Laundry Dryers Market Size

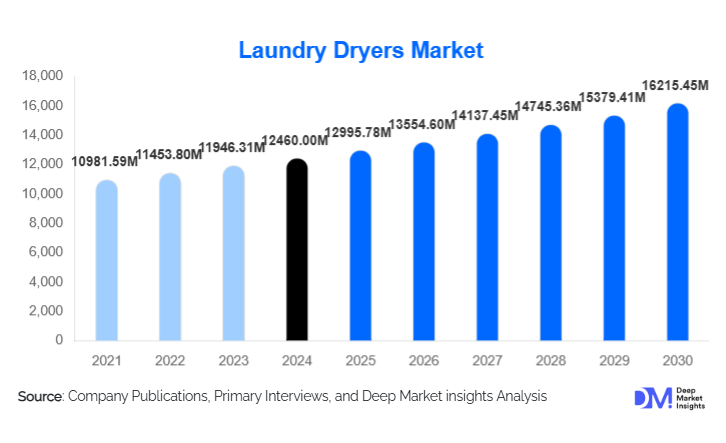

According to Deep Market Insights, the global laundry dryers market size was valued at USD 12,460.00 million in 2024 and is projected to grow from USD 12,995.78 million in 2025 to reach USD 16,215.45 million by 2030, expanding at a CAGR of 4.3% during the forecast period (2025–2030). The laundry dryers market growth is primarily driven by increasing urbanization, rising disposable income, growing adoption of energy-efficient and smart appliances, and expanding demand from residential, commercial, and institutional end-use sectors.

Key Market Insights

- Residential adoption of energy-efficient dryers is accelerating globally, driven by urban lifestyles, compact housing, and a preference for smart home appliances.

- Commercial and institutional demand is rising, with hotels, hospitals, and laundromats investing in high-capacity dryers to improve operational efficiency and hygiene.

- North America dominates the market, particularly the USA, due to high appliance penetration and strict energy-efficiency regulations.

- Asia-Pacific is the fastest-growing region, led by China and India, fueled by rising urbanization, industrial expansion, and increasing disposable income.

- Technological adoption, including heat pumps, IoT-enabled dryers, and AI-assisted drying cycles, is reshaping consumer preferences and improving energy efficiency.

- Government initiatives promoting energy-efficient appliances, such as EU Ecodesign regulations and Japan Top Runner standards, are accelerating market growth.

What are the latest trends in the laundry dryers market?

Energy-Efficient and Smart Dryers Gaining Popularity

Consumers are increasingly adopting heat pumps and condenser dryers due to their superior energy efficiency and reduced operational costs. Smart features, including remote operation, real-time monitoring, and AI-driven drying cycles, are becoming standard in premium models. Integration with IoT-enabled smart home systems allows users to schedule cycles, monitor energy consumption, and receive maintenance alerts, improving convenience and efficiency. Manufacturers are investing in advanced sensors and AI algorithms to optimize drying times and reduce energy use. These innovations appeal to environmentally conscious consumers and align with regional energy-efficiency regulations, particularly in Europe and North America.

Rise of Commercial and Institutional Adoption

Hotels, hospitals, and laundromats are driving demand for industrial-scale, high-capacity dryers. Institutions are increasingly prioritizing hygiene, speed, and operational efficiency, leading to investments in robust, energy-efficient models. Commercial facilities benefit from advanced dryers with large drum capacities, automated cycles, and durability, ensuring consistent performance under high-volume operations. Expansion of the hospitality and healthcare sectors in Asia-Pacific and the Middle East is further boosting commercial demand, creating opportunities for manufacturers to supply large-scale installations with premium features and extended service support.

What are the key drivers in the laundry dryers market?

Urbanization and Rising Disposable Income

Rapid urbanization and increasing household income levels are driving the adoption of home appliances, particularly in the Asia-Pacific and Latin America. Compact urban living spaces create demand for washer-dryer combos and energy-efficient models. Consumers are willing to invest in advanced dryers that save time and reduce manual labor, particularly in dual-income households. Rising urban middle-class populations and lifestyle changes contribute significantly to residential market growth, supporting both premium and mid-range segments.

