Latex Pillow Market Size

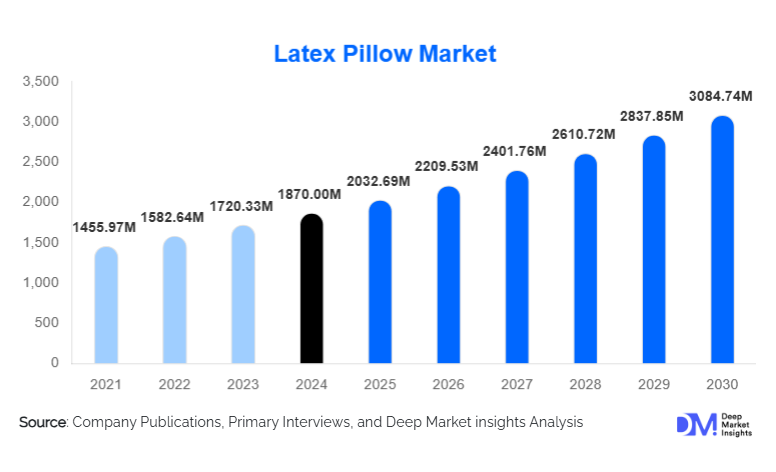

According to Deep Market Insights, the global latex pillow market size was valued at USD 1,870 million in 2024 and is projected to grow from USD 2,032.69 million in 2025 to reach USD 3,084.74 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). The latex pillow market growth is driven by rising consumer focus on sleep health, increasing adoption of ergonomic and orthopedic bedding products, and growing preference for sustainable and hypoallergenic materials in home furnishing and hospitality sectors.

Key Market Insights

- Natural and organic latex pillows are gaining strong traction as consumers prioritize sustainability, chemical-free products, and long-term durability.

- Residential demand dominates the market, supported by increasing awareness of posture correction, cervical support, and sleep-related wellness.

- North America leads global consumption, driven by high spending on premium bedding and strong penetration of D2C sleep brands.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, and expanding hospitality infrastructure.

- E-commerce channels are reshaping distribution, enabling customization, product education, and direct brand engagement.

- Mid-range latex pillows (USD 50–100) represent the largest revenue-generating price segment globally.

What are the latest trends in the latex pillow market?

Growing Preference for Natural and Organic Sleep Products

Consumers are increasingly opting for natural latex pillows made from sustainably harvested rubber tree sap. These products are perceived as healthier alternatives to memory foam and synthetic fiber pillows due to their hypoallergenic, antimicrobial, and breathable properties. Certifications such as GOLS and OEKO-TEX are becoming important purchasing criteria, particularly in North America and Europe. Brands emphasizing eco-friendly sourcing, biodegradable packaging, and ethical manufacturing are witnessing stronger brand loyalty and premium pricing power.

Customization and Zoned Support Designs

Product innovation is accelerating with the introduction of contoured, zoned, and adjustable loft latex pillows. These designs cater to different sleeping positions, back, side, and stomach sleepers, offering personalized comfort and enhanced spinal alignment. Shredded latex pillows with adjustable fill volumes are also gaining popularity, allowing users to modify firmness levels. Cooling-infused latex and ventilated designs are emerging to address heat retention concerns, especially in warmer climates.

What are the key drivers in the latex pillow market?

Rising Awareness of Sleep Health and Orthopedic Support

The increasing prevalence of neck pain, cervical spondylosis, and sleep disorders has heightened demand for ergonomic sleep solutions. Latex pillows provide consistent support, pressure relief, and durability, making them a preferred choice among health-conscious consumers and aging populations. Healthcare professionals and chiropractors increasingly recommend latex-based bedding products, reinforcing consumer trust and adoption.

Premiumization of Home Bedding Products

Consumers are shifting from low-cost, frequently replaced pillows to premium, long-lasting sleep products. Latex pillows, with an average lifespan of 7–10 years, align with this trend. Rising disposable incomes and growing interest in wellness-oriented home upgrades are driving demand for mid-range and premium latex pillows across developed and emerging economies.

What are the restraints for the global market?

High Initial Product Cost

Latex pillows are significantly more expensive than conventional polyester or basic foam pillows, which limits adoption in price-sensitive markets. The higher upfront cost can deter first-time buyers, especially in developing regions where awareness of long-term benefits remains limited.

Volatility in Natural Latex Raw Material Prices

Fluctuations in natural rubber prices, influenced by climate conditions, labor availability, and geopolitical factors, impact manufacturing costs. This volatility can pressure margins and lead to periodic price adjustments, affecting market competitiveness.

What are the key opportunities in the latex pillow industry?

Expansion in Hospitality and Healthcare Sectors

Luxury hotels, wellness resorts, hospitals, and rehabilitation centers are increasingly adopting latex pillows due to their durability, hygiene, and comfort benefits. Bulk procurement by hospitality chains offers stable, long-term revenue opportunities for manufacturers. Medical and assisted-living facilities are also emerging as important end users, particularly for orthopedic-grade latex pillows.

Growth of Direct-to-Consumer and Smart Sleep Solutions

DTC brands leveraging online platforms are well-positioned to educate consumers, offer customization, and collect sleep-related data. Integration with smart sleep ecosystems, including sleep tracking and personalized recommendations, presents opportunities for premium differentiation and higher margins.

Product Type Insights

Natural latex pillows dominate the product landscape, accounting for approximately 46% of global market revenue in 2024, driven by sustainability and health benefits. Blended latex pillows balance cost and performance, appealing to mid-range consumers, while synthetic latex pillows cater to price-sensitive segments. Solid latex pillows lead construction types due to uniform support and durability, while shredded latex pillows are gaining popularity for adjustable comfort.

Application Insights

Residential applications account for nearly 68% of total market demand, supported by rising home wellness spending and replacement purchases. Commercial applications, including hotels, hospitals, and corporate housing, are growing at a faster pace, driven by demand for premium guest experiences and long-life bedding solutions.

Distribution Channel Insights

Offline retail channels, including specialty bedding stores and furniture retailers, account for around 55% of sales, benefiting from in-store trials and brand trust. However, online channels are expanding rapidly, supported by e-commerce marketplaces and brand-owned websites offering competitive pricing, customization, and subscription-based replacement models.

Price Range Insights

Mid-range latex pillows priced between USD 50 and USD 100 represent the largest segment, capturing about 44% of global revenue in 2024. Premium pillows priced above USD 100 are growing steadily, driven by luxury positioning and organic certifications, while economy variants remain limited to blended and synthetic latex products.

| By Latex Type | By Pillow Construction | By Firmness Level | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global latex pillow market, led by the United States. High consumer spending on premium bedding, strong brand presence, and widespread awareness of sleep health support regional dominance.

Europe

Europe holds around 27% of global market share, driven by strong demand for sustainable and organic home products in Germany, the U.K., and France. Regulatory support for eco-friendly materials further strengthens market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 11% CAGR. China, India, Japan, and South Korea are key growth markets, supported by urbanization, rising incomes, and expanding hospitality sectors.

Latin America

Latin America represents about 7% of global demand, led by Brazil and Mexico. Growth is supported by rising awareness of premium bedding products among urban consumers.

Middle East & Africa

The region accounts for approximately 6% of the market, with demand driven by luxury hotels and high-income consumers in the UAE and Saudi Arabia, alongside growing hospitality investments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Latex Pillow Market

- Tempur Sealy International

- Dunlopillo

- Talalay Global

- Latexco

- Boyd Sleep

- Royal-Pedic

- Simmons Bedding Company