourcing is gaining preference, particularly in Europe and North America. Brands offering certified eco-leather products attract environmentally conscious consumers willing to pay a premium. Partnerships with sustainable tanneries and transparent supply chains strengthen brand credibility while supporting corporate social responsibility goals. Adoption of low-impact tanning processes, water conservation methods, and chemical-free finishing is gradually becoming a standard across the industry.

Digital and Personalized Purchasing Experience

Technological innovations in e-commerce are transforming how consumers engage with leather boots. AR-enabled virtual try-on, AI-driven size and style recommendations, and personalized design options allow buyers to customize leather boots with choices of color, stitching, sole type, and even personalized engraving. Younger demographics in North America, Europe, and the Asia Pacific are particularly drawn to these interactive digital experiences. Direct-to-consumer platforms and online marketplaces also facilitate easier comparison of products, pricing transparency, and faster delivery, enhancing the overall shopping experience and driving repeat purchases.

What are the key drivers in the leather boots market?

Growing Demand for Durable and High-Quality Footwear

Consumers increasingly prefer durable leather boots that offer comfort, long-lasting performance, and versatility for multiple occasions. Functional attributes such as waterproofing, slip resistance, and ergonomic fit make leather boots popular in work, outdoor, and urban fashion categories. Rising awareness of long-term value and preference for premium quality drives consistent market growth across both developed and emerging economies.

Fashion Influence and Premiumization

Leather boots have become a fashion staple, with seasonal trends, celebrity endorsements, and lifestyle influences significantly driving demand. Mid-range and premium segments benefit from aspirational purchasing behavior, offering higher profit margins for manufacturers. Limited-edition and designer collections, as well as fashion collaborations, continue to stimulate repeat purchases and brand loyalty.

Expansion of Digital Retail and Distribution Channels

E-commerce platforms, social media marketing, and direct-to-consumer channels have expanded the global reach for leather boots. Brands can now access niche markets and younger demographics more effectively, leveraging personalized marketing campaigns, virtual fittings, and online customization options. The digital channel also enables improved inventory management and supply chain efficiency, supporting global expansion.

What are the restraints for the global market?

Volatility in Raw Material Prices

Leather prices are highly dependent on livestock availability, hide quality, and global commodity markets. Price fluctuations can impact manufacturing costs, squeeze profit margins, and pose challenges for small and mid-sized producers in maintaining competitive pricing while delivering high-quality products.

Environmental and Regulatory Challenges

The traditional leather industry involves chemical-intensive tanning and significant water usage, leading to environmental scrutiny and stricter regulations. Compliance with environmental standards, ethical sourcing policies, and production certifications increases operational costs. Failure to meet regulatory and consumer expectations can negatively impact market adoption, particularly in Europe and North America.

What are the key opportunities in the leather boots industry?

Sustainable Leather Innovations

Investing in eco-friendly and traceable leather production provides a major growth opportunity. Sustainable practices appeal to environmentally conscious consumers, enabling brands to charge premium prices and differentiate in competitive markets. Collaboration with eco-certified tanneries and transparent supply chains can also strengthen brand reputation and align with government sustainability incentives.

Emerging Market Penetration

Emerging economies, particularly India, Southeast Asia, and Latin America, present significant growth potential due to rising disposable incomes and urbanization. Expanding manufacturing capabilities under initiatives like “Make in India” and favorable trade policies provide an opportunity for both local and international brands to capture new consumer segments in these regions.

Expansion in Specialized Segments

Work, safety, and outdoor adventure segments are witnessing growing demand globally. Industrial safety boots are increasingly adopted due to infrastructure development, regulatory compliance, and occupational safety requirements. Outdoor and adventure boots benefit from rising trekking, hiking, and outdoor tourism activities. Integrating certifications and technical innovations in these segments can create long-term contracts and steady revenue streams beyond casual and fashion markets.

Product Type Insights

Casual leather boots dominate the market (30–35% share) due to their versatile appeal for daily wear and urban fashion. Work and safety boots are significant for industrial applications, while luxury and designer boots cater to high-income fashion-conscious consumers. Mid-range products (45%) balance affordability and quality, attracting the largest demographic across developed and emerging markets. Full-grain leather remains the most preferred material (40%) for its durability and premium aesthetics.

Application Insights

Daily wear and urban fashion applications represent the largest share (40%) of the market. Industrial and safety applications are steady, driven by infrastructure projects and regulatory compliance. Outdoor and adventure segments are growing rapidly due to increased trekking and hiking activities. Fashion-conscious consumers continue to seek premium and designer options, while sustainable and customizable boots are emerging as niche applications.

Distribution Channel Insights

Offline retail (55–60% share) continues to lead due to consumers’ preference for trying footwear before purchase. However, online channels are rapidly growing, offering convenience, customization, and a wider product variety. Direct-to-consumer brand websites, e-commerce marketplaces, and social commerce platforms are increasingly influencing purchasing decisions. Specialty footwear stores and department stores complement brand-owned stores in providing in-person shopping experiences.

Consumer Demographics Insights

Men account for the largest demographic (50–55%), driven by work, outdoor, and casual footwear demand. Women’s and children’s segments are growing, supported by fashion trends and premium casual options. Younger consumers (18–30 years) are embracing digital customization and sustainable products, while the 31–50 age group drives volume purchases in mid-range and premium categories. Older consumers (>50 years) predominantly favor premium and comfort-focused boots.

| By Product Type | By Material | By Distribution Channel | By End Use | By Consumer Demographics |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 20–25% of the market, driven by outdoor lifestyle adoption, fashion trends, and high disposable income. The U.S. is the largest market within the region, with demand for casual, fashion, and premium work boots. Digital retail expansion and sustainable product adoption are influencing consumer behavior.

Europe

Europe accounts for 25–30% of the market, with Germany, the UK, France, and Italy leading consumption. Premium fashion and industrial safety boots dominate. Sustainability concerns and regulatory compliance are key factors shaping product offerings, while digital platforms are enhancing direct-to-consumer engagement.

Asia Pacific

Asia Pacific is the fastest-growing region (30–35%), led by China and India. Rising urbanization, disposable incomes, and outdoor leisure activities are fueling demand. Emerging markets in Southeast Asia are adopting premium and casual segments, while industrial and safety boots are growing with manufacturing and infrastructure development.

Latin America

Latin America (8–10%) is growing due to rising interest in fashion and adventure footwear. Brazil and Mexico are key markets, with middle-class consumers adopting casual and outdoor boots. Outbound purchases and urban fashion trends are driving premium segment growth.

Middle East & Africa

The Middle East (5–8%) shows growing demand for luxury and rugged outdoor boots. GCC countries, particularly the UAE and Saudi Arabia, drive premium purchases, while Africa remains a producer hub and emerging consumer market for industrial and outdoor boots.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Leather Boots Market

- VF Corporation (Timberland)

- Dr. Martens PLC

- Clarks Shoes Ltd.

- Wolverine World Wide, Inc.

- Ecco Sko A/S

- Ariat International, Inc.

- Caterpillar (CAT Footwear)

- Palladium Boots

- Sorel (Columbia Sportswear)

- R.M. Williams

- Justin Brands, Inc.

- Geox S.p.A.

- ASICS Corporation

- Hush Puppies

- Red Wing Shoe Company