Energy Efficiency and Environmental Awareness

Energy-efficient dryers, such as heat pump and condenser models, are gaining traction due to electricity cost savings and environmental consciousness. Governments incentivize the adoption of energy-efficient appliances through rebate programs and regulatory mandates. Europe, North America, and Japan are leading regions where such policies drive market expansion. Consumer preference for eco-friendly products enhances brand loyalty and justifies higher pricing for energy-efficient models.

Expansion of Commercial and Institutional Use

Hotels, hospitals, universities, and laundromats are increasingly investing in high-capacity dryers to handle large volumes efficiently. The need for reliable, hygienic, and time-saving drying solutions drives the adoption of industrial-grade equipment. Emerging economies in the Asia-Pacific and Middle East are seeing rapid infrastructure expansion in these sectors, further increasing demand for large-scale dryer installations.

What are the restraints for the global market?

High Initial Cost

Premium dryers, particularly heat pump and industrial models, have high upfront costs. Price-sensitive consumers in emerging markets may delay adoption despite long-term energy savings. Manufacturers need to balance cost and features to ensure wider market penetration.

Dependence on Electricity Infrastructure

In regions with unreliable electricity supply or high energy costs, the adoption of electric dryers is limited. Gas dryers offer alternatives but are constrained by infrastructure and regulatory barriers. Addressing these issues is critical for broader market expansion.

What are the key opportunities in the laundry dryers industry?

Emerging Market Expansion

Countries such as India, China, and Brazil offer significant growth opportunities due to urbanization, increasing disposable incomes, and evolving lifestyles. Affordable, energy-efficient dryers tailored for these markets can capture substantial residential and commercial demand.

Technological Innovation and Smart Integration

Integration of IoT-enabled features, AI-assisted drying, and energy management systems offers differentiation in competitive markets. Smart dryers appeal to environmentally conscious consumers and facilitate remote monitoring, predictive maintenance, and personalized drying programs, enhancing user convenience.

Commercial and Institutional Growth

Hotels, hospitals, and laundromats require high-capacity, durable dryers, creating long-term, stable demand. Expansion of hospitality and healthcare infrastructure, particularly in the Asia-Pacific and Middle East, provides opportunities for manufacturers to supply advanced industrial dryers with premium features.

Product Type Insights

Heat pump dryers dominate the global laundry dryers market, accounting for approximately 28% of the total market share in 2024. Their leadership is primarily driven by superior energy efficiency, significantly lower electricity consumption, and compliance with stringent energy-efficiency regulations, particularly in Europe and developed Asia-Pacific markets. Heat pump technology enables heat recycling during the drying process, reducing operational costs for consumers and making these dryers increasingly attractive amid rising electricity prices and sustainability awareness.

Electric dryers lead the technology segment, capturing nearly 65% of the global market share, owing to widespread electricity access, ease of installation, and high consumer familiarity across residential and commercial applications. Electric dryers benefit from lower upfront complexity compared to gas dryers and are widely available in multiple capacities and price ranges, supporting mass adoption in North America, Europe, and parts of Asia-Pacific.

Application Insights

Residential applications dominate the laundry dryers market, accounting for approximately 58% of total demand in 2024. Growth in this segment is driven by increasing urbanization, rising disposable income, higher penetration of home appliances, and growing demand for convenience-oriented household solutions. The expansion of nuclear families, dual-income households, and time-constrained lifestyles has accelerated the adoption of automated laundry solutions, particularly in urban areas.

The commercial and institutional segment is witnessing faster growth compared to residential demand, supported by rising investments in hotels, hospitals, laundromats, universities, and corporate housing facilities. Hygiene regulations in healthcare and hospitality sectors are driving demand for high-capacity, industrial-grade dryers capable of handling large laundry volumes efficiently. Commercial operators increasingly prefer energy-efficient and durable models to reduce operational costs and downtime.

