Lacrosse Sticks Market Size

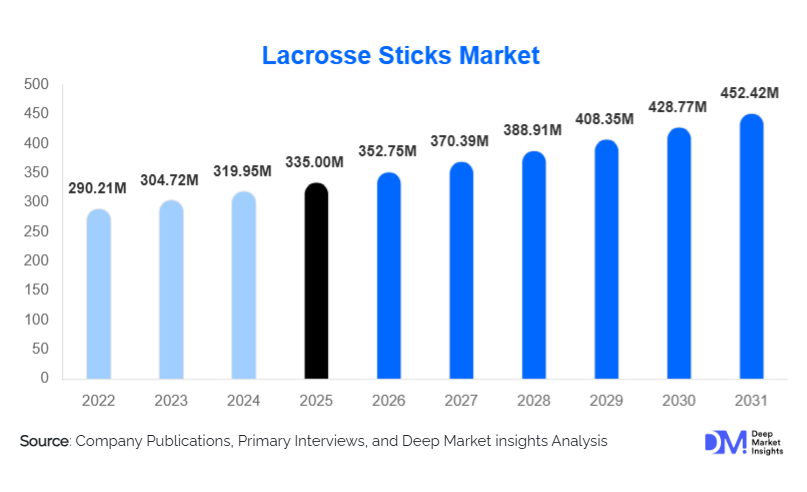

According to Deep Market Insights, the global lacrosse sticks market size was valued at USD 335 million in 2025 and is projected to grow from USD 352.75 million in 2026 to reach USD 452.42 million by 2031, expanding at a CAGR of 5.0% during the forecast period (2026–2031). The lacrosse sticks market growth is primarily driven by rising participation in organized lacrosse leagues, increasing youth and collegiate sports enrollment, growing popularity of women’s lacrosse, and continuous innovation in lightweight composite materials and performance-oriented stick designs.

Key Market Insights

- North America dominates the global lacrosse sticks market, supported by a deep-rooted sports culture, school-level programs, and professional leagues.

- Composite and carbon-fiber-based sticks are rapidly replacing traditional metal shafts due to superior strength-to-weight ratios and enhanced performance.

- Youth and high school players represent the largest consumer base, driving volume demand and frequent replacement cycles.

- Women’s lacrosse sticks are the fastest-growing segment, supported by rising female participation and dedicated league structures.

- Mid-range priced sticks dominate sales, balancing affordability with performance features.

- Online direct-to-consumer sales channels are expanding rapidly, improving brand reach and margins.

What are the latest trends in the lacrosse sticks market?

Advanced Composite and Hybrid Material Adoption

The lacrosse sticks market is witnessing a strong shift toward advanced composite and hybrid material constructions. Carbon fiber, graphite composites, and reinforced polymers are increasingly preferred over traditional aluminum shafts due to their lightweight properties, improved durability, and optimized flex profiles. These materials enhance ball control, shot speed, and overall player performance, particularly at competitive levels. Manufacturers are investing heavily in proprietary composite layering techniques to differentiate products and justify premium pricing. This trend is particularly prominent in collegiate and professional segments, where performance advantages directly impact gameplay outcomes.

Customization and Position-Specific Design Innovation

Customization has emerged as a key trend, with players seeking position-specific sticks tailored for attack, midfield, defense, and goalie roles. Brands are offering differentiated shaft stiffness, grip textures, and head designs optimized for each playing style. Modular stick systems allowing interchangeable heads and shafts are also gaining popularity, especially among advanced players. This trend is increasing average selling prices and strengthening brand loyalty, as players become more invested in personalized equipment solutions.

What are the key drivers in the lacrosse sticks market?

Rising Participation in Youth and Collegiate Lacrosse

One of the primary drivers of the lacrosse sticks market is the expanding participation base at youth, high school, and collegiate levels. Educational institutions continue to invest in organized sports infrastructure, with lacrosse increasingly adopted as a mainstream sport beyond its traditional strongholds. This has resulted in consistent volume demand for entry-level and mid-range sticks, along with recurring replacement purchases as players progress through skill levels.

Growth of Women’s Lacrosse Globally

The rapid growth of women’s lacrosse is significantly contributing to market expansion. Dedicated women’s leagues, international tournaments, and increased media visibility have boosted demand for women-specific stick designs that comply with distinct gameplay rules. Manufacturers are actively expanding their women’s product portfolios, creating a high-growth sub-market within the broader lacrosse sticks industry.

What are the restraints for the global market?

High Cost of Premium Lacrosse Sticks

Premium lacrosse sticks, particularly those made from advanced composite materials, are priced at a significant premium. This limits adoption among entry-level players and price-sensitive consumers in emerging markets. While mid-range products mitigate this challenge to some extent, cost remains a key barrier to broader international penetration.

Limited Awareness Outside Core Markets

Lacrosse remains a niche sport in many regions outside North America. Limited awareness, lack of training infrastructure, and competition from established sports restrict demand growth in emerging economies. This slows global market expansion despite increasing international promotion efforts.

What are the key opportunities in the lacrosse sticks industry?

