Large White Goods Appliances Market Size

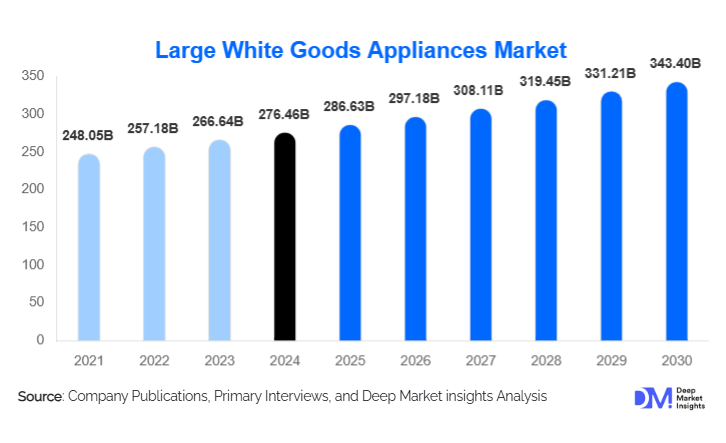

According to Deep Market Insights, the global large white goods appliances market size was valued at USD 276.46 billion in 2024 and is projected to grow from USD 286.63 billion in 2025 to reach USD 343.40 billion by 2030, expanding at a CAGR of 3.68% during the forecast period (2025–2030). The market growth is driven by rising urbanization, steady replacement demand in mature economies, expanding residential construction in emerging markets, and increasing adoption of energy-efficient and smart home appliances.

Key Market Insights

- Refrigerators and freezers dominate global demand due to near-universal household penetration and consistent replacement cycles.

- Asia-Pacific accounts for the largest market share, supported by strong housing growth, electrification, and rising middle-class income.

- Smart and connected appliances are the fastest-growing category, contributing disproportionately to revenue through premium pricing.

- Energy efficiency regulations across Europe, North America, and parts of Asia are accelerating appliance replacement demand.

- Offline retail remains dominant, though online channels are expanding rapidly through omnichannel strategies.

- Residential end-users account for over four-fifths of global demand, while commercial applications are growing faster.

What are the latest trends in the large white goods appliances market?

Rapid Adoption of Smart and Connected Appliances

Smart large white goods appliances are gaining strong traction globally as consumers seek convenience, automation, and energy optimization. Features such as AI-driven load sensing, remote diagnostics, predictive maintenance, and integration with smart home ecosystems are becoming standard in premium models. Although smart appliances represent a smaller share of unit volumes, they account for nearly one-third of total market value due to higher average selling prices. Urban households in North America, Europe, China, Japan, and South Korea are leading adoption, while emerging markets are gradually transitioning as affordability improves and digital infrastructure expands.

Energy Efficiency and Sustainability-Led Product Design

Manufacturers are increasingly focusing on energy-efficient motors, inverter technology, water-saving washing systems, and recyclable materials to comply with tightening regulations and evolving consumer preferences. Sustainability has become a key purchasing criterion, particularly in Europe, where stringent efficiency labeling and carbon reduction targets influence buying behavior. This trend is driving innovation in low-energy refrigeration, heat-pump dryers, and eco-friendly manufacturing processes, while also supporting premiumization across product categories.

What are the key drivers in the large white goods appliances market?

Urbanization and Housing Development

Rapid urban migration and residential construction are core demand drivers for large white goods appliances. New household formation in Asia-Pacific, the Middle East, and Latin America continues to generate first-time appliance purchases, particularly for refrigerators and washing machines. Government-led housing programs and expanding rental housing stock further reinforce baseline demand.

Technological Advancement and Premiumization

Consumers are increasingly upgrading observed appliances to technologically advanced models offering improved performance, lower operating costs, and enhanced convenience. Premium and built-in appliances are gaining traction in developed markets, supported by lifestyle upgrades and smart home adoption. This shift has increased average selling prices and improved margins for manufacturers.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuating prices of steel, aluminum, copper, plastics, and semiconductors continue to pressure manufacturing costs. These input cost variations often result in periodic price increases, which can dampen demand in price-sensitive regions and limit margin expansion.

Supply Chain and Geopolitical Risks

Global supply chain disruptions, trade restrictions, and geopolitical uncertainties pose challenges for appliance manufacturers with highly integrated international operations. Delays in component availability and logistics constraints can affect production schedules and product availability, particularly for electronics-heavy smart appliances.

What are the key opportunities in the large white goods appliances industry?

Expansion in Emerging Markets

Emerging economies such as India, Indonesia, Vietnam, Brazil, and parts of Africa present strong growth opportunities driven by rising incomes, electrification, and urban housing development. Localized manufacturing, affordable product lines, and energy-efficient entry-level models can help manufacturers expand penetration and build long-term brand loyalty.

Growth of Commercial and Institutional Demand

The recovery of hospitality, healthcare, education, and co-living infrastructure is driving demand for commercial-grade large white goods appliances. Hotels, serviced apartments, and institutional kitchens require durable, high-capacity, and energy-efficient appliances, offering manufacturers a stable, higher-volume sales channel beyond residential consumers.

Product Type Insights

Refrigerators and freezers account for approximately 34% of the global market value in 2024, making them the largest product category due to essential daily usage, high replacement frequency, and rising household penetration globally. Urbanization and changing food storage habits are major drivers for this segment, with multi-door and smart refrigeration models gaining popularity in developed and emerging markets. Washing machines hold the second-largest share, driven by urban lifestyles, increasing dual-income households, and the adoption of water-efficient and energy-saving technologies. Cooking appliances, dishwashers, and dryers are experiencing steady growth, particularly in developed regions such as North America and Europe, where higher penetration rates, premium appliance adoption, and consumer preference for convenience are shaping demand. Technological upgrades and the shift toward built-in and smart appliances further accelerate growth in these categories, while replacement cycles continue to provide a stable revenue stream.

Technology Insights

Conventional appliances continue to dominate with nearly 68% market share in 2024, especially in cost-sensitive and emerging regions, where affordability and basic functionality drive consumer preference. However, smart and connected appliances, accounting for about 32% of market value, represent the fastest-growing segment. Growth in this segment is primarily fueled by urban consumers adopting smart homes, IoT integration, and AI-powered features that enhance energy efficiency, convenience, and predictive maintenance. Premium consumers in North America, Europe, and Asia-Pacific are increasingly willing to invest in smart appliances, driving higher revenue per unit and improving profit margins for manufacturers. The adoption of smart appliances is further accelerated by government initiatives promoting energy-efficient technologies and the growing popularity of sustainable living.

Distribution Channel Insights

Offline retail channels continue to dominate, accounting for around 65% of total sales, benefiting from physical product inspection, on-site demonstrations, installation services, and financing support. However, online and e-commerce channels are expanding rapidly, supported by improved digital infrastructure, real-time price comparisons, targeted marketing campaigns, and efficient last-mile delivery solutions. Urban consumers increasingly prefer online platforms for convenience and broader product selection. The hybrid omnichannel approach, combining in-store and online engagement, is also emerging as a key strategy among leading manufacturers to increase reach and improve customer experience.

End-User Insights

Residential consumers dominate the large white goods appliances market, contributing approximately 82% of global revenue. Growth in this segment is driven by rising household formation, urban migration, increasing disposable incomes, and demand for energy-efficient and smart appliances. The commercial segment, while smaller in overall share, is growing at a faster pace due to demand from hotels, restaurants, healthcare facilities, educational institutions, and real estate developers. The recovery of the hospitality sector and expansion of institutional facilities are expected to further boost demand for commercial-grade appliances, providing manufacturers with additional revenue streams beyond residential end-users.

| By Product Type | By Technology | By Installation Type | By Distribution Channel | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with approximately 38% market share in 2024. China remains the largest single market, driven by replacement demand, rising disposable incomes, and rapid adoption of premium and smart appliances. India is the fastest-growing major country, expanding at over 7% CAGR, fueled by urbanization, increasing household formation, government housing initiatives, and electrification programs. Southeast Asian countries such as Indonesia, Vietnam, and Thailand are also emerging as high-growth markets, supported by growing middle-class income, rising urban population, and improving retail and distribution infrastructure. The region’s strong manufacturing capabilities and supportive government policies for local production further accelerate growth.

North America

North America accounts for around 22% of global demand, led primarily by the United States. Growth is driven by replacement purchases of aging appliances, increasing adoption of smart and connected devices, and government incentives promoting energy-efficient products. Consumer preference for high-quality and technologically advanced appliances, coupled with steady housing construction and renovation activities, sustains market demand. Canada is also witnessing growth due to rising urbanization and the adoption of premium home appliances. Advanced retail infrastructure and e-commerce expansion further support penetration across the region.

Europe

Europe represents nearly 20% of the market, with Germany, the U.K., France, and Italy leading regional consumption. Strict energy-efficiency regulations, high penetration of built-in appliances, and strong consumer preference for sustainable products are key drivers. Replacement demand from aging households, coupled with increasing adoption of smart appliances in urban households, further supports growth. Additionally, rising disposable income, growing awareness of eco-friendly solutions, and technological innovation in premium appliances are encouraging manufacturers to expand their presence across Western and Northern Europe.

Latin America

Latin America contributes close to 10% of global demand, with Brazil and Mexico leading regional consumption. Growth is driven by urban population expansion, rising household incomes, and increasing appliance penetration in both residential and commercial segments. Government housing initiatives and electrification programs support demand for entry-level and mid-range appliances, while urban consumers show growing interest in energy-efficient and modern appliances. Expansion of retail and e-commerce infrastructure in major cities is facilitating broader market access and consumer reach.

Middle East & Africa

The Middle East & Africa region accounts for roughly 10% of the market. Demand is supported by rapid urbanization, real estate development, and rising disposable income in Gulf countries such as the UAE, Saudi Arabia, and Qatar. South Africa and Nigeria are the largest contributors in the African sub-region, driven by increasing urban population, growing appliance penetration, and government support for residential electrification. Investment in high-quality housing projects, combined with a preference for premium and energy-efficient appliances, is further fueling market growth. Additionally, regional initiatives to modernize infrastructure and expand smart city projects are creating opportunities for smart and connected appliances.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Large White Goods Appliances Market

- Whirlpool Corporation

- Haier Group

- Electrolux AB

- Samsung Electronics

- LG Electronics

- BSH Hausgeräte

- Midea Group

- Panasonic Corporation

- Hisense Group

- Arçelik A.Ş.

- Sharp Corporation

- GE Appliances

- Toshiba Corporation

- Hitachi Appliances

- Gorenje Group