Distribution Channel Insights

Offline retail channels continue to dominate the laundry dryers market, accounting for approximately 55% of global sales. Consumers prefer physical retail outlets for large appliances due to the ability to evaluate product size, capacity, build quality, and energy ratings in person. Offline channels also offer installation support, after-sales services, and financing options, which remain critical for high-value appliance purchases.

Online retail is the fastest-growing distribution channel, supported by increasing internet penetration, improved logistics infrastructure, and the expansion of appliance-focused e-commerce platforms. Online channels provide wider product assortments, transparent pricing, customer reviews, and promotional discounts, making them increasingly attractive, particularly among younger and tech-savvy consumers.

| By Product Type | By Technology Type | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America, led by the United States, holds approximately 32% of the global laundry dryers market share. The region’s dominance is driven by high household appliance penetration, widespread availability of electric and gas infrastructure, and strong consumer preference for premium, high-capacity dryers. Stringent energy-efficiency standards and labeling programs further support the adoption of advanced models such as heat pumps and smart dryers.

Commercial demand from hotels, hospitals, and large-scale laundromats significantly contributes to regional growth, particularly in the U.S. Canada supports market expansion through steady residential adoption and growing interest in energy-efficient appliances. While the market is relatively mature, replacement demand and technological upgrades continue to sustain growth.

Europe

Europe accounts for approximately 22% of global market share, with Germany, the United Kingdom, and France serving as key demand centers. Growth in the region is primarily driven by strict energy-efficiency regulations, strong environmental awareness, and widespread government incentives for low-energy appliances. Heat pump dryers are especially popular, benefiting from regulatory support and consumer preference for sustainable solutions.

High electricity costs and carbon reduction targets encourage households and commercial operators to shift toward energy-efficient technologies. Additionally, premium product adoption and compact housing trends in urban Europe support demand for advanced and space-saving dryer models.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the laundry dryers market, led by China and India, and is expected to register a CAGR of 8–9% through 2030. Rapid urbanization, rising disposable income, expanding middle-class populations, and growing awareness of home appliance convenience are key growth drivers.

China dominates regional demand due to large-scale residential construction, strong domestic manufacturing, and increasing adoption of modern home appliances. India is emerging as a high-growth market, supported by urban housing development, lifestyle changes, and increasing penetration of organized retail and e-commerce. Expansion of hospitality, healthcare, and institutional infrastructure across Southeast Asia further boosts commercial dryer demand.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth, with the UAE, Saudi Arabia, and South Africa emerging as key markets. Growth is driven by high-end residential developments, rising expatriate populations, and substantial investments in hospitality, healthcare, and tourism infrastructure.

Commercial and industrial dryers are in strong demand across hotels, hospitals, and large residential complexes. Government-led infrastructure development and increasing preference for premium appliances are accelerating adoption, while intra-regional trade supports market expansion across neighboring countries.

Latin America

Latin America is an emerging market for laundry dryers, with Brazil, Argentina, and Mexico leading regional demand. Growth is supported by increasing urbanization, rising middle-income populations, and gradual lifestyle shifts toward automated home appliances.

Residential demand dominates, while commercial adoption remains limited but growing, particularly in hospitality and institutional sectors. Economic volatility and electricity cost sensitivity continue to moderate growth; however, expanding retail networks and improving consumer awareness are expected to support steady market expansion over the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Laundry Dryers Market

- Whirlpool Corporation

- Electrolux AB

- LG Electronics

- Samsung Electronics

- Haier Group

- Bosch Siemens Hausgeräte (BSH)

- Miele & Cie. KG

- Panasonic Corporation

- Arçelik A.Ş.

- Gree Electric Appliances

- Godrej Appliances

- IFB Industries Ltd

- Sharp Corporation

- Hitachi Ltd

- Fisher & Paykel Appliances