International Market Expansion in Europe and Asia-Pacific

Europe and the Asia-Pacific region represent high-growth opportunities as lacrosse gains institutional recognition in schools and universities. Countries such as the U.K., Germany, Japan, China, and Australia are investing in organized lacrosse programs. Early market entry, localized pricing strategies, and partnerships with sports federations can enable manufacturers to establish long-term dominance in these regions.

Institutional and Team-Based Bulk Procurement

Bulk procurement by schools, colleges, and sports academies presents a significant opportunity for manufacturers. Long-term supply contracts, sponsorship agreements, and standardized equipment programs can generate stable, high-volume revenue streams while strengthening brand presence at the grassroots level.

Product Type Insights

Attack sticks dominate the global lacrosse sticks market, accounting for the largest share of revenue, primarily due to their high replacement frequency and universal usage across youth, high school, collegiate, and professional levels of play. Attack players rely heavily on stick responsiveness, head shape precision, and lightweight shafts for improved shooting accuracy and ball control, which leads to faster wear and tear and frequent upgrades. This has positioned attack sticks as the leading revenue-generating segment, particularly in competitive leagues where performance differentiation is critical.

Midfield sticks represent a substantial share of the market owing to their versatility and dual-role functionality in both offensive and defensive play. Midfielders typically cover the largest on-field distance, driving demand for balanced, lightweight, and durable sticks that offer flexibility and endurance. As a result, midfield sticks experience consistent demand across amateur and professional segments, especially in collegiate leagues where positional specialization is less rigid.

End-Use Insights

Educational institutions account for the largest share of end-use demand in the lacrosse sticks market, supported by widespread participation in school and collegiate leagues, particularly in North America. Public and private schools, universities, and sports academies procure lacrosse sticks in bulk for training programs, interscholastic competitions, and developmental leagues. This segment benefits from predictable demand cycles and structured replacement timelines as players progress through age categories.

Professional and semi-professional players contribute a smaller share in volume but a significantly higher share in value. These players predominantly adopt premium composite sticks with advanced performance features, driving higher average selling prices. The professional segment also influences broader market trends, as amateur and youth players often emulate equipment choices used at elite levels.

Distribution Channel Insights

Offline sporting goods retailers continue to hold the largest share of global lacrosse stick sales, supported by in-store product trials, professional fitting assistance, immediate product availability, and strong brand trust. Specialty sports retailers play a critical role in educating consumers, particularly first-time buyers and parents purchasing equipment for youth players.

However, online direct-to-consumer (D2C) platforms represent the fastest-growing distribution channel. Manufacturers are increasingly leveraging e-commerce to offer customization options, competitive pricing, wider product assortments, and direct engagement with end users. Online channels also enable brands to expand internationally with lower overhead costs, making them particularly effective in emerging markets.

| By Product Type | By Material Type | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 62% of the global lacrosse sticks market in 2025, with the United States leading the way. The region’s dominance is driven by a deeply entrenched lacrosse culture, strong interscholastic and collegiate sports systems, and the presence of professional leagues that promote equipment innovation. High disposable income, structured youth development programs, and frequent equipment replacement cycles further support sustained demand. Canada also contributes significantly, supported by strong youth participation, community leagues, and cross-border equipment trade.

Europe

Europe holds around 18% of the global market share, with the U.K., Germany, and France leading regional adoption. Growth in Europe is driven by increasing institutional recognition of lacrosse, expansion of university leagues, and rising participation in international tournaments. Government-backed sports development initiatives and growing awareness through international competitions are accelerating demand. Additionally, Europe’s strong emphasis on organized amateur sports is supporting steady growth in mid-range and entry-level stick segments.

Asia-Pacific

Asia-Pacific represents nearly 12% of the global market and is the fastest-growing region, expanding at close to double-digit CAGR. Japan and Australia are relatively mature markets with established lacrosse federations and school-level programs. Meanwhile, China and India are emerging as high-growth markets due to expanding international school networks, rising youth sports participation, and increasing exposure to global sports culture. The region’s growth is further supported by increasing online retail penetration, making imported lacrosse equipment more accessible.

Latin America

Latin America remains a niche but emerging market, with growing interest in club-level lacrosse in Brazil, Mexico, and Argentina. Market growth is primarily driven by urban youth populations, expatriate communities, and increasing participation in international amateur tournaments. Demand is largely import-driven, with online platforms playing a key role in market access. While volumes remain limited, rising awareness and grassroots development programs present long-term growth potential.

Middle East & Africa

The Middle East and Africa account for a small but steadily growing share of the global market. Growth in this region is supported by international schools, expatriate sports communities, and increasing investment in diversified sports infrastructure, particularly in the UAE. In Africa, South Africa leads regional demand due to structured school sports programs and club participation. Government-led sports diversification initiatives and private investment in recreational facilities are expected to gradually expand lacrosse adoption across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Lacrosse Sticks Market

- STX

- Maverik Lacrosse

- Warrior Sports

- Nike Lacrosse

- StringKing

- Epoch Lacrosse

- True Temper Sports

- Brine

- Under Armour

- East Coast Dyes

- Powell Lacrosse

- Adidas Lacrosse

- Franklin Sports

- Decathlon

- Champro